One-On-One: A Conversation With EFRC Chair Gunther Machu

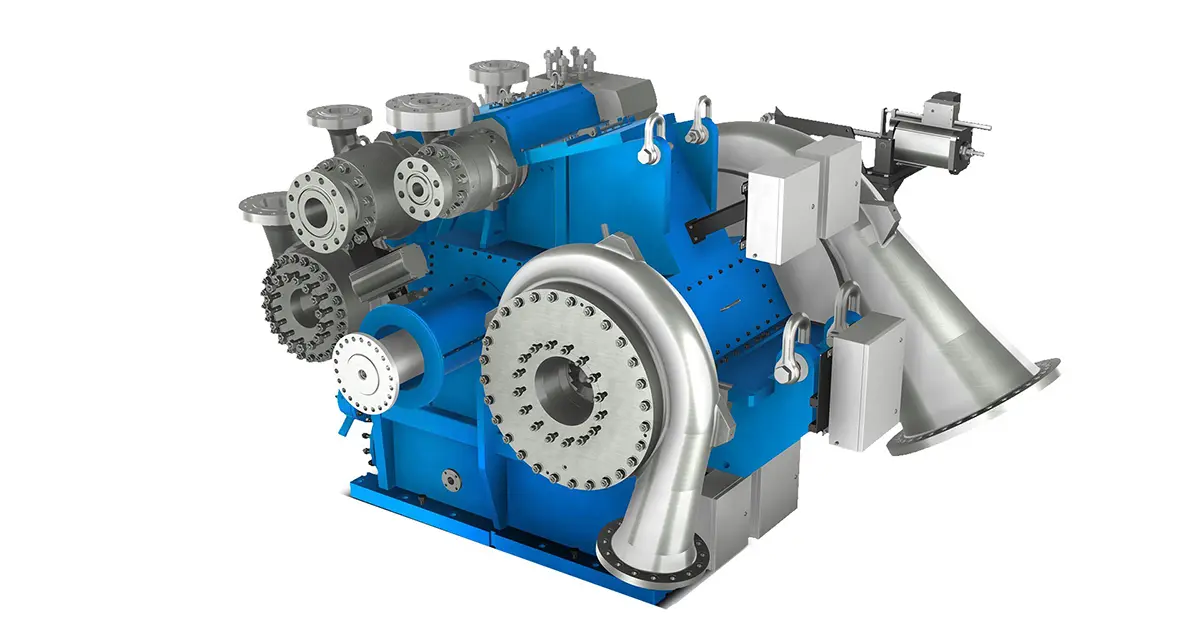

The 13th EFRC Conference will take place in Zagreb, Croatia, from September 19 to 21, 2023. Founded in 1999, the European Forum for Reciprocating Compressors (EFRC) is a non-profit association that supports operators, manufacturers, and engineers working with reciprocating compressors. The organization serves as a platform to exchange information and experiences, as well as perform joint research to improve the performance of reciprocating compressors worldwide.

The 13th EFRC Conference will take place in Zagreb, Croatia, from September 19 to 21, 2023. Founded in 1999, the European Forum for Reciprocating Compressors (EFRC) is a non-profit association that supports operators, manufacturers, and engineers working with reciprocating compressors. The organization serves as a platform to exchange information and experiences, as well as perform joint research to improve the performance of reciprocating compressors worldwide.

ESG Review sat down with EFRC Chair Gunther Machu to discuss the compression industry and the role the organization plays within the marketplace.

In your opinion, what are the biggest challenges facing the gas compression industry today, and what are companies doing to address these challenges?

The oil and gas industry is ageing. A lot of experts will retire soon, and new people find oil and gas less attractive to work for. To address this, I think digitalization is important. Young people expect work experiences similar to their private experience using apps. For example, being able to access company knowledge [preferably from the phone], having key performance parameters of critical assets available, and scheduling work electronically. Also, companies that provide a sense of purpose — why am I doing what I am doing at work — find it easier to attract young talent.

Next, oil demand will start to eventually decline, especially in the United States and European Union [EU]. The Middle East and Asia, with large, integrated petrochemical complexes, will pick up market shares. Some refineries in the west will try to compensate for this by moving to renewable feedstock, but this has its own challenges.

Lastly, natural gas is here to stay but emissions reductions are a big challenge. Fugitive emissions of methane along the entire value chain — from wellhead compression, gas gathering, processing, and delivery to large cities via pipelines — is a big topic that needs to be addressed urgently. With regards to fugitive emissions reductions, this is becoming a booming market. Lots of new technologies are emerging, from identification, to quantification, mitigation, and elimination.

The market landscape is transforming, but we shouldn’t forget that completely new markets are opening as well, for example along the hydrogen value chain. The emerging hydrogen economy provides ample opportunities for the compression industry to change direction and engage in solving the various challenges along the hydrogen value chain — from commercial challenges to technical challenges. Lucky for us, reciprocating compressors have emerged as the most promising technology for cost effective, scalable hydrogen compression.

Market strength varies by location. In your opinion, which geographic locations hold the most promise for the gas compression industry?

North America is the single biggest market for natural gas compression and is here to stay. Not only because natural gas is a cleaner burning alternative to oil and coal, but natural gas could help to provide the massive amounts of hydrogen needed for the upcoming hydrogen economy. Steam methane reforming, in combination with carbon capture technologies, could bridge the gap between demand and supply in an environmentally friendly way — stimulated further by the US Inflation Reduction Act.

In a similar fashion, the EU green deal industrial plan will stimulate all the applications of compression in the hydrogen value chain. From electrolysis to pipeline feed, hydrogen pipeline compression, trailer filling, hydrogen fueling stations — the opportunities are manyfold in the EU, and also in China, Japan, and Korea.

What market indicators do you follow/track to forecast the short- and long-term health of the gas compression industry?

There are short-term indicators like oil demand and spot price, rig count, and spot prices of natural gas and liquefied natural gas [LNG]. There are also investment barometers. For example, are companies starting to hedge gas prices again?

In the long term, we have to face a transition. The best way is to follow macro trends, and those clearly lead toward digitalization, reduction of carbon footprint, and better energy efficiency.

What new products and or/technologies have impressed you most within the last few years?

The new technology landscape of methane leak detection, quantification, and mitigation is a fascinating topic. Companies are also working hard to extend the operating envelope of reciprocating compression. For 10,153-psi [700-bar], nonlube hydrogen compression required at a hydrogen filling station, the compressor needs to be super flexible in terms of pressure ratio, flow, and side streams. Research and development on stepless control systems, new ring and packing designs, materials, and completely new cylinder/ring concepts are very impressive.

In your opinion, what opportunities do ESG mandates and requirements present for the gas compression industry? What challenges do they present?

I think that ESG mandates are a huge opportunity for each company — just look at the first challenge we discussed at the beginning of our interview — attracting young talent. At the end of the day, ESG mandates provide the chance to create a sense of purpose and meaning for each company. What can we do to reduce our carbon footprint and reduce waste? What can we do to provide better working conditions for our employees and give back to society? “Governance” provides a framework of trust and transparency — a place where people like me want to work.

Challenges in the context of ESG arise if companies just see it as a “something we need to have — let’s just get it behind us.” Employees will sense superficiality — greenwashing is a prominent example of this. At the end of the day, investors rule and they will have a close look at ESG practices.

What opportunities does the hydrogen economy present for the gas compression industry? What are the challenges?

The hydrogen economy provides ample of opportunities for compression along the value chain, but the challenges are profound as well:

- Technology challenges: sizable 10,153- to 14,504-psi [1000-bar], nonlube hydrogen compression equipment will be needed soon — a lot of key technical challenges need to be addressed to achieve high levels of reliability.

- Commercial challenges: at the same time, to enable commercially feasible costs of hydrogen to reach fossil fuel parity, gas compression equipment needs to have low capital expenditures and lowest total cost of ownership.

Discuss the importance of associations such as the EFRC and the role that the EFRC plays in the overall marketplace.

The role the EFRC wants to play in the overall marketplace is best described by our mission statement: We connect professionals to promote the reciprocating compressor on the path to a carbon neutral world. The importance that associations like the EFRC have in the overall marketplace is to first and foremost serve as a nucleus to bring people together — component manufacturers, original equipment manufacturers, equipment end users, engineering companies, universities, and research and development organizations. We can finance precompetitive research in defined focus groups like the EFRC’s Future Energies & Compression or Operation & Reliability. We offer comprehensive training on various subjects around the reciprocating compressor, including a bi-annual student workshop and excursion visiting end users, universities, and manufacturers. We identify gaps in certain standards, and, together with our members, issue publications within our standards group for various subjects. Examples include EFRC guidelines on vibration levels or guidelines on flow meter errors in pulsating flows.

All in all, I think the work that the EFRC members have performed in the various working groups over the last 20 years has helped increase the performance and reliability of the reciprocating compressor — and that is a very fruitful role the EFRC can play in the overall marketplace.

What are your goals for the EFRC in 2023?

We will host the 13th EFRC conference in Zagreb, Croatia, from September 19 to 21, 2023. We are always looking for a healthy mix of organizations to join the conference, and to attract even more end users. Another goal is to increase the number of members by including new players in the hydrogen value chain — they would benefit so much from the interaction in the various EFRC working groups. Also, we are fostering cooperation with other industry organizations and universities. This year we will be hosting a hydrogen panel discussion at the 13th Conference of Compressors And Their Systems together with the City University of London in September as well.