Energy Transfer LP (Energy Transfer) is acquiring Lotus Midstream Operations LLC (Lotus) from EnCap Flatrock Midstream (EFM) for US$900 million in cash and 44.5 million common units of Energy Transfer. The total transaction value is approximately US$1.45 billion.

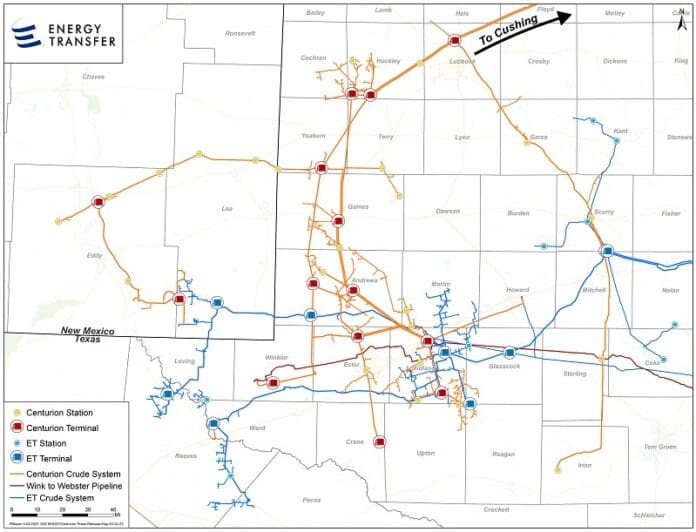

The acquisition complements Energy Transfer’s portfolio of oil and gas midstream assets across the United States and Canada. Lotus owns the valuable Centurion Pipeline Company LLC (Centurion). Located in the Permian Basin, Centurion is a 3000-mile (4828-km) crude oil pipeline with a capacity of 1.5 million bpd. The pipeline’s associated infrastructure includes wellhead gathering, intra-basin transportation, terminalling, and long-haul transportation services. The most notable piece of infrastructure associated with the pipeline is the Midland Terminal, which has 2 million barrels of crude oil storage capacity. Lotus also has a 5% stake in the 650-mile (1046-km) Wink to Webster Pipeline, which can transfer more than 1 million bpd of crude oil from the Permian Basin to the Gulf Coast.

Figure 1 shows an overlap of Lotus’ assets with Energy Transfer’s. The map illustrates that Energy Transfer will have significantly higher gathering volumes and heighted connectivity for its crude oil transportation and storage businesses once it completes the deal with Lotus. Energy Transfer said that the deal will boost its access to key downstream markets. The enhanced asset portfolio will feed nicely into major hubs in Oklahoma such as the Cushing oil hub and Texas hubs in Midland, Colorado City, Wink, and Crane. Like most midstream business models, the assets are backed by long-term, fee-based and fixed-fee contracts that provide stable cash flows no matter what oil and gas prices are doing. Once the deal is complete, Energy Transfer will boost its coverage even more by constructing a 30-mile (48-km) pipeline project that will allow the company to originate barrels from its Midland terminals for delivery to Cushing. This additional pipeline is expected to be completed in Q1 2024.

With a market capitalization of roughly US$40 billion and an enterprise value closer to US$95 billion, the deal is significant but not large enough to alter Energy Transfer’s leverage ratio even though it is being funded mostly with cash.

A Sector-Wide Decline In Spending

The Energy Transfer deal follows the same pattern we’ve been seeing in the US/Canada midstream industry for the last couple of years. Midstream majors are making strategic acquisitions and gradually increasing spending. There’s been some consolidation in the industry, which will likely continue if market conditions stay favorable. For the most part, each acquisition seems to be deliberate and conservative. Shareholders have a short leash with midstream companies and don’t want to see deals that lever up the balance sheet, deplete free cash flow, or require capital that could have otherwise been used to grow dividends or buy back shares. In other words, there’s a theme of caution and skepticism as investors want to make sure that midstream companies don’t overexpand and set the stage for a messy contraction during the next downturn.

Since the oil and gas crash of 2014 and 2015, midstream majors have been cautious to ramp spending as they seek to regain investor trust. Even over the last five and 10 years, trailing 12-month (ttm) capital expenditures of major midstream oil and gas companies are down big.

| Company | 5-Year Change In TTM Capital Expenditures | 10-Year Change In TTM Capital Expenditures |

| Enbridge | (47.7%) | (38.2%) |

| Enterprise Products Partners | (45.7%) | (40.1%) |

| Kinder Morgan | (49.8%) | (28.6%) |

| TC Energy | (13.5%) | 69.1% |

| Energy Transfer | (61.5%) | (1.6%) |

| Williams Companies | (20.9%) | (21.6%) |

| ONEOK | 81% | (40.5%) |

| Pembina Pipeline | (59.2%) | (30.1%) |

| Magellan Midstream Partners | (66.1%) | (56.9%) |

| Plains All American Pipeline | (55.2%) | (65.1%) |

Data Source: Company SEC Filings

Lower spending is a sign that the midstream industry has struggled to justify funding large-scale, capital-intensive projects related to oil and gas. As an alternative to building new assets, companies are finding value through bolt-on acquisitions.

Bundles Of Bolt-Ons

The Energy Transfer deal comes shortly after Phillips 66’s January announcement to buy the remaining common units of DCP Midstream for a cash consideration of US$41.75 per common unit. Again, not a massive deal given the size of Phillips 66, but a noteworthy one, nonetheless. In February, Williams Companies closed its deal with Southwest Gas Holdings for the acquisition of MountainWest Pipelines Holding Company for US$1.5 billion. MountainWest comprises roughly 2000-miles (3219-km) of interstate natural gas pipeline systems primarily located across Utah, Wyoming, and Colorado, totaling approximately 8 Bscf/d (226.5 × 106 m3/d) of transmission capacity. MountainWest also holds 56 Bscf (1.59 × 109 m3) of total storage capacity. In February 2022, Enterprise Products Partners (Enterprise) completed its US$3.25 billion acquisition of Navitas Midstream Partners LLC. The deal complemented Enterprise’s presence in the Permian Basin and Delaware Basin with 1750 miles (2816 km) of pipelines and more than 1 Bscf/d (28.3 × 106 m3/d) of cryogenic natural gas processing capacity.

These deals are just some of the many recent examples of bolt-on acquisitions midstream companies have competed over the last few years. Bolt-on acquisitions seek to complement existing assets and drive synergies without taking on the risks associated with investing in a new geography or industry. However, there has also been a sizeable uptick in midstream investment in liquefied natural gas (LNG) projects; renewable natural gas (RNG); hydrogen; carbon capture, utilization, and storage (CCUS); and even renewable energy.

Embracing The Energy Transition

In 2021, Kinder Morgan bought Stagecoach Gas Services for US$1.23 billion and RNG developer Kinetrex Energy for US$310 million. In September 2022, Canadian midstream giant Enbridge acquired Tri Global Energy — the third-largest onshore wind developer in the United States, with a development portfolio of wind and solar projects representing more than 7 GW of renewable generation capacity.

Midstream companies are noticing the value that low-carbon alternative energy can bring to their portfolios. At the end of the day, midstream companies are in the business of transporting energy from areas of production to areas of consumption. If there’s money to be made and emissions to be reduced by investing in new fuels, then companies will put capital to work. Roughly one-third of all energy consumed in the United States comes from natural gas. Despite its growth over the last decade, RNG still makes up less than 1% of US natural gas consumption. As investment and federal support for lower-carbon alternatives continues to grow and companies look for short-term viable solutions, RNG could begin to take market share from other forms of renewable energy. Despite excitement for the hydrogen economy, there are still too few practical use cases for hydrogen to justify full-throttle investment. However, hydrogen does provide a unique opportunity for midstream companies to leverage existing infrastructure to transport natural gas/hydrogen blends, as well as build pure-play hydrogen pipelines.

Just about every 20 to 30-year energy forecast points to stagnant or lower domestic natural gas consumption. However, LNG opens the door to global natural gas growth. Domestically, RNG, hydrogen, and other forms of renewable energy provide a chance for midstream companies to diversify their revenue streams. CCUS preserves the relevancy of oil and gas even in a lower-carbon economy.

Bolt-on acquisitions like Energy Transfer’s deal with Lotus are a way for midstream companies to drive profits and boost cash flows without building anything new. That being said, shuffling ownership stakes from one company to the next doesn’t create jobs or add economic value to the overall economy. If anything, it often leads in job cuts. Therefore, lasting growth in the midstream industry won’t come from bolt-on acquisitions. It will come from investments in the energy transition.