NextDecade’s Rio Grande LNG Receives Record US$18.4 Billion In Financing

Originally published July 19, 2023.

Some liquefied natural gas (LNG) projects are so large in scale, complex in their engineering, and far-reaching in their impact that they appear larger than life. Rio Grande LNG (RGLNG) was one of those projects.

The US Federal Energy Regulatory Commission (FERC) granted final environmental approval for the Rio Grande LNG Project in April 2019. It then granted construction and operation approval for the LNG terminal as well as the associated pipeline in November 2019. The project was initially expected to cost US$15 billion and enter service in 2023 but was heavily impacted by the COVID-19 pandemic and the decline in natural gas and LNG spot prices. Delays ensued, and the project found itself on the brink of being shelved. Then, the market began turning the corner, and faith was restored in RNLNG. The real tipping point came in 2022 when Russia’s invasion of Ukraine disrupted the global natural gas and LNG market and reminded buyers of the importance of energy reliability and security.

On July 12, more than four years after FERC’s initial environmental approval, NextDecade Corporation (NextDecade) made the long-awaited announcement that it had completed a positive final investment decision (FID) for Phase 1 of its 27 MTPA Rio Grande LNG (RGLNG) export facility in Brownsville, Texas. Phase 1 consists of three liquefactions trains and will have a nameplate capacity of 17.6 MTPA. According to NextDecade, the US$18.4 billion received in financing for RGLNG Phase 1 represents the largest greenfield energy project financing in US history. RGLNG expects to enter service in 2027. “Achieving FID and issuing [notice to proceed] NTP on RGLNG Phase 1 is a landmark event reflecting years of hard work and dedication by NextDecade’s employees, shareholders, construction partners, equipment suppliers, and customers,” said Matt Schatzman, chair and chief executive officer of NextDecade. “I want to specifically recognize the Rio Grande Valley community, the Port of Brownsville, and the countless leaders and officials at the local, state, and federal levels that have supported us throughout the development of RGLNG Phase 1.”

The announcement comes just a few weeks after TotalEnergies unveiled a major partnership with NextDecade and Global Infrastructure Partners (GIP) that has a lot of moving parts. The headline news was that TotalEnergies is buying a 17.5% stake in NextDecade in three tranches that will total US$219 million. The first tranche of 5.06% was completed on June 13 for US$40 million. TotalEnergies didn’t say when the next two tranches will be complete. TotalEnergies is also boosting its LNG portfolio by acquiring a 16.7% interest in RNLNG Phase 1. Additionally, TotalEnergies is entering an offtake agreement with NextDecade for 5.4 MTPA of RGLNG’s production. If all goes according to plan, the 20-year deal will pole vault TotalEnergies’ US LNG export capacity above 15 MTPA by 2030. Anticipating further investment, TotalEnergies has the right to participate in future phases of the project. To help advance its environmental, social, and governance goals, TotalEnergies plans to participate in NextDecade’s carbon capture and storage project (CCS), which will help reduce emissions of Rio Grande LNG.

Details Of The FID

The Rio Grande LNG export terminal will occupy 750 acres (303 ha) along the northern shore of Brownsville Ship Channel in Cameron County, approximately 2 miles (3.2 km) west of the Port of Isabel and 10 miles (16 km) east of Brownsville. Enbridge will build, own, and operate the Rio Bravo Pipeline to supply natural gas to Rio Grande LNG. Upon completion, the Rio Bravo Pipeline will transport up to 4.5 Bscf/d (127.4 × 106 m3/d) of natural gas from the South Texas Agua Dulce supply area to Rio Grande LNG.

The US$18.4 billion in Phase 1 project financing is broken down into four major parts. The first is US$283 million in Phase 1 investments by NextDecade, which includes US$125 million of pre-FID capital investments. The second is the closing of a US$700 million senior secured non-recourse private placement notes offering. The third is the closing of US$5.9 billion in financial commitments from TotalEnergies, GIP, and Mubadala Investment Company (Mubadala). Finally, the remaining US$11.6 billion in project financing is coming from senior secured non-recourse bank credit facilities consisting of US$11.1 billion in construction term loans and a US$500 million working capital facility.

In addition to the FID, NextDecade announced that 92% of RGLNG Phase 1’s nameplate capacity has already been contracted under long-term binding LNG sale and purchase agreements (SPAs) with TotalEnergies, Shell NA LNG LLC, ENN LNG Pte Ltd, Engie S.A., ExxonMobil LNG Asia Pacific, Guangdong Energy Group, China Gas Hongda Energy Trading Co., Galp Trading S.A., and Itochu Corporation.

Cost Breakdown

NextDecade was kind enough to break down the costs of the project. The majority of expenditures, or around US$12 billion, are allocated toward engineering, procurement, and construction (EPC) efforts. NextDecade issued the NTP to Bechtel Energy Inc. (Bechtel) to begin construction of Phase 1 under its lump-sum turnkey EPC contract. “NextDecade is on a mission to produce lower-carbon intensive LNG for its customers, and we’re honored to be their partner,” said Paul Marsden, president of Bechtel Energy. “Today, as we commence engineering, procurement, and construction on the first phase of this project, we reaffirm our commitment to the community through quality jobs, training, and support for the supply chain and small businesses.”

Other costs include US$2.3 billion in owner’s costs and contingencies, dredging for the Brazos Island Harbor Channel Improvement project, conservation of more than 4000 acres (1619 ha) of wetland and wildlife habitat area, and installation of utilities of approximately US$600 million, and interest during construction and other financing costs of approximately US$3.1 billion.

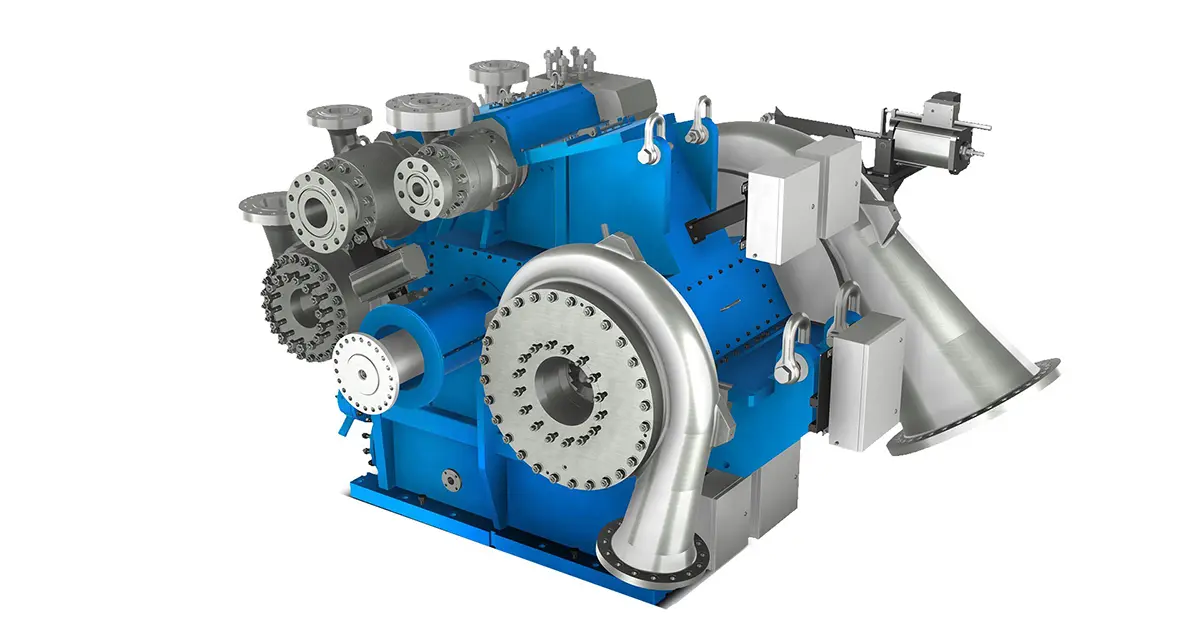

Bechtel has begun the process of handing out contracts to various original equipment manufacturers. For example, Baker Hughes has been awarded an order by Bechtel to supply three main refrigerant compressors. In total, Baker Hughes will supply six Frame 7 gas turbines paired with 18 centrifugal compressors across the three liquefaction trains associated with Phase 1 of the project. Rio Grande’s first three LNG trains will operate in a parallel configuration arrangement. “This order builds on our longstanding relationship with Bechtel and is a significant milestone in our partnership with NextDecade, supporting them on this key LNG project,” said Ganesh Ramaswamy, executive vice president of Industrial & Energy Technology at Baker Hughes. “We are delighted that our proven and reliable technology solution will support the production of LNG in the United States, which is crucial in balancing energy affordability, security and sustainability globally.” Packaging of the turbine/compressor train, as well as assembly of the compressors and testing of the trains, will take place at Baker Hughes’ facilities in Italy.

Potential Payoff

NextDecade will receive 20.8% of Phase 1 cash flows. Global Infrastructure Partners and Mubadala Investment Company, which NextDecade refers to as the Financial Investors, will receive a minimum of 62.5% of Phase 1 cash flows, and Total Energies will receive 16.7% of Phase 1 cash flows.

“Achieving FID is an important milestone in NextDecade’s mission of becoming a reliable supplier of low-carbon LNG that will replace coal with a cleaner source of energy,” said Bayo Ogunlesi, chair and chief executive officer of Global Infrastructure Partners. “Our investment in RGLNG affirms GIP’s commitment to promoting decarbonization, energy security and energy affordability.”

“Today’s announcement marks a pivotal milestone in Mubadala’s enduring partnership with NextDecade in the development of RGLNG,” said Khaled Abdulla Al Qubaisi, chief executive officer of Mubadala’s Real Estate & Infrastructure Investments platform. “Mubadala is delighted to welcome GIP, GIC, and TotalEnergies into the partnership as RGLNG enters its next phase of development.”

The financial investors and TotalEnergies have the option to invest in Train 4 and Train 5 of RGLNG, as well as the previously mentioned CCS plant. TotalEnergies’ right to invest in Train 4 and Train 5 is conditioned on exercising LNG purchase rights of 1.5 MTPA for Train 4 and Train 5. “We look forward to delivering this important LNG project that will supply the world with reliable, and lower-carbon intensive LNG, while proudly supporting the Rio Grande Valley community by investing billions of dollars and creating thousands of much needed and well-deserved jobs,” said Schatzman. “Now our focus turns to safely constructing Phase 1 on time and on budget and progressing commercial negotiations on RGLNG Train 4 and Train 5 to further expand our LNG platform and grow NextDecade shareholder value.”