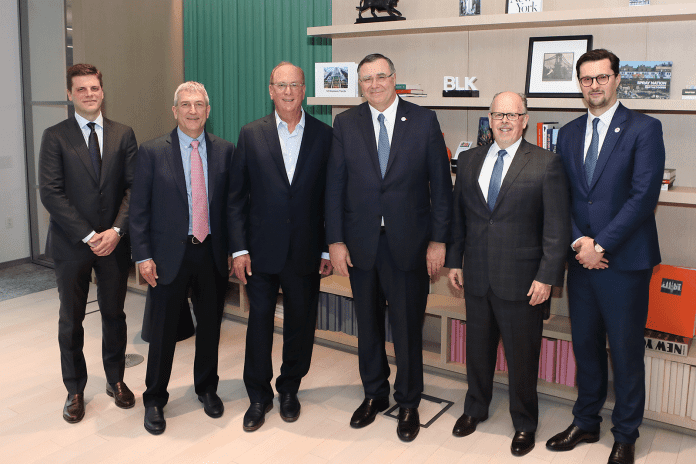

TotalEnergies and Vanguard Renewables, a farm-based organics-to-renewable natural gas (RNG) production business and a portfolio company of a fund managed by BlackRock’s Diversified Infrastructure business, have signed an agreement to create an equally owned joint venture (JV) to develop, build, and operate Farm Powered RNG projects in the United States. The signing took place in New York on April 12, 2024, in the presence of Patrick Pouyanné, chair and chief executive officer (CEO) of TotalEnergies and Larry Fink, chair and CEO of BlackRock.

TotalEnergies and Vanguard Renewables will advance 10 RNG projects into construction over the next 12 months, with a total annual RNG capacity of 0.8 TWh (2.5 Bscf). The three initial projects in this agreement are currently under construction in Wisconsin and Virginia, each with a unit capacity of nearly 75 GWh (0.25 Bscf) of RNG per year.

Beyond these first 10 projects, the partners will consider investing together in a potential pipeline of about 60 projects across the country for a total capacity of 5 TWh (15 Bscf) per year.

“TotalEnergies is pleased to partner with BlackRock and its portfolio company Vanguard Renewables, to accelerate the development of food biowaste processing into RNG in the United States,” said Olivier Guerrini, vice president of biogas at TotalEnergies. “By expanding into this fast-growing market, our joint venture will create value for both companies while benefiting the food and farming sectors as well as providing a ready-to-use solution to industrial companies willing to decarbonize their energy supply. This joint venture is a new step for TotalEnergies in achieving its objective to produce 10 TWh of RNG by 2030.”

Headquartered near Boston, Massachusetts, Vanguard Renewables was founded in 2014 and has a workforce of approximately 260 people. The company currently operates 17 organics-to-renewable energy facilities with an annual capacity of more than 440 GWh (1.5 Bscf) of RNG. Looking beyond 2024, Vanguard Renewables plans to commission more than 100 RNG projects by the end of 2028.

In July 2022, Vanguard Renewables was acquired by BlackRock, through a fund managed by its Diversified Infrastructure business (BlackRock). BlackRock has partnered with Vanguard Renewables’ management team to build on the company’s track record to drive the next phase of its growth to support the nationwide expansion of its anaerobic digester projects from coast to coast. BlackRock will remain the majority shareholder of Vanguard Renewables.

“We are thrilled to welcome TotalEnergies as a strategic partner, building on our mission of developing farm-based organics-to-RNG projects across the United States. This collaboration validates Vanguard’s leadership position in the RNG space in the United States and brings together our expertise with TotalEnergies’ extensive experience in large-scale energy development, safety procedures, and global partnerships. These 10 RNG projects, jointly undertaken by TotalEnergies and Vanguard Renewables as co-investment partners, further reinforce our commitment and ability to deliver on our mission of harnessing the power of waste to decarbonize our planet,” said Neil H. Smith, CEO of Vanguard Renewables.

Thanks to its experienced teams and development platform, Vanguard Renewables will contribute to the JV its ready-to-build projects at scale. It will also manage feedstock supply, the assets, operations, and RNG sales. Leveraging its strong position in the European market, especially in France and Poland, TotalEnergies will bring to the JV its industrial expertise, providing technical support on the design and engineering of the facilities, and on the plant’s operational performance.

TotalEnergies and Vanguard Renewables will market the RNG through long-term purchase agreements with buyers actively engaged in decarbonization of their industrial processes.

“This exciting partnership brings together TotalEnergies’ global experience in scaling and operating renewable gas assets with Vanguard Renewables’ position in the United States, extensive operational history and customer relationships, and robust project portfolio. With TotalEnergies as a strategic partner, Vanguard Renewables will be positioned to achieve even stronger growth and continued success,” said Doug Vaccari, managing director of diversified infrastructure at BlackRock.

The first 10 projects are based on a model of waste materials recovery from the food and beverage industries, supplemented with dairy manure from dairy farms. The anaerobic digesters will be built on the dairy farms themselves, which will then recover and manage the digestate (a byproduct of the anaerobic digestion process) as a low-carbon and nutrient dense fertilizer.

To feed its digesters, Vanguard Renewables has established a major network of food industry brands across the United States and the groundbreaking Farm Powered Strategic Alliance, which gives Alliance members preferred access to recycle their organic waste generated from manufacturing or retail activities and the potential opportunity to purchase the renewable energy generated at a Vanguard Renewables’ facility. The Alliance’s members include multi-national corporations across several verticals, including food, beverage, and pharmaceutical manufacturers.

In anticipation of the company’s growing portfolio of anaerobic digesters, Vanguard Renewables has expanded its food and beverage diversion services and its organics solutions team to provide service throughout the contiguous United States.

The transaction completion is subject to customary conditions precedent.