Canada released its Budget 2023 Impacts Report, which detailed spending plans, policies, programs, and legislation. Chapter 3 of the report focused on affordable energy, job creation, and the country’s interest in growing its clean economy.

Clean Fuels For The Clean Economy

Canada believes that hydrogen, biofuels, and biomass will be critical sources of energy where electricity would be inefficient or impractical. In addition to emissions reductions benefits, these burgeoning industries can help create good-paying jobs for Canadians.

Clean hydrogen is rapidly becoming a leading candidate to fuel long-haul road, marine, and aviation transport, as well as for heavy industries like iron and steel production. Canada believes it has the potential to become a global supplier of various forms of clean hydrogen. Globally, the pace of development in the production and use of hydrogen is accelerating. It will require considerable investment before hydrogen can scale to the point of becoming a critical source of energy — which is why measures such as the Investment Tax Credit for Clean Hydrogen announced in the 2022 Fall Economic Statement are so important.

Biofuels, such as renewable diesel and sustainable aviation fuel, generate fewer emissions on a lifecycle basis compared to fossil fuels, and will also be critical to the growth of Canada’s clean economy. With its abundant feedstocks, Canada is well positioned to grow its biofuels industry.

Biomass, which is renewable organic material that comes from plants, includes wood and wood processing waste, such as wood chips, lumber mill sawdust and waste, and black liquor from pulp and paper mills. Biomass is often combusted for heating and industrial applications, notably in the pulp and paper industry. Biomass heating also presents an opportunity for rural and remote Indigenous communities in Canada to reduce reliance on diesel fuel.

An Investment Tax Credit For Clean Hydrogen

In the 2022 Fall Economic Statement, Canada’s federal government announced a refundable investment tax credit for investments made in clean hydrogen production based on the lifecycle carbon intensity of hydrogen. Since the release of that statement, Canada has consulted on how to best implement the Clean Hydrogen Investment Tax Credit, using the input to inform its design. The result of these consultations was outlined in the Budget 2023 Impacts Report.

Here are the key design features outlined in the budget:

- The levels of support will vary between 15% and 40% of eligible project costs, with the projects that produce the cleanest hydrogen receiving the highest levels of support (see Table 1).

- The Clean Hydrogen Investment Tax Credit will also extend a 15% tax credit to equipment needed to convert hydrogen into ammonia, to transport the hydrogen. The tax credit will only be available to the extent the ammonia production is associated with the production of clean hydrogen.

- Labor requirements will need to be met to receive the maximum tax credit rates. If labor requirements are not met, credit rates will be reduced by 10%. These labor requirements will come into effect October 1, 2023.

| Table 1. Proposed Tax Credit Incentive Structure For Clean Hydrogen Production | |

Carbon Intensity Tiers1 |

Tax Credit Rate2 (Applied To Eligible Costs) |

| < 0.75 kg | 40% |

| 0.75 kg to < 2.0 kg | 25% |

| 2.0 kg to < 4 kg | 15% |

| 4 kg or higher | N/A |

| 1 Reflects the expected life-cycle emissions of a project based on its carbon intensity (measured as kilograms [kg] of carbon dioxide equivalent per kg of hydrogen produced).

2 Assumes labor requirements are met. |

|

(Data Source: Government Of Canada)

The proposed Clean Hydrogen Investment Tax Credit is expected to cost US$4.14 billion over five years, beginning in 2023 and 2024. Between 2028 and 2029 and 2034 and 2035, the Clean Hydrogen Investment Tax Credit is expected to cost an additional US$8.94 billion.

Becoming A Top Hydrogen Exporter

Canada has grown to become the fourth-largest oil producer and exporter in the world, reaching all-time high production of 5.558 million bpd in 2021. In addition to its oil industry, Canada has several planned and proposed liquefied natural gas (LNG) projects. Canada has higher oil and gas production per capita than the United States. Despite its heavy reliance on fossil fuels, the country has been adamant about hydrogen investments, carbon capture and storage (CCS), and other alternative fuels.

Canada’s hydrogen ambitions took a leap forward in late August 2022 when Canada and Germany signed a joint declaration of intent focused on the export of Canadian hydrogen to Germany. Known as the Canada-Germany Hydrogen Alliance, the goal is to align policy, develop secure supply chains, and open a transatlantic Canada-Germany supply corridor that will set the stage for the export of clean hydrogen by 2025. The Hydrogen Strategy For Canada sees hydrogen making up 6% of Canada’s end energy use by 2030 and up to 30% by 2050. What’s unique about clean hydrogen is that it is one of the few investment opportunities that relates to almost every subcategory of Canada’s US$7 billion 2030 Emissions Reductions Plan. The largest line item from the plan is US$2.2 billion toward investments in zero-emissions vehicles (ZEVs), including charging investments in hydrogen-powered vehicles as well as electric vehicles (EVs). Hydrogen filling stations can require dozens of high-pressure storage tanks, multiple hydrogen compressors, and fuel pumps. Like California, Canada plans to have ZEVs make up 100% of new passenger vehicles sales by 2035. However, Canada also aims to have ZEVs make up 20% of new passenger vehicle sales by 2026 and 60% by 2030. Hydrogen can also play a role in the US$770 million investment toward Canada’s net-zero by 2050 building plan, which is part of the Canada Green Buildings Strategy. Canada’s 2030 Emissions Reductions Plan involves federal support for industrial adoption of green hydrogen and US$650 million toward decarbonizing Canada’s electricity grid, which aims to be net-zero by 2035. The hydrogen industry offers a key growth driver for Canada’s oil and gas industry. However, it’s worth mentioning that Canada doesn’t just want its oil and gas industry to embrace hydrogen, it is somewhat forcing it through emissions caps.

The US$7 billion Emissions Reductions Plan also includes US$770 million toward clean farming, US$1.68 billion toward expanding the Low-Carbon Economy Fund (grassroots emissions reductions investments to support projects from governments, schools, non-profits, and Indigenous Peoples), and US$600 million to help Canada’s oceans, wetlands, peatlands, grasslands, and agricultural lands capture and store carbon, and explore the potential for negative emissions technologies in the forest sector. Federal support and private industry investment are essential elements for growing the hydrogen economy.

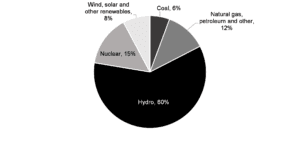

In its 2022 Canada Energy Policy Review, the International Energy Agency recognized the cleanliness of Canada’s energy grid largely due to its hydropower. However, since the country lacks ample solar and wind energy potential, it is investing heavily in nuclear, CCS, and hydrogen, transitioning away from coal and other solutions that can leverage existing oil and gas workforce and infrastructure. Oil and gas play a major role in the Canadian economy. As such, decarbonizing upstream oil and gas production and building LNG export terminals that operate well below global average emissions are essential for operating an oil and gas industry while also reducing emissions.

‘We Will Not Get Left Behind’

Despite Canada’s optimism and embrace of hydrogen investment, the country concluded Chapter 3 of the Budget 2023 Impacts Report with a dire warning. The elephant in the room is Canada’s neighbor to the south, the United States. Canada gave its support for the Inflation Reduction Act (IRA), while also recognizing that the IRA is going to drive US hydrogen growth to the point where the United States could have competitive advantages over other exporters, including Canada. Over time, US hydrogen investment could undermine Canada’s hydrogen investment.

To quote the report:

Despite our competitive advantages and the foundational investments we have made in building Canada’s clean economy over the past seven years, there are two fundamental challenges that Canada must address. First, many of the investments that will be critical for the realignment of global supply chains and the net-zero future are large-scale, long-term investments. Some investments may require developing infrastructure, while others may require financial incentives or a patient source of financial capital. For Canada to remain competitive, we must continue to build a framework that supports these types of investments in Canada — and that is what we are doing. Second, the recent passage of United States’ IRA poses a major challenge to our ability to compete in the industries that will drive Canada’s clean economy. Canada has taken a market-driven approach to emissions reductions. Our carbon pollution pricing system not only puts money back in the pockets of Canadians but is also efficient and highly effective because it provides a clear economic signal to businesses and allows them the flexibility to find the most cost-effective way to lower their emissions. At the same time, it also increases demand for the development and adoption of clean technologies.

In contrast, the United States has chosen to rely heavily on new industrial subsidies to reduce its emissions. The IRA has introduced subsidies for the production of clean technologies and clean products. The IRA’s federal clean growth incentives are officially estimated at US$369 billion by the US Congressional Budget Office, though a number of observers estimate the final total will be significantly higher. As a result of these uncapped subsidies, private sector estimates suggest that the IRA could mobilize as much as US$1.7 trillion of private and public investments in the US clean economy over 10 years. As the United States’ closest trading partner — and with our economies so closely intertwined — Canada stands to benefit from the IRA, both from the accelerated pace of technological development, and from new opportunities in North American supply chains for clean energy and technologies. The IRA also offers tax credits to US consumers for purchasing EVs produced in North America. The Government of Canada led a relentless advocacy and outreach effort to ensure that the tax credits would apply to Canadian production, given the integrated nature of Canada-United States supply chains in the auto sector. This ‘Buy North American’ policy stands to benefit both Canada and the United States, and ensures that the supply of critical minerals processed, and batteries manufactured, in Canada supports a continued partnership in auto-making.

Canada has all of the fundamentals required to build one of the strongest clean economies in the world. However, without swift action, the sheer scale of US incentives will undermine Canada’s ability to attract the investments needed to establish Canada as a leader in the growing and highly competitive global clean economy. If Canada does not keep pace, we will be left behind. If we are left behind, it will mean less investment in our communities, and fewer jobs for an entire generation of Canadians. We will not be left behind.