Equinor, Shell Cancel European Hydrogen Megaprojects

Despite their steadfast optimism that hydrogen will be a key contributor to the energy transition, Equinor and Shell are citing weak demand as cause for putting some of their biggest hydrogen projects on hold.

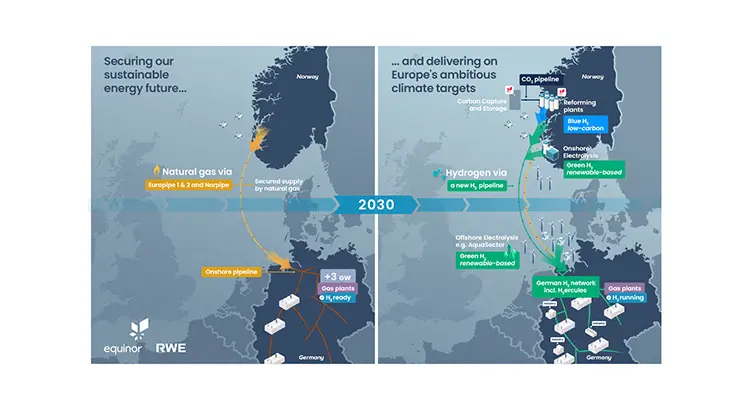

In late September, Equinor announced that it was abandoning plans to export blue hydrogen to Germany due to a lack of demand and unjustifiably high capital costs. In January 2023, Equinor and German energy major, RWE, announced a partnership to develop large-scale value chains for low carbon hydrogen. The idea was to replace coal-fired power plans with hydrogen gas-fired power plants, with Equinor and RWE jointly owning the new gas plants. Germany has a goal to phase out all coal-fired power plants by 2030.

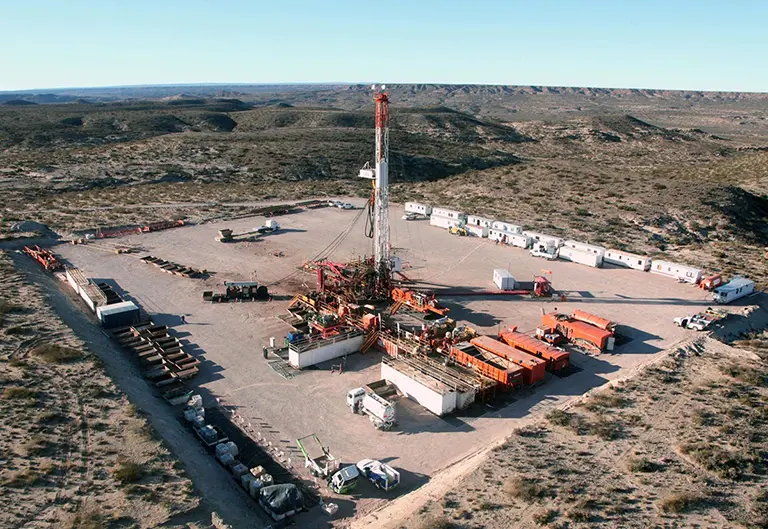

(Image courtesy of Aker Horizons)

The companies planned to produce blue hydrogen, which is hydrogen from natural gas using carbon capture and storage, and the transport that hydrogen via pipeline from Norway to Germany. According to Equinor, more than 95% of the carbon dioxide would be captured and stored safely and permanently under the seabed offshore Norway. Equinor has spent decades drilling oil and natural gas offshore Norway and has built multiple offshore wind farms in the North Sea and other major bodies of water. Equinor hoped to produce green hydrogen from some of its offshore wind farms to help power industrial customers.

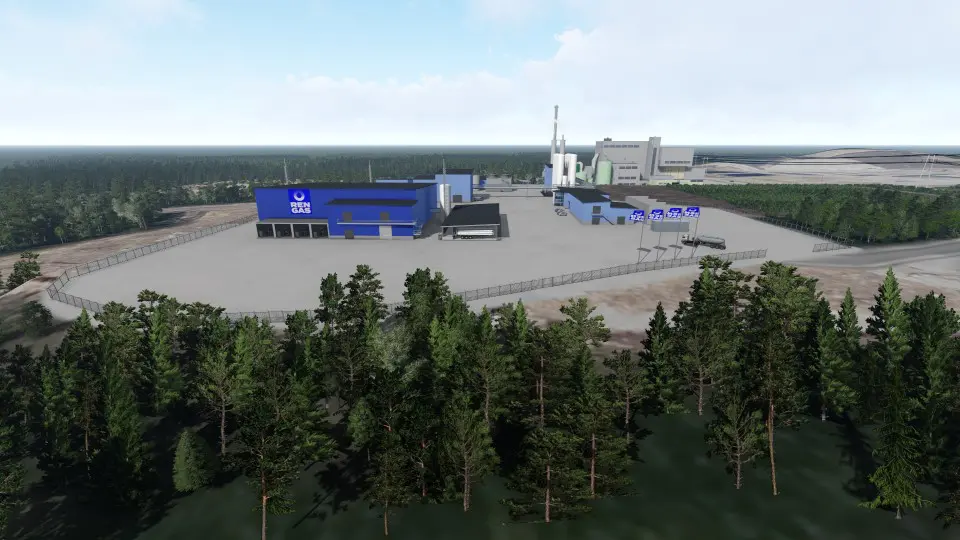

Just days after reports surfaced of Equinor’s canceled projects, Shell decided to scrap its plans for its hydrogen hub in Norway. In July 2021, Aker Clean Hydrogen and CapeOmega signed a Memorandum of Understanding with AS Norske Shell to explore opportunities to develop the Aukra Hydrogen Hub to a large-scale production facility for clean hydrogen using natural gas from the local gas processing plant. The consortium had a goal to utilize 250 MW of renewable power from existing onshore grid capacity to produce 1089 tons (1200 tonnes) per day of blue hydrogen by 2030 and then double capacity by 2035 using blue hydrogen and green hydrogen from offshore wind farms. Like Equinor, Shell blamed market dynamics for the project’s downfall.

The news is a setback for the natural gas, hydrogen, and offshore wind industries and a reminder that the hydrogen economy needs a reliable network of hydrogen producers and consumers to thrive. It also showcases that even the biggest players with the deepest pockets are struggling to justify the funding of hydrogen megaprojects.

Technological advancements and the build out of infrastructure can help scale the European hydrogen economy to make it more cost effective over time. The two discussed project disruptions shed light on the need for reliable and clear hydrogen policy and government funding from Germany and Norway to make hydrogen a worthwhile choice for energy majors looking to achieve their environmental, social, and governance goals.

(Image courtesy of Aker Horizons)