Follow The Breadcrumbs

In July, Honeywell announced the US$1.81 billion all-cash acquisition of Air Products’ liquefied natural gas (LNG) process technology and equipment business. The deal is not small by any means, but it was also not big enough to capture the spotlight of the oil and gas industry, especially by Honeywell’s standards.

From 2005 to 2016, Honeywell made a slew of acquisitions that shaped what the company is today — a US$130 billion behemoth that touches the energy, aerospace, chemical, construction, manufacturing, utility, technology, healthcare, life sciences, retail, logistics, warehouse, and retail industries. The Air Products deal was Honeywell’s fourth acquisition of 2024 and not even its biggest, as Honeywell completed the acquisition of Carrier Global Corporation’s Global Access Solutions business for US$4.95 billion in June.

Despite being upstaged by other deals, the acquisition is meaningful because it expands Honeywell’s LNG offering to include natural gas pretreatment and liquefaction, using digital automation technologies unified under the Honeywell Forge and Experion platforms. Honeywell said the full-service solution will enable efficient, reliable, and optimized management of natural gas assets. Currently, Honeywell provides a pretreatment solution serving LNG customers globally. Air Products’ complementary LNG process technology and equipment business consists of a comprehensive portfolio, including in-house design and manufacturing of coil-wound heat exchangers (CWHEs) and related equipment. CWHEs can provide the highest throughout of natural gas in a single exchange with a small footprint for onshore and offshore applications.

“This acquisition will bolster our energy transition portfolio within Energy and Sustainability Solutions. The LNG technology will immediately expand our installed base, creating new opportunities to compound growth in aftermarket services and digitalization through Honeywell Forge,” said Honeywell Chief Executive Officer Vimal M. Kapur during Honeywell’s Q2 2024 earnings call.

In October 2023, Honeywell realigned its business to target three multi-decade trends, the energy transition, automation, and the future of aviation. Its approach to the energy transition, and LNG in particular, centers around equipment and infrastructure management rather than oil and gas production. For example, Honeywell UOP provides natural gas pretreatment, natural gas liquids recovery, and liquefaction solutions offerings as licensed technology and packaged equipment. It also offers modular LNG pretreatment systems that remove impurities upstream of liquefaction. Honeywell Integrated Business Solutions delivers operating and business systems with supporting computing and networking infrastructure. Honeywell offers enterprise resource planning, management information systems, supply chain management systems, and integrated subsystems for compressors and turboexpanders, turbogenerators, turbines, LNG transfer pumps, custody transfer, tank gauging, and marine export loading arms.

Tying it all together is Honeywell Forge. Launched in June 2019, Honeywell Forge is a software-as-a-service (SaaS) solution that provides insights into asset performance, helps contextualize data, and more. Honeywell Forge partners with upstream, midstream, downstream, and LNG processing customers to digitally transform their assets and improve emissions monitoring. It also offers cybersecurity services and insights to protect critical infrastructure.

At first glance, it may seem like Honeywell is just doing what it has done for decades, which is acquiring good businesses to support slow and steady growth and make its shareholders happy. Ask a few questions, however, and you may stumble upon a deeper meaning.

Why is a company known for its aerospace division investing so much in oil and gas?

Why is LNG a key part of Honeywell’s US$10 billion acquisition frenzy since 2023?

Why would the oil and gas industry buy into Honeywell’s snazzy and expensive data analytics and software services?

The answer is that the oil and gas industry is at a crossroads. Up until now, oil and gas were commodities. Going forward, not all oil and gas will be created equal. Companies will want to track carbon molecules from production to consumption. They’ll care more about insights into emissions and efficiency. Oil and gas demand won’t automictically grow in lockstep with economic growth as it did in the past. There’s competition from other fuel sources and within the industry between companies that are taking emissions and data analytics seriously and those that are not.

Golden Opportunity

Artificial intelligence (AI) workflows demand more computing power, which means more data centers, and in turn, higher energy consumption. Many production companies, equipment manufacturers, and pipeline and infrastructure players believe that higher data center energy consumption will lead to higher demand for natural gas. (see “Haight Report: Data Centers Will Drive The Need For Gas Compression,” September 2024 Gas Compression Magazine, p.110). The largest data center operators are Amazon Web Services, Microsoft, and Google parent company Alphabet. All three companies have aggressive environmental, social, and governance (ESG) goals. Powering cloud infrastructure with natural gas wouldn’t exactly move the needle in the right direction for an ESG score. But that doesn’t mean natural gas can’t be a major player in the data center energy mix.

The key is to continue improving natural gas production practices and grow production of cleaner forms of gas, such as renewable natural gas (RNG) produced from the decomposition of organic material in manure, landfills, wastewater, and food waste. LNG projects that use RNG as a feedstock can power data centers with a clean and reliable fuel source while helping data center operators achieve their environmental targets.

Although no LNG project will have zero environmental impact, a project can reduce its carbon footprint by having an on-site combined-cycle power plant, by implementing carbon capture utilization and storage, adding hydrogen facilities, using electric drivers, renewable power, and other technological solutions.

Sophisticated data analytics and supply chain management tools can help companies improve equipment performance and lower the environmental footprint of an LNG operation. In recent years, we have seen several LNG projects tout a lower emissions profile as a key advantage to achieving regulatory approval, attracting investment, and bridging the gap between ideas on paper and an operational plant.

In recent years, Baker Hughes has seen a surge in turbomachinery equipment orders for both modular and large-scale liquefaction projects (see “Baker Hughes’ Hat Trick,” July 2023 Gas Compression Magazine, p. 30). The company has invested in developing new compression solutions that can thrive in a low-carbon future (see “The Rise Of Zero-Emissions Compression,” December 2022 Gas Compression Magazine, p. 36). Earlier this year, Baker Hughes announced that it will supply a range of turbomachinery equipment, including four electric-driven main refrigeration compressors, two electric-driven boil-off gas compressors, and six centrifugal pumps to Cedar LNG. The Canadian project will be powered by renewable electricity and will have an emissions intensity of just 0.08% of carbon dioxide per tonne of LNG, which is less than a third of the emissions profile of the global average LNG project.

Caterpillar has set a goal that 100% of new products through 2030 will be more sustainable than the previous generation. Beginning in 2022, Caterpillar incorporated ESG performance into the incentive plan for executive officers. Caterpillar also publishes an annual sustainability report. Emissions are driving a significant amount of the company’s research and development investments on proven equipment lines, such as the G3600. Caterpillar sees compression applications converting to electric motors and the need for products and services to evolve to maintain reliability while also meeting increasingly strict emissions regulations (see “Leveling Up The Playing Field,” February 2024 Gas Compression Magazine, p. 30).

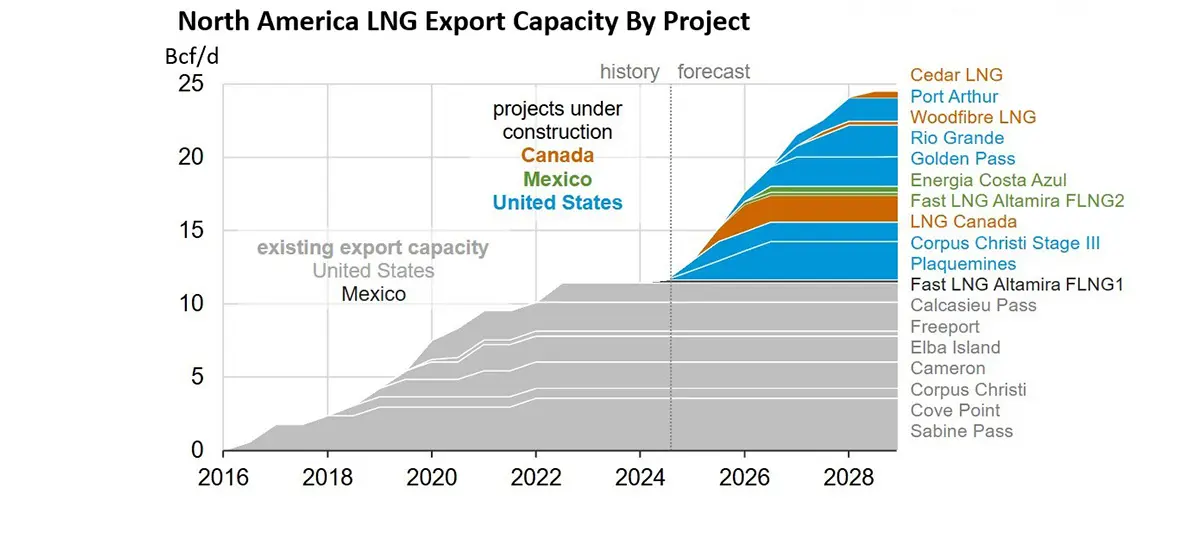

The Great Divide

The US is gearing up for record natural gas production in 2025. The Energy Information Administration forecasts US natural gas production to average 103 Bcf/d (2.91 x 109 m3/d) in 2024, down slightly from 2023, and then increase to average 105 Bcf/d (2.97 x 109 m3/d) in 2025. The main drivers for its forecast of growth in US production next year are an increasing Henry Hub price and growing natural gas demand as feedgas for LNG projects scheduled to come online in the second half of 2024 and 2025 (see “2024 Forecast For Compression: Demand For Gas Compression Remains Strong,” September 2024 Gas Compression Magazine, p. 58).

In the near-term, economic factors, supply, and demand will continue to drive natural gas market dynamics. After all, it is the accessibility, affordability, and reliability of oil and gas has made it the backbone of the global energy mix. But for oil and gas to play a role in the AI age, the industry must continue to evolve to reduce emissions and improve cybersecurity.

While no one has a crystal ball, we can learn a lot about where the oil and gas industry is headed by following the breadcrumbs. Right now, the breadcrumbs are all leading toward technological innovation, especially considering the industry desperately wants to be included in the AI conversation. While cost and reliability will likely play a major factor in landing partnership agreements with data centers, the real winners could be the companies that take emissions and data management seriously.

Regular readers of Mergers & Markets are likely aware of the wave of consolidation that is sweeping across the oil and gas industry as big companies gobble up smaller players to achieve efficiency improvements and accelerate growth. It’s too early to tell, but we could see a similar theme play out in aftermarket services, digitalization, and the SaaS companies that support the oil and gas industry.

As the late Charlie Munger once said, “Show me the incentive, and I’ll show you the outcome.” The incentive is that the natural gas industry could become the driving force behind technological innovation, the power source behind large language models, the energy source that gives data centers unparalleled uptime, and the lifeblood behind keeping them cool. The most important economic indicators could shift from manufacturing output, new home builds, and job growth to a country’s computing power and the size of servers within a data center rack.

We could still be years away from seeing a divide between the companies that care only about costs and profitability and the ones that have embraced this new paradigm shift. But today, we are already seeing myriad examples of companies that are investing significant capital to ensure they have competitive advantages in emissions, analytics, and cybersecurity. Those companies stand to thrive in the age of sophisticated oil and natural gas, while others may fall behind.