Baker Hughes LM9000 Gas Turbines To Move Large Compressors Used In Argent LNG Liquefaction

First Six Trains Scheduled To Begin Construction In 2026, Online By 2030

By Drew Robb

Argent LNG has selected Baker Hughes as the provider of liquefaction solutions and related services for its proposed liquified natural gas (LNG) export facility in Port Fourchon, Louisiana. Baker Hughes will supply liquefaction solutions, power generation equipment, and gas compression systems for the facility, which is set to deliver approximately 24 MTPA of LNG.

Phase 1 construction is targeted to begin in 2026, with commercial operations expected by 2030. Phase 2, which aims to expand capacity, is advancing through critical milestones, including resource reporting, securing US Federal Energy Regulatory Commission approvals, formalizing gas supply agreements, and achieving financial close. Baker Hughes will provide multi-year maintenance and support services for Argent LNG terminal operations.

Technology Elements

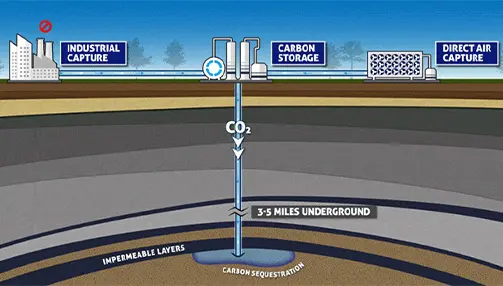

The project will incorporate a series of Baker Hughes technologies, including its NMBL modularized LNG solution, LM9000 gas turbines, and iCenter digital solutions powered by Cordant (see “The Cutting Edge Of Carbon Capture,” February 2025 Gas Compression Magazine, p. 36).

“Argent LNG is comprised of a collection of lower carbon technologies,” said Andrea Intieri, LNG platform manager at Baker Hughes.

Argent LNG is adopting Baker Hughes LM9000 gas turbines, which were specifically conceived with the LNG market in mind, noted Intieri. The LNG field has traditionally favored heavy duty industrial gas turbines in mechanical drive operations as well as for power generation within LNG trains (see “Baker Hughes’ Hat Trick,” July 2023 Gas Compression Magazine, p. 30). But the era of mega-LNG trains that demand the largest possible turbines appears to be over. For years, a race was ongoing to see who could build the biggest LNG plants with the largest trains. These large-scale LNG plants are tending to give way to mid-range trains that offer stronger economics (see “Mid-Scale Marvel, January 2025 Gas Compression Magazine, p. 20).

Mid-scale LNG trains range from 0.5 to 2 MTPA. Small, light aeroderivative gas turbines like the LM2500 and the LM6000 were often used in LNG trains in this range (see “Venture Global LNG Doubles Down On Baker Hughes’ Midscale Liquefaction Train Systems,” October 2023 Gas Compression Magazine, p. 22). The LM9000 extends train sizes to the upper limits of the mid-range. It offers high efficiency (44%) and up to 73 MW of power. It is well suited to LNG plants operating in mechanical drive to move the large compressors used in liquefaction.

“The LM9000 is the right size for the Argent LNG facility,” said Intieri. “As it is compact, light, and efficient, it is suitable for both onshore and offshore applications.”

Although the trains may be smaller than before, overall project sizes have not fallen. Argent LNG will need many LM9000s for both power generation and mechanical drive to meet its overall scope of 24 MTPA (12 trains of 2 MTPA each). The first six trains are part of phase one, which is scheduled to begin construction in 2026 and enter operation by 2030.

NMBL modules are prefabricated and tested at Baker Hughes facilities to ensure scalable and reliable LNG production. These liquefaction solutions range from 0.8 to 2 MPTA. They are built around centrifugal compressors, primarily 2BCL barrel-type compressors that operate as part of a single mixed refrigerant (SMR) process. These compressors operate at 85% or more efficiency, courtesy of the latest designs as well as the adoption of upgraded impellers (see “The Rise of Zero-Emissions Compression, December 2022 Gas Compression Magazine, p. 36).

“We have recently expanded the size BCL compressors now available from Baker Hughes,” said Intieri.

NMBL uses different drivers depending on the application. Beyond the LM9000, some use cases might favor smaller LM2500 or LM6000 machines. In addition to these aeroderivative gas turbines, decarbonization initiatives often favor electric drive technology. Intieri said that three Baker Hughes projects in 2024 achieved their final investment decision with electric drive units. Baker Hughes offers Brush electric motors up to 75 MW, a similar size to the LM9000. That said, large-scale LNG facilities using heavy frame gas turbines continue to have some applicability in places like Qatar and certain projects in the US.

As integrated NMBL modules are manufactured and tested in house, construction costs are minimized. Intieri said that this reduces cost as well as risk because the modules are much faster to install than stick-built projects.

iCenter digital solutions powered by Cordant are yet another element of the Argent LNG project. These software controls are designed to maximize availability, reliability, and operational efficiency in terminal operations. iCenter addresses asset health, asset strategy, maintenance, and optimization of the SMR process. One element of iCenter is the carbon optimizer digital suite that works on any gas turbine to fine-tune performance. It can zero in on the ideal operating point for the gas turbines, which reaps rewards when the unit operates at partial load.

“During the life of a project, a facility often experiences changes in humidity, temperature, and fuel mix so it is always a challenge to operate at the highest point of efficiency,” said Intieri. “NMBL is a digitally native product that includes iCenter-based onboard instrumentation and software to monitor its liquefaction processes and optimize them.”

LNG Market Trends

The global capacity of LNG currently is around 500 MTPA. By 2030, it is expected to reach 800 MTPA. About 200 MTPA of that is already under construction.

“The market fundamentals for LNG are good and natural gas demand will remain strong for the foreseeable future,” said Intieri. “When you add in data center demand, we expect market growth of about 0.9% per year through 2040.”

The strength of the market is highlighted in Baker Hughes financial reports and the number of projects it has recently completed or has in progress. During the fourth quarter of 2024, the company amassed a grand total of US$7.5 billion in orders, with more than half coming from its Industrial and Energy Technology (IET) division that looks after compressor and gas turbine manufacturing.

“IET booked US$3.8 billion of orders in the fourth quarter, supported by strong LNG orders and another gas infrastructure award,” said Lorenzo Simonelli, chair and chief executive officer (CEO) of Baker Hughes. “Including this strong end to the year, 2024 orders totaled US$13 billion, our second-highest order year ever.”

The Need For Balance

The last several years have seen heavy emphasis given to sustainability mandates and net-zero targets. Baker Hughes is firmly onboard with these goals. However, it’s CEO believes that emissions reduction and decarbonization targets should be implemented in a realistic way.

“We need to balance sustainability with affordability and energy security,” said Simonelli. “Gas is not just a transition fuel. It is a destination fuel. We need to harness all fuel types including oil, hydrogen, renewables, nuclear, and natural gas to ensure energy abundance as we move forward.”