This article was written by Michael Dwyer.

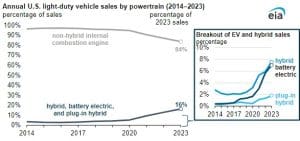

Combined sales of hybrid vehicles, plug-in hybrid electric vehicles (PHEV), and battery electric vehicles (BEV) in the United States rose to 16.3% of total new light-duty vehicle (LDV) sales in 2023, according to data from Wards Intelligence. In 2022, hybrid, PHEV, and BEV sales were 12.9% of total sales.

BEVs use stored electrical energy in a battery pack to fully operate and move the vehicle. PHEVs can use either an electric motor powered by an on-board battery pack or an internal combustion engine that uses fuel stored in on-board tanks to operate and move the vehicle. The internal combustion engine can use gasoline, diesel, natural gas, propane, or biofuels; however, nearly all PHEVs available in the United States use gasoline. PHEVs do not have tailpipe emissions when operating in electricity-only mode.

The full-year share of total US LDV sales for hybrids, PHEVs, and BEVs rose as the number of BEV model options increased, hybrid vehicles were offered in more popular size classes, and BEV prices declined. Manufacturer price cuts and the Clean Vehicle Credit and Qualified Commercial Vehicle Credit from the Inflation Reduction Act also reduced the cost of BEVs. Sales increased despite a semiconductor chip shortage, which persisted through much of 2023 and likely affected the quantity and mix of vehicles that manufacturers could produce.

Note: EV = electric vehicle, which includes both battery electric and plug-in hybrid electric vehicles

US sales of hybrids, PHEVs, and BEVs reached their highest share of total LDV sales in the second half of 2023 at 17.9%. Manufacturers added 20 new BEV models during 2023 (mostly in the second half) for a total of 70 BEV models at year-end out of 459 unique LDV models. Half of the new BEV models were crossover vehicles, a market segment that has more than doubled its share of total LDV sales since 2014.

The number of hybrid model offerings declined in 2023, but sales increased significantly across existing models. In addition, manufacturers offered more hybrid crossover options and fewer car options, thereby increasing hybrid availability within the most popular vehicle market segment (crossovers) and decreasing it within the least popular vehicle market segment (cars).

The average transaction price for BEVs fell to US$50,798 in December 2023, bringing the price 24.2% lower than at the price peak in Q2 2022. Tesla’s price cuts played a significant role in the overall BEV price decline. The average Tesla vehicle transaction price dropped 29% between June 2022 and December 2023. The average price paid for all LDVs increased by 1.5% during that same period, shrinking the gap between BEV and overall industry average LDV transaction prices to US$2000 at the end of 2022.

One additional market dynamic that likely influenced BEV sales in 2023 was the increase in the luxury vehicle market share after the pandemic. Wards uses criteria based on price, body style, and size to segment nameplates into luxury and non-luxury. Among all LDV sales, luxury vehicle sales surpassed their 2019 level in 2021, but non-luxury sales have remained 13% below their 2019 level. BEV sales continue to be concentrated in this luxury category, growing to 31.3% of the total luxury vehicle market in 2023 and 1.7% of the non-luxury vehicle market. Vehicle sales classified as luxury made up 80% of BEV sales and 13.3% of non-hybrid gasoline- or diesel-fueled vehicle sales.