Unlocking The Hydrogen Economy

Constituents gathered in Houston for the 2nd American Hydrogen Forum. The event brought together stakeholders from the entire hydrogen value stream for a two-day examination of the global hydrogen economy and discussions on the challenges and opportunities that lie ahead. Following is a recap of some of the presentations made during the conference.

Department Of Energy

The Biden administration has set a goal of net-zero emissions by 2050 and a completely carbon-free electric grid by 2035. As a nation, the United States is making progress toward those goals.

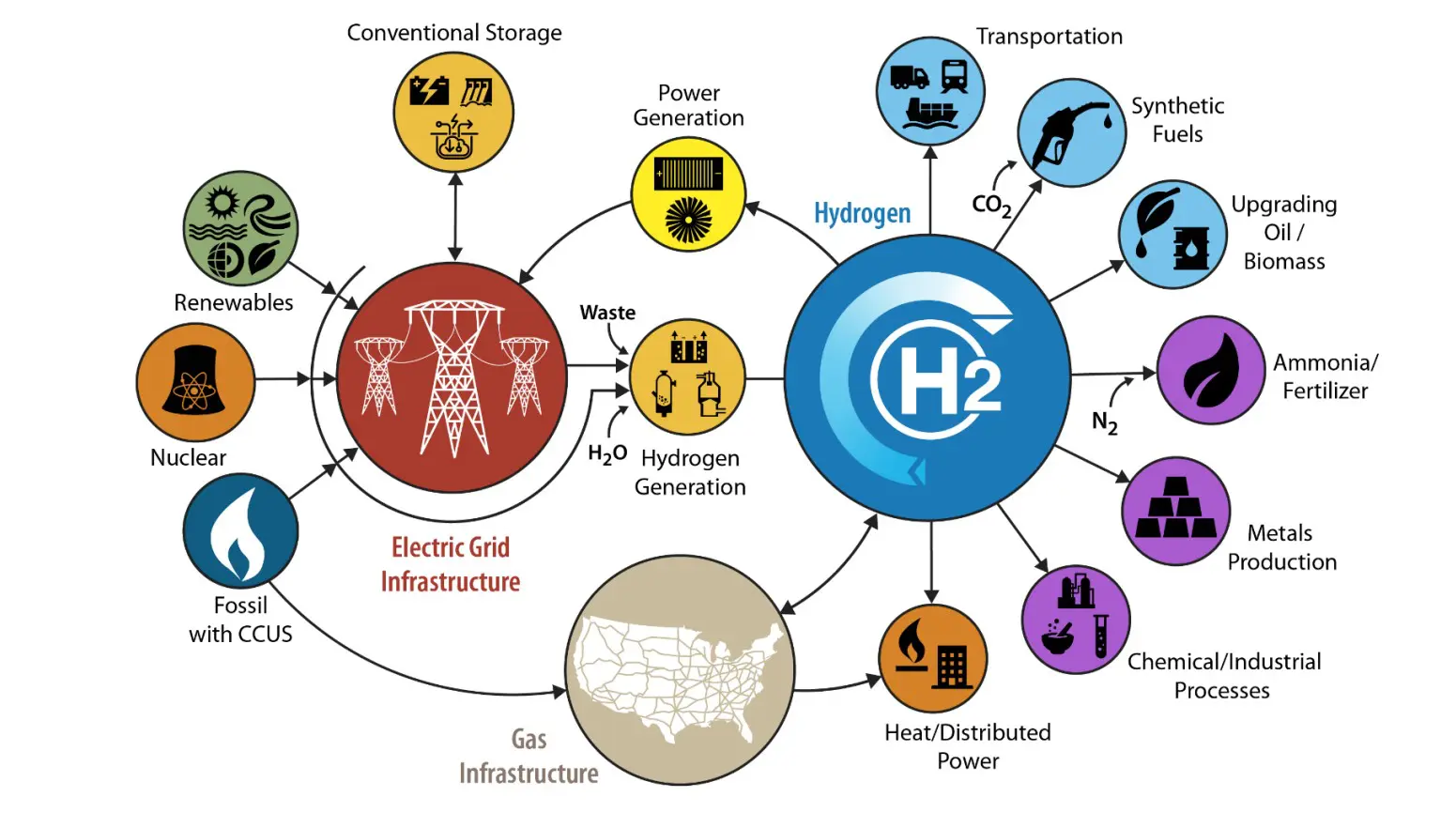

“We produce more than 10 million metric tons of hydrogen per year. There is tremendous potential for growth, and a lot of job creation opportunity with hydrogen,” said Sunita Satyapal, director of the US Department of Energy’s (DOE’s) hydrogen and fuel cell technologies office. “Renewables surpassed coal in terms of consumption for the first time last year. Hydrogen is one part of a very balanced portfolio to lower emissions in the United States. The DOE has a Hydrogen Program Plan that provides a strategic view across all the relevant offices. Three priorities are: we have to get to low-cost, clean hydrogen; we must develop a safe delivery and storage infrastructure; and then, finally, we must enable end-use applications at scale for impact.”

According to Satyapal, one the greatest barriers to public acceptance of hydrogen is cost. “If we can get to where hydrogen is less than US$1.50/kg, it becomes less than a gallon of gas, and we can unlock significant market potential. The Biden administration launched the Hydrogen Shot last summer, which is targeting US$1/kg of clean hydrogen within one decade.”

Hydrogen Shot is part of the DOE’s Energy Earthshots Initiative, which aims to “accelerate breakthroughs of more abundant, affordable, and reliable clean energy solutions within the decade.” Launched in June 2021, Hydrogen Shot seeks to reduce the cost of clean hydrogen by 80%, to US$1/kg, within 10 years.

(Image Courtesy Of The DOE)

The Hydrogen Shot establishes a framework and foundation for clean hydrogen deployment in Biden’s American Jobs Plan, which includes support for demonstration projects. Industries are beginning to implement clean hydrogen to reduce emissions, yet many hurdles remain to deploying it at scale. Currently, hydrogen from renewable energy costs about US$5/kg.

The DOE plans to hold a series of events to engage stakeholders, including a Hydrogen Shot Summit which will take place August 31 to September 1, 2021.

“The key is to bring the cost of hydrogen down, so that we can significantly ramp up scale,” said Satyapal. “Collaboration, diversity, equity, and inclusion are high priorities. It really takes the whole — governments, industry, the investment community, and the global community — to accelerate progress.”

(Image Courtesy Of The Hydrogen Council)

Chart Industries

Chart Industries Inc. (Chart) manufactures engineered equipment servicing multiple market applications in energy and industrial gas. Its product portfolio is used throughout the liquid gas value chain in the production, storage, distribution, and end use of atmospheric, hydrocarbon, and industrial gases. Headquartered in Georgia, Chart has domestic operations located across the United States and an international presence in Asia, Australia, Europe, and Latin America.

“As we looked at our business, we asked, ‘where is the future going?’ The one thing you hear every government, public sector official, and private industry company and shareholder talk about is sustainability,” said Jillian Evanko, CEO at Chart.

“We tend to get very US-centric when we think about addressing the problems of carbon emissions. If you look at the broader globe and you look at where populations don’t have power or water, what do you think they’re going to pick first? I’d pick clean water, personally. I’d start there and then you can address the power situation,” said Evanko. “I think you’re going to start seeing more clean power and clean water applications going together. You’re also going to start to see the way that carbon dioxide [CO2] capture works with food and beverage, as an example. So, the nexus of clean [clean energy, water, food, and industrials] is really important to think about and, at Chart, we serve that across the board.”

Hydrogen’s role in the “nexus of clean” continues to advance, and Chart offers myriad technologies and solutions to advance the hydrogen economy. Evanko looks at the hydrogen value chain in segments — hydrogen production, hydrogen storage and transport, and hydrogen end use.

“Most of the investment is in bucket one, in the production of molecules,” said Evanko. “You’ll hear people talk about ‘how do we get the cost down? How do we scale up?’ But, at the end of the day, the entire set of three buckets [hydrogen production, hydrogen storage and transport, and hydrogen end use] have to work together in order for this industry to get to a point where hydrogen is self-sustaining — where it isn’t reliant on credits or on public sector funding.”

With more than 57 years of hydrogen experience, Chart has negotiated the shifting demands of the hydrogen economy firsthand. “Prior to 2019, discussions on hydrogen were primarily related to space exploration,” said Evanko. “Enter 2020, and the universal shift to sustainability, and hydrogen became a household word. Fast forward to 2021, and we’ve seen an incredible amount of traction and progress.”

According to Evanko, to date, US$500 billion in hydrogen investment has been announced through 2030. “If you looked at that figure a year ago, it was US$350 billion,” she said. “So, there was a real meaningful shift in a matter of three, or four, or five months from US$350 to US$500 billion, with very tangible projects.”

Evanko noted that there are currently 75 countries with net-zero targets, and more than 30 have hydrogen strategies. “This is another piece of data that is way different than it looked even in June of 2020.” Breaking it down one step further, Evanko shared that 228 hydrogen projects are currently under development globally, with 85% in EU, Asia, and Australia, and that number is growing.

While the increased interest and investment in hydrogen is encouraging, Evanko cautioned that it is important to acknowledge that the technology that exists today, especially in the production of the molecule, is not the technology that will achieve the planet’s 2050 emission goals. “There has to be more innovation that happens,” said Evanko. “We have already seen that in the last couple of years. For example, what used to be an acceptable electrolyzer is no longer deemed efficient. Continued innovation is really important, and that is one of the things that we at Chart believe in. There is going to be a lot of different ways to accomplish emissions reductions, a lot of different technologies that are going to play in the entire ecosystem.”

Geographically, hydrogen activity varies. Data shared by Evanko shows that the United States is beginning to move to networks / scaling of infrastructure. State level activity is still extremely varied, but the development of hydrogen hubs is happening. In Canada, a national hydrogen strategy supports investment but provinces and localized demand drives behavior, which shows a growing trend toward liquid hydrogen.

“We are starting to see various stages of investment around the world,” said Evanko. “South Korea and Australia, I think, are the next regions that are going to be spending more and more investment dollars in hydrogen. India and South and Central America are at different stages of that evolution. India for example, is focused on getting power to a broad set of the population. There’s still natural gas investment in infrastructure happening. In the background, there is development of a hydrogen strategy with projects that are focused on industrial, green hydrogen.”

Evanko continued, “To date, most of the spending really has been in bucket one and bucket two [hydrogen production and hydrogen storage and transport]. I think we’re going to start to see bucket three [hydrogen end use] speedup a little bit. Because what do you do if you now have plenty of hydrogen available? Can you move it around? But where does it go? And who’s using it? And if I’m driving a heavy-duty truck and I want to go from California to New York, I need places to stop to fill that. We’re going to start to see more spend in bucket three, certainly that’s what we anticipate in the coming year.”

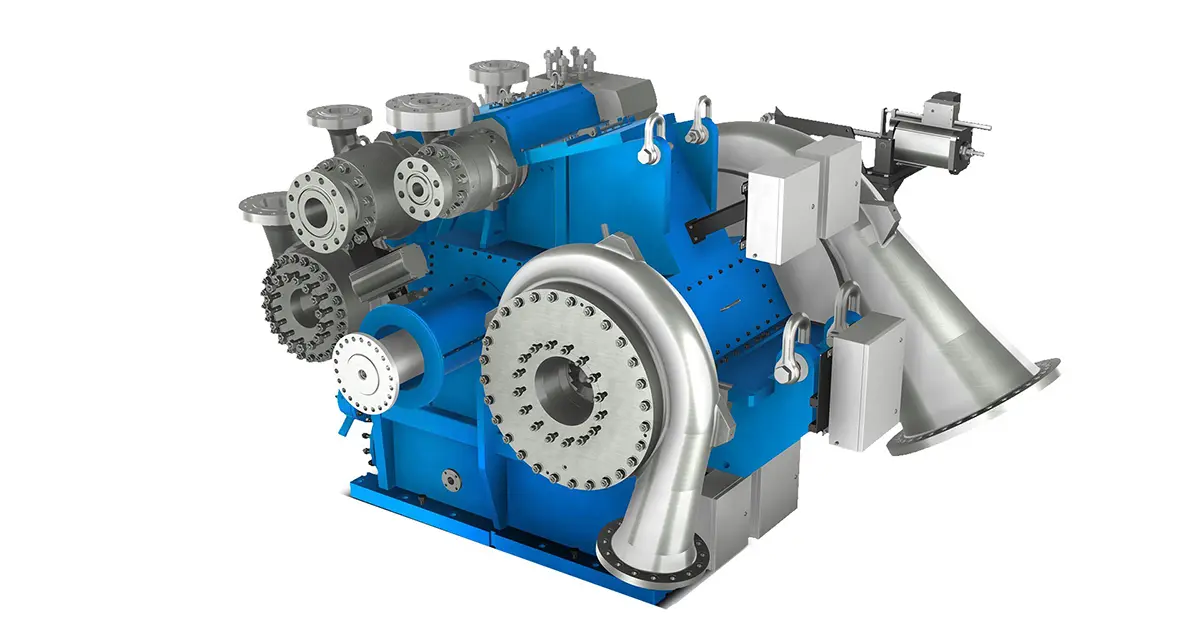

PDC Machines

PDC Machines, a green hydrogen company and compressor manufacturer based out of Warminster, Pennsylvania, sees a hydrogen future as well. With locations in Germany, Japan, South Korea, and China, PDC Machines serves the alternative energy economy with its diaphragm compressors and hydrogen refueling stations. It also has a presence in the chemical and petrochemical, oil and gas, and power generation industries worldwide.

“We are witnessing an outpouring of international commitment to expanding green hydrogen in all sectors,” said Freddy Falck, senior vice president of Engineering at PDC Machines. “China is certainly at the forefront of this effort. In Japan, public and private partnerships are motivated to put consumer hydrogen mobility in the streets. In the European Union, virtually every country has some sort of decarbonization plan that either focuses on hydrogen or has hydrogen as a critical component.”

Falck sees demand for hydrogen technology growing in captured fleets. “These are fleets of vehicles in different sizes that have a fixed route. They have a start point and come back to that start point or a preset location. These fixed routes make it easy to have refueling stations in strategic places, as opposed to having a widespread network. We are seeing a lot of growth right now in this area,” said Falck.

“The two main growth areas on the captured fleet side are material handling and transit vehicles,” continued Falck. “In material handling, we are seeing a lot of diesel retrofits of forklifts. Fuel cell forklifts and vehicles perform better and take up less space. With these considerations, the choice seems pretty clear. Fuel cell vehicles also have a shorter fueling time.”

Looking ahead, Falck sees growing interest in light-duty trucks. “From Class 2 to Class 7 trucks, and also long-haul trucks, there is a lot of investment happening right now. We are seeing this from truck manufacturers like Daimler, Nikola, and Hyzon, as well as station operators who are getting into hydrogen refueling and fuel cell trucks. Right now, there are 160 new stations pledged by 2025.”

As the hydrogen economy grows, so does PDC Machines. The company is in the process of opening new manufacturing facilities in Pennsylvania and in Munich, Germany. “We are in the middle of very aggressive growth,” said Falck. “We’re projecting to grow our manufacturing capacity 10 times by 2025, with most of that growth coming from investing heavily within the hydrogen industry.”

Hydrogen Council

The Hydrogen Council is tracking 520 major-scale hydrogen projects. “There is a very large concentration of projects around Europe led by very strong policy initiatives and funding from countries like France and Germany,” said Daryl Wilson, executive director of the Hydrogen Council. “There is also a heavy concentration of projects in Australia and in China. The picture in North America is starting to fill out, but frankly, Canada and the United States are somewhat behind the rest of the world in the scale up of hydrogen technology.”

Headquartered in Belgium, the Hydrogen Council is a global CEO-led initiative of 134 energy, transport, industry, and investment companies with a united and long-term vision to develop the hydrogen economy.

Wilson stated that the projects that have been put forward are mix of green hydrogen projects, originating from renewable energy; and blue hydrogen projects, which utilize fossil fuels. “What’s notable is how quickly the picture has changed,” said Wilson. “From 2019 to 2021 we’ve seen a very rapid increase in the number of projects. In fact, just in the last nine months, there’s been a 3X scale up in the announced project portfolio for hydrogen.”

The distribution of applications covers the entire value chain — from production to distribution to end use; from power generation, mobility, heating, industrial use, and new energy uses such as the development of aviation fuels from hydrogen.

“You’re used to hearing a lot about electrical vehicles and how they’ll transform transport, but if you look carefully at what’s going on around the world, and the project portfolio of announced projects, there are a very significant amount of large-scale mobility projects,” said Wilson. “A lot of these are falling in the heavy mobility areas with trucks, trains, buses, and shipping, but the role of hydrogen and transport will be very significant and we’re just in the early days.”

Wilson noted that hydrogen commitments vary by geography. “Hydrogen leaders in the world today are France, Germany, China, Japan, and Korea,” said Wilson. “This is where funding and policy is fully deployed and actually available in the market. Closely behind that, the United States and Canada are included, as they are places where there’s active implementation of policy and funding announcements just getting underway.

“China dominates with projected funding between US$22 and 23 billion,” continued Wilson. “Germany is close behind with US$10.3 billion. The United States, with current announced funding of US$9.5 billion, is also a very significant player, followed by France, Japan, and the rest of the European Union.”