After more than a year of deliberation, the US Department of Energy (DOE) has selected seven regional hydrogen hubs that will split US$7 billion in funding as a result of the Bipartisan Infrastructure Law. The initial applicant pool was narrowed down from 79 candidates to 33 in December 2022. Full applications were accepted in April 2023. At the time, the DOE said it would choose six to 10 winners to accelerate the domestic market for low-cost, clean hydrogen.

Hydrogen is a key component of the DOE’s goals to strengthen energy security, bolster domestic manufacturing, create healthier communities, and deliver new jobs and economic opportunities across the nation. However, the US$7 billion in regional hydrogen hub funding is merely one aspect of the broader US national hydrogen strategy. This article will discuss how the many US hydrogen programs fit together, the details of each hydrogen hub, hydrogen economy challenges, opportunities for hydrogen compression, and the coordination needed between public and private industry for US hydrogen to enjoy sustainable growth over the next several decades.

Years In The Making

The DOE’s approach toward clean hydrogen has transitioned from an ill-defined idea to an officially stated policy. The DOE now has several initiatives designed to bring together stakeholders to help drive down the cost of advanced hydrogen production, transport, storage, and use across multiple sectors in the economy. The unprecedented positive federal support for the hydrogen economy is having sweeping ripple effects across the energy, utility, industrial, and technology sectors.

In June 2021, the DOE released its Energy Earthshots initiative, the goal being to develop programs across the DOE’s science, applied energy offices, and Advanced Research Projects Agency-Energy (ARPA-E) to address tough technological challenges and cost hurdles, and rapidly advance solutions to help achieve climate and economic competitiveness goals. Even more important than Energy Earthshots were topics discussed at the DOE’s Hydrogen Program Annual Merit Review and Peer Evaluation Meeting. During this time, the DOE’s Hydrogen Program conducted a feasibility study and risk assessment for potential hydrogen hubs based on existing infrastructure, job creation, benefits for disadvantaged communities, hydrogen cost reductions, carbon emissions reductions, end user access, and the advancement of science and innovation. The DOE then issued a request for information in viable hydrogen demonstrations.

The first project under Energy Earthshots was the Hydrogen Shot program. The goal of Hydrogen Shot is to bring the cost of green hydrogen down to US$1 per kg by 2031, which would be around an 80% reduction from 2021 levels. Hydrogen Shot is part of the broader DOE goal to create a 100% electric grid by 2035 and to have net-zero US emissions by 2050.

In many ways, the efforts by Hydrogen Shot, as well as the request for information issued by the DOE’s Hydrogen Program, was a precursor to the DOE’s much larger hydrogen initiatives. In June 2022, one year after the launch of the Energy Earthshots program, the DOE’s hydrogen initiatives took a leap forward with the passing of the Bipartisan Infrastructure Law’s US$8 billion program to develop regional clean hydrogen hubs across America. In September 2022, the United States outlined its National Clean Hydrogen Strategy and Roadmap, which is supported by the Clean Hydrogen Standard, Inflation Reduction Act tax incentives, and coordination between the United States and Mexico to build out the clean hydrogen supply chain across North America.

As we enter 2024, the hydrogen hub idea has transitioned from a mere budget line item to a nation-wide effort to bring the United States into the forefront of the global hydrogen economy. At the same time, there is continued funding for existing hydrogen programs like Hydrogen Shot, as well as the addition of newer programs. For example, the DOE is also allocating an additional US$1 billion toward the Clean Hydrogen Electrolysis Program and US$500 million for Clean Hydrogen Manufacturing and Recycling Activities (more on that later).

The Tip Of The Iceberg

The White House believes that the seven selected regional clean hydrogen hubs will catalyze more than US$40 billion in private investment and create tens of thousands of good-paying jobs — bringing the total public and private investment in hydrogen hubs to nearly US$50 billion. Roughly two-thirds of total project investment are associated with green (electrolysis based) production within the hubs. Several of the hubs were developed in close partnerships with unions, with three requiring project labor agreements.

Collectively, the hubs aim to produce more than 3.31 million tons (3 million tonnes) of clean hydrogen per year, achieving nearly one third of the 2030 US clean hydrogen production goal of 11.02 million tons (10 million tonnes). Through technological strides and scale, the hubs should help to reduce the cost of green hydrogen production. Together, the seven Hydrogen Hubs will eliminate 27.56 million tons (25 million tonnes) of carbon dioxide (CO2) emissions from end uses each year — an amount roughly equivalent to combined annual emissions of more than 5.5 million gasoline-powered cars. The DOE said the nearly US$50 billion investment is one of the largest investments in clean manufacturing and jobs in history.

Clean hydrogen can reduce emissions in many sectors of the economy and is especially important for hard-to-decarbonize sectors and industrial processes, such as heavy-duty transportation and chemical, steel, and cement manufacturing. Targeted investments in these areas can help reduce costs, make new breakthroughs, and create jobs for American engineers, manufacturing workers, construction workers, and others.

Regional Clean Hydrogen Hubs

Mid-Atlantic Hydrogen Hub

States: Pennsylvania, Delaware, New Jersey

Funding: Up To US$750 Million

Job Growth: 20,800 Direct Jobs — 14,400 Construction & 6400 Permanent

The Mid-Atlantic Hydrogen Hub will help unlock hydrogen-driven decarbonization while repurposing historic oil infrastructure and using existing rights-of-way. It plans to develop renewable hydrogen production facilities from renewable and nuclear electricity using both established and newer electrolyzer technologies, where it can help reduce costs and drive further technology adoption. As part of its labor and workforce commitments to the community, the Mid-Atlantic Hydrogen Hub plans to negotiate Project Labor Agreements for all projects and provide close to US$14 million for regional Workforce Development Boards that will serve as partners for community college training and pre-apprenticeships.

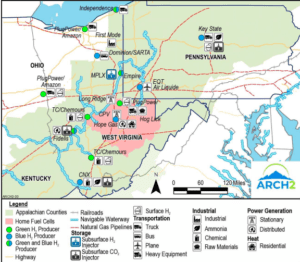

Appalachian Hydrogen Hub

States: West Virginia, Ohio, Pennsylvania

Funding: Up To US$925 Million

Job Growth: 21,000 Direct Jobs — 18,000 Construction & 3000 Permanent

The Appalachian Hydrogen Hub will leverage the region’s ample access to low-cost natural gas to produce low-cost clean hydrogen and permanently and safely store the associated carbon emissions. The strategic location of this Hydrogen Hub and the development of hydrogen pipelines, multiple hydrogen fueling stations, and permanent CO2 storage have the potential to drive down the cost of hydrogen distribution and storage. The Appalachian Hydrogen Hub is anticipated to bring quality job opportunities to workers in coal communities, helping ensure the Appalachian community benefits from the development and operation of the hub.

California Hydrogen Hub

State: California

Funding: Up To US$1.2 Billion

Job Growth: 220,000 Direct Jobs — 130,000 Construction & 90,000 Permanent

The California Hydrogen Hub will produce hydrogen exclusively from renewable energy and biomass. It will provide a blueprint for decarbonizing public transportation, heavy-duty trucking, and port operations — key emissions drivers in the state and sources of air pollution that are among the hardest to decarbonize. This Hydrogen Hub has committed to requiring Project Labor Agreements for all projects connected to the hub, which will expand opportunities for disadvantaged communities.

Gulf Coast Hydrogen Hub

State: Texas

Funding: Up To US$1.2 Billion

Job Growth: 45,000 Direct Jobs — 35,000 Construction & 10,000 Permanent

The Gulf Coast Hydrogen Hub will be centered in the Houston region, the traditional energy capital of the United States. It will help kickstart the clean hydrogen economy with its plans for large-scale hydrogen production through both natural gas with carbon capture and renewables-powered electrolysis, leveraging the Gulf Coast region’s abundant renewable energy and natural gas supply to drive down the cost of hydrogen — a crucial step to achieving market liftoff.

Heartland Hydrogen Hub

States: Minnesota, North Dakota, South Dakota

Funding: Up To US$925 Million

Job Growth: 3880 Direct Jobs — 3067 Construction & 703 Permanent

The Heartland Hydrogen Hub will leverage the region’s abundant energy resources to help decarbonize the agricultural sector’s production of fertilizer, decrease the regional cost of clean hydrogen, and advance the use of clean hydrogen in electric generation and for cold climate space heating. It also plans to offer unique opportunities of equity ownership to tribal communities through an equity partnership and to local farmers and farmer co-ops through a private sector partnership that will allow local farmers to receive more competitive pricing for clean fertilizer.

Midwest Hydrogen Hub

States: Illinois, Indiana, Michigan

Funding: Up To US$1 Billion

Job Growth: 13,600 Direct Jobs — 12,100 Construction & 1500 Permanent

The Midwest Hydrogen Hub will enable decarbonization through strategic hydrogen uses including steel and glass production, power generation, refining, heavy-duty transportation, and sustainable aviation fuel. This Hydrogen Hub plans to produce hydrogen by leveraging diverse and abundant energy sources, including renewable energy, natural gas, and low-cost nuclear energy.

Pacific Northwest Hydrogen Hub

States: Washington, Oregon, Montana

Funding: Up To US$1 Billion

Job Growth: 10,000 Direct Jobs — 8050 Construction & 350 Permanent

The Pacific Northwest Hydrogen Hub plans to leverage the region’s abundant renewable resources to produce clean hydrogen exclusively from renewable sources. It’s anticipated widescale use of electrolyzers will play a key role in driving down electrolyzer costs, making the technology more accessible to other producers, and reducing the cost of hydrogen production. The Pacific Northwest Hydrogen Hub has committed to negotiating Project Labor Agreements for all projects more than US$1 million and investing in joint labor-management/state-registered apprenticeship programs.

Other DOE Hydrogen Efforts

In total, the Bipartisan Infrastructure Law allocates US$65 billion in clean energy investments at the DOE, including US$8 billion for the Regional Clean Hydrogen Hubs Program. As mentioned, around US$7 billion is going directly to the hubs. Up to US$1 billion of the remaining funding will be used for demand-side support for the hubs to drive end uses of clean hydrogen.

The hubs are covered under the Justice40 Initiative, which aims to ensure that 40% of the overall benefits of certain federal investments flow to disadvantaged communities that are marginalized by underinvestment and overburdened by pollution. Hubs have also submitted detailed Community Benefits Plans, including how the project performers will transparently communicate, eliminate, mitigate, and minimize risks.

The DOE has announced other resources to support clean hydrogen research and development. The new Hydrogen Hub Matchmaker resource is helping clean hydrogen producers, end users, and others find opportunities to develop networks of production, storage, and transportation infrastructure.

The DOE is allocating US$1 billion toward its Clean Hydrogen Electrolysis Program. Electrolysis (using electricity to split water into hydrogen and oxygen) allows for clean hydrogen production from carbon pollution-free power sources like wind, solar, and nuclear. This program aims to improve the efficiency and cost-effectiveness of these technologies by supporting the entire innovation chain — from research, development, and demonstration to commercialization and deployment.

The DOE is allocating US$500 million for Clean Hydrogen Manufacturing and Recycling Activities. The DOE is also supporting American manufacturing of clean hydrogen equipment, including projects that improve efficiency and cost-effectiveness and support domestic supply chains for key components, through the Bipartisan Infrastructure Law’s Clean Hydrogen Manufacturing Initiative. The DOE has also announced funding, as part of the Clean Hydrogen Technology Recycling Research, Development, and Demonstration Program, for approaches to increase the reuse and recycling of clean hydrogen technologies.

In March 2023, the DOE announced the first phase of funding for the Clean Hydrogen Electrolysis Program and manufacturing and recycling initiatives with a US$750 million funding opportunity to reduce the cost of electrolyzers and other clean-hydrogen technologies. The Department of Energy Loan Programs Office has also completed investments in clean hydrogen facilities.

Challenges Facing The Hydrogen Economy

The primary goal of programs like Hydrogen Shot and the seven hydrogen hubs is to reduce the costs of hydrogen to make it economically and environmentally competitive. As the hydrogen economy grows, hydrogen compression demand will increase. Developing lower cost compression will be essential for making the hydrogen economy a reality. The DOE has completed several helpful studies that discuss the importance of reducing hydrogen costs.

The National Renewable Energy Laboratory (at the request of the DOE) conducted an independent review of hydrogen compression, storage, and dispensing (CSD) for pipeline delivery of hydrogen and forecourt hydrogen production. The study found that CSD hydrogen costs for a pipeline scenario were about US$2.40 per kg. About 75% of those costs, or US$1.54 per kg, came from compression alone, while the other 25% of costs came from storage, dispensing, cooling, and other.

A separate study by the DOE involving cost and performance targets for hydrogen delivery and process technologies detailed the ways compression costs must come down to reduce delivery costs associated with distributed and centralized hydrogen production.

Technical targets for hydrogen delivery components forecasted a 25% reduction in total capital investment for transmission pipelines between the DOE’s 2020 target and its ultimate target and a 39% reduction in total capital investment for pipeline distribution from truck and service lines. The DOE’s ultimate target is based on 15% hydrogen market penetration. The DOE said the specific scenario it examined assumes central production of hydrogen that serves a city with a population around 1 million and that the fueling station average dispensing rate is 1000 kg/day.

The cost reductions demanded from pipeline, terminal, and geologic storage compressors were far greater than pipeline transmission and distribution. The DOE is targeting a 50% reduction in uninstalled capital cost from pipeline, terminal, and geologic storage compressors between its 2020 target and its final target. It also expects to bring down the annual maintenance costs as a percentage of installed capital cost down from 6% in 2015 to 2% for the final target.

Perhaps the tallest order falls on small compressors, which the DOE expects to post boosted availability, higher compressor-specific energy, lower uninstalled capital costs, lower maintenance costs, and the ability to last for more than 10 years. However, the DOE did say that the compressor lifetime assumes that routine maintenance is performed on the compressor, such as replacement of seals and valves, at the service intervals specified by the manufacturer. It also said compressor longevity is dependent on operator know-how, proper operation, and maintenance.

In sum, compressors are expected to achieve higher performance at lower cost to make hydrogen production, transportation, and storage scalable.

Opportunities In Hydrogen Compression

The DOE has identified four main types of compression solutions that can help to reduce the costs of a full-scale hydrogen economy.

- Reciprocating compressors use a motor with a linear drive to move a piston or a diaphragm back and forth. This motion compresses the hydrogen by reducing the volume it occupies. Reciprocating compressors are the most used compressor for applications that require a very high compression ratio.

- Rotary compressors compress through the rotation of gears, lobes, screws, vanes, or rollers. Hydrogen compression is a challenging application for positive displacement compressors due to the tight tolerances needed to prevent leakage.

- Ionic compressors are similar to reciprocating compressors but use ionic liquids in place of the piston. These compressors do not require bearings and seals, two of the common sources of failure in reciprocating compressors. Ionic compressors are available today at the capacities and pressures required at hydrogen fueling stations.

- Centrifugal compressors are the compressor of choice for pipeline applications due to their high throughput and moderate compression ratio. Centrifugal compressors rotate a turbine at very high speeds to compress the gas. Hydrogen centrifugal compressors must operate at tip speeds three times faster than that of natural gas compressors to achieve the same compression ratio because of the low molecular weight of hydrogen.

(Data Source: US Department Of Energy)

The Long Road Ahead

Three years ago, we saw what corporate environmental, social, and governance (ESG) commitments and federal funding could do to kickstart the US hydrogen economy. Today, we are seeing the beginning of real projects come to life. For those projects to succeed, advancements need to be made by the owners, operators, utilities, and original equipment manufacturers (OEMs) that are driving innovation in the hydrogen economy. But there is also the need for competent service and support from the companies, organizations, and people that are devoted to fostering safe and effective hydrogen best practices. The hydrogen economy requires total buy in. However, the dawn of a new hydrogen industry paired with growth from liquefied natural gas and renewable natural gas could lay the runway for multidecade growth in the energy sector.

The greatest risk isn’t the funding itself and where it is allocated, but whether these projects end up creating a lasting impact and long-term jobs. Based on the presentations for each hydrogen hub, the total number of direct jobs created by the seven hubs is estimated to be 334,280 jobs, including 111,953 permanent jobs. Many of these jobs will be available to workers whose occupations have been displaced or are threatened by the energy transition. For the hydrogen economy to support future job growth, there needs to be advancements in hydrogen technology, machinery, equipment, and systems, as well as if these advancements are being used in new projects to reduce costs.

At the end of the day, the success or failure of the hydrogen economy is all based on its economics. It took decades for renewable energy to be cost competitive with fossil fuels. Once hydrogen costs come down, the industry can thrive even without government subsidies. Now is the time to take advantage of the opportunities and funding available to accelerate the profitability of the hydrogen economy. Failure to do so could put the capital-intensive nature of the hydrogen economy in jeopardy and lead policy makers to pivot toward other options.