North Star Renewables (North Star) plans to produce two service operation vessels (SOVs) for Equinor’s Dogger Bank wind farm. The first vessel will go toward Dogger Bank A, the first phase of the project, which the second is slated for production when Dogger Bank B comes online. Each 5511-ton (5000-tonne) vessel is expected to house 40 technicians. A third vessel will feature a helideck and can house up to 50 personnel. The first vessel is expected to be delivered in the summer of 2023.

Each SOV will be supported by a hybrid-powered daughter craft, which North Star Renewables said are the first of its kind. The daughter crafts transport technicians from the SOVs to the offshore wind turbines. Over the last decade, North Star has built and delivered 17 ships. However, it has never quite taken on a project like Dogger Bank. “It’s been exhilarating to see construction beginning on our first renewables fleet at both locations, demonstrating we are fully on track for delivering the six vessels on schedule despite the global pandemic,” said North Star CEO, Matthew Gordon. “Our SOVs bring a superior level of comfort to offshore wind technicians working in the harsh North Sea environment. We are also introducing a raft of exciting new systems and software to the market in conjunction with our technology partners across the fleet which truly push the boundaries of performance to help increase workability, safety, on-board comfort, lowered fuel consumption and hits the mark with the sector’s sustainability goals. This is just the start of our journey in renewables. Not only do we have the capital in place, we also have the experience and capabilities within our organization to deliver and operate numerous offshore wind vessel fleets simultaneously. It’s our overarching objective we have planned to secure at least 15 renewable fleet contracts within the next five years; and our business is ready to do so.”

“We are building Dogger Bank with focus on innovation and sustainability, and the vessels supplied by North Star and Alicat are great examples of both,” said Rune Rønvik, prepare for operations manager for Dogger Bank. “First steel cut is a great milestone on the path to have the first SOV delivered at the Port of Tyne in 2023, where we will run the operations for the world’s biggest offshore wind farm.”

“The steel cutting ceremony for the first of the three vessels under construction at VARD [North Star’s Vietnamese shipping partner] for North Star is an important milestone,” said Fredrik Mordal Hessen, general manager for the offshore and specialized vessels business area in VARD. “Together, we have developed future-oriented vessels with a high focus on workability, comfort, safety, and sustainability. Now, we have started the exciting shipbuilding phase, and we are looking forward to continuing the excellent teamwork to build the innovative vessels for the Dogger Bank Wind Farm.”

“It’s always a very exciting moment to see the first cut of the aluminum achieved on a newbuild project, but to be involved in a first for the offshore wind industry has really upped the ante,” said Alicat Director Simon Coote. “We are very proud to be part of this journey with North Star and its design partner Chartwell Marine, helping to put their innovative daughter craft fleet design on the map with the UK renewables sector and internationally. There is a wealth of industry talent on Dogger Bank’s doorstep and it’s great to be recognized for having the necessary skills and facilities to deliver a project of this size.”

Changing Of The Guard

On November 2, Equinor announced a farm down of Dogger Bank C, the third phase of the project, as it looks to raise money. Equinor sold a 10% equity stake in the project to Eni in coordination with SSE Renewables, which also sold a 10% stake. A 1% interest in the project is currently valued at roughly US$9.4 billion. The farm down transaction is expected to close in the first quarter of 2022. “With this offshore wind transaction, we continue to demonstrate value creation from Equinor’s renewables business,” said Pål Eitrheim, executive vice president in renewables at Equinor. “As with Dogger Bank A and B, the divestment in the Dogger Bank C project is in line with our strategy of accessing selective markets early and at scale, leveraging our offshore capabilities to mature and de-risk projects.”

Dogger Bank Details

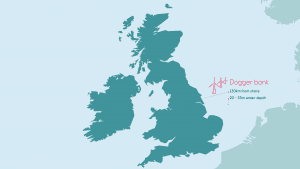

In 2019, Equinor and SSE Renewables secured a 3.6-GW offshore wind contract during the UK’s Contract for Difference auction. Dogger Bank A and Dogger Bank B reached financial close of competitive terms in 2020. Each of the three phases is expected to have a capacity of 1.2 GW. If completed, the project will be the world’s largest offshore wind farm in both capacity and in annual power generation with an estimated 18 TWh. “Dogger Bank is the largest wind farm in the world under construction,” said Eitrheim. “Together with SSE Renewables, we are pleased to continue with Eni as an industrial partner for all three phases of the windfarm. Together we will deliver value to the United Kingdom for years to come and help drive toward a net-zero emissions future for the UK.” The project is located 81 miles (130 km) off England’s north-east coast.