The Rise Of Renewables

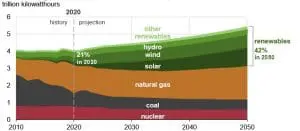

In its Annual Energy Outlook 2021 (AEO 2021), the US Energy Information Administration (EIA) projects that the share of renewables in the US electricity generation mix will increase from 21% in 2020 to 42% in 2050. Wind and solar generation are responsible for most of that growth. The renewable share is projected to increase as nuclear and coal-fired generation decrease and the natural gas-fired generation share remains relatively constant. By 2030, renewables will collectively surpass natural gas to be the predominant source of generation in the United States. Solar electric generation (which includes photovoltaic [PV] and thermal technologies and both small- and utility-scale installations) will surpass wind energy by 2040 as the largest source of renewable generation in the United States, according to the EIA.

The AEO 2021 reference case project the natural gas share of the US electricity generation mix will remain at about one-third of total generation from 2020 to 2050. The natural gas share of generation will remain stable even though natural gas prices will remain low (at or lower than US$3.50 per million Btu) for most of the projection period. This stability occurs despite significant coal and nuclear generating unit retirements resulting from market competition as regulatory and market factors induce more renewable electricity generation.

The share of natural gas-fired generation in the United States will remain relatively constant through 2050, as projected in the AEO 2021 Reference Case, and the contribution from the coal and nuclear fleets will drop by half. Through 2050, the share of electricity generation from renewables will double. Wind will be responsible for most of the growth in renewable generation from 2020 through 2024, accounting for two-thirds of the increase in that period.

After the production tax credit (PTC) for wind phases out at the end of 2024, solar generation will account for almost 80% of the increase in renewable generation through 2050. Based on the Internal Revenue Service safe harbor guidance, the EIA assumes that utility-scale solar PV facilities will receive a 30% investment tax credit (ITC) through 2023, which will then be reduced to 10% beginning in 2024. AEO 2021 does not account for the revised PTC and ITC phase-outs established in the Consolidated Appropriations Act, 2021 that was passed in December 2020.

Because renewable energy technology costs and natural gas prices are key determinants of these projections, the EIA explores sensitivity cases with varying levels of both renewable costs and natural gas price trajectories. Accordingly, the renewable technology share of generation will be higher in the Low Renewables Cost and High Oil and Gas Supply cases, relative to the Reference case, and the share of generation from renewables will be lower in the High Renewables Cost and Low Oil and Gas Supply cases.

About The Report

The AEO 2021 explores long-term energy trends in the United States. According to the EIA, projections are not predictions of what will happen, but rather, they are modeled projections of what may happen given certain assumptions and methodologies. By varying those assumptions and methodologies, AEO 2021 can illustrate important factors in future energy production and use in the United States.

Energy market projections are uncertain because many of the events that shape energy markets — as well as future developments in technologies, demographics, and resources — cannot be foreseen with certainty. To illustrate the importance of key assumptions, AEO 2021 includes a reference case and side cases that systematically vary important underlying assumptions.

EIA develops the annual energy outlook by using the National Energy Modeling System (NEMS), an integrated model that captures interactions of economic changes and energy supply, demand, and prices. The report is published to satisfy the Department of Energy Organization Act of 1977, which requires EIA’s Administrator to prepare annual reports on trends and projections for energy use and supply.