Originally published September 13, 2023.

Enbridge Inc. (Enbridge) dropped an absolute bomb last month when it announced the US$14 billion acquisition of three natural gas utilities from Dominion Energy (Dominion). The deal is the second largest the North American midstream industry has seen since Enbridge merged with Spectra Energy for US$28 billion in 2016.

Before we get into the pipelines and compressor stations involved and how the deal relates to other recent midstream mergers and acquisitions (M&A), it’s important to note the premium price Enbridge is paying for these assets. Enbridge is paying 16.5 times the utilities’ estimated 2023 earnings — a premium price for what are generally considered low-growth gas transmission, gathering, and distribution assets. It’s also a particularly high price relative to what liquefied natural gas (LNG) assets have been going for, which is perceived to be a higher-growth industry. “We think the future of oil is through and out of North America, [and] the future of natural gas is through North America and exports,” said Enbridge Chief Executive Officer (CEO) Greg Ebel in an interview with CNBC.

Enbridge’s acquisition is a bold stamp of approval on the value of legacy North American oil and gas assets. The price Enbridge is paying for these assets comes not from growth, but from the affordability, reliability, and security of natural gas relative to other fuels — factors that don’t normally garner the attention they deserve. Enbridge expects the deal to close in 2024 and for the utilities to be fully integrated into Enbridge by 2025. Once complete, the deal will make Enbridge the largest natural gas utility business by volume in North America.

Infrastructure Assets Included In The Deal

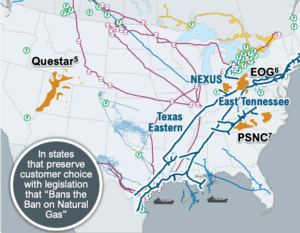

Enbridge is buying the East Ohio Gas Company (East Ohio), Questar Gas (Questar), and the Public Service Company of North Carolina (PSNC).

East Ohio serves more than 1.2 million customers across more than 400 communities and 27 counties. The utility has 22,000 miles (35,406 km) of transmission, gathering, and distribution pipelines, as well as 60 Bscf (1.7 × 109 m3) of natural gas storage. East Ohio operates 21 compressor stations.

Questar serves about 97% of households in Utah as well as customers in southwestern Wyoming and Idaho. The utility has about 21,000 miles (33,796 km) of transmission, gathering, and distribution pipelines. It has a regulated supply agreement with Wexpro, which can supply up to 65% of Questar’s gas needs without commodity exposure.

PSNC serves more than 600,000 customers across North Carolina and has about 13,000 miles (20,921 km) of transmission, gathering, and distribution pipelines.

Notable Compressor Stations Included In The Deal

| Facility | Location | Compressor Unit(s) | Power | Plant Cost |

| Thistle Creek Compressor Station | Indianola, Utah | 2 | 12,500 hp (9321 kW) | US$27.98 million |

| Eakin Compressor Station | Lyman, Wyoming | 5 | 15,080 hp (11,245 kW) | US$29.83 million |

| Fidlar Compressor Station | Bonanza, Utah | 4 | 8070 hp (6018 kW) | US$24.91 million |

| Blind Canyon Compressor Station | Price, Utah | 2 | 9400 hp (7010 kW) | |

| Coalville Compressor Station | Coalville, Utah | 1 | 1600 hp (1193 kW) | |

| Oak Spring Compressor Station | Spring Glen, Utah | 2 | 5939 hp (4429 kW) | |

| Rifle Compressor Station | Rifle, Colorado | 2 | 650 hp

(485 kW) |

|

| Simon Compressor Station | Rock Springs, Wyoming | 1 | 3350 hp (2498 kW) | |

| South Baxter Compressor Station | Rock Springs, Wyoming | 3 | 1040 hp

(776 kW) |

|

| State Line Compressor Station | Craig, Colorado | 1 | 1085 hp

(809 kW) |

|

| Lebanon Compressor Station | Lebanon, Ohio | 6 | 14,600 hp (10,887 kW) | US$30.45 million |

| Newark Compressor Station | Nashport, Ohio | 3 | 16,900 hp (12,602 kW) | US$14.15 million |

| Groveport Compressor Station | Groveport, Ohio | 3 | 11,600 hp (8650 kW) | US$32.72 million |

| Gilmore Compressor Station

|

Gilmore, Ohio | 6 | 13,600 hp (10,142 kW) | US$34.48 million |

| Washington Compressor Station | Washington, Ohio | 3 | 17,100 hp (12,751 kW) | US$22.6 million |

| Carroll Compressor Station | Carrollton, Ohio | 2 | 9400 hp (7010 kW) | US$19.27 million |

| Mullett Compressor Station | Powhatan Point, Ohio | 1 | 3550 hp (2647 kW) |

Data Sources: Environmental Protection Agency, Federal Energy Regulatory Commission, Dominion Energy, Oak Ridge National Laboratory, Argonne National Laboratory Decision And Infrastructure Sciences Division, National Geospatial-Intelligence Agency, Homeland Security Infrastructure Program

The utilities bring Enbridge’s total gas delivery volume to 9.3 Bscf/d (263.3 × 106 m3/d), making it the largest natural gas utility in North America. “Adding natural gas utilities of this scale and quality, at a historically attractive multiple, is a once-in-a-generation opportunity,” said Ebel in a statement. “The assets we are acquiring have long, useful lives — and natural gas utilities are ‘must-have’ infrastructure for providing safe, reliable, and affordable energy. The entire Enbridge team is committed to working with the East Ohio, Questar, and PSNC teams, and to investing in the communities they serve. We look forward to serving our customers with dedication, and to providing them with safe, reliable, and affordable energy service for years to come.”

Before the acquisition, only 12% of Enbridge’s 2023 estimated earnings before interest, taxes, depreciation, and amortization (EBITDA) came from gas distribution, with 3% coming from renewable power, 28% from gas transmission, and 57% from liquids pipelines. Once the acquisition is complete, gas distribution will make up 22% of Enbridge’s business, renewable power will stay at 3%, gas transmission will fall to 25%, and liquids pipelines will make up half of 2023 estimated EBITDA. The idea is that Enbridge will make its overall business more predictable since gas utilities provide stable and predictable cash flow. Prior to the acquisitions, Enbridge had no gas distribution exposure in the United States, with 99% of the segment’s adjusted EBITDA coming out of Ontario. Now, about 48% of gas distribution adjusted EBITDA will come from the United States, and the other 52% will come from Canada.

“Adding three high quality US gas utilities further underlines the stability of our risk profile,” said Ebel during the Enbridge September acquisition investor presentation. “Incremental regulated earnings improve our cash flow quality, while the funding plan allows us to maintain our balance sheet strength. An even more steady and reliable cash flow profile will support long-term dividend growth. The assets come with attractive rate-based growth profiles, adding capital efficient low-risk annual investment, which further de-risks our previously disclosed growth outlook. The quick cycle from capital investment to earnings and cash generation these assets provide set us apart from our sector peers. Lastly, the utilities each have low-carbon initiatives that are similarly aligned with Enbridge’s environmental, social, and governance (ESG) goals and provide longer term growth opportunities. In short, we see this being an extremely rare opportunity to acquire gas utilities of scale in support of jurisdictions at an extremely attractive price.”

Enbridge’s Growth Plans

Enbridge has come a long way since being a single purpose crude oil pipeline company. The beginning of its expansion took place in 1994 when Enbridge acquired Consumers Gas, a gas distribution utility in southern and eastern Ohio. In 2002, Enbridge acquired a stake in Alliance Pipeline. The real jump came in 2017 when it completed its merger with Spectra Energy, followed by the merger of Union and Enbridge Gas Distribution to form Enbridge Gas Inc. in 2019. In 2021, Enbridge acquired the Enbridge Ingleside Energy Center. In 2022, Enbridge became operator of the Gray Oak Pipeline. In 2023, it acquired Tres Palacios and Aitken Creek, two gas storage facilities. Post-acquisition, Enbridge expects its total adjusted EBITDA to be US$18 billion.

Enbridge held its annual investor’s day conference in March. During the presentation, the energy company unveiled plans for annual investments of more than US$5 billion, with US$3 billion earmarked for natural gas infrastructure. Further budgeting includes US$1 billion for liquids infrastructure and US$1 billion toward renewable power.

“In gas transmission, growing demand from utility customers, the expansion of the LNG export connections, and the growth in gas-fired generation will drive more than US$2 billion a year of investment opportunity through the markets we serve,” said Ebel. “This also includes capital for the modernization program, which lowers our emissions and will be recoverable through periodic rate cases. The utility will add about a billion dollars of annual growth capital, driven by population growth and the expansion of our storage and transportation capabilities. And in renewables, we see a further billion dollars a year of investment opportunity as we expand our onshore footprint here in North America, continue to grow European offshore wind, and execute our solar self-power program. And then in liquids pipelines, we expect to invest a billion dollars annually from capital efficient expansions, leveraging production growth in the Western Canadian sedimentary basin and by continuing to grow our US Gulf Coast export platform. In sum, we’re opportunity rich with conventional and renewable growth capital of approximately US$5 billion a year across our footprint.”

Enbridge sees promise in renewable natural gas (RNG) and is investing accordingly. During the conference, the company announced it had acquired a 10% stake in Divert Inc., a food waste management company expanding into RNG to help major food retailers manage their waste more sustainably. The agreement includes further investment opportunities to develop wasted food-to-RNG projects across the United States.

“We’re now actively working on opportunities to reduce food waste from landfills to produce RNG, having successfully announced our 10% equity investment in Divert, a company addressing the wasted food crisis, partnering with customers like Kroger, Albertsons, Target, and other large retailers,” said Cynthia Hansen, Enbridge’s executive vice president and president of gas transmission and midstream. “This investment gives us the option to invest up to US$1 billion in RNG projects across the United States. The US Environmental Protection Agency [EPA] estimates that decomposing food accounts for 26% of all US methane emissions, and food waste presents a valuable feedstock for RNG production, given the billions of dollars’ worth of waste created each year.”

According to Divert, the new agreement will accelerate its expansion of anaerobic digestion facilities to sustainably convert wasted food into renewable energy, with plans to scale its facilities to be within 100 miles (161 km) of 80% of the US population over the next eight years. Divert said it is also considering new wasted food-to-RNG facilities in Canada.

Midstream Mergers & Acquisitions

Oneok And Magellan Merger

2023 is likely to be the largest year of midstream M&A activity since before the oil and gas crash of 2014 and 2015. The largest deal is the merger of Magellan Midstream Partners LP (Magellan) and Oneok Inc. (Oneok). The merger was announced in May but has yet to go through. Doubts have emerged due to tax implications of Oneok common stock versus Magellan units. Magellan is a master limited partnership (MLP). MLPs have a different tax structure than a corporation. The merger would trigger a tax event for Magellan unitholders, which Oneok and Magellan believe isn’t a big deal considering the long-term benefits of merging the two companies. What’s more, Oneok is buying Magellan for a 22% premium to its market price, the gain of which will exceed the tax expense for investors.

Oneok’s specialty is the gathering, processing, fractionation, storage, transportation, and marketing of natural gas and natural gas liquids (NGLs), whereas Magellan is primarily a fee-based, refined products and crude oil transportation business. The companies are headquartered less than three blocks from each other in Tulsa, Oklahoma.

The combined company will own more than 25,000 miles (40,234 km) of liquids-oriented pipelines, with significant assets and operational expertise at the Gulf Coast and Midcontinent market hubs. “When you look at our space, it’s been consolidating for a while,” said Magellan Midstream CEO Aaron Milford in an interview with Yahoo Finance. “You’ve had a lot of smaller companies coming together to make larger companies so as you look forward, it’s all about having more ways to win. When you have a strong refined products business, a strong crude oil transportation business, and you add to that a strong NGL and natural gas business, you simply have more ways to win. So, you have more ways to create growth and value for our investors moving forward. Energy transition is uncertain and the more ways you can adapt the better off you’re going to be as a company and this merger allows us to do that.”

The merger is expected to boost cash flows from a variety of sources, lower capital requirements, create US$200 million of instant annual synergies, create more than US$400 million in synergies within two to four years, and allow the combined company to grow dividends and earnings over time. In sum, it’s a way to combine an oil midstream company with a natural gas and NGL company to create resilience to market cycles and the energy transition.

Smaller Midstream Deals

Energy Transfer LP (Energy Transfer) acquired Lotus Midstream Operations LLC (Lotus) from EnCap Flatrock Midstream (EFM) for US$900 million in cash and 44.5 million common units of Energy Transfer. The total transaction value is approximately US$1.45 billion. The acquisition complements Energy Transfer’s portfolio of oil and gas midstream assets across the United States and Canada. Lotus owns the valuable Centurion Pipeline Company LLC (Centurion). Located in the Permian Basin, Centurion is a 3000-mile (4828-km) crude oil pipeline with a capacity of 1.5 million barrels per day (bpd). The pipeline’s associated infrastructure includes wellhead gathering, intra-basin transportation, terminalling, and long-haul transportation services. The most notable piece of infrastructure associated with the pipeline is the Midland Terminal, which has 2 million barrels of crude oil storage capacity. Lotus also has a 5% stake in the 650-mile (1046-km) Wink to Webster Pipeline, which can transfer more than 1 million bpd of crude oil from the Permian Basin to the Gulf Coast. Energy Transfer said the deal will boost its access to key downstream markets. The enhanced asset portfolio will feed nicely into major hubs in Oklahoma such as the Cushing oil hub and Texas hubs in Midland, Colorado City, Wink, and Crane. Like most midstream business models, the assets are backed by long-term, fee-based, and fixed-fee contracts that provide stable cash flows no matter what oil and gas prices are doing. Once the deal is complete, Energy Transfer will boost its coverage even more by constructing a 30-mile (48-km) pipeline project that will allow the company to originate barrels from its Midland terminals for delivery to Cushing. This additional pipeline is expected to be completed in Q1 2024. With a market capitalization of roughly US$40 billion and an enterprise value closer to US$95 billion, the deal is significant but not larger enough to alter Energy Transfer’s leverage ratio, even though it is being funded mostly with cash.

The Energy Transfer deal comes shortly after Phillips 66’s January announcement to buy the remaining common units of DCP Midstream for a cash consideration of US$41.75 per common unit. Again, not a massive deal given the size of Phillips 66, but a noteworthy one, nonetheless. In February, Williams Companies closed its deal with Southwest Gas Holdings for the acquisition of MountainWest Pipelines Holding Company (MountainWest) for US$1.5 billion. MountainWest comprises roughly 2000 miles (3219 km) of interstate natural gas pipeline systems primarily located across Utah, Wyoming, and Colorado, totaling approximately 8 Bscf/d (226.5 × 106 m3/d) of transmission capacity. MountainWest also holds 56 Bscf (1.59 × 109 m3) of total storage capacity. In February 2022, Enterprise Products Partners (Enterprise) completed its US$3.25 billion acquisition of Navitas Midstream Partners LLC. The deal complemented Enterprise’s presence in the Permian Basin and Delaware Basin with 1750 miles (2816 km) of pipelines and more than 1 Bscf/d (28.3 × 106 m3/d) of cryogenic natural gas processing capacity. These deals are just some of the many recent examples of bolt-on acquisitions midstream companies have competed over the last few years. Bolt-on acquisitions seek to complement existing assets and drive synergies without taking on the risks associated with investing in a new geography or industry. However, there has also been a sizeable uptick in midstream investment in LNG projects; RNG; hydrogen; carbon capture, utilization, and storage; and even renewable energy. In 2021, Kinder Morgan bought Stagecoach Gas Services for US$1.23 billion and RNG developer Kinetrex Energy for US$310 million.

Bolt-on acquisitions are a way for midstream companies to drive profits and boost cash flows without building anything new. The wave of midstream mini moves we are seeing across the industry is evidence that companies are finding value in consolidation. The larger and more diversified an individual entity, the more it can be insulated from competition within and outside the oil and gas industry.

Divergence

The energy sector is at a crossroads. There are some companies that believe in the long-term relevance of oil and natural gas and others that are abandoning the industry in favor of other opportunities. Sometimes, the decision is out of a company’s control.

As a regulated utility, Dominion works directly with government agencies. The Virginia Department of Energy released the Virginia Energy Plan (VEP), which includes the goal to achieve a net-zero carbon energy economy for all sectors no later than 2045. Virginia is Dominion’s home state. A key part of the VEP is renewable electricity, which means shifting some power generation away from natural gas to offshore wind. Under pressure from government agencies and regulators, Dominion has been selling a lot of its oil and gas assets and doubling down on offshore wind.

Aside from the deal with Enbridge, Dominion has made two notable deals with Berkshire Hathaway Energy (BHE). BHE GT&S acquired Dominion’s 50% stake in Lusby, Maryland-based Cove Point LNG LP (Cove Point) for US$3.3 billion in cash. In 2020, Dominion canceled its Atlantic Coast Pipeline project and sold US$9.7 billion in natural gas assets to BHE, including a 25% stake in Cove Point LNG.

The project builds upon BHE GT&S’ impressive interstate natural gas transmission and storage portfolio, which includes 5400 miles (8690 km) of transmission pipeline in the eastern United States, 756 Bscf (21.4 × 109 m3) of total natural gas storage capacity — with 420 Bscf (11.9 × 109 m3) of working gas capacity, and natural gas gathering and processing assets. The company provides LNG solutions through Cove Point LNG, Pivotal LNG, and other LNG processing and storage ventures. BHE already serves as operator of the facility. It owns 75% of the project, while a subsidiary of Brookfield Infrastructure Partners owns the remaining 25%. The Cove Point LNG Terminal is located on Chesapeake Bay and has 14.6 Bscf (413 × 106 m3) of storage capacity and a send-out capacity of 1.8 Bscf/d (50.9 × 106 m3/d). The project has a nameplate capacity of 5.25 MTPA.

According to Dominion’s SEC filings, facilities associated with the Cove Point LNG Terminal include the Cove Point Pipeline and two compressor stations. The Cove Point Pipeline is a 36-in. (914-mm) bi-directional underground, interstate natural gas pipeline that extends approximately 88 miles (142 km) from the Cove Point LNG Facility to interconnections with pipelines owned by Transco in Fairfax County, Virginia, and with Columbia Gas Transmission LLC (Columbia) and DETI, both in Loudoun County, Virginia. The Loudoun Compressor Station is located at the western end of the Cove Point Pipeline where it interconnects with the pipeline systems of DETI and Columbia. The Pleasant Valley Compressor Station is located roughly 13 miles (21 km) to the southeast of the Loudoun Compressor Station, where the Cove Point Pipeline interconnects with Transco’s pipeline system. Combined, the two compressor stations have approximately 30,840 hp (23,007 kW) of installed compression at Cove Point’s interconnections with the three upstream interstate pipelines.

The Cove Point acquisition builds upon a multi-year uptick in Berkshire Hathaway and BHE oil and gas investments. It also illustrates the stark contrast between a company like Dominion that continues to sell its oil and gas assets, and an investment company like Berkshire Hathaway that has no problem buying proven cash cows.

Measured Confidence

BHE paid 10.8 times 2025 estimated EBITDA for the remaining 50% noncontrolling interest in Cove Point LNG, a far lower premium than what Enbridge is paying for the three gas utilities. The premium price proves that the midstream industry is entering a new dynamic. Over the last several years, oil and gas companies have sold off assets for bargain bin prices, only to pay a hefty price for renewable and low-carbon assets. The dynamic has completely shifted. Today, reliable, safe, and profitable oil and gas assets are fetching a much higher price from a growing swath of buyers. Many of these buyers are some of the largest companies in the industry or public and private equity firms.

Companies like Enbridge are staying mostly within the oil and gas industry instead of investing outside of it. Similarly, Magellan believes that fossil fuels will remain relevant despite the energy transition. In sum, the oil industry, and to a larger extent the natural gas industry, has shifted from a position of defense and desperation to a position of confidence in the long-term value of fossil fuels.

The future global energy mix will likely depend on existing solutions for longer than many realize but will also look dramatically different a few decades from now than it does today. Oil and gas companies deserve to be confident and avoid underselling valuable legacy infrastructure assets like in years past. However, it would be a mistake to think that the industry shouldn’t change, and flat out foolish to assume we can pause the rapid advance of climate change.