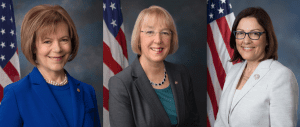

United States Senators, Tina Smith and Patty Murray, and US Representative Suzan DelBene, have put forth legislation in the Senate and House. Officially called The Financial Factors in Selecting Retirement Plan Investments Act, the proposal aims to provide legal clarity regarding workplace retirement plans that choose to consider ESG factors in their investment decisions or offer ESG investment options.

“Sustainable investment options are good for retirees and good for our environment — that’s a win-win,” said Senator Smith. “We’re putting forth this legislation because we know there’s a growing demand for sustainable investing, and because we believe Congress should act now to provide the legal certainty necessary to make sure workplace retirement plans are able to offer these options to workers across the country.”

ESG investment options have been on the rise as retail investors look for customized solutions to wealth management. From low-cost exchange traded funds (ETFs) to ESG-focused hedge funds, ESG products were one of the few asset classes that experienced strong inflows throughout the COVID-19 pandemic (see “An Introduction to ESG,” First Quarter 2021 ESG Review, p.2).

Smith, Murray, and DelBene point out that despite strong demand for sustainable investing, few pensions or 401(k) plans abide by ESG principles when making investment decisions. Many do not provide sustainable options at all. According to the proposed legislation, sustainable investing was discouraged by a Department Of Labor (DOL) rule under former President Trump that imposed new limits on the consideration of ESG factors by workplace retirement plans. “Americans deserve a secure retirement. ESG investments are a key component in accomplishing that goal,” said Congresswoman DelBene. “This bill promises retirees a pathway not only to reach that secure retirement but a pathway to live in a world worth retiring in.”

“Retirement security is all about planning for the future — and you can’t truly do that if you aren’t able to consider the ESG factors that will shape the future,” said Senator Murray. “Allowing this approach isn’t just common sense, it’s a win for workers, retirees, investors, businesses, communities, the environment, and more. That’s why Senator Smith, Congresswoman DelBene, and I are introducing legislation to make sure people are able to invest in a future that’s not only more financially secure for their family, but more just, diverse, and sustainable for everyone.”

From A Luxury To A Human Right

According to Pew Research, nearly 30 million American Baby Boomers are in retirement. And with around 10,000 people turning 65 every day, the number is expected to go up from here.

Retirement is a concept that has changed a lot over the years. It wasn’t long ago when laying your burden down for good was considered a luxury. Lower life expectancies, less access to capital markets, and higher children per family meant that many folks never truly stopped working. There was no such thing as the bridge cruise or the summer vacation house. Labor was just a necessary part of life, from childhood until death.

Industrialization changed that. Massive increases in standard of living and economic productivity gave rise to the pension in the mid 19th century. The propagation of the corporation and a lack of workers’ rights and regulations led to the consolidation of wealth. Companies began using pensions to retain talent by providing for employees and their families even after they stopped working. By the 1920s, pensions were the norm among corporate America. Everyone else wasn’t as fortunate, as there were no comparable retirement options available outside the pension.

The Great Depression led to years of 20% or higher unemployment, a nearly 90% crash in the US stock market, and the collapse in value of many physical assets. During the early 1930s, everyone was hurting. And companies that promised pensions were on the brink of going belly up. Enter the Social Security Act of 1935, which effectively shifted retirement from a privilege to a right. But for many, it still wasn’t nearly enough to live off of.

After World War II, the US economy underwent arguably its biggest expansion in history. The standard of living soared. Many homes gained access to appliances like vacuums and refrigerators for the first time. Mortgage requirements were loose and interest rates were low, so even those with little savings could get a home. The economy was roaring, and pensions were ballooning. It was unsustainable.

Fast forward to the tail-end of the Vietnam War in the mid-1970s. Pensions were looking less and less affordable for the companies paying them. The rise of individualism meant that people no longer wanted to devout decades of service toward companies in order to qualify for a pension. They wanted to take ownership of their finances and their retirement.

The Birth Of Individual Retirement Planning

The Employee Retirement Income Security Act (ERISA) of 1974 established the individual retirement account (IRA), with traditional IRAs becoming available in 1975. For the first time, there was now an investment vehicle that allowed individuals to defer paying taxes on a portion of their income and grow that income tax free. The only downside was paying taxes upon withdrawing from the account in retirement. The contribution limits started at US$1500 a year in 1975, grew to US$2000 by 1982, and today, are US$5500.

IRAs were powerful, but they were nothing compared to the 401(k). Section 401(k) is a provision of the Revenue Act of 1978 that allows employees a tax-free way to defer compensation from bonuses or stock options. In 1981, the Internal Revenue Service (IRS) extended this benefit to salary deductions in response to the Economic Recovery Act of 1981.

The 401(k) had everything: employee contributions, employer contributions, tax benefits, and the ability to invest in riskier asset classes. Unlike pensions, which faced intense regulations, were limited in what they could invest in, and mostly focused on capital preservation, 401(k)s were able to engage in more “speculative” asset classes. The average American suddenly found most of their retirement money flipping hands on Wall Street. It was uncomfortable, but it worked out. The US stock market has been one of the best asset classes in the world for decades. Today, Americans hold nearly US$5 trillion dollars in 401(k) plans.

A final note on our retirement journey came in 1997, when Senator William Roth helped create what today is known as the Roth IRA. A traditional IRA on steroids, the Roth IRA allows individuals to pay taxes upfront on a portion of their income, then put it into a retirement vehicle that not only grows tax free but also is able to be withdrawn from tax free in retirement. The advantage is that younger people tend to have lower tax rates. So, by paying taxes now, they are helping themselves even more down the road.

A Unified Front

In today’s day and age, retirement planning isn’t just about contribution limits and tax incentives. It’s also about individuals choosing the kinds of companies they want to support with their hard-earned savings. Even if Smith, Murray, and DelBene’s bill fails to pass, it carries an important message regarding a need to build legal framework around ESG investing in retirement plans.

Whether bipartisan support comes through or not, the Congresswomen were successful in garnering support from several independent organizations, like the Securities Industry and Financial Markets Association (SIFMA). “SIFMA believes it is important for financial institutions to be able to consider all factors, including ESG factors, as part of an investment and risk management strategy,” said SIFMA President and CEO Kenneth E. Bentsen Jr. “ESG factors should continue to be valid considerations for investment decisions — including for qualified default investment alternatives (QDIAs) and their components — so long as they are evaluated in a manner consistent with a prudent process. We strongly believe the focus should be on the prudence of the analysis, as opposed to the particulars of the investments. SIFMA commends Chair Murray and Senator Smith for their engagement on this important issue and look forward to working with the committee toward final passage.”

“The bill makes clear that ESG criteria may be considered in ERISA-governed retirement plans and will end the policy pendulum of regulatory interpretations on this issue at the Department Of Labor,” said Lisa Woll, CEO of the US Forum for Sustainable and Responsible Investment.

“ESG risk analysis is an important part of prudent investing. We support the Financial Factors in Selecting Retirement Plan Investments Act because it would help mainstream the use of this analysis as part of retirement plan investment selection, benefiting participants,” said Aron Szapiro, head of policy research at Morningstar Inc.

“Retirement plan sponsors and participants deserve the freedom to choose the 401(k) investments that best suit their needs,” said Brian Graff, CEO of the American Retirement Association. “This legislation allows the ESG investments to be included on a 401(k) menu consistent with a normal fiduciary process without artificial and unnecessary barriers that are inconsistent with fundamental principles of ERISA.”

“CFA Institute is pleased to support the Financial Factors in Selecting Retirement Plan Investments Act,” said Kurt Schacht, head of advocacy, Americas at the CFA Institute.

“Integration of all material factors, including material ESG factors is an important part of the analytical and investment decision-making process, regardless of investment style, asset class, or investment approach; and one that extends to the exercise of shareholder rights and proxy voting. The legislation helps to address the confusion created by one of the Department Of Labor rules [RIN 1210–AB95] finalized last year and clarifies that integrating ESG factors in the financial evaluation and management of plan investments can be consistent with ERISA fiduciary obligations.”

“The Financial Factors in Selecting Retirement Plan Investments Act proposal would require fiduciaries to primarily consider investment returns, but also allow them to incorporate ESG factors both as a source of potential investment returns and as a tie-breaker when deciding between two otherwise equivalent investments. We believe this is an appropriate framework, as it allows fiduciaries to incorporate ESG factors into their investment decisions, including those that apply to the qualified default investment alternative (QDIA), while still prioritizing the obligation of fiduciaries to seek investment returns for beneficiaries,” said Catherine Reilly, director of retirement solutions at Smart USA.