Honeywell International (Honeywell) is acquiring Compressor Controls Corporation (Compressor CC) from INDICOR LLC for US$670 million in cash. INDICOR LLC is owned by funds affiliated with private equity firm Clayton, Dubilier, & Rice LLC and Roper Technologies Inc. For nearly 50 years, Compressor CC has provided turbomachinery control and optimization solutions, including control hardware, software, and services for process engineers, controls engineers, safety personnel, turbomachinery experts, and plant managers. The company primarily serves the liquefied natural gas (LNG), gas processing, refining, and petrochemical segments. The deal, subject to customary closing conditions, is scheduled to conclude in the second half of 2023.

A Primer On Honeywell’s Business

Honeywell is a massive and complex industrial conglomerate that operates four major business segments — Aerospace, Honeywell Building Technologies (HBT), Performance Materials and Technologies (PMT), and Safety and Productivity Solutions (SPS). Honeywell provides a wide range of systems, components, and services for the aerospace industry. Its products touch virtually the entire industry, from engines, to navigation sensors, radar, cabin management and cleaning, etc. HBT makes control panels, provides electric and wiring solutions, sensors, software, and more to help buildings lower energy consumption and improve their safety. PMT is mainly split into Advanced Materials (polymers, performance fluids, chemicals, etc.), Honeywell Process Solutions (HPS) (automation and measurement technologies for industrial customers, and Honeywell UOP (midstream and downstream technologies, equipment, processes, and lifecycle solutions). SPS makes advanced sensing technologies, automation and productivity solutions, and safety products across for a variety of industries, including healthcare, transportation, and manufacturing.

Each business segment is tasked with connecting physical assets to the digital world. Honeywell spent its last 100 years making independent products. However, the next 100 years are focused on interconnecting the industrial world into one smart system, a trend commonly known as the industrial internet of things (IIoT). Honeywell is investing heavily into artificial intelligence, automation, machine learning, and sustainability. The buzz words are thrown around a lot nowadays, but the key takeaway is that Honeywell is trying to grow its business by making smarter systems and harnessing data instead of just making marginal product improvements. The strategy is working, as Honeywell’s business segments are becoming increasingly interconnected.

A Perfect Fit

Compressor CC will become a part of HPS, which, as mentioned, is part of the company’s PMT segment. “Compressor CC is an ideal complement to our process solutions portfolio, as it brings an installed base of more than 14,000 control applications to our portfolio and will enable us to accelerate growth in combination with Forge’s industry leading asset performance management [APM] capability,” said Lucian Boldea, president and chief executive officer of Honeywell PMT. “By enhancing our digitalization portfolio, we are helping customers accelerate their energy transitions through new controls and automation that, for example, can help with carbon capture and sequestration.”

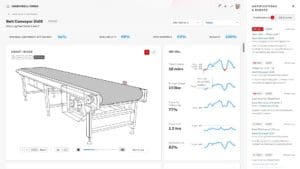

Honeywell aims to blend Compressor CC’s proprietary performance analytics, optimization algorithms, and predictive health analysis with Honeywell Forge to provide a more comprehensive solution for customers. Honeywell has been investing heavily in Forge in recent years. The solution works for any industry, but arguably has the most benefits for energy and industrial customers. Essentially, Forge provides a software as a service solution for customers that allows them to monitor asset health, overall equipment efficiency, availability, performance, quality, quantify process on key performance indicators, and even track trends to lower energy consumption and improve performance. Forge can be used across an entire fleet of assets to make it easier to track performance and leverage data.

In many ways, Compressor CC has been providing customers with a similar APM system. Uniting Compressor CC’s solution with Forge makes a lot of sense given Compressor CC’s widespread installed base. “The combination of the company’s existing offerings will provide the most complete end-to-end portfolio of products for operational control, safety, and asset performance management of compressors, turbines, generators, and other turbomachinery in the LNG, gas processing, refining, and petrochemical segments,” said Honeywell in a statement. “These are the most critical production assets in these industries and have significant impact on the downtime, energy consumption, and maintenance expense of end users.”

All told, Honeywell expects to achieve annual cost synergies of US$8 million and a cash-basis return on investment of more than 15% five years after closing the acquisition. Compressor CC made around US$115 million in 2022 sales. Honeywell paid roughly 15 times Compressor CC’s estimated 2023 earnings before interest, taxes, depreciation, and amortization, which is a premium valuation. However, Compressor CC aligns perfectly with the investments that HPS has been making.

Data-Driven Decision Making

Honeywell Forge and Compressor CC’s APMs are examples of how data analytics can improve business operations and lead to cleaner operations. In April, Honeywell announced a deal in its Connected Enterprise business with Globalworth, a real estate investor in central and eastern Europe. According to Honeywell, the deal unlocked US$40 million in value thanks to Honeywell Forge. “Globalworth is using Honeywell Forge for building technology to help monitor energy consumption down to a device or asset level across their commercial office buildings in Romania and Poland while maintaining occupant comfort and productivity,” said Vimal Kapur, president and COO of Honeywell on the company’s Q1 2023 earnings call. “Our solution will help reduce operating costs and lower energy consumption, a key outcome for Europe’s overreaching climate objectives. This existing technology provides us with a new growth sector, while reinforcing Honeywell’s sustainability message.”

APM systems like Honeywell Forge prove there are plenty of ways to achieve environmental, social, and governance (ESG) targets without tearing everything down and pivoting away from oil and gas. Carbon capture and storage (CCS) has been one of the most exciting technological developments in oil and gas because it allows for emissions reductions without cutting oil and gas production. Honeywell has been building a high growth sustainability portfolio that includes carbon capture control solutions. Many of these solutions operate on the very same turbomachinery as Compressor CC. Honeywell’s acquisitions will allow it to work with Compressor CC’s installed base to remove carbon dioxide from process plant emissions and the atmosphere.

A Glimpse Of What’s To Come

The majority of deals we discuss in Mergers & Markets include the usual suspects of industry consolidation, bolt on acquisitions, minority stake equity buyouts, and acreage accumulation. However, we may start seeing more deals like Honeywell’s acquisition of Compressor CC.

Whether it’s cybersecurity, emissions reductions, or plain old cost reduction, the name of the game for industrial software providers are data. The more assets that fall under a company’s umbrella, the better its solutions will become and the more value they can provide customers. Honeywell Forge is more effective if it works on a system of systems instead of just a standalone job site. The same goes for cybersecurity solutions, such as those provided by Siemens.

It wouldn’t be surprising if industrial conglomerates continue to execute unconventional acquisitions, such as buying smaller companies with a lot of moving parts across the integrated oil and gas value chain. By focusing on the industry’s supporting cast instead of the main characters, companies like Honeywell can increase the exposure of their solutions while avoiding the waste that often comes when conglomerates buy companies that only partially align with their objectives.