Future-Proofing Your Waste-To-Value Project

This article was written by Ross Faransso.

To meet national and global net-zero goals, investors and developers are turning trash into treasure — converting traditionally pollutive materials into low-carbon solutions. But, as with any emerging sector garnering attention, industry players must climb an uphill battle to prove they can generate long-term value and returns without veering off course. Conducting due diligence on new projects before reaching the development stage can help get low-carbon projects off the ground and prevent them from becoming distressed.

Identifying ways developers can future proof their projects to leapfrog these challenges and successfully bring them to scale comes down to three integral steps before the development stage: selecting the correct technology for the project, conducting a full analysis of feedstocks, and properly implementing an economic and operational analysis of the project development process.

Selecting The Right Technology And Feedstock For Your Project

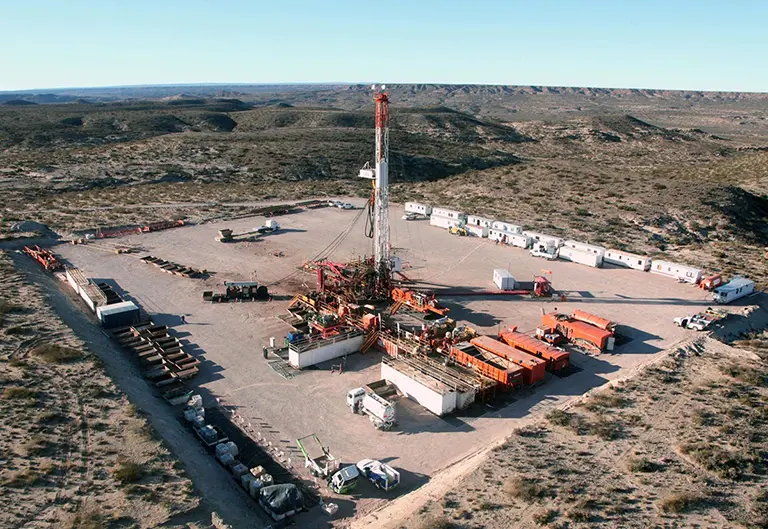

The emerging X-to-fuel markets, including sustainable aviation fuel (SAF), waste-to-fuel, and biofuels, are becoming increasingly popular as the aviation and transportation sectors race to decarbonize. However, these sectors lack the tenure of traditional fuel markets to guarantee success, and developers must navigate the challenges of understanding which technologies and feedstocks are poised to generate consistent and valuable results. That’s why choosing the correct inputs from the beginning (and continuing to audit for feedstock performance) is one of the most crucial points in bringing a low-carbon project from conception to commercial scale.

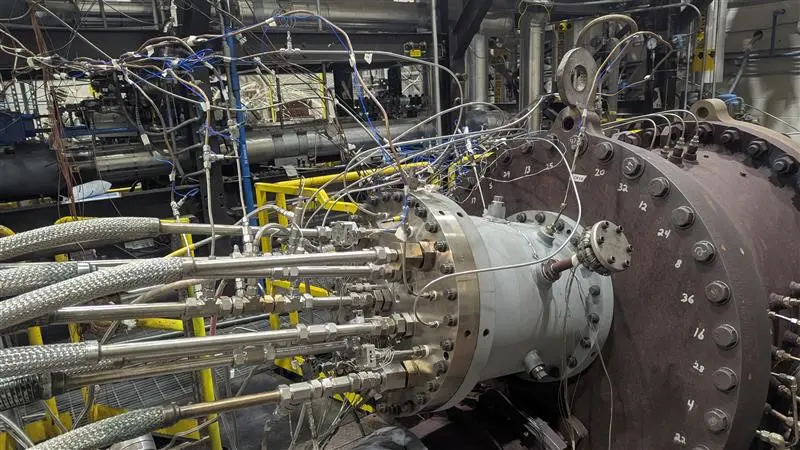

When analyzing the correct technologies for your project, assessing the Technology Readiness Level (TRL) is the first step in ensuring that a technology will be viable. In tandem, developers must determine if the technology is suitable for the available feedstock. Even if the technology is proven commercially, it must be proven for the selected feedstock and throughout the commercialization process, ensuring that the correct processes are in place as a project begins to scale beyond the early-stage production level. Additionally, developers should analyze the impacts to balance the plant requirements when selecting technology and feedstocks. Different technologies require different utilities, feedstock preparation, and waste treatment. It is also critical to ensure that the project’s technology can handle potential roadblocks, such as feedstock inconsistencies, environmental factors, and bringing processes to scale.

Feedstocks are a sticking point for many developers entering the green fuels sector, as many feedstocks are inherently variable. Thoroughly analyzing the feedstocks ahead of design will identify the level of feedstock storage and preparation required and ensure that the technology can handle the input material. Conducting a pre- and post-investment analysis of the feedstock will safeguard operators from commencing a project that is doomed to fail. Understandably, the most important component is the cost. Most developers consider the cost of the feedstock itself but exclude the cost of logistics and transport, which can take a huge bite out of a project’s budget.

Beyond the cost, developers must also guarantee the feedstock is available at scale, factoring in whether competitors are branching into the same market, if the feedstock has a sustainable harvest, and if there is enough feedstock readily available to fuel operations. Failure to implement a robust feedstock sourcing program can threaten project success before construction even begins. Developers might analyze the feedstock market and determine the availability, but they neglect to test the feedstock with the technology and are left with an unusable and costly project. Before any developer moves onto the next stage of development, a robust feedstock sampling and analysis of technology performance ahead of the design will be the backbone of a successful project.

Ongoing Analysis

So, you’ve conducted your pre-investment due diligence, what’s next?

Conducting an ongoing analysis of the project is key when working in emerging sectors, especially when new technologies and feedstocks are introduced. Once you’ve conducted all the pre-investment work, continue to sample the feedstock before accepting deliveries to ensure the feedstock composition meets design specifications. Analyzing the contractual terms and understanding the quality specifications and associated damages is one of the most important steps before the feedstock itself is delivered to the site. Ensuring alternate feedstock sourcing plans will mitigate the risk of poor feedstock quality or availability.

In one recent example of a failed project, a US municipal solid waste-to-energy power facility assumed the feedstock they received from a producer was just as they agreed on in their contract. After running the feedstock through the facility, the technology couldn’t process the waste and failed to produce any valuable fuel. The feedstock was not properly audited, and instead of being composed of only municipal waste, other trash and waste products were intermixed, causing the entire project to fail. Even with the correct operations, technology, and development processes in place, if the feedstock is not properly analyzed, the project has a 0% chance of success.

Analyzing The Operational Success Of Your Project

As investors continue eyeing sustainable infrastructure, ensuring the economic and operational viability of the project from the beginning is imperative for the success of the entire facility.

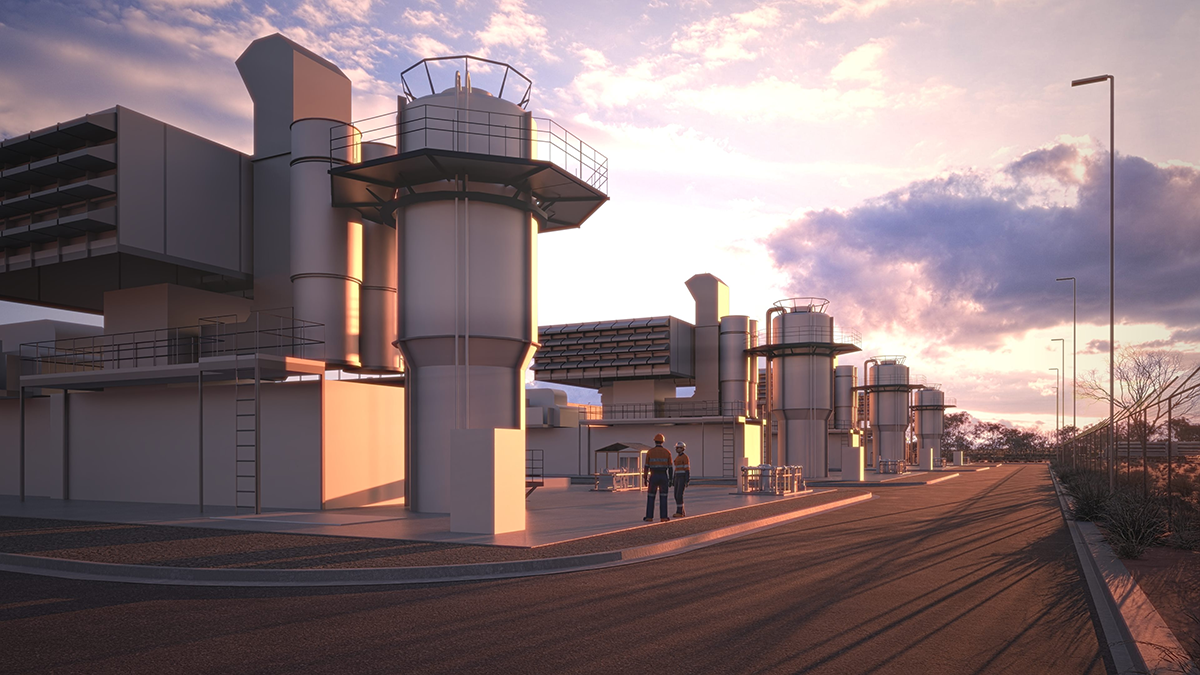

A common failure seen in recent projects has been the insufficient schedule allotted for start-up and ramp-up to full production. With emerging technologies, it is crucial to allow enough time to systematically ramp up the facility to full production. Another related failure has been schedule-related delays in construction and commissioning that compress start-up and ramp-up schedules. This often leads to improper commissioning methods and taking shortcuts as the pressure to ramp up production mounts. The development team should perform a structured schedule risk review and factor in appropriate schedule contingency for construction, commissioning of the project, and the startup of the facility.

Another failure seen in recent projects has been incomplete operations and maintenance planning. Project developers should consult with the operations team to develop an end-to-end operations and maintenance plan, including operations and maintenance procedures, training the people working day-to-day at the facility, vendor support, and a plan for spare parts and replenishment. Development of these components takes time, resources, and money that need to be accounted for in the overall cost and schedule of the project.

Creating a flourishing green fuels sector requires the projects to rival that of the incumbent fossil fuel sector. As developers branch into this new market, the operational side will be just as important as the final production of the project.

About The Author

Ross Faransso is chief executive officer of project development services at Nexus PMG. Faransso joined Nexus PMG in Fall 2023, bringing two decades of energy transition, operations, project management, and development experience to the company. Before joining the team, Faransso spent 16 years at KBR as director of operations and most recently as the company’s Americas head of business development for EPCM services. Faransso also serves as an active board member for the Association for the Capital Projects Engineering & Construction Community, commonly known as ECC.