Earthstone Energy Inc (Earthstone) is acquiring Novo Oil & Gas Holdings LLC (Novo) from EnCap Investments LP (EnCap) for US$1.5 billion. However, Earthstone is also selling one-third of the oil and gas assets to Northern Oil and Gas Inc. (Northern) for US$500 million, making the net purchase price U$1 billion.

Earthstone is funding the acquisition mainly with cash but is also borrowing funds under its senior secured revolving credit facility. The company expects the acquisition to close in Q3 2023, subject to customary closing conditions. “Over the past few years, we strategically positioned the company as a significant operator in the Permian Basin,” said Robert J. Anderson, president and CEO of Earthstone. “In 2022, we materially advanced our consolidation strategy, closing three accretive acquisitions totaling US$2 billion, including two significant northern Delaware Basin asset acquisitions. I am pleased that we are continuing to further our consolidation strategy with today’s announcement of the Novo acquisition as we further build our northern Delaware Basin asset base. With significant production volumes from the Novo Acquisition, we expect Earthstone’s near-term production levels to surpass 135,000 barrels of oil equivalent/day [boe/d]. Further, we anticipate free cash flow [FCF] to increase significantly compared to standalone Earthstone as we have added substantial producing assets but are not increasing capital expenditures. The addition of approximately 200 high-quality, low-breakeven locations deepens our drilling inventory and with our flat rig count, extends our inventory life significantly to more than a decade. We believe the benefits of continued consolidation are very compelling, and we strongly believe this is a value-creating transaction for Earthstone. We are also pleased that Northern recognized the value of these assets and chose to participate in this highly accretive transaction.”

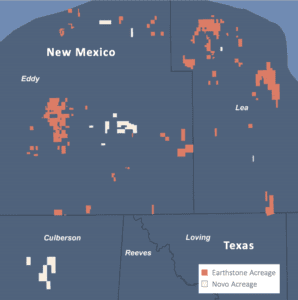

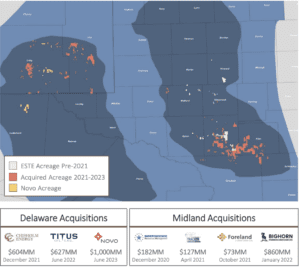

Earthstone primary operates in the Permian Basin. It finished Q1 2023 with average daily production of 104,450 barrels per day (bpd), a nearly 200% increase from Q1 2022. The company operates five drilling rigs, three in the Delaware Basin and two in the Midland Basin. The company said it will maintain a five drilling rig program, but will move one of its Midland Basin rigs to the Delaware Basin to support Novo’s assets. All told, Earthstone’s portfolio is now heavily concentrated in the northern portion of the Delaware Basin.

Novo Asset Highlights (Net To Earthstone)

When factoring in the two-thirds stake in Novo’s assets, Earthstone is getting 38,000 boe/d (37% oil, 66% liquids) worth of production from 114 wells, 11,300 acres (4573 ha), US$912 million proved developed (PD) PV-10 and PD reserves of approximately 73.9 MMboe, 21 gross operated wells waiting on completion, and around 200 gross operating locations with average breakeven below US$40 per barrel of oil.

Over the next 12 months, Earthstone estimates that these assets will produce US$360 million to US$380 million in adjusted earnings before interest, taxes, depreciation (or depletion), amortization, and exploration expense (EBITDAX).

Simple math indicates that Earthstone is paying about 2.7 times Nova’s next 12 months of adjusted EBITDAX, representing approximately a 30% next 12-month unlevered FCF yield. Earthstone expects the transaction to boost its 2024 adjusted EBITDAX by 20% and its 2024 FCF by more than 60%.

Earthstone’s Expansion

Over the last few years, Earthstone has been a major net acquirer of Permian Basin assets. However, the company continues to sell off assets to streamline its portfolio.

On May 31, Earthstone sold certain non-core assets in the Midland Basin for cash proceeds of approximately US$56 million. The sale only reduced its production by 530 boe/d and acreage comprising 32 short lateral drilling locations. However, this still serves as an example of the company’s wiliness to let go of less productive assets in favor of those that boost FCF and lower its cost of production.

In Q4 2023, Earthstone expects its production to increase by 30,000 to 35,000 bpd, bumping up its 2023 guidance to a new range of 130,000 to 135,000 bpd. However, it expects its production to decline slightly in Q1 2024 and then flatten out in the second half of 2024.

| Forecast | Earthstone | PF With Novo | Change |

| Q4 2023 Production | 96,000 to 104,000 bpd | 130,000 to 135,000 bpd | 33% |

| Q4 2023 Production | 45% oil, 71% liquids | 41% oil, 69% liquids | (4%) , (2%) |

| Fiscal Year 2023 Capital Expenditures | US$725 million to US$775 million | US$725 million to US$775 million | 0% |

| Fiscal Year 2024 Reinvestment Rate | 75% | 60% | (15%) |

| Total Proved Reserves | 349,000 boe | 460,000 boe | 32% |

| Gross Locations | 820 | 1020 | 24% |

Data Source: Earthstone Energy

An Aggressive Strategy That’s Paying Off

The Nova acquisition, paired with last year’s deal with Chisholm Energy Holdings LLC, solidifies Earthstone as a powerhouse exploration and production player in New Mexico. The company’s expansion has come at a favorable time, as the added acreage has boosted returns thanks to efficiency improvements and relatively high oil and gas prices.

Despite the success, there’s no denying that Earthstone is banking on sustained high oil and gas prices. The acquisitions have led to surging revenue but have taken a toll on Earthstone’s FCF.

| Metric | 2022 | 2021 | 2019 | 2018 | 2017 |

| Revenue | US$1.7 billion | US$419.6 million | US$144.5 million | US$191.3 million | US$165.4 million |

| Net Income | US$452.5 million | US$35.5 million | US$43.3 million | US$0.72 million | US$42.3 million |

| Free Cash Flow | (US$998.9 million) | (US$196.3 million) | (US$13.6 million) | (US$78.6 million) | (US$80.3 million) |

Data Source: Earthstone Energy SEC Filings

The company remains confident that the deals will amplify FCF in the long run. In the meantime, Earthstone will likely focus on paying down debt to prepare its balance sheet for sustained organic growth or possibly another acquisition.