The Role Of Natural Gas In The Russia-Ukraine Conflict

Tensions between Russia and Ukraine are escalating as troops assemble along the border. US Secretary of State Antony Blinken said on February 11 that an invasion “could begin at any time.” Talks of a war between Russia and Ukraine rekindles memories of February and March 2014, when Russia invaded and proceeded to annex Ukraine’s Crimean Peninsula.

The timing of the conflict is undeniably purposeful. European natural gas prices are through the roof as the seasonal winter price hike pairs with global increases in fossil fuel prices. Estimates vary, but roughly 40% of European natural gas comes from Russia. Holding a lot of leverage, Russia knows that the European Union (EU) may have to turn a blind eye to its imperialistic efforts or face an energy shortage. Reports indicate that Russia has shipped the bare minimum of natural gas to Europe so far this winter, with European reserves currently sitting far below normal levels.

What’s more, the US economy is under pressure due to runaway inflation. On February 10, the US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index rose by 7.5% between January 2021 and January 2022, which was the highest reading in 40 years. Low interest rates paired with fiscal stimulus helped pole-vault the United States out of the COVID-19-induced recession. However, a surge in consumer spending caused prices to rise as demand continues to outpace supply for many goods and services. Faced with the threat of reduced margins, companies have had little choice but to pass along costs to customers. Unemployment is low, but wages are now struggling to keep up with inflation, which could wreak havoc on the American middle class. In sum, Russia is threatening Ukraine at a time of weakness for the EU and the United States.

The Nord Stream 2 Pipeline

One of the few cards that the United States can play would be to sanction the Nord Stream 2 pipeline, which would prevent Russia from shipping natural gas directly to Germany and increase its reliance on pipelines that pass-through Ukraine.

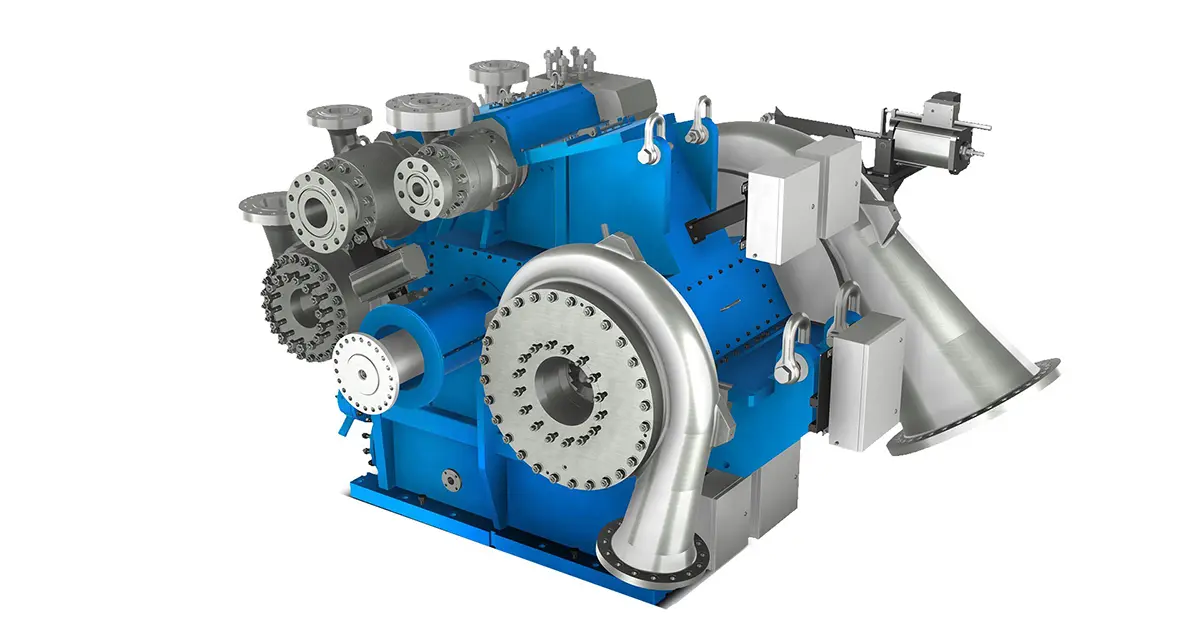

At a length of 759 miles (1222 km), Nord Stream 1 is the longest sub-sea pipeline in the world. It consists of two twin natural gas lines, the first of which was launched in November 2011 and the second was launched in October 2012. The lines run on the seabed of the Baltic Sea from Vyborg, Russia, to Lubmin, Germany. Due to increased demand, Russia’s national oil company (NOC), Gazprom, decided to build a second twin-line sub-sea pipeline, this time from Ust-Luga, Russia, to Lubmin, Germany.

Nord Stream 2’s pipe was laid between 2018 to 2021. The first line was complete in June 2021 and the second line was complete in September 2021. However, Nord Stream 2 has yet to go into service due to geopolitical concerns put forth by the United States and several central and eastern European countries.

Ukraine is particularly opposed to the Nord Stream pipelines because it reduces the country’s importance in the transportation of natural gas from Russia to the EU. Ukraine is essentially a middleman that receives transit fees from several land-based pipelines that connect Russia to end markets in the rest of Europe. By building Nord Steam 2, which cost an estimated US$10.8 billion, Russia is becoming even more self-reliant and increasing its ability to serve its largest customer, Germany, as well as other nearby economic powerhouses like France.

The combined capacity of Nord Stream 1 and Nord Stream 2 is 3.9 trillion cubic feet of natural gas per year, or 5.21 billion cubic feet of natural gas per day (bscf/d). To put that into perspective, consider that the Permian Basin, which is one of the largest natural gas plays in the world, produces around 20 bscf/d of natural gas. For further context, consider that Germany consumed an average of 8 billion bscf/d of natural gas in 2019. According to the US Energy Information Administration (EIA), Germany is Europe’s largest natural gas consumer, and depends on natural gas for 25% of its primary energy consumption.

Surging Natural Gas Prices

EU import natural gas prices have gone parabolic. Between December 2021 and December 2022, European prices increased 649% while US Henry Hub natural gas spot prices rose 154%. What’s even crazier is that European prices were just US$1.58 MMBtu in May 2020 and Henry Hub Prices were US$1.79 MMBtu compared to European import prices of US$38.03 MMBtu in December 2021 and Henry Hub prices of US$4.16 MMBtu.

Since the financial crisis of 2007 and 2008, European import natural gas prices have traded at a steep premium to Henry hub prices. But thanks to the advent of horizontal drilling and hydraulic fracturing, new offshore discoveries, and liquefied natural gas (LNG) investment, global natural gas prices fell dramatically after the oil and gas crash of 2014 and 2015. In the five-year period between 2016 and 2021, European import prices averaged just US$8.43 MMBtu and Henry Hub prices averaged US$3.47 MMBtu.

Geopolitical Risk

The Russia-Ukraine conflict reminds us of the geopolitical importance of energy. Increased renewable energy investment in Europe paired with LNG exports from the United States and other allies to European countries, particularly members of the North Atlantic Treaty Organization (NATO), reduces dependence on Russian gas while also bringing Europe closer to hitting its environmental goals. Energy dependent countries, particularly those in Europe and Southeast Asia, as well as South Korea and Japan, are some of the hottest markets for LNG imports and renewable energy investment. However, all of these countries face security risks and depend on energy and military support from the United States and other allies. Energy projects, more so than those in other sectors, have a blend of economic, environmental, and geological importance.

Unfortunately, we are likely several years away from European LNG import capacity being high enough to counter dependence on Russian gas. In the meantime, Russia continues to exhibit sophisticated engineering prowess and an ability to complete large-scale projects faster than private companies and other NOCs. Geopolitical tensions aside, Nord Stream 1 and Nord Stream 2 are technological marvels. The efficiency and size of both pipelines make it harder for LNG to compete Russian natural gas. However, many countries would likely be happy paying a premium for LNG if it meant increasing their safety and security.