The Continued Rise Of Renewables

The US Energy Information Administration (EIA) has published its Annual Outlook 2021 (AEO2021). This annual report explores long-term energy trends in the United States. Projections in the AEO2021 are not predictions of what will happen, but rather, they are modeled projections of what may happen given certain assumptions and methodologies.

The EIA develops its annual outlook reports by using the National Energy Modeling System (NEMS), an integrated model that captures interactions of economic changes and energy supply, demand, and prices. These reports are published to satisfy the Department of Energy Organization Act of 1977, which requires the EIA’s Administrator to prepare annual reports on trends and projections for energy use and supply.

2021 Forecast Highlights

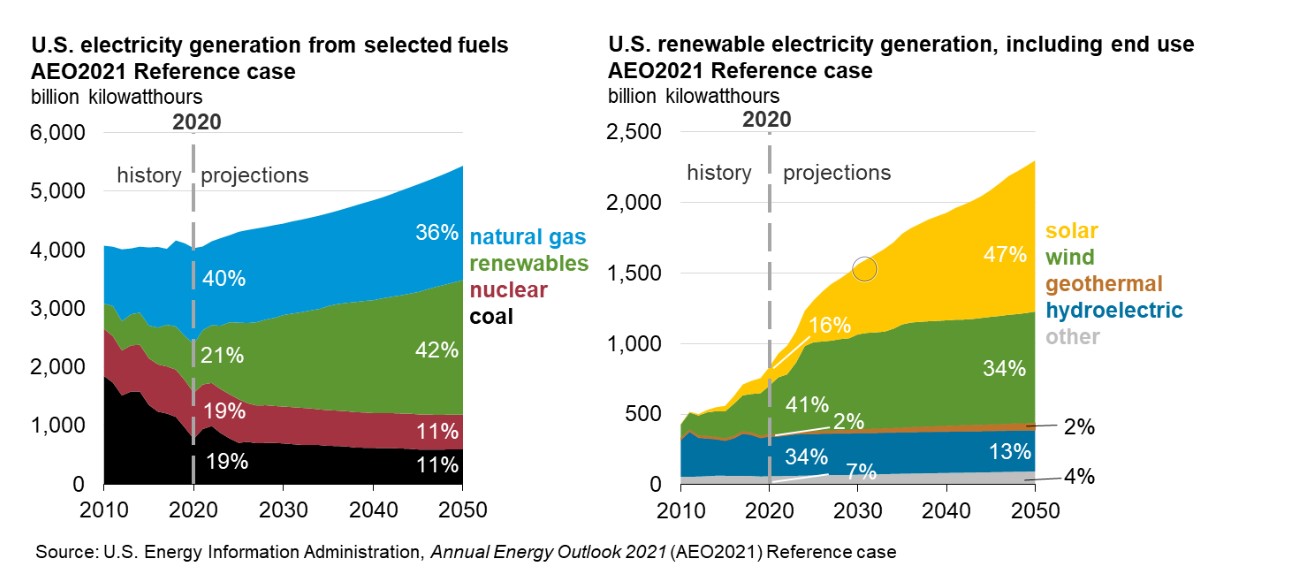

As coal and nuclear generating capacity retires, new capacity additions come largely from natural gas and renewable technologies. Renewable technologies account for the majority of the projected capacity additions.

In its AEO2021 report, the EIA predicts that renewable electric generating technologies will account for almost 60% of the approximately 1000 gigawatts of cumulative capacity additions projected from 2020 to 2050. The large share is a result of declining capital costs but is also a result of increasing renewable portfolio standard (RPS) targets and tax credits. Although wind contributes to renewable electric generating capacity additions, it is on a much smaller scale compared with solar capacity, which builds steadily throughout the projection period.

Wind additions are largely tied to policy. The projection now assumes the production tax credit (PTC) for wind runs for an extra year, or through 2024, following a one-year extension under the Taxpayer Certainty and Disaster Tax Relief Act of 2019, Division Q, of the Further Consolidated Appropriations Act of 2020 passed in December 2019 and under the Internal Revenue Service’s Notice 2020-41 issued in May 2020. Although capital costs for both wind and solar continue to decline throughout the projection period, without additional policy intervention, wind is not as cost competitive as solar. More than two-thirds of cumulative wind capacity additions from 2020 to 2050 occur before the PTC expires at the end of 2024. The steadier pace of solar additions in part reflects the continued availability of a 10% investment tax credit (ITC), which continues in perpetuity after 2023 when the current 30% phases out.

Natural gas continues to be the fuel of choice for fossil-fuel capacity additions. Although renewable electric generating technologies account for about 60% of cumulative capacity additions throughout the projection period in the AEO2021 report, natural gas-fired generators account for almost the entire remaining balance of additions — about 40% through 2050. These natural gas-fired generator additions are almost evenly split between combined-cycle technologies and combustion turbines, which both provide energy and help balance the intermittent output from wind and solar generators.

Most of the coal-fired generating capacity retirements assumed in the AEO2021 report occur by 2025. The EIA includes legislation and regulation as of September 2020, and so incorporated the EPA’s Affordable Clean Energy (ACE) rule (84 FR 32520), which was vacated in the United States Court of Appeals for the District of Columbia Circuit on January 19, 2021. In AEO2021, the coal-fired plants remaining after ACE takes effect are more efficient and continue to operate throughout the projection period. Low natural gas prices in the early years of the projection period also contribute to the retirements of coal-fired and nuclear plants because both coal and nuclear generators are less profitable in these years, because natural gas generation generally sets power prices in wholesale electricity markets.