Berkshire Hathaway Energy (BHE) GT&S is acquiring Dominion Energy’s (Dominion’s) 50% stake in Lusby, Maryland-based Cove Point LNG LP (Cove Point) for US$3.3 billion in cash. In 2020, Dominion canceled its Atlantic Coast Pipeline project and sold US$9.7 billion in natural gas assets to BHE, including a 25% stake in Cove Point LNG.

The project builds upon BHE GT&S’ impressive interstate natural gas transmission and storage portfolio, which includes 5400 miles (8690 km) of transmission pipeline in the eastern United States, 756 Bscf of total natural gas storage capacity — with 420 Bscf of working gas capacity, and natural gas gathering and processing assets. The company provides liquefied natural gas (LNG) solutions through Cove Point LNG, Pivotal LNG, and other LNG processing and storage ventures.

BHE already serves as operator of the facility. After the acquisition is complete, it will own 75% of the project, while a subsidiary of Brookfield Infrastructure Partners owns the remaining 25%.

Cove Point Facilities

The Cove Point LNG Terminal is located on the Chesapeake Bay and has 14.6 Bscf of storage capacity and a send-out capacity of 1.8 Bscf/d (50.9 × 106 m3/d). The project has a nameplate capacity of 5.25 MTPA.

According to Dominion Energy Midstream Partners LP SEC filings, facilities associated with the Cove Point LNG Terminal include the Cove Point Pipeline and two compressor stations. The Cove Point Pipeline is a 36-in.-diameter bi-directional underground, interstate natural gas pipeline that extends approximately 88 miles (142 km) from the Cove Point facility to interconnections with pipelines owned by Transco in Fairfax County, Virginia, and with Columbia Gas Transmission LLC and DETI, both in Loudoun County, Virginia. The Loudoun Compressor Station is located at the western end of the Cove Point Pipeline where it interconnects with the pipeline systems of DETI and Columbia Gas Transmission LLC. The Pleasant Valley Compressor Station is located roughly 13 miles (21 km) to the southeast of the Loudoun Compressor Station, where the Cove Point Pipeline interconnects with Transco’s pipeline system. Combined, the two compressor stations have approximately 30,840 installed compressor horsepower at Cove Point’s interconnections with the three upstream interstate pipelines.

Betting Big On Oil And Gas

The Cove Point acquisition builds upon a multi-year uptick in Berkshire Hathaway and BHE investments. Berkshire Hathaway stepped in when the oil and gas industry was on its knees during the COVID-19 pandemic, quickly building positions in integrated oil and gas major Chevron and exploration and production company Occidental Petroleum (Oxy). By the end of 2022, Chevron became Berkshire’s largest public equity holding after Apple and Bank of America. However, Berkshire sold some Chevron stock in Q4 2022, and then slashed its Chevron stake by 20.8% in Q1 2023. Even after the sale, Chevron remains Berkshire’s fifth largest public equity holding. According to Berkshire Hathaway’s 13F filing from May 15, 2023, Berkshire owns 132.41 million Chevron shares, or roughly 7% of the company.

On the surface, the trimming of Chevron stock may seem like Berkshire’s confidence in oil and gas was waning. However, at the same time, Berkshire was building its stake in Oxy. As of May 15, 2023, Berkshire’s Oxy stake has ballooned to 224.13 million shares, giving Berkshire a staggering 25.1% ownership of Oxy and making it its sixth-largest public equity holding. Meanwhile, Berkshire-owned energy companies and utilities have been aggressively investing in infrastructure projects. Berkshire Hathaway-led Warren Buffett has long been a fan of pipelines for their long-term contracts, predictable cash flows, and their resistance to oil and gas price fluctuations.

Environmental Stewardship

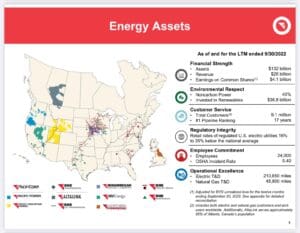

BHE remains heavily invested in oil and gas. As of December 31, 2022, 66% of its energy asset profile was allocated toward electric transmission and distribution, gas pipeline, and other, 5% was in natural gas generation, and 5% was in coal generation. The final 24% was in non-carbon generation.

In recent years, BHE has amped up its environmental investments and has worked to reduce the carbon footprint of its oil and gas assets. Cove Point has long been seen as a cleaner LNG project. In this vein, it checks all the boxes that BHE was looking for in an acquisition.

Cove Point got its start as an LNG import facility in the 1970s when the United States was still a net importer of oil and gas. However, it has since shifted to an export facility. In 2018, it was awarded a Leadership in Energy and Environmental Design (LEED) certification. It shipped its first export cargo in March 2018 after completing the costly conversion from import to export facility. Cove Point still has import capabilities if needed, making it one of six export-import storage facilities in the United States.

According to Dominion, Cove Point consumes 32% less energy and 40% less water in restrooms than a similar facility of its size. The facility itself takes up just 131 acres (53 ha) of the 1000 acres (401 ha) available, resulting in an informal wildlife sanctuary. The facility’s work with local habitats, preservation of marsh ecosystems, and conservation efforts have resulted in several awards, including the National Environmental Excellence Award from the National Association of Environmental Professionals, the Environmental Excellence award from the Southern Gas Association, and the Chairman’s Stewardship Award from the Interstate Oil and Gas Compact Commission. In August 2022, Cove Point shipped its 300th load. As of press time, it has shipped more than 338 loads, with the typical LNG vessel carrying 3.5 Bscf of natural gas equivalent.

Although Berkshire Hathaway doesn’t own any publicly held renewable energy companies, it has used BHE to boost its renewable exposure. BHE, mainly through its utility businesses, has been ramping investments Through year-end 2022, BHE had invested approximately US$7.3 billion in solar projects, two of which are among the largest projects in the United States. As of year-end 2022, its renewable generation portfolio consisted of 63% wind, 24% solar, 9% hydroelectric, and 4% geothermal.

In March, BHE was part of consortium that invested US$500 million in a titanium plant that will make products primary for the aerospace industry. The project will run entirely on renewable energy using BHE Renewables’ first-of-its-kind solar energy microgrid-powered industrial site. To ensure steady access to solar energy, BHE Renewables selected Our Next Energy Inc. as its partner for large-scale battery storage.

In June, BHE-owned MidAmerican Energy announced the donation of a 35-acre (14.2 ha) property located in Woodbury County to the Iowa Department of Natural Resources to be used as a public conservation area.

A Shrewd Approach

Cove Point remains one of the few US east coast export projects. Most of the growth in LNG export capacity is along the southeast and the Gulf Coast, a region where BHE has relatively little infrastructure.

Instead of investing in newer projects, Buffett and his team are unlocking value by purchasing assets that complement BHE’s existing network of pipelines, compressor stations, storage facilities, terminals, and other infrastructure. For example, Dominion Energy has made a major strategic push in recent years to sell-off its oil and gas assets and focus more on being a regulated electric utility. BHE serves as a willing buyer for any company that is downsizing or going in a different strategic direction.

BHE’s general approach has a massive runway. By centering its oil and gas portfolio around legacy assets and devoting growth expenditures toward newer renewable energy projects, BHE can continue hitting its environmental targets while also making sure useful and reliable fossil fuel projects are put to use instead of decommissioned.