US EV Sales Reach New Highs

US Electric And Hybrid Vehicle Sales Set A Record In Q3 2024

A new report for the US Energy Information Administration (EIA) shows that the share of electric and hybrid vehicle sales in the United States increased in Q3 2024, reaching a record. Combined sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEVs) increased from 19.1% of total new light-duty vehicle (LDV) sales in the United States in Q2 2024 to 19.6% in Q3 2024, according to estimates from Wards Intelligence.

This increase in the electric and hybrid vehicle market share was driven primarily by hybrid electric vehicle sales. BEV sales decreased, with the share dropping from 7.4% of the US LDV market in Q2 2024 to 7.0% in Q3 2024. The share of hybrid vehicle sales increased, with hybrid vehicles making up 10.8% of the US LDV market in Q3 2024, a record.

BEVs continued to be popular in the luxury vehicle segment, accounting for 35.8% of US LDV luxury sales in Q3 2024. However, luxury BEVs as a share of total BEV sales have been decreasing as sales outside the luxury market have increased, falling to the lowest share since Q2 2017. Still, 70.7% of BEVs sold in the United States during Q3 2024 were luxury vehicles, while 10.3% of the hybrid vehicles sold were luxury. According to Cox Automotive, the average transaction price for a new BEV before accounting for any consumer or government incentives was US$56,351 at the end of Q3 2024, about 16% higher than the overall industry average price.

Tesla still holds the number one spot in the US BEV market, although at 48.8%, its market share was less than 50% for a second consecutive quarter this year. Tesla’s Model Y and Model 3 continue to drive sales, and the recently released Tesla Cybertruck was a driving factor in Tesla’s increase in sales in Q3 2024, outselling all its large truck competitors (Rivian R1S, Rivian R1T, Ford F150 Lightning, Chevy Silverado EV, Hummer EV, and GMC Sierra EV). Ford continued to hold the second-largest share of the BEV market, although that share shrunk to 6.9% in Q3 2024 from 7.94% in Q2 2024. Sales shifted to other manufactures such as Chevrolet, driven by sales of the newly introduced Equinox model and the continued success of the Blazer model. Chevrolet replaced Hyundai as the manufacturer with the third-largest share of the BEV market in Q3 2024, with 5.8% of sales.

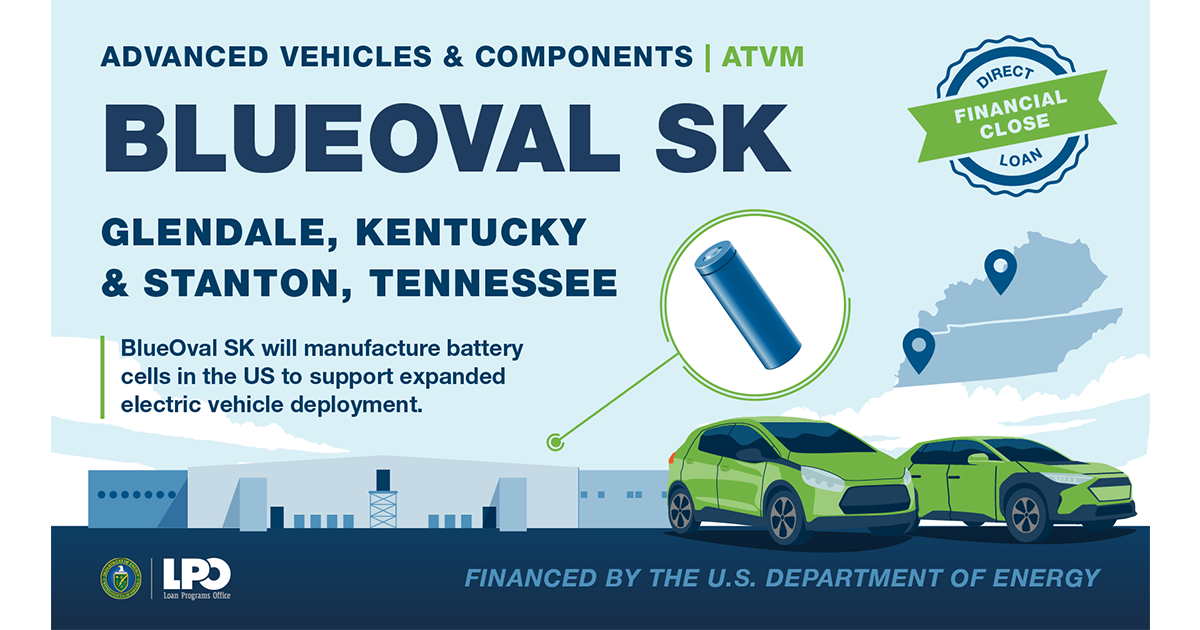

EV manufacturers are producing vehicles both domestically and globally. According to estimates from Wards Intelligence, 78.9% of total BEVs sold in the United States in Q3 2024 were produced in North America, 7.3% were produced in South Korea, and 5.3% were produced in Germany.

To qualify for the clean vehicle tax credits in the Inflation Reduction Act, manufacturers must comply with domestic content requirements for final assembly, battery components, and critical mineral inputs that extend beyond simply manufacturing in North America. Therefore, not all vehicles classified as manufactured in North America will qualify for this credit. These requirements, while applicable to EV purchases, are less stringent for EV leases. Many EV purchases that do not qualify for the incentives under the clean vehicle tax credit will qualify for the tax credit when leased under the commercial clean vehicle credit, providing consumers with a wider variety of eligible EV models.