Impact Of The Inflation Reduction Act’s Methane Fee Charge Explained

This article was written by Chris Kipp.

The two greenhouse gases (GHGs) most abundant in the oil and gas industry are carbon dioxide (CO2) and methane (CH4). One way to look at GHGs and create an equal comparison is on a carbon dioxide equivalent (CO2e) basis. This equation normalizes the ability of a molecule to trap heat in the atmosphere to that of a CO2 molecule, using a Global Warming Potential (GWP) factor. The United States primarily uses the 100-year GWP as a measure of the relative impact of different GHGs that results in a GWP factor of 25 for CH4. In 100 years, 1 ton (0.9 tonnes) of CH4 emitted would have the same warming potential as 25 tons (22.7 tonnes) of CO2, resulting in this equation:

CO2e = CO2 + (CH4 × 25) + others

However, CH4 molecules break down much faster in the atmosphere and have a higher short-term global warming impact, therefore, other metrics have been developed to compare one GHG to another. For example, the 20-year GWP is sometimes used as an alternative to the 100-year GWP; the 20-year GWP is based on the energy absorbed over 20 years. Since all GWPs are calculated relative to CO2, GWPs based on a shorter timeframe will be larger for gases with lifetimes shorter than CO2, and smaller for gases with lifetimes longer than CO2. Using the 20-year GWP results in a GWP factor for CH4 several times higher than the 100-year GWP.

CH4 emissions have become an important topic with an increasing number of industry conferences focusing strictly on CH4 mitigation. The CH4-focused conferences typically consist of oil and natural gas producers presenting and demonstrating technology used to capture all vented CH4 and reducing every possible source, at times going above and beyond current regulations. This is a benefit from a public perception perspective and benefits investors, shareholders, communities as well as the entire oil and gas industry. By responsibly producing oil and natural gas today, the industry is helping pave the way for a strong future.

What are the typical emissions sources and where do the CO2 and CH4 emissions originate on a compressor station? CO2 emissions are almost directly correlated to the amount of fuel burned on-site, with the largest sources being any engines or turbines and smaller sources like heaters. CH4 emissions are more complicated to measure and are emitted in two different ways: from vented or leaked sources and through engine exhausts. The CO2e footprint of a typical lean-burn compressor station, from engine exhaust and vented CH4, is comprised of 67% CO2 and 33% CH4 using the 100-year GWP. The CO2 emissions are almost entirely from the engine’s exhaust, while the CH4 emissions are split almost equally between uncombusted CH4 in the engine exhaust and CH4 from leaks and vents. With the major sources identified, producing companies can target reductions in those specific areas.

The Inflation Reduction Act (IRA), signed on August 16, 2022, includes a few provisions related to CH4 emissions impacting the oil and gas industry. Section 60113 of the IRA adds Section 136 to the Clean Air Act, imposing the first-ever direct “charge” on CH4 emissions. The premise of the regulation is that GHG emissions are contributing to climate change and that reducing CH4 emissions is the fastest, most economical way to reduce impact to the environment. The CO2 component comes from the combustion of gas, and while small incremental reductions in fuel consumption can reduce CO2, the easier emissions to reduce are CH4. Fugitive CH4 can be relatively easy to capture, and the unburned CH4 in the exhaust can be almost eliminated with Miller cycle, rich-burn combustion technology.

To enforce and facilitate CH4 reductions, a CH4 waste fee will be imposed on facilities that exceed segment-specific thresholds, and the CH4 quantification methods will be based on the US Environmental Protection Agency’s (EPA’s) Greenhouse Gas Reporting Program (GHGRP). This fee will be US$900 per metric ton of CH4 for 2024, US$1200 for 2025, and US$1500 for 2026 and each year thereafter. The CH4 intensity calculations are a ratio of the amount of CH4 emitted to the total natural gas throughput of the station. This means a producer’s potential fee can be reduced by either decreasing CH4 emissions or increasing the station’s throughput. The allowable fee thresholds range from 0.05% for gathering and boosting stations to 0.2% for onshore or offshore production segments.

The GHGRP is used by the EPA to quantify GHG emissions, as the name implies, however, there is a proposed ruling that would revise emissions factors to correct inaccuracies that have been brought to the EPA’s attention through various measurements and studies completed by academic institutions. The largest impact comes from how CH4 emissions are quantified. Historically, the EPA correlated engine CH4 emissions to the industry the engine was operating in (Subpart C for Transmission, Subpart W for Gathering & Boosting and Natural Gas Processing). The new proposed rule now considers the combustion technology an engine is using and assigns a different factor depending on whether the engine is a rich- or lean-burn.

To help define the difference between a rich-burn (stoichiometric) and lean-burn engine, we can go back to high school chemistry class. Natural gas engines combust fuel and air to create mechanical power. Writing out a perfectly balanced chemical equation for CH4 + 2 O2 = CO2 + 2 H2O, provides the stoichiometric ratio for the balanced amount of air to fuel (This is a simplified equation for pure CH4 and O2. Other constituents like N2 will be present, and those help form NOx, etc.). A rich-burn engine operates at almost this exact air-fuel ratio. A lean-burn engine runs with excess air in the combustion. This extra air allows for cooler combustion temperatures, lower engine out NOx, and better fuel consumption to a certain extent. However, to keep up with NOx regulations, these engines must continually increase the amount of air in the combustion chamber, which leads to a less complete combustion and results in an increase of CH4 emissions. The rich-burn engine runs at a stable air-fuel ratio and uses a three-way catalyst to reduce NOx and other pollutants. Due to the exhaust composition and exhaust temperatures, three-way catalysts are not effective on a lean-burn engine. The EPA has proposed updated emissions factors that are more representative of operational emissions and would improve the accuracy of emissions data submitted to the EPA as current Subpart W methodologies do not distinguish between rich- and lean-burn engines, as shown in both theoretical lab and field testing. The proposed emissions factors significantly change the impact of the IRA’s CH4 fee as the proposed lean-burn GHGRP factor for CH4 slip is more than 11 times higher than that of a rich-burn engine.

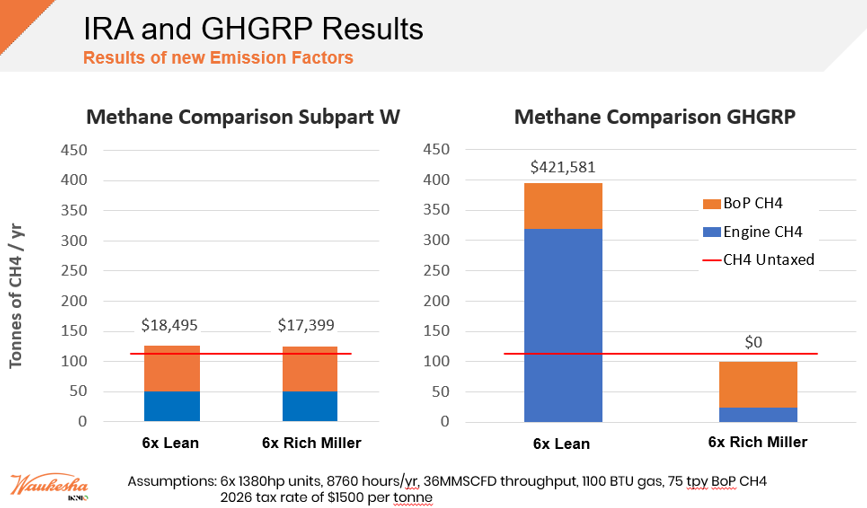

To demonstrate the impact of the proposed emissions factors, a sample compression site was modeled independently as both a 100% rich-burn site and a 100% lean-burn site, as shown in Figure 1. The site includes six compressor skids, each running at 1380 hp (1029 kW) and compressing 6 MMscf/d (169,901 m3/d). With the compressor vents, tank vents, and blowdowns, the site is permitted to emit 82.7 tons (75 tonnes) of CH4 per year outside of the engine’s exhaust. In 2026, with a fee of US$1500 per metric ton of CH4, using the EPA’s old Subpart W factors, both the modeled rich- and lean-burn site would have to pay just under US$20,000 to satisfy the CH4 fee. By applying EPA’s proposed GHGRP factors, the lean-burn site would pay more than US$400,000 while the rich-burn site would pay US$0 in CH4 fees.

The producing companies most severely impacted by IRA’s Methane Emissions Reductions Program are midstream oil and gas operators with large fleets of lean-burn engines. These fleets will have the lowest fee threshold factor and the highest engine CH4 emissions factors. Overhauls are expensive; reducing emissions is expensive. Where does the budget come from to do both? A lean- to rich-burn engine conversion at the time of a major overhaul can accomplish both goals. For example, original equipment manufacturer (OEM) remanufactured engine exchange programs can help facilitate engine swap-outs or exchanges, seamlessly transitioning from lean-burn combustion into the latest Miller cycle rich-burn technology. This is on par with lean-burn fuel consumption but with a much lower CH4, and therefore CO2e, footprint. Other emissions such as NOx and volatile organic compounds (VOCs) can also be reduced during the transition from lean to rich burn.

Additionally, the CH4 fee is averaged over entire fleets, not only at individual sites. There is still time to act before the CH4 fee goes into effect. To target package emissions, a quick remediation is to reduce the CH4 emitted from the package, especially pneumatic items powered by gas or vents. Targeting and mitigating engine CH4 emissions requires additional planning. Since an engine is typically overhauled once every six plus years, this interval becomes the most economical time to target an upgrade and start reducing or eliminating applicable CH4 fees. And further, combining engine overhauls with emissions reductions generates multiple synergies: increased profitability, reduced emissions, cleaner communities, attraction of a new skilled workforce, and the continued investment in the technologies required to grow economies and improve the quality of life around the globe.

The world needs access to hydrocarbons, now more than ever. The United States has the reserves, infrastructure, and technology to grow the production and export capacity to bring clean-burning natural gas to places it is needed most. The oil and gas industry is well-positioned to continue innovating, supported by collaboration between industry and policy makers, to implement the technologies available to achieve the lowest CH4 and carbon footprint. The world needs more energy and lower emissions. Technologies are available today to do both.

About The Author

Chris Kipp is a Senior Business Development Manager at INNIO’s Waukesha Engine. Over his 12-year tenure with the company, he has held technical positions in the areas of Application Engineering, Product Management, and Sales. He has a bachelor’s degree in Mechanical Engineering from the Milwaukee School of Engineering and an MBA from the University of Wisconsin-Madison.