The Golden Opportunity

Earth Day is this Friday. The first Earth Day was in 1970, where folks from all walks of life came together to recognize the need to guard our planet. Later that year, the US Environmental Protection Agency (EPA) was established to directly address environmental protection. Earth Day is a globally recognized event that’s celebrated by the very same 190+ countries that signed the Paris Agreement. The official stated goal of the Paris Agreement is “to limit global warming to well below 3.6°F [2°C], preferably to 2.7°F [1.5°C] compared to pre-industrial levels.” Earth Day 2022 marks the 6th Anniversary of the Paris Agreement.

Mother Nature is brand agnostic. She doesn’t care which companies are doing what so long as carbon emissions are decreasing and an end to global warming is in sight. With that logic, it would make sense that the biggest strides that can be made aren’t new companies spouting up and forcing change, but rather, new technologies pairing with the expertise of legacy firms to invest and develop new ways to grow the economy without harming the planet.

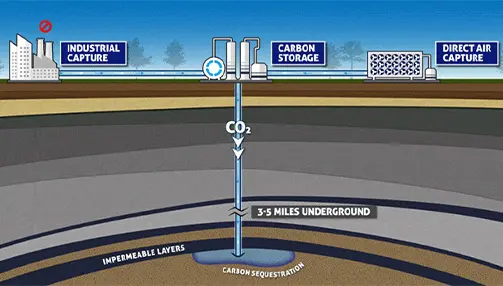

At the end of the day, we all want the same goal — economic growth that doesn’t come at the expense of the environment or the wellbeing of future generations. We want good paying and stable jobs. And we want growing industries, not declining ones. The good news is that the talent, skill, and expertise that underpins existing industries can be translated into growing ones. There exists substantially greater growth opportunities, financial gain, and engineering challenges in LNG, CNG, RNG, blue and green hydrogen, alternative energy, and renewable energy than there does in the traditional oil and natural gas industry. This is not an opinion, but a fact confirmed by virtually every developed country and major energy company. The growth opportunities in compression specifically, are endless. Constructing and operating new infrastructure to support the global use of LNG and the emerging hydrogen economy provide incredible growth opportunities in gas compression. Downstream operations that run on low-carbon feedstocks instead of petroleum is another growth opportunity for reimagined compression. Carbon dioxide (CO2) compression plays a critical role in supporting carbon, capture, and storage (CCS).

So far 2022 has been an extraordinary year partly because oil and gas prices rose and have stayed at levels that many thought they would never reach again. The even bigger surprise is the reaction of industry leaders to these higher energy prices. So far, firms are not reacting to higher oil and gas prices by directly investing in oil and gas. Rather, they are taking advantage of a golden opportunity by finding new investments in new industries. Ten years ago, even just five years ago, many oil and gas firms were made fun of for calling themselves “energy companies.” But it seems as though many of these companies will have the last laugh. The simple fact is that runaway inflation and a slowing economy are hurting virtually every sector of the economy except for energy, materials, and utilities. Inflation makes capital more expensive, meaning those that have extra cash get a big advantage for what is likely to be at least a year of rising interest rates. That leaves the oil and gas industry primed to not just participate more in low-carbon projects, but lead them.

Winston Churchill famously said that “generals are always prepared to fight the last war.” In energy, that means overly investing in fossil fuels at a boom time in the business cycle. Rather, now is the time to fight the next war, which is the war on climate change. Environmental stewardship and economic gain do not have to be mutually exclusive paradigms. Already, we are seeing new use cases for turbomachinery in a lower-carbon world. If the oil and gas industry collectively keeps production low, it can enjoy the two-pronged advantage of higher prices, high margins, growing cash flows, and tons of extra capital to invest in alternative and renewable energy.

In the spirit of Earth Day, we wanted to highlight some of the notable achievements and commitments that companies have made to reduce emissions and work toward carbon neutrality.

Russia’s Impact On Oil And Gas Supply

One of the hottest topics of 2022 has been LNG’s role in reducing Europe’s dependence on Russian natural gas. Germany, the largest buyer of Russian natural gas, has already pledged major investments in hydrogen development and the construction of additional LNG import terminals. The European Union (EU), along with the United States and other allies have discussed banning Russian energy imports. Russia, along with Saudi Arabia and the United States, is one of the world’s three largest oil and gas exporting nations. If the western world collectively stops buying Russian energy, that could disrupt the global oil and gas industry for quite some time. On one hand, it could mean more European LNG imports from the United States. On the other hand, it could mean that Russia simply diverts its exports toward countries that will do business with it, like China and other Asian import nations, which could result in less US LNG exports to those countries.

Accelerating Alternative And Renewable Energy Development

Regardless of how it shakes outs, one of the biggest certainties of the Russia-Ukraine conflict is that it is accelerating renewable and alternative energy investment. Supply demand imbalances could mean higher oil and natural gas prices for quite some time. For example, the US Energy Information Administration (EIA) estimates that West Texas Intermediate Crude Oil will average US$97.96 per barrel in 2022 and US$88.57 per barrel in 2023 compared to US$68.21 per barrel in 2021 and just US$39.17 per barrel in 2020.

So far, integrated oil majors and exploration and production (E&P) companies have shown little interest in ramping capital expenditures to take advantage of higher prices over the medium-term. Rather, many are still recovering from brutal losses from 2020, and mediocre gains that strained their balance sheets in the years leading up to the pandemic. However, 2021 was a banner year for the upstream oil and gas industry. And 2022 will probably be even better. In that case, we could see greater merger and acquisition activity and increased capital expenditures, which would raise supply over time from western producers and help offset the supply demand imbalance, leading to lower prices.

Another reaction, especially from Europe and other energy dependent regions is to use this environment of higher fossil fuel prices as a justification for even greater investment in renewable and alternative energy. RNG investment is booming. In December 2021, Archaea Energy commenced pipeline quality RNG production and commercial operations at project Assai, which is the highest capacity operation RNG facility in the world.

The developed world has pledged carbon-neutrality targets, with 2050 being the latest goal. But many companies have goals that are much sooner than that. Instead of reacting to higher oil and gas prices by investing in oil and gas to reduce dependence on imports, increase supply, and eventually lower commodity prices, now could be the ideal opportunity to invest in hydrogen, refineries that use soybeans, food waste, and other feedstocks to produce renewable diesel, nuclear energy, and solar, wind, and hydroelectric forms of power generation.

Allocating Extra Cash Toward Low-Carbon Investments

Even in the United States, many traditional oil and gas companies are using excess free cash flow generated by higher commodity prices to diversify into renewable energy. BP is still heavily investing in wind and solar. In April 2021, it pledged to end flaring in the Permian Basin by 2025. Earlier this year, it announced development plans for the H2Teesside project. Targeting 1 GW of hydrogen production by 2030, the H2Teesside project will capture and send for storage up to two million tonnes of CO₂ per year. And in March, it teamed up with Equinor to turn the South Brooklyn Marine Terminal (SBMT) complex in Brooklyn, New York, into a major regional hub for offshore wind.

In June 2021, Equinor And ExxonMobil announced the investment of US$8 billion to reduce emissions in Brazilian oil and gas fields. Equinor estimates that the project’s lifetime average CO2 intensity will be less than 9 kg per barrel produced, significantly lower than the global average of 17 kg per barrel. In November, North Star Renewables began construction on the first of two vessels bound for Equinor’s Dogger Bank offshore wind farm. In December, Aker Solutions was awarded an engineering, procurement, and construction (EPC) contract from Equinor to provide a subsea gas compression system for the Midgard and Mikkel gas reservoirs in the Åsgard field along the Norwegian Continental Shelf. Successful delivery will mark Aker Solutions’ fifth subsea gas compression module and is a copy of its previously awarded fourth module.

TotalEnergies remains a leader in solar investments. Earlier this year, it announced it would acquire SunPower’s commercial and industrial solar business for US$250 Million. In March, TotalEnergies stepped up its investments in wind energy by winning a maritime lease to develop a 3-GW+ offshore wind farm on the east coast of New York and New Jersey.

Shell continues to be a major player in solar and CCS. Its net-zero by 2050 plan centers around meeting or exceeding the goals of the Paris Agreement. Shell estimates that its emissions peaked in 2018. It is in the process of transforming its business to meet its target of providing more low-carbon energy such as charging for EVs, hydrogen, and electricity generated by solar and wind power. It is also working with customers as they make changes in sectors that are difficult to decarbonize, such as aviation, shipping, and road freight. In November, Shell entered into an agreement with Burckhardt Compression for the development of heavy-duty hydrogen refueling station compressor systems. Burckhardt Compression will build the new test facility in Winterthur, Switzerland, which is dedicated to the advancement of sealing technologies and solutions for hydrogen refueling stations serving heavy-duty vehicles. Earlier this yar, Shell’s 20-MW hydrogen electrolyzer in Zhangjiakou, Hebei Province, China, began producing green hydrogen. In March, Shell applied for a license from Brazil’s environmental agency, Ibama, to generate offshore wind power in six areas in the country. The total installed capacity of the projects will be 17 GW with studies beginning as early as later this year.

Chevron, which had been resistant to investing in renewable energy, is buying Renewable Energy Group Inc for US$3.15 billion and raised its low-carbon project budget from US$3 billion to US$10 billion between now and 2028. Even ExxonMobil is planning to build a hydrogen production plant and CCS projects at its integrated refining and petrochemical site in Baytown, Texas. ExxonMobil was the final oil major to pledge net-zero by 2050, and it also pledged net-zero Permian Basin operations by 2030, and has begun the certification process for natural gas produced at its Permian Basin facilities.

The oil and gas boom has created an opportunity for today’s oil and gas giants to be tomorrow’s leaders in fossil fuels, alternative energy, and renewable energy. Pure-play and integrated oil and gas firms are some of the fastest growing, most profitable, and most cash rich companies in the industrial, energy, utility, and materials sectors right now. And it’s expected to stay that way for at least the next few years

A Slowdown In Electric Vehicle Growth

In February, the EIA reported that hybrid, plug-in hybrid, and EVs accounted for 11% of light-duty vehicle sales in the United States in Q4 2021. The news comes on top of the International Energy Agency’s January report that global electric car sales more than doubled in 2021 from 2020’s numbers, equaling to 6.6 million total sales or 9% of the global car market. Nearly every major legacy automaker has announced some sort of EV program, many of which plan to have EVs make up 50% or more of sales by 2035 or sooner. However, automakers are struggling to meet their production and delivery goals amid ongoing supply chain constraints. The global chip shortage and rising lithium and copper prices are leading to much higher costs than anticipated. As mentioned, rising interest rates make it more expensive to borrow money and meet capital requirements, especially for new pure-play electric automakers.

In April, Tesla reported lower than expected production and delivery numbers for Q1 2022. It produced 305,407 vehicles and delivered 310,048 vehicles compared to 305,840 vehicles produced in Q4 2021 and 308,600 vehicles delivered. Tesla is still on pace to pass its 2021 total delivery number of 936,172 units but is unlikely to match 2021’s year-over-year growth rate of 87%. If Tesla, which has the most experience and deepest supply chain in the industry, is struggling to make and deliver EVs, chances are other EV automakers are having a much harder time, which throws a wrench in the short-term outlook of the EV industry.

Utilities Are Some Of The Biggest Investors In Renewable Energy

Major regulated electric utilities generate stable cash flows from long-term power purchase agreements, which make them resistant to recessions and inflation. It also makes some uniquely positioned to invest in renewable energy power generation, transmission, and distribution infrastructure during a time when many pure-play renewable energy operators and finance companies either don’t have the cash to do so or can no longer justify investment due to higher borrowing costs.

All of the major integrated electric utilities are now investing in renewable energy. Years of capital-intensive investments paired with long-term contracts have transformed NextEra Energy’s portfolio from majority fossil fuels to more natural gas and less coal, less nuclear, and a lot more wind and solar. In August, NextEra Energy Resources, a subsidiary of NextEra Energy, began planning a 3000-acre (1214-ha) solar farm in the Sonoran Desert near the town of Buckeye, Arizona. Called the Sonoran Solar project, the farm is expected to generate up to 260 MW of renewable energy accompanied by 260 MW of battery storage. In February, Florida Power & Light (FPL), which is owned by NextEra Energy, announced that it is ahead of schedule on its “30-by-30” initiative. Officially launched in early 2019, FPL made the goal to install 30 million solar panels in Florida by 2030. Now, it expects to do it by 2025. In March, Nacero Inc. awarded NextEra Energy Resources a long-term power purchase agreement to supply renewable wind power to Nacero’s planned manufacturing facility in Penwell, Texas, which will supply lower and net-zero lifecycle carbon footprint gasoline to consumers.

In November, Dominion Energy and Siemens Gamesa announced plans for a Virginia Offshore Wind Power Hub. Siemens Gamesa will develop more than 80 acres (32 ha) at the Portsmouth Marine Terminal in Portsmouth, Virginia, upon execution of a firm order for the 2.6-GW Coastal Virginia Offshore Wind Commercial project with Dominion Energy. Once fully operational, the blade facility is expected to create approximately 260 jobs. In March, Dominion Energy expanded solar and energy storage in Virginia with multiple projects in the works. Once in operation, the projects will provide 1 GW of carbon-free electricity, 4200 jobs, and US$880 million in economic activity.

In July, Duke Energy Florida announced four new solar energy sites. Duke Energy Florida plans to invest an estimated US$1 billion in 10 new solar power plants across Florida. In September, Duke announced the construction of the 207-MW Ledyard Windpower project in Kossuth County, Iowa. In November, Duke completed its Duette Solar Facility with plans to accelerate solar investments in Florida. With a combined investment of more than US$2 billion, Duke Energy Florida’s solar generation portfolio will include 25 grid-tied solar power plants that will benefit all of the company’s 1.9 million Florida customers. These projects will provide about 1500 MW of emissions-free generation using approximately 5 million solar panels by 2024. In February, Duke Energy unveiled plans to eliminate the use of coal in its energy-generation portfolio by 2035, with a phase out scheduled that will see coal representing less than 5% of the company’s total power generation by 2030.

In March 2021, Southern California Gas Co. (SoCalGas), the largest gas utility in the United States, announced plans to achieve net-zero greenhouse gas (GHG) emissions in its operations and delivery of energy by 2045. In mid-November, SoCalGas announced it will support research to test and further develop an innovative technology that captures CO2 from the air while simultaneously collecting water that can then be reused for irrigation. It also outlined its Clean Fuel Network to help California reach its ESG goals based on findings from a study titled The Role of Clean Fuels and Gas Infrastructure in Achieving California’s Net-Zero Climate Goal. From the study, SoCalGas found that electrification combined with clean fuels, carbon management, and technologies like fuel cells deliver the most affordable, resilient, and technologically proven path to full carbon neutrality. It also found that California can leverage its natural gas system to deliver clean fuels and to manage carbon and reach 100% net-zero goals more affordably, more equitably, and with less risk of power disruptions, customer conversion barriers, and technological limitations. And finally, it found that rapidly scaling up clean fuels initiatives today is vital to putting a clean fuels network in place in time to help California meet its climate goals. SoCalGas believes that the faster stakeholders can collaboratively act to expand and accelerate clean fuels initiatives, the quicker California can decarbonize. These findings provided the basis for SoCalGas’s proposed Angeles Link mega project. The proposal would develop what would be the nation’s largest green hydrogen energy infrastructure system to deliver clean, reliable renewable energy to the Los Angeles (LA) region. As proposed, the Angeles Link would support the integration of more renewable electricity resources like solar and wind and would significantly reduce greenhouse gas emissions from electric generation, industrial processes, heavy-duty trucks, and other hard-to-electrify sectors of the Southern California economy. The proposed Angeles Link would also significantly decrease demand for natural gas, diesel, and other fossil fuels in the LA Basin, helping accelerate California’s and the region’s climate and clean air goals.

Hydrogen Is The New Bridge Fuel

It’s not just utilities like SoCalGas that are investing in hydrogen. Industrial conglomerates, turbomachinery original equipment manufacturers (OEMs), parts suppliers, and other companies are rapidly increasing their hydrogen investments. Hydrogen has become a major part of energy policy in the United States and Europe. The United States believes that getting hydrogen to cost less than US$1.50/kg, or less than a gallon of gasoline, is a key step toward unlocking market potential. The Biden Administration launched Hydrogen Shot in summer 2021, which is a program that targets US$1/kg of clean hydrogen within a decade.

Chart Industries CEO Jillian Evanko put it well when she said that “prior to 2019, discussions on hydrogen were primarily related to space exploration. Enter 2020, and the universal shift to sustainability, and hydrogen became a household word. Fast forward to 2021, and we’ve seen an incredible amount of traction and progress.” According to Evanko, US$500 billion of hydrogen investment has been announced through 2030, up from US$350 billion around one or two years ago.

Europe continues to be the leader in developing the hydrogen economy. The European Union’s hydrogen strategy is centered around developing integrated infrastructure that uses hydrogen as a complement to natural gas and renewables. This includes hydrogen fuel cells, hydrogen vehicles, the use of hydrogen in energy storage, hydrogen boilers, and even the blending of hydrogen into existing natural gas systems to reduce emissions.

The blending of natural gas with hydrogen provides one of the greatest opportunities for the hydrogen and natural gas industry to grow while also lowering emissions. In April, Siemens Energy has announced plans to begin industrial production of electrolysis modules in Berlin in 2023. The 21,527-sq.ft. (2000-m2) site is currently used to manufacture gas turbines. The company is spending around US$32 million to install new production lines for electrolyzers at its Huttenstrasse plant. Siemens Energy said that the site currently manufactures gas turbines. Siemens Energy also noted that the gas turbines it produces on site can be operated with up to 50% hydrogen and expects these same turbines to be able to operate on 100% hydrogen by 2030.

On March 15, Siemens Mobility and Bayerische Regionbahn signed a leasing contract for a new prototype for Bavaria’s first hydrogen-powered train.

In March, Cooper Machinery Services (Cooper), a portfolio company of Arcline Investment Management, successfully tested a slow-speed integral engine-compressor running on a hydrogen/natural gas fuel blend. The research project demonstrated the safe operating range of hydrogen blends in large-bore internal combustion engines. Cooper ran an unmodified large-bore, slow-speed integral engine-compressor with a hydrogen blend of 5% by volume, but expects to ramp the concentration from 5% to 33% to further lower emissions.

Last year, BASF announced partnerships with Siemens Energy and RWE to try and reduce environmental consequences of its chemical production process at the Ludwigshafen Chemical Complex, which is the largest chemical complex in the world. The company identified the construction of proton exchange membrane (PEM) electrolyzers for hydrogen production as a way it can reduce CO2 emissions.

Making Progress

Almost all of the updates discussed in this article are less than a year old, and many of them are less than six months old. However, even then, we had to leave out plenty of the content published in ESG Review over the last year. Given the depth and breadth of the content discussed, it is clear that we have made an incredible amount of progress toward lowering industry emissions. Between 2020 and today, there has arguably been more advancement, more goals established, and more capital allocated toward ESG than in the prior 10 years. Hopefully by Earth Day 2023, we’ll have even more to celebrate — and find ourselves a lot closer to a net-zero world.

The golden opportunity is upon us. And those that are taking an early advantage are already beginning to see the economic and environmental benefits.