Germany Doubles 2030 Green Hydrogen Production Target, Updates National Hydrogen Strategy

Germany made a splash in 2020 when it unveiled its now famous National Hydrogen Strategy (NHS). NHS checked all the boxes for German energy policy by increasing the role of clean energy in domestic production and by boosting the economy by creating jobs and economic growth. However, the NHS came before Russia’s invasion of Ukraine.

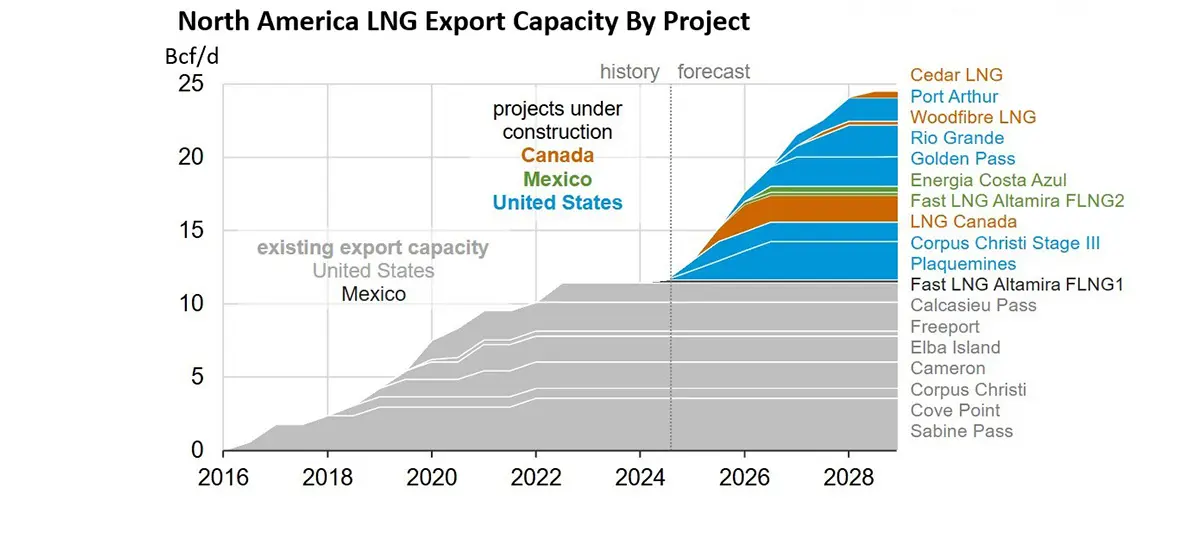

In the short-term, Germany’s energy policy is centered around security, which has opened the door to a rapid increase in liquefied natural gas (LNG) imports. Germany’s Federal Ministry for Economic Affairs and Climate Action estimates the country will import a staggering 26.83 MT of LNG in 2024. Some analysts have Germany exceeding 70 MT of LNG imports by 2030. Less than 18 months after Russia’s invasion of Ukraine, Germany commissioned five floating storage regasification units for a total regasification capacity of 23.8 MTPA.

LNG is a solution that works right now and is the obvious choice to supplement the gas that Germany used to get from Russia. However, Germany has made it clear that it wants to rely less on energy imports in general. In this vein, LNG makes Germany even more of a net importer of energy while also pushing it further away from its goal to be climate-neutral by 2045.

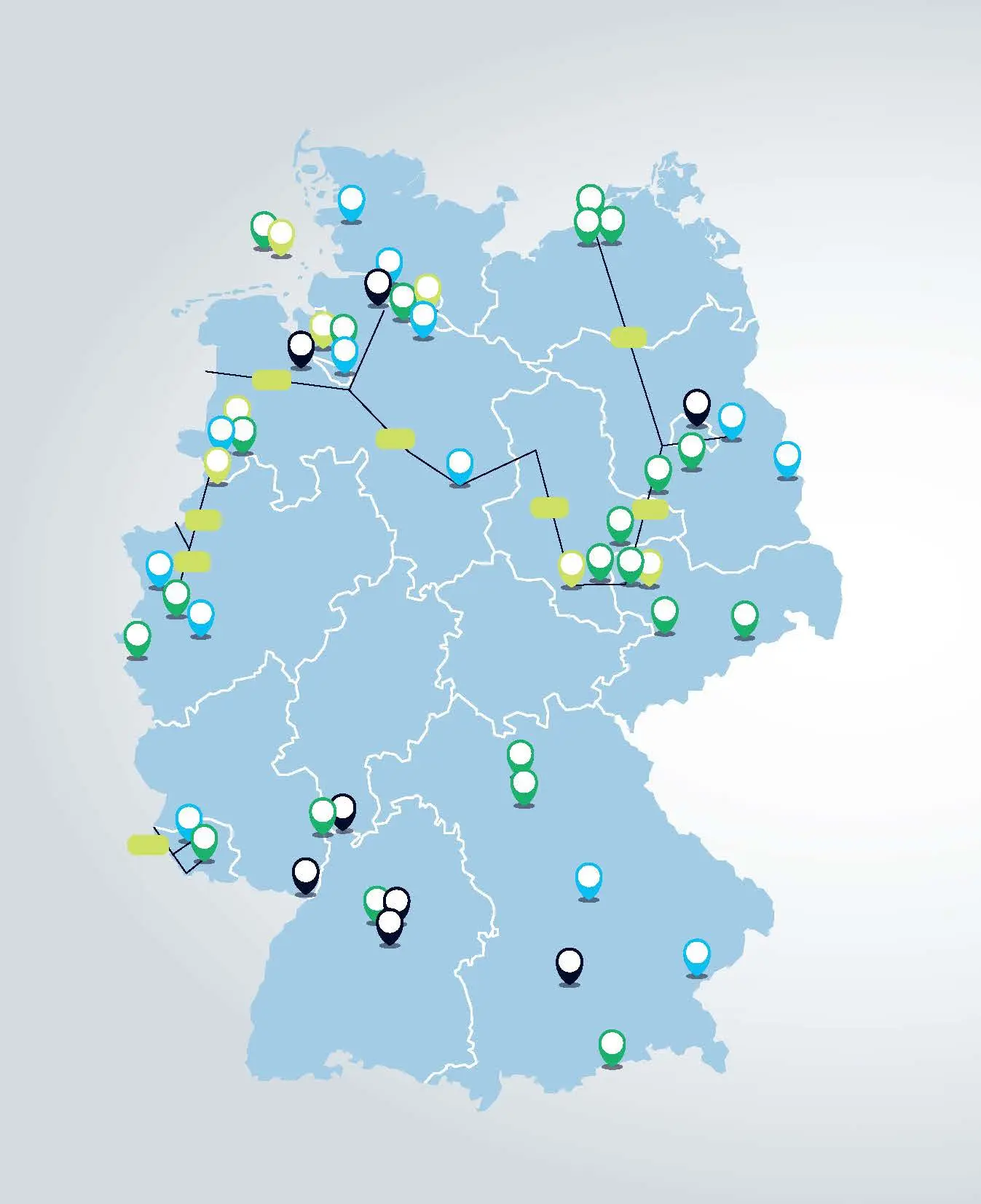

To help tip the balance in the right long-term direction, Germany is doubling its 2030 green hydrogen production target from 5 to 10 GW. It forecasts consumption to exceed this production level, so hydrogen imports will also be needed. To support the hydrogen economy, Germany is constructing 1118 miles (1800 km) of converted and newly built hydrogen pipelines by 2027 to 2028. The pipelines will be a part of a 2796-mile (4500 km) network across Europe, known as the European Hydrogen Backbone, that will be paid for by European Union funds. One-third of the European Hydrogen Backbone will be new hydrogen pipelines, while the other two-thirds will be natural gas pipelines converted to hydrogen pipelines.

Producing hydrogen is a challenge in and of itself. Arguably the harder objective is to convince German industries to buy into to the hydrogen economy. In its updated NHS, Germany outlines key applications across major industries, such as commercial vehicles, air, ship traffic, power generation, the industrial sector, chemical industry, steel industry, and the heating industry. One way Germany plans to boost nationwide buy in is by funding hydrogen technologies — namely electrolyzers and fuel cell technology. If Germany is producing the most hydrogen of any country in Europe while also acting as the epicenter of manufacturing and technological prowess, then it stands a good chance of being the continent’s leader in hydrogen.

The updated NHS consists of four fields of action:

- Hydrogen Availability

In addition to doubling its green hydrogen target, Germany increased its estimated total hydrogen demand by the year 2030 from a prior goal of 40 to 75 TWh to the new goal of 95 to 130 TWh. Germany said it has about 55 TWh of existing grey hydrogen production. Unlike blue hydrogen, which is produced from natural gas and implements carbon capture, grey hydrogen is produced from coal or natural gas without carbon capture. Shifting the focus away from grey hydrogen toward blue hydrogen and green hydrogen lowers the environmental impact of the industry while also localizing production, simplifying the value chain, and shortening transportation routes, among other benefits.

One of the key updates to the NHS is the addition of new ways to produce green hydrogen. Offshore electrolysis, namely from offshore wind, is expected to contribute 1 GW of the 10-GW green hydrogen production goal. The NHS update specified the importance of making sure the production and storage of green hydrogen is a united effort, so the overall system limits the impact on the environment and is as economical and practical as possible. “By intelligently interlocking electrolysis with the electricity system and the transport and storage infrastructure for hydrogen [system-friendly electrolysis], we gain an important flexibility option for the energy transition and limit the need to expand the electricity grid,” said a translated version of the NHS update. “Adequate temporal correlation between the generation of renewable and available energies and electricity consumption, as well as electrolysis sites close to the production site, ensure efficient integration of renewable energies and support of the electricity system.”

- Hydrogen Infrastructure

Hydrogen infrastructure plans center around the European Hydrogen Backbone network. On top of that, there’s the need for hydrogen storage facilities, hydrogen refueling stations for everything from heavy goods traffic to hydrogen buses, hydrogen facilities at ports for the shipping industry, and more. The sheer volume of hydrogen infrastructure that Germany expects to roll out by 2030 is jaw dropping. If it pulls it off, it will represent one of the most dramatic energy evolutions in European history.

The updated NHS discusses several risks that could derail plans. The biggest is simply the investment cycle. Hydrogen has a lot of potential. At the end of the day, it’s a growth industry that is highly vulnerable to the strength of the German economy and the overall global market cycle. A recession would greatly impact the fledgling hydrogen economy as companies and investors tend to gravitate toward proven solutions during periods of uncertainty. Whereas during an economic boom, there’s more optimism to take risks and think ultra-long term. The goal of the NHS is to provide a sizeable amount of support to build out hydrogen infrastructure even if there’s an economic downturn. To do that, Germany has laid out a series of short-term measures for 2023 and then medium-term measures for 2024 and 2025. The main measure is normalizing the supply and application of hydrogen through updated policy by the Federal Network Agency. Germany will also have to work with several of its government agencies and programs to ensure that the hydrogen economy is safe and standardized. The European Hydrogen Backbone network will connect the German hydrogen economy to as many other countries as possible. Production hubs are planned for Central Europe, Scandinavia, and Eastern Europe, with import hubs throughout Western Europe. There are also medium-term plans in place to connect North Africa to the European hydrogen economy through France, Spain, and Portugal or through Austria and on to Italy. Germany said that its talks with Norway and Demark are the most advanced, which makes sense given the cooperation and economic overlap. It’s also likely that the bulk of offshore wind electrolysis would be a joint effort between Germany and its neighbors to the north and would likely center around the North Sea and its thriving offshore wind industry.

- Hydrogen Applications

The updated NHS forecasts 290 to 440 TWh of hydrogen demand for industry by 2045. To get there, Germany believes it not only needs to help fund hydrogen production and infrastructure, but also support hydrogen applications with subsidies and marketing. The updated NHS includes various short-term funding measures that bank on the competitiveness of Germany as an industrial and business location. Germany also believes that strong marketing campaigns will boost interest in green hydrogen, which would reduce the need for subsidies down the road. The strategy recognizes that this is a new industry and needs marketing support, but that the sooner the industry can be self-reliant, the better it will be from a cost standpoint.

- Effective Framework Conditions

The fourth field of action in the updated NHS discusses planning and approval procedures, including shortening the approval process and simplifying regulatory and legislative framework. It also admits there needs to be new suitability standards and certification systems for Germany, with the bigger goal of making these standards and systems as consistent as possible throughout Europe.

Aside from the regulatory portion of the equation, Germany wants to create a framework for improving the research, innovation, and education of its hydrogen workforce so that it emerges as the clear leader in a growing industry. Domestic training programs will serve a purpose, but Germany also wants to make sure it is cooperating with other countries as much as possible to ensure the industry progresses on a unified front, which will help the functionality of the value chain.

Germany Is Making A Statement

Germany’s updated NHS provides a bright green light for the hydrogen economy. By pegging hydrogen as the ultimate cross section of environmental stewardship and economic growth, Germany is putting a priority on energy independence and is sending a clear message that it wants to be more in control of its energy mix. However, the importance of the European Hydrogen Backbone network and Germany’s detailed plans to import a great deal of hydrogen indicate the importance of cooperation if the hydrogen economy is going to succeed.

Government policy, standardization, permitting, and other factors are important for making the hydrogen economy investable and to spark adoption. However, Germany is also depending heavily on technological improvements regarding electrolysis and hydrogen fuel cells, timely execution by operators, and responsible investing. Legacy energy and industrial companies will also play a pivotal role since the hydrogen economy requires an all-in revamp of existing infrastructure and processes.

It’s a long road to get to Germany’s 2030 goals, and an even longer one to get to climate neutrality by 2045. Germany’s updated NHS shows that it is doubling down on the hydrogen economy, is doing an excellent job of addressing all the moving parts, and is taking a particularly heightened interest in green hydrogen.