Update: Vanguard Renewables Inks Record RNG Offtake Agreement

AstraZeneca is partnering with Vanguard Renewables to enable the delivery of renewable natural gas (RNG) to all its sites in the United States by the end of 2026. Starting in June 2023, AstraZeneca began purchasing RNG produced by Vanguard Renewables for its Newark Campus in Delaware, where the company packages 26 medicines for distribution across the United States and makes medicine formulations for global supply. By 2026, this collaboration will enable as much as 650,000 MMBtu, or 190,500 MWh per year, of RNG to be used across AstraZeneca’s US sites, equivalent to the energy required to heat more than 17,800 US homes for a year. This amount of RNG is enough to completely decarbonize and replace conventional natural gas at AstraZeneca’s North American manufacturing and research and development facilities.

The announcement marks the largest voluntary purchase of RNG in the industry’s North American history. “We recognize the interconnection between the health of people and the planet and are committed to driving deep decarbonization across our operations and value chain,” said Pam Cheng, executive vice president of Global Operations & IT and chief sustainability officer at AstraZeneca. “Our innovative partnership with Vanguard Renewables in the United States is an illustration of how we are collaborating at scale to deliver sustainable science and medicines, as part of the transition to net-zero health systems and a circular economy.”

AstraZeneca is a global, science-led biopharmaceutical company that focuses on the discovery, development, and commercialization of prescription medicines in oncology, rare diseases, and biopharmaceuticals, including cardiovascular, renal and metabolism, and respiratory and immunology. As heat and power are critical to manufacturing medicines, the decarbonization of healthcare requires access to clean sources of heat, such as RNG. The company is on track to reduce greenhouse gas (GHG) emissions from its global operations (Scope 1 and 2) by 98% by 2026 from a 2015 baseline. By 2030, AstraZeneca aims to halve its entire value chain footprint on the way to becoming science-based net zero by 2045 at the latest. The use of RNG at AstraZeneca sites in the United States will further enable the company’s transition to 100% renewable energy for heat and power.

“Vanguard Renewables and AstraZeneca have demonstrated incredible leadership by engaging in this deal that serves as an example of decarbonizing Scope 1 gas demand,” said Johannes Escudero, founder and chief executive officer (CEO) of the Coalition for Renewable Natural Gas. “With an increasing number of organizations pursuing long-term decarbonization strategies, RNG is the primary option for those who need a carbon-neutral replacement for natural gas.” Escudero joined AstraZeneca and coalition member, Vanguard Renewables in DC for the announcement. RNG Coalition members are a vested group of entities and individuals, joined under a common cause to engage, share resources, perspective, and expertise. “AstraZeneca now plays a key role in recycling food waste, eliminating methane emissions, and circularizing our economy — advancing our mission and charting a path for other companies to follow in the quest to achieve net-zero today,” said Escudero.

Vanguard’s Unique RNG Offering

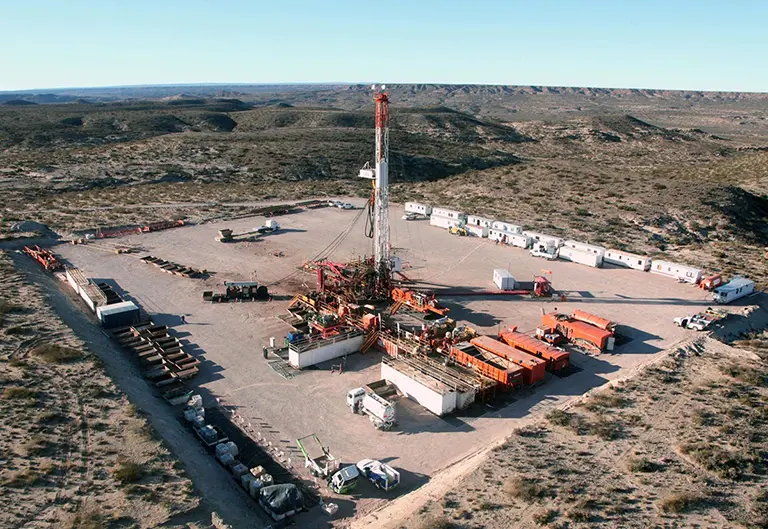

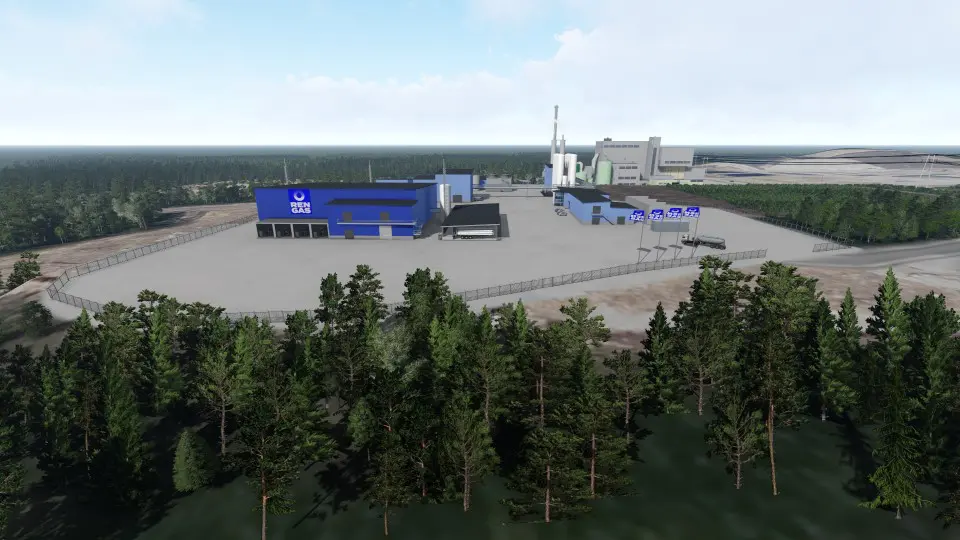

Vanguard Renewables develops food and dairy waste-to-renewable energy projects. The company owns and operates on-farm anaerobic digester facilities in the northeast and currently operates manure-only digesters in the south and west for Dominion Energy. Vanguard Renewables plans to expand nationwide to more than 120+ anaerobic digestion facilities by 2026. The agreement with AstraZeneca will use Vanguard Renewables Farm Powered process, allowing Vanguard Renewables to work with dairy farmers and food and beverage manufacturers, retailers, and distributors to produce RNG using farm-based anaerobic digestion (AD) from food and dairy cow manure (see “Cow Power,” Q2 2023 ESG Review, p. 18). Once the RNG is produced and captured through AD, it will be injected into existing natural gas infrastructure for use in AstraZeneca medicines research and manufacturing processes.

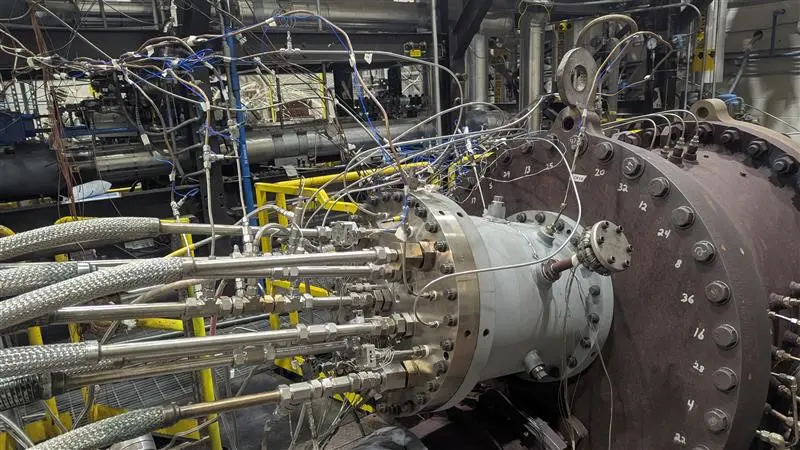

Through the AD process, inedible or unsaleable food and beverage waste from the manufacturing and retail sectors is collected, sorted, depackaged on-site, and combined with dairy farm manure in a sealed biodigester tank. Once combined in the biodigester, microorganisms that naturally occur in manure digest the waste, converting sugars, fats, and other compounds into biogas. Harnessing the waste’s energy captures as much as 95% of the potential GHG emissions that would result if food and beverage waste was sent to a landfill or if the farm manure was field applied. The process produces biogas that is upgraded to pipeline-quality RNG that is then injected into the existing pipeline infrastructure on-site, displacing traditional fossil fuels.

Through the partnership with Vanguard Renewables, AstraZeneca will access RNG from three on-farm anaerobic digester facilities across the United States for the next 15 years or more. “Vanguard Renewables is excited to partner with AstraZeneca on this transformative business-to-business clean energy solution,” said Neil H. Smith, CEO of Vanguard Renewables. “AstraZeneca has set a very ambitious and challenging net-zero target, which is a benchmark for their sector and other global corporations. We strongly believe this partnership will provide a path for other like-minded companies to join us on the journey toward global decarbonization.” This collaboration will use food and waste from local and family-owned farms, supporting rural communities across the United States. By capturing methane from dairy operations that would have otherwise ended up in the atmosphere, this partnership also reduces pollution from the farming sector.

A Leading Example Of Decarbonizing Scope 1 Gas Demand

A core driver of high-profile RNG deals is heighted awareness of the benefits of RNG, especially for companies with sustainability targets. RNG Coalition advocates and educates for sustainable development, deployment, and utilization of RNG so that present and future generations will have access to domestic, renewable, clean fuel and energy. “The majority of RNG markets and most of the RNG purchased in North America today are the result of public policies that created or expanded RNG markets and that require RNG procurement,” said Escudero.

Companies like Vanguard Renewables showcase the rapid increase in RNG project development. A big part of the acceleration is due to funding. Last year, Vanguard Renewables received US$2 billion from BlackRock Real Assets which will be used to expand its AD portfolio. In many ways, the stage is now set for RNG to receive increased funding. Despite these advancements, it would be a mistake to assume that RNG’s growth is solely due to developments over the last few years. “Most overnight successes are decades in the making,” said Escudero. “The first RNG facility was built in 1982 and operated in virtual obscurity for 30 years before we coalesced the industry. RNG Coalition has advocated for sustainable development, deployment, and utilization of renewable gas for almost 12 years. As a result, the general public and world leaders – both in business and in government – are recognizing that we have a growing waste problem, and that we not only have to address waste, but what to do with the methane – and other gases – that emit from society’s inevitable waste streams.”

RNG’s Next Growth Phase

RNG is more expensive than fossil-based natural gas. For that reason, regulatory and economic incentives, both from a private and public funding perspective, are necessary to pole vault RNG to a larger share of the energy mix. “There are a growing number of regulatory programs we have helped create at the federal, state, and provincial levels – like the Renewable Fuel Standard (RFS), Low Carbon Fuel Standard (LCFS), and renewable portfolio standard (RPS), and other incentives soon to be realized as a result of the recently enacted Inflation Reduction Act (IRA),” said Escudero. “RNG facilities present a myriad of environmental and economic benefits. First and foremost, they mitigate the harmful environmental impacts of what would otherwise be inevitable methane and other greenhouse gas emissions by capturing and then converting those gases into various forms of renewable energy to decarbonize fuel, heat, power and sustainably produce other products. Second, because the public and shareholders are prioritizing sustainability in the healthcare, food and beverage, aviation, marine, rail and other industries, there is new demand for RNG and renewable gases in the voluntary market.”

RNG Coalition does a lot of work on the regulatory and policy framework side of RNG. Despite RNG finding a place on the desks of many policymakers, RNG Coalition believes there is still a lot of work to be done to build upon the RFS, LCFS, and RPS. “RNG Coalition is working towards achieving our Sustainable Methane Abatement & Recycling Timeline (SMART),” said Escudero. “We have identified over 43,000 organic waste sites across North America where methane and other GHGs are produced. We are working to capture and control those renewable gases by 2050 and have identified near-term benchmarks for 2025, 2030, and 2040. The voluntary market will scale and could fund the achievement of our SMART initiative. Until then, public policy will continue to be the key driver supporting ongoing emissions reductions. Policy makers in a growing number of states are recognizing the benefits of RNG as they develop rules around new clean fuel standards, renewable gas standards, clean heat standards and clean electricity standards, but more support is needed to address this urgent challenge.”

Another feature for policymakers to consider is security. Europe provides a model for the multi-faceted benefits of RNG. According to the European Biogas Association, the European Union produced 1.74 bcf/d of biogas and biomethane in 2020. By 2030, it expects that number to nearly double to 3.39 bcf/d as Europe turns to RNG as a secure and sustainable energy source. “The unfortunate invasion of Ukraine by Russia has threatened the European Union’s access to conventional natural gas – a cautionary tale that we had better pay attention to,” Escudero. “Europe is pivoting to RNG for many of the same reasons we have been advising policy makers and business leaders to do the same – it’s a source of domestic, renewable, clean fuel and energy that improves our energy independence, security, and resilience.”

RNG partnerships can serve as an example of the practical use cases of RNG production and use in the eyes of policymakers. Like most burgeoning industries, it is important for policymakers and the industry in general to see investments pay off and customers like AstraZeneca “buy in” to the fuel source’s benefits. “There are no doubts about the environmental benefits, but there has been some question about the cost,” said Escudero. “AstraZeneca’s move is evidence that sustainability is good for business. History has been made. They’re the first multi-national in the pharmaceutical space to partner with RNG, but there are opportunities for other corporations to demonstrate leadership and take the first step to help decarbonize their respective sectors. The food and beverage industry comes to mind, for example. Carbon dioxide (CO2) can be used to sustainably stun sources of protein – and I think beverages should be carbonated with CO2 captured from RNG facilities, too.”

RNG’s Role In The Circular Economy

The circular economy is often associated with reusing and recycling products. However, a better way to think about the circular economy is a system that prolongs the useful life of materials by broadening use cases across multiple sectors of the economy. RNG is an excellent example of a fuel source that supports the circular economy because it traverses several industries on the production side, including agriculture, utilities, and energy, and can be used as a fuel source in every industry on the consumption side. “As long as our planet is populated by people, and as long as we sustain our families, pets and livestock with food there is going to be some waste – the banana peel, the apple core, the orange rind,” said Escudero. “Even with all our efforts to reduce, reuse and recycle, the World Bank still projects waste to increase 70% by 2050. Wherever the organic waste ends up – be it in a landfill or at a digester – it is going to biodegrade and produce methane and other gases. Our coalition of industry stakeholders represents a no-regrets and readily available solution to capture and convert these greenhouse gas liabilities into renewable energy assets and products.”

Similar to the liquefied natural gas industry, RNG production growth means little if there’s a lack of buyers. As the Vanguard Renewables/AstraZeneca deal proves, RNG can have an impact across every sector of the economy if there is a willing buyer. Deals like this spread awareness about the economic and environmental benefits of RNG across the economy. “As a company dedicated to advancing science and improving the quality of people’s lives through medicine, AstraZeneca’s 15-year offtake agreement and commitment to RNG is significant,” said Escudero. “It not only sends a strong message to policy makers, it sends a clear signal to competitors in the pharmaceutical and healthcare space, and to leading companies operating in other sectors, too, that RNG is the primary solution for business and industries that need a carbon neutral replacement for natural gas use in Scope 1 (be it for fuel, heat or power), to achieve the most ambitious, near-term greenhouse gas reduction goals.”