Vanguard Renewables’ Path To 150 RNG Digesters By 2028

Vanguard Renewables (Vanguard) and TotalEnergies have signed an agreement to create an equally owned joint venture (JV) to develop, build, and operate renewable natural gas (RNG) projects in the United States. TotalEnergies and Vanguard will advance 10 RNG projects into construction over the next 12 months, with a total annual RNG capacity of 2.5 Bscf (0.8 TWh). The three initial projects in this agreement are currently under construction in Wisconsin and Virginia, each with a unit capacity of nearly 0.25 Bscf (75 GWh) of RNG per year. Beyond these first 10 projects, the partners will consider investing together in a potential pipeline of about 60 projects across the country for a total capacity of 15 Bscf (5 TWh) per year.

“TotalEnergies is a global integrated energy giant and leader in anaerobic digestion projects around the world and was seeking a partner to expand its biogas operations in the United States,” said Neil H Smith, chief executive officer of Vanguard Renewables. “Because of our decade-long track record of successfully owning, building, and operating biogas facilities, TotalEnergies believed we were the best partner for its ambitions in the United States. Through this collaboration, we will spearhead US anaerobic digestion development for TotalEnergies’ American portfolio. TotalEnergies’ expertise, combined with our success in the United States, and Vanguard’s backing by BlackRock’s Diversified Infrastructure business, validates our leadership in the renewable gas space and accelerates our growth potential. Further, our vision to harness the power of waste to decarbonize our planet and repurpose methane for good fits perfectly with TotalEnergies’ global vision to do the same.”

In July 2022, Vanguard Renewables was acquired by BlackRock, through a fund managed by its Diversified Infrastructure business (BlackRock). BlackRock has partnered with Vanguard Renewables’ management team to build on the company’s track record to drive the next phase of its growth to support the nationwide expansion of its anaerobic digester projects from coast to coast. BlackRock will remain the majority shareholder of Vanguard Renewables.

“Joining forces with industry titan TotalEnergies and leveraging its multiple decades of experience in anaerobic digestion to significantly enhance our expertise in digester design, construction, and operations is a game changer for Vanguard and food and beverage companies that are looking to embrace circularity in materials management, and the renewable gas industry in the United States,” said Smith. “This strategic partnership combines Vanguard’s farmer relationships, technology, and established customer base with TotalEnergies’ deep knowledge of large-scale renewable gas development. Our financial backing from BlackRock’s Diversified Infrastructure business and TotalEnergies further propels Vanguard as a long-term leader in the US renewable gas market, ensuring the success of our organics-to-renewable energy program.”

“TotalEnergies is pleased to partner with BlackRock and its portfolio company Vanguard Renewables, to accelerate the development of food biowaste processing into renewable natural gas in the United States,” said Olivier Guerrini, vice president of biogas at TotalEnergies. “By expanding into this fast-growing market, our joint venture will create value for both companies while benefiting the food and farming sectors as well as providing a ready-to-use solution to industrial companies willing to decarbonize their energy supply. This joint venture is a new step for TotalEnergies in achieving its objective to produce 10 TWh of RNG by 2030.”

Accelerating TotalEnergies’ ESG Goals

In 2023, ESG Review sat down with Smith to discuss the company’s growth plans and projects (see “Cow Power,” Q2 2023 ESG Review, p.18). Once again, ESG Review had the privilege of connecting with Smith to discuss the partnership with TotalEnergies and how the two companies will work together to accelerate RNG production and expand pathways for low-carbon fuel use.

“Vanguard Renewables is dedicated to working across industries to help decarbonize business sectors,” said Smith. “Working with TotalEnergies to help achieve its ambitious climate goals is an exciting opportunity. We are proud to play an essential role in helping to achieve those milestones.”

TotalEnergies has a goal to produce 34 Bscf (10 TWh) of RNG by 2030, and half of that (17 Bscf or 5 TWh) could come from the JV with Vanguard if it decides to invest in the 60-digester potential project pipeline. Vanguard has become a key contributor to helping one of the world’s most well-known integrated majors reach its ESG goals. TotalEnergies has been aggressively ramping its renewable energy investments, particularly in solar energy. In March, TotalEnergies said it expects its on-site solar generation capacity to reach 8 to 9 GW by 2030 and 100 GW of total renewable energy generation capacity by 2030. The partnership with Vanguard Renewables helps put RNG on the map as a worthwhile low-carbon investment in conjunction with solar energy.

“Vanguard Renewables sees renewable gas as a vital tool in our climate mitigation toolbox that is needed to support industries with hard-to-abate systems that rely on fossil fuels,” said Smith. “Renewable gas is a drop-in replacement that does not require the building of new infrastructure and does not have a long interconnection wait time like solar or wind. The renewable gas produced at our anaerobic digesters is upgraded and injected onsite into our nation’s existing pipeline infrastructure. Again, this partnership authenticates Vanguard Renewables’ decade-long success in the renewable gas industry and further elevates the role that renewable gas will play in decarbonization.”

Accelerating Construction Of RNG Projects

At the time of our last conversation with Vanguard Renewables in Spring 2023, the company had eight projects under construction, six projects in development, and operated 10 anaerobic digesters, with six in New England, three in Colorado, and one in Georgia. Since then, its portfolio and the rate of project investment have grown.

“We plan to have more than 10 projects either completed, in commissioning, or under construction by this time next year,” said Smith. “This is in addition to our 17 currently operating projects across the United States with our partner, and we currently have approximately 23 sites under construction across both our agriculture [manure-only] and organics [food waste and manure] portfolios. The renewable gas industry is one that is still nascent in the United States. That said, we are moving full steam ahead and have a pipeline of approximately 100 potential projects. Coupled with our current portfolio of operating projects and with those that are currently in construction, we will have around 150 sites by 2028. To put that number into greater perspective, as of 2021 there were nearly 19,000 biogas facilities in the European Union. Thanks to its experienced teams and development platform, Vanguard Renewables will contribute to the JV its ready-to-build projects at scale. It will also manage feedstock supply, the assets, operations, and RNG sales. “

Vanguard’s Unique Approach

In addition to its experienced team and development platform, Vanguard’s main differentiating factor from other RNG project developers is its ready-to-build strategy that can be implemented at scale. It has a specific approach to managing feedstock supply, assets, operations, and RNG sales. “With our team’s extensive experience in building and operating 17 organics-to-renewable energy projects and our commitment to embracing new technologies, we have led the way in creating the anaerobic digester facility of the future,” said Smith. “Our track record of engineering and designing similar projects at scale instills confidence that we have indeed built a blueprint for success. With approximately 250 employees around the country, we operate with an integrated approach that is not just a strategy, but a key to our success. This approach ensures that our projects move seamlessly through the various development phases into construction and then finally into operation. We also have a dedicated team who work with our food and beverage waste providers, including a national sales team, a robust logistics team, and expert service providers at every step of the way. We are already working with companies that have ‘reserved space’ in our digesters near their facilities even before they have been built and we are diverting their waste to other sustainable destinations in the interim. This is another indicator that our decade-long history is an essential factor in the trust we have created with our partners.”

A New Model For Waste Material Recovery

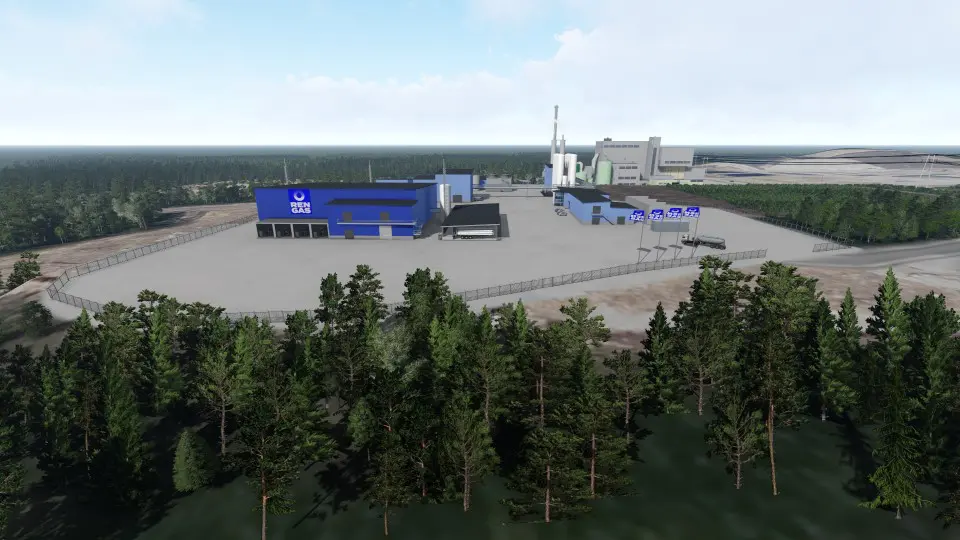

Europe has an established and sizable RNG industry, but the infrastructure, regulations, and credit markets are vastly different. To make RNG thrive in the United States, Vanguard has drawn inspiration for what has worked in Europe, while adding its own flare based on US market conditions. One example is its Farm-Powered approach, which is a series of partnerships with American dairy farms to solve manure and nutrient management challenges and provide small and regional players with a diversified income stream by hosting an anaerobic digester on their property.

“Anaerobic digestion is not a new technology,” said Smith. “Germany alone has more than 9000 facilities, in a country that is roughly the size of New England and has widespread adoption in Europe and in other parts of the world. Yet, it is relatively new to the United States at this scale. Our Farm-Powered facilities take unsaleable food and beverage waste from retailers, manufacturers, and institutions and recycle that along with cow manure in, for lack of a better term, a crockpot [a sealed digester tank] and heat it at 104°F [40°C] for 30 days. Once that cycle is completed, we take the biogas produced and upgrade it onsite and then inject it directly into the nation’s existing pipeline infrastructure. The process also creates valuable byproducts for our farm partners, including a liquid digestate or biofertilizer that replaces traditional fertilizers for our farmers’ cropland and the solids are used as either a soil amendment or for the herd’s bedding. In addition to providing our host farmers with a manure management system, we are also helping promote regenerative agriculture on the farms. Our Farm-Powered process is designed to process several organic feedstocks while recovering recyclable material. This approach leads to excellent material recovery rates and energy production. The design for our projects encompasses industry best practices and supports our site’s long-term technical and economic feasibility.”

The first 10 projects for the JV are based on a model of waste materials recovery from the food and beverage industries, supplemented with dairy manure from dairy farms,” said Smith. “The anaerobic digesters will be built on the dairy farms themselves, which will then recover and manage the biofertilizer [a byproduct of the anaerobic digestion process] as a low-carbon and nutrient-dense fertilizer. To feed its digesters, Vanguard Renewables has established a major network of food industry brands across the United States and the Farm Powered Strategic Alliance, giving alliance members preferred access to recycle their organic waste generated from manufacturing or retail activities and the potential opportunity to purchase the renewable energy generated at a Vanguard Renewables’ facility. The alliance’s members include multi-national corporations across several verticals, including food, beverage, and pharmaceutical manufacturers. In anticipation of its growing portfolio of anaerobic digesters, Vanguard Renewables has expanded its food and beverage diversion services and its organics solutions team to provide service throughout the contiguous United States.”

Vanguard’s partnerships with local dairies through its Farm Powered Strategic Alliance and its Farm Powered Sustainability Heroes programs have grown in recent years, but so has its approach to new project development. For example, the first 10 projects of its new JV with TotalEnergies will be noticeably different than past projects, such as the co-location of digesters and organics receiving areas.

“These projects have evolved greatly from our New England organics-to-renewable energy sites,” said Smith. “Many will have a standalone organics receiving area for packaged waste streams. The overall facility designs are very different. Think of our digesters as the iPhone, we’re going from the iPhone 10 to the iPhone 15. By co-locating our digesters and organics receiving areas, we are working to mitigate even more greenhouse gas emissions from our operations. For most sites, this will eliminate packaged waste having to go to an off-site organics receiving area, reducing hauling distance and time. As for the Farm Powered Strategic Alliance, we continue to grow our members and work together to share best practices relating to decarbonization and everything in the ESG lexicon. Over the past year, we have added several major companies to the alliance, including AstraZeneca, Foremost Farms, Milk Specialties Global, and Agropur.”

RNG Industry Outlook And Challenges To Consider

“In the next decade, we will build 50 to 60 sites on the organics side of our business and about the same on the manure-only [agriculture] side,” said Smith. “The growth potential of renewable gas is not limited to a single market. It has the capacity to thrive in various industries, particularly in those where reducing the use of fossil gas is a challenge. This adaptability is a key factor in its potential for growth. There is an execution side to our business, and then there is the market side that is going to mature quite rapidly in hard-to-predict ways. Renewable gas comes at a premium, and it is companies like AstraZeneca that understand that the only way to meet its ESG goals is to embrace all decarbonization options. As we get closer to 2030 and companies are looking at how they are going to achieve their climate goals, renewable gas is going to play a major role in reaching those targets. Further, there is no question that demand is going to outstrip supply. Many hard-to-abate industries will still require some sort of liquid fuel to operate their facilities. I see the marketplace evolving for many different industries and new and interesting uses for low-carbon liquid fuels.”

Dairy farms benefit from a favorable credit market, especially in California. Californian dairy farms, like most primary agriculture, are not required to capture their methane emissions. The installation of anaerobic digesters can help dairies yield a negative carbon intensity score of roughly -250 grams per MJ thanks to California’s Low Carbon Fuel Standard. Uncertainty regarding the future of the credit market, especially state policy, has been noted as a major concern for California RNG developers (see “RNG Spotlight: The Role Of Carbon Credits In California’s RNG Market,” Q2 2024 ESG Review, p. 6). However, Vanguard Renewables sees cracks in the RNG supply chain as a main deterrent for sustained growth in the industry.

“The biggest challenge is understanding that the supply of renewable gas is limited and comes at a premium,” said Smith. “And that there is only a finite amount of time to address the changing climate before it is too late. We are working to repurpose methane for good, because methane has 80 times the warming power of carbon dioxide over a 20-year period. If we can mitigate methane emissions from food waste and cow manure at scale, we can help, in part, buy the time needed for other mitigation tools to come into play. Another consideration is that Americans don’t often properly recycle food waste. We throw it in the garbage can and someone comes and picks it up once a week. That food waste then goes to a landfill where it emits methane into the atmosphere, and we need to retrain ourselves to do better. If food waste were a country, it would be the third-largest emitter of greenhouse gases after China and the United States. We cannot afford to have an ‘all-or-nothing’ approach to our shared 2030 and beyond decarbonization goals. We need every tool in the climate change mitigation toolbox, and renewable gas will play a key role in reaching those targets.”