Tesla has been the single most instrumental company in advancing electrification in the automotive industry. Today, virtually every major legacy automaker has announced multi-billion-dollar plans to invest in electric vehicles (EVs). New pure-play EV companies have sprouted up to electrify the trucking and passenger vehicle industries. A lot of credit deservingly goes to Tesla for proving that EVs can be profitable and take market share from the internal combustion engine (ICE) models.

However, ESG criteria isn’t just about cutting emissions. To be included in an ESG fund (which benefits public companies because it increases demand for their shares), a company must check all three boxes. Tesla is being called out for its poor performance in the “S” and the “G” categories. This isn’t anything new. Tesla has long received criticism for unfair labor practices. It also has a surprisingly poor track record for disclosures. Fatalities because of its autopilot software could also hurt its ESG score. That’s just the “S.”

Tesla’s Poor Governance

Tesla’s governance has always been terrible. Tesla issues bloated stock options for Elon Musk and other C-suite executives. Even after falling more than 40% from its all-time high, Tesla stock has crushed the Nasdaq Composite and S&P 500 in recent years. Some folks would argue that Musk deserves massive bonuses for that performance. Others disagree.

Aside from disproportionate executive compensation, another problem for Tesla’s governance is Musk’s impulsive tweeting. The Securities and Exchange Commission (SEC) has doled out little more than a slap on the wrist for Musk’s behavior. Musk has long been at odds with Twitter. However, the tensions have escalated to a whole new level the last couple of months as Musk, who is the wealthiest human in the world and the CEO of the most valuable automaker in the world, offered to buy Twitter. Twitter stock has since plunged, and Musk is trying to rewrite the terms of the deal at a less expensive valuation. To buy Twitter, Musk would have to sell Tesla stock, which is where most of his net worth resides. Having a CEO go on a crusade that seems grounded in entertainment and not in running a business well, and then needing to sell a good chunk of the stock he is the CEO of to fund that transaction, is about as bad of governance as you can ask for.

However, it’s also a bit silly that on the same day Tesla was kicked out of the S&P Dow Jones Indices’ ESG fund, ExxonMobil and Marathon Petroleum were added in. In response to the news, Musk tweeted “Exxon is rated top ten best in world for ESG by S&P 500, while Tesla didn’t make the list! ESG is a scam. It has been weaponized by phony social justice warriors.”

It’s worth mentioning that this index fund is by no means the largest financial ESG vehicle and makes up a mere fraction of global ESG investments. For example, other large institutions like Blackrock and Vanguard haven’t kicked Tesla out of their ESG funds.

ESG Standards Need To Be Stricter

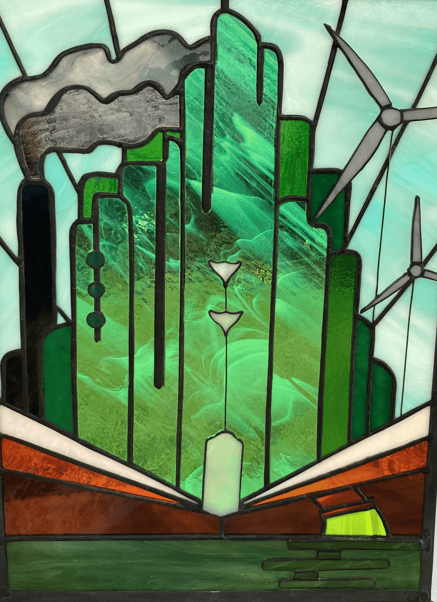

The cover feature of the Q1 2022 issue of ESG Review was a piece titled “The Gilded Age Of Greenwashing.” In that article, we discussed the importance of actions over words. Carbon-neutral pledges are good natured. But results speak for themselves. We’d love to see every company hit its medium- and long-term goals. The reality is many won’t. Companies shouldn’t be added to an ESG fund simply because they say they will do something. They should be added to an ESG fund only when they prove they are committed to ESG and don’t view it as a fad, but rather, an essential part of conducting a business that benefits all stakeholders and not just shareholders.

For that reason, ExxonMobil and Marathon Petroleum do not deserve to be added simply because they only began ramping up the ESG rhetoric less than two years ago. It’s too early. Tesla also arguably does not deserve to be included because hitting on the “E” isn’t enough.

In general, the biggest problem we are seeing with Wall Street’s interpretation of ESG is that every company wants to be included. And right now, most companies are getting their way. Financial institutions benefit from including more companies in ESG funds because it gives them an excuse to charge higher management fees for an ESG exchange traded fund (ETF) than an S&P 500 index fund.

At its worst, the ESG fund trend is reminiscent of the atrocities committed by ratings agencies during the financial crisis. Ratings agencies were arguably the biggest catalyst for widespread fraud and delinquencies because they did not do their due diligence for the mortgage bonds they were tasked with inspecting. Instead, they dished-out AAA investment grade ratings like they were candy when the underlying assets held in many of those bonds would soon become insolvent.

In sum, making an S&P 500 ESG index fund that includes the vast majority of S&P 500 components and then making an example out of Tesla is not the way to go about gaining credibility for ESG investing. Neither is adding oil and gas companies that have only recently changed their marketing campaigns and committed real dollars to work. Let’s see if those commitments turn into real projects before handing out participation trophies.