A Conference In Transition

This article was written by John Wilson.

The annual PowerGen conference evolved in lockstep with the broader power generation industry as an annual meeting place to showcase new technologies and update relationships. I had attended for dozens of years as a representative of an original equipment manufacturer (OEM) in the gas turbine and wind turbine business by meeting customers and scoping out what competitors offered. After a several year hiatus, this year’s conference was a bit different. It is clearly a conference in transition.

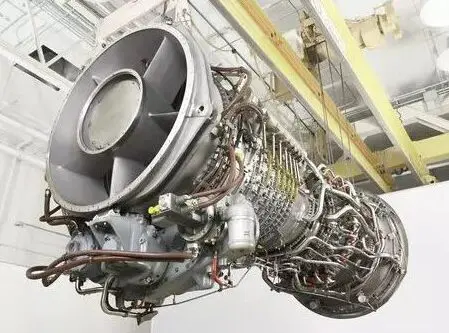

Among the 1400 exhibitors, there were plenty of equipment services and suppliers to support the conventional power generation industry. The 22,000 participants came from all parts of the industry, and certainly updated a lot of relationships. In the past, PowerGen was instrumental in showcasing the benefits of shifting from steam coal plants to combined cycle generation that impacted the power generation industry. There were several mid-size generation equipment suppliers exhibiting, but the large power plant equipment prime movers were absent. With the rise of wind and solar conferences, and a dramatic reduction in new fossil fuel plants, the still popular PowerGen has lost some supporters.

The new technologies that were being showcased this year were not the newest gas turbine, or biggest generator, but rather, the green initiatives in hydrogen and battery storage. As I was welcomed from booth to booth, the majority of exhibitors were privately held companies. When questioned on their receptivity to ESG efforts, these companies gave quite a range of responses. While I did not question all 1400 booths, my informal survey was pretty informative. Most people knew the term ESG, or said they did, but very few thought it applied to them. When I gained someone’s interest, the majority of discussions were on how ESG was about minimizing future risks with green initiatives or addressing the risk in maintaining their workforces. The governance topic was the least understood by far, being the least self-explanatory term.

There was a general acknowledgement among some of the publicly held companies that headquarters, or their parent company, were taking care of an ESG initiative. The opportunity to leverage the actions the organization was taking on ESG was not part of any sales organization strategy that I found. Although staffing was a challenge among many, and customers requiring carbon information on submittals was described, the benefits of having a proactive ESG strategy was not recognized. With the fortune 500 companies virtually all having an ESG strategy, and driving that requirement to their suppliers, it is only a matter of time for broader application.

As the PowerGen conference has evolved, so has the need for the power generation industry to address ESG risks without explicitly naming ESG. Clearly, the rise of the power generation industry adoption of efficient combined cycle plants, large-scale solar and wind projects, and pollution control technologies address the environmental risk the industry faces. The growth of a safety culture in every corner of the industry, the emphasis placed on diversity, and increased visibility of supply chain management are examples of how the social elements of ESG risks have already been addressed.

In the power generation industry, the risks involved in governance were very real. The industry has been involved in multi-year consent decrees for anti-competitive practices, billion-dollar settlements for corruption, and cyber security breaches to name a few, all which had tremendous impacts on bottom lines. Addressing governance risks have always been common sense — be honest, adhere to your business principles, and support good management practices.

The ESG initiative was started to address the risks that conventional financial reporting does not address. The power generation industry has already been successfully addressing ESG risks better than many other industries. A formal ESG reporting program merely aligns the organization’s current risk portfolio to a standard reporting metric for a specific industry.

Power generation conferences continue to offer the opportunity to network with other industry participants and learn how they are addressing the risks that they face across the industry. The presentations, exhibits, and interactions all provide information to develop projects to address the risks that each organization faces in today’s environment. Coordinating all those projects into a comprehensive and effective ESG program is becoming the challenge the power generation industry is now facing.

About The Author

John Wilson is the president of Wilson Enterprise Engineering (WEE). WEE provides consulting expertise to perform analysis, strategic planning, and program management to enhance the efficiency of sales and marketing operations with a focus on incorporating ESG factors to improve customer operations and valuation. WEE provides the proven tools to manage ESG initiatives into programs that are integrated into current processes and can help individuals and organizations dream, plan, internalize, implement, measure, and share their ESG tools and scores.