Baker Hughes’ Hat Trick

Baker Hughes provided ESG Review images for this article but declined to comment beyond its prior public statements.

Baker Hughes is taking the liquefied natural gas (LNG) industry by storm. The company was awarded an order by Bechtel to supply two main refrigerant compressors (MRCs) for Sempra Infrastructure’s (Sempra) Port Arthur LNG Phase 1 project in Jefferson County, Texas. Baker Hughes will supply two 1-MTPA LM9000 gas turbine-driven compressor trains for the Petronas nearshore LNG facility in Sabah, Malaysia. The company was also awarded an order to supply two MRCs for the North Field South (NFS) project, which will be executed by Qatargas.

According to Baker Hughes’ website, there are currently 60 LNG plants in operation or under construction around the world that rely on its turbomachinery — which drives more than 450 MTPA of global installed LNG capacity. This accomplishment makes Baker Hughes the most referenced original equipment manufacturer for large gas turbines on main refrigerants. The company’s work on Port Arthur Phase 1, the Petronas Sabah LNG Project, and NFS will add to its installed LNG capacity.

Baker Hughes Compressors For Port Arthur LNG Phase 1 Project

Sempra announced a positive final investment decision (FID) for the development, construction, and operation of the Port Arthur LNG Phase 1 project on March 20, 2023. Total capital expenditures for the Port Arthur Phase 1 project are estimated at US$13 billion. The Port Arthur LNG Phase 1 project is fully permitted and designed to include two LNG trains, two LNG storage tanks, and associated facilities.

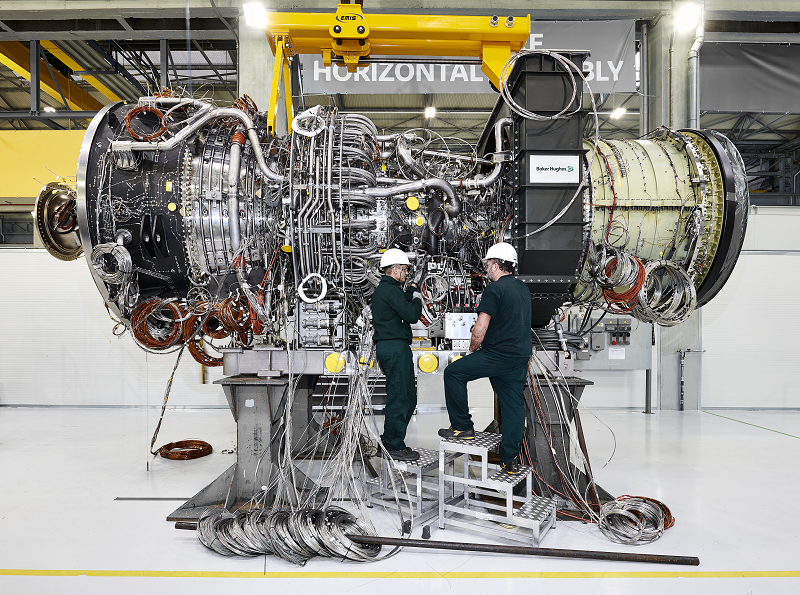

To achieve Port Arthur Phase 1’s nameplate capacity of 13 MTPA, Baker Hughes said in a press release it will supply four Frame 7 turbines paired with eight centrifugal compressors across two LNG trains, as well as two electric motor driven compressors for the plant’s boosting services. “We are delighted to be working with Bechtel and Sempra Infrastructure to supply critical equipment for this innovative LNG project,” said Baker Hughes Chair and CEO Lorenzo Simonelli in a March 27 news release. “Baker Hughes has been committed to LNG for more than 30 years, and today’s announcement builds on our track record of delivering high-availability and reliable LNG technology, with low total cost of operations, further enabling increased exports of LNG from the US Gulf Coast to meet global energy needs.”

Packaging of the turbine/compressor train, as well as manufacturing the compressors and testing the trains, will take place at Baker Hughes’ facilities in Italy. The expected commercial operation dates for Port Arthur LNG Phase 1 Train 1 and Train 2 are 2027 and 2028, respectively. According to Sempra’s press note, the long-term contractable capacity of approximately 10.5 MTPA is fully subscribed under binding long-term agreements with strong counterparties — ConocoPhillips, RWE Supply and Trading, PKN ORLEN S.A., INEOS, and ENGIE S.A., all of which became effective upon reaching FID. Sempra is now actively marketing and developing the Port Arthur LNG Phase 2 project, which is expected to have similar offtake capacity to Phase 1.

Baker Hughes Technology For Petronas LNG Project

Baker Hughes will supply two LM9000 gas turbine-driven compressor trains of 1 MTPA each for the Petronas nearshore LNG facility in Sabah, Malaysia. The contract also includes an order for spare parts. The facility is scheduled to reach commercial operations by the second half of 2027 and is designed to produce 2 MTPA of LNG. Malaysia finished 2021 with an export capacity of around 25 MTPA, making it one of the 10 largest LNG exporting nations in the world.

Baker Hughes Compressors And Turbines For North Field South Project

The MRCs for Qatargas are part of two LNG trains representing 16 MTPA of additional capacity. Each MRC train will consist of three Frame 9E DLN Ultra-Low NOx gas turbines and six centrifugal compressors across two LNG trains for a total scope of supply of six gas turbines to drive 12 centrifugal compressors. Like the Port Arthur Phase 1 project, packaging, manufacturing, and testing of the gas turbine/compressor trains will take place at Baker Hughes’ Gas Technology facilities in Italy and leverage its service site in Ras Laffan, Qatar, for maintenance and technical assistance services. “We are pleased to be a long-time partner to Qatar, helping to position the country as a leading supplier of LNG and helping to unlock more global capacity,” said Simonelli. “LNG will enable the energy transition by acting as a more reliable, affordable, and flexible energy source alongside other new energy sources, including renewables and hydrogen. As an LNG technology leader, Baker Hughes is committed to supporting the sector to capture, transfer, and transform gas in a way that meets rising energy demand and reduces emissions.”

The order builds upon a previously announced award for North Field East (NFE) expansion in 2020 and will bring the overall number of LNG mega trains driven by Baker Hughes’ energy solutions to 12. At the time, it was among the largest LNG deals secured by Baker Hughes in the past five years, for both MTPA and equipment awarded. Baker Hughes said that the NFE project will feature the latest compression technology to reduce 60,000 tons (54,431 tons) of carbon dioxide (CO2) per train each year without any reduction in LNG production, representing a 5% decrease versus previous technologies. The compression trains will also be produced using the latest manufacturing techniques, minimizing raw material and emissions-intensive processes to reduce CO2 emissions during production by up to 10%.

The North Field is the world’s single largest non-associated natural gas field. The NFS project, owned by QatarEnergy in partnership with a number of international oil companies, and operated by Qatargas, is the second phase of the North Field Expansion Project, which was announced in 2017. When fully completed, it will increase Qatar’s LNG production capacity from 110 MTPA, which will be achieved by the end of the first phase North Field East Expansion (NFEE) in 2025, to 126 MTPA by 2027. For context, the International Gas Union estimated in April 2022 that global liquefaction capacity was 472.4 MTPA and global regasification capacity was 901.9 MTPA.

The NFS project involves producing gas from the southern sector of the North Field. The gas will be transported by pipeline to Ras Laffan Industrial City to process it into LNG for exports. The upstream part of the NFS will include five platforms, 50 wells, and gas pipelines to the onshore processing plant. The downstream component of the project will involve delivering 8 MTPA of liquefaction. The native CO2 generated from the natural gas production will be captured and sequestered to reduce its greenhouse gas emissions intensity. The processing plant will be connected to Qatar’s electrical grid.

Baker Hughes’ Extensive History Of Driving Qatar’s LNG Infrastructure

Envisioning an export market unconstrained by land, Qatar was arguably the greatest pioneer in the development of LNG. Qatar Petroleum, the state-owned national oil company, established Qatargas 1 in 1984, consisting of three LNG trains and a production capacity close to 10 MTPA. Then in 1997, the facility sold its first shipment of LNG to Chubu Electric, a Japanese electric utilities provider. By 2010, Qatar had, by far, the highest LNG export capacity of any country in the world.

Baker Hughes played a pivotal role in developing Qatar’s LNG infrastructure. A case study published by Baker Hughes in the summer of 2020 recaps the longstanding collaboration and support to LNG projects in the country.

Qatar’s Next LNG Growth Chapter

Qatar’s LNG growth stagnated between 2010 and 2021. However, over the summer of 2022, QatarEnergy began awarding stakes in its NFEE LNG project. Over the fall and winter of 2022, QatarEnergy finalized several deals with major integrated oil and gas majors. TotalEnergies invested US$1.5 billion for a 25% share in a joint venture (JV) for one of the NFEE LNG trains. In other words, it got 2 MTPA worth of capacity or 1/16 of the project. ExxonMobil and Shell signed similar deals, while ConocoPhillips and Eni each signed deals for 1/32 of the project. QatarEnergy retained a 75% ownership of the NFEE.

On January 8, QatarEnergy made a FID with Chevron Phillips Chemical Company LLC (CPChem) to build a US$6 billion integrated olefins and polyethylene facility at Ras Laffan Industrial City, Qatar. Known as the Ras Laffan Petrochemicals complex, QatarEnergy will retain a majority 70% share of the project, with CPChem controlling the other 30%. Chevron and Phillips 66 each hold a 50% stake in CPChem.

QatarEnergy said that the Ras Laffan Petrochemicals complex is expected to begin production in 2026 and will consist of an ethane cracker and 2.1 MTPA of ethylene capacity. If all goes according to plan, that will make the complex the largest ethylene production facility in the Middle East and one of the largest in the world. In addition to the ethane cracker, the facility will include two polyethylene trains with a combined output of 1.7 MTPA of high-density polyethylene polymer products. All told, the Ras Laffan Petrochemicals complex would boost Qatar’s overall petrochemical production capacity to almost 14 MTPA.

Proven Solutions For Modern Projects

Baker Hughes’ Frame 9E turbines, which were instrumental in the Qatargas 2, are being used for the NFS expansion nearly 15 years later. Baker Hughes’ solutions have been around for several years. The company remains uniquely positioned to deliver an integrated compressor and turbine package for LNG trains.

Baker Hughes is leveraging decades of experience in the gas and LNG space and proven solutions to accomplish modern projects that are more complex than ever before. The company continues to lower emissions and reduce costs for its customers and has invested in developing new compression solutions that can thrive in a low-carbon future.

The completion of projects like Port Arthur Phase 1 and NFS will meaningfully increase the world’s LNG export capacity, create thousands of well-paying jobs, and provide a reliable and secure source of energy for industrializing countries looking for lower-emissions alternatives to coal.