CCUS 10-Year Outlook

There is still much debate about the role of carbon capture, utilization, and storage (CCUS) in decarbonizing the global economy. Some insist it should be strictly an interim technology for hard-to-abate sectors including cement, chemicals, steel, refining, and power generation. Others see it as a deep decarbonization tool. Either way, for CCUS to fulfill its potential over the next 10 years, several conditions must be met. To deploy CCUS at scale, heavy emitters must be motivated to decarbonize, the technology must be cost-effective and efficient, and a viable option for utilization or storage must be available.

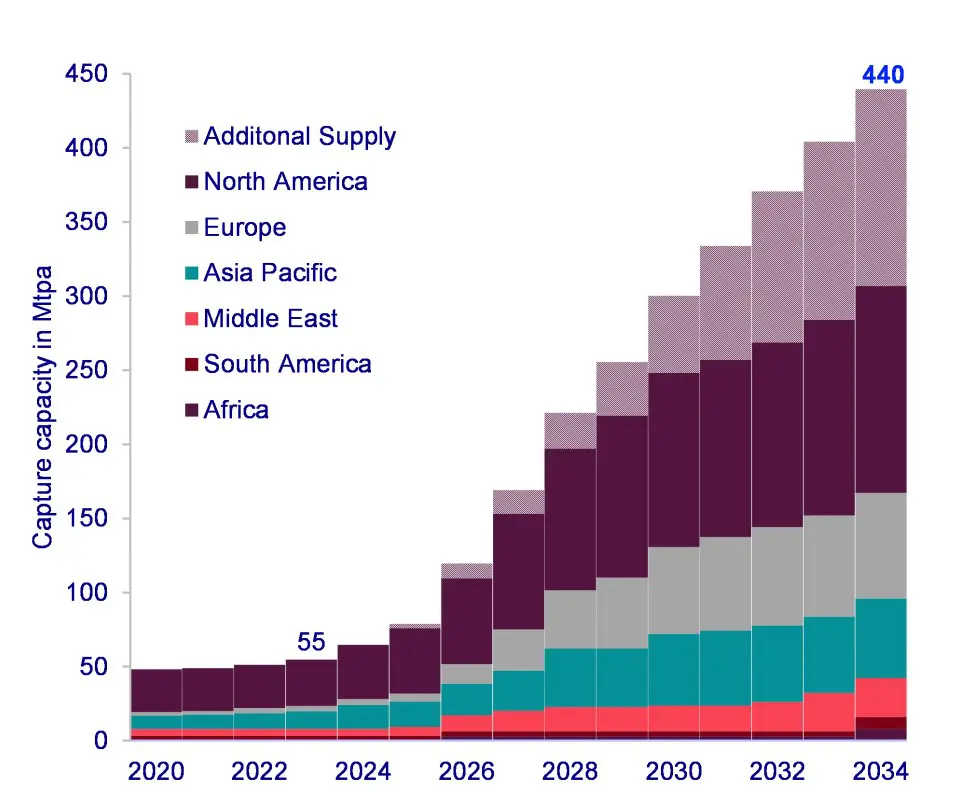

By 2034, global carbon capture capacity will reach 440 MTPA and storage capacity will reach 664 MTPA, requiring US$196 billion in total investment, according to a recent report from Wood Mackenzie. Nearly half of the investment globally is associated with carbon dioxide capture, with the remaining US$53 billion from transport and US$43 billion from storage. About 70% of the investment will be in North America and Europe across the value chain.

“This is a huge ramp-up from where the industry is today. Government funding plays a critical role in driving the first wave of CCUS investments,” said Hetal Gandhi, Asia Pacific CCUS lead at Wood Mackenzie. “We see governments offering capital expenditure grants, operating expense subsidies, tax incentives, and contracts for differences for CCUS. While no single mechanism has been used predominantly and each country devises novel methods to incentivize investments, nearly US$80 billion is directly committed to CCUS across five key countries.”

Announced government funding specifically for CCUS across key countries, including the United States, Canada, the UK, Denmark, and Australia, amounts to around US$80 billion. The United States leads funding with a 50% share of the total, followed by the UK at 33% and Canada at 10%.

“While we are seeing strong support in countries like the United States, government support in Asia Pacific lags behind,” said Stephanie Chiang, research analyst for CCUS at Wood Mackenzie. “Australia, Malaysia, and Indonesia have announced some benefits, but they are substantially lower as compared to their investment needs. Australia’s direct incentives at US$40 million is less than 1% of the investment needed over the next 10 years.”

Capacity Not Keeping Up With Demand

Despite the large forecasted increase in projects, Wood Mackenzie does not expect supply of carbon capture to meet demand. Industries will need up to 640 MTPA of carbon capture capacity by 2034 as they look to decarbonize, but the projects expected to come into operation fall around 200 MTPA short of that.

“Of the projects already announced and expected to go ahead in the development pipeline, 71% are in North America and in Europe,” said Hetal. “Government incentives such as the US Inflation Reduction Act, UK business models, Canada’s Investment Tax Credit, and the Netherlands SDE++ scheme are moving projects toward final investment decision. We also expect a further boost to European projects due to the recently announced EU Industrial Carbon Management Strategy.”

The expected pace of CCUS deployment will be driven by the level of regulation and support in different countries. The United States and Canada have robust regulatory and funding mechanisms in place to drive development and implementation, as does the European Union and the UK. In Asia Pacific, while regulatory momentum is strong in Australia, Japan, South Korea, and Indonesia, government incentives are needed to accelerate CCUS development. In contrast, development in China, India, Latin America, the Middle East, and Africa is limited by a lack of firm policy, regulatory frameworks and funding support.

“The lack of CCUS announcements in Asia Pacific’s largest emitting countries, China and India, is causing the region to have substantially lower capacity than needed under Wood Mackenzie’s base case,” said Hetal. “Key sectors like power and chemicals will see a large gap between demand potential and actual supply until 2034. We expect Asia Pacific’s capture pipeline will mature through additional announcements later in the decade.”