In June 2022, a pipeline rupture resulted in a fire and explosion that took America’s second-largest liquefied natural gas (LNG) export terminal offline. On February 3, 2023, Freeport LNG announced it was restarting Train 3 of its liquefaction plant, with Trains 1 and 2 soon to follow. The news is a boon for the LNG export industry, which relies heavily on the terminal. Freeport LNG operates a three-train, 15-MTPA, all electric-driven motor plant that reduces carbon emissions by more than 90% relative to comparable gas turbine-driven liquefaction plants. The facility was planning on adding a fourth liquefaction train and has received regulatory approval for its construction.

Background

In December 2022, Freeport LNG released a statement saying it “substantially completed” the reconstruction work needed to commence operations. At the time, it was forecasting the initial restart in the second half of January 2023, which was already far later than its previous November 2022 target. The delay seems to be the result of the company waiting for regulatory agencies to approve the safe restart of the facility, not Freeport LNG’s own doing.

Freeport LNG had been working with Texas environmental regulators, as well as the Federal Energy Regulatory Commission (FERC). On December 12, 2022, FERC sent a data request to Freeport LNG so it could work toward completing its safety review and recommending necessary changes to the facility. Freeport LNG also went through inspections and consultations with the Pipeline and Hazardous Materials Safety Administration. In late January 2023, FERC approved Freeport LNG’s request for initial restart activities, beginning with the cool down of feed gas through Train 3. Freeport LNG said the restart process will be gradual and could take several weeks, making it unlikely to reach its full operational capacity until March at the earliest.

LNG Export Volumes And Prices

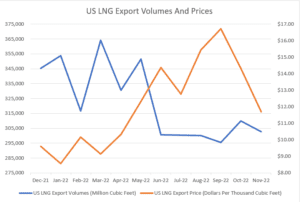

Despite Freeport LNG’s shutdown, US LNG export prices continued to fall heading into the winter months, which is unusual based on seasonality and the fact that the Freeport LNG facility closure resulted in lower US supply. The countertrend action is likely a result of heavy LNG buying in the summer and fall as Europe and Asia competed to boost reserve levels in time for the winter. The rapid buying pulled forward price and volume increases normally seen in the winter.

For example, Germany spent the summer ramping up its natural gas reserves. Gas Infrastructure Europe Aggregated Gas Storage Inventory (AGSI) data from August 21, 2022, said the EU’s storage levels were 77.42% full, while Germany had successfully increased its storage levels to 80.14% capacity — putting it ahead of schedule to reach its winter goals. AGSI data says that Germany now has 195.5818 TWh of natural gas in storage, by far the largest of any EU country and making up 23% of total EU storage levels.

Germany’s buying spree was reflected in the price of natural gas. The Netherlands Title Transfer Facility (TTF) natural gas futures, commonly known as Dutch TTF, serves as the EU benchmark for gas import prices. Dutch TTF trades in euros per MWh with a tick size of 0.005 per MWh. On August 23, 2022, September Dutch TTF futures reached an all-time high of more than US$344 per MWh. For context, Dutch TTF futures were between US$21 and US$35 per MWh in summer 2021 and between US$70 and US$134 per MWh last winter. In August 2020, TTF futures fell below US$16 per MWh. Put another way, Dutch TTF prices in late August 2022 were up more than 10-fold in one year and up more than 20-fold compared to August 2020 levels. As seen in Figure 1, similar record natural gas price increases were seen in the United States around the same time. Natural gas prices this high are unsustainable and threaten to derail European industry.

According to the US Energy Information Administration (EIA), LNG export volumes averaged 364,116 MMscf (10 × 109 m3) in March 2022, which is an all-time high. The peak volume figure was likely a result of Russia’s February 2022 invasion of Ukraine. LNG export prices averaged US$16.72 per Mscf in September 2022, also an all-time high. In September 2022, a frenzy of buying paired with the reality that Freeport LNG would likely be down for the rest of 2022 triggered a surge in prices.

Figure 1. Data Source: Energy Information Administration

Long Term Consequences

The restart of Freeport LNG is a win for the oil and gas industry and could even lead to safer facility construction in the future. Although the fire and explosion at Freeport LNG resulted in zero injuries, it still received heavy scrutiny from several regulators and stakeholders. It also acted as a catalyst for LNG opposers looking to discourage Europe and other importing nations from ramping LNG investments, as well as the United States from building greater export capacity.

However, regulatory filings indicate that Freeport LNG handled the incident and the path toward its restart with safety as a top priority. Industry followers should monitor the impact of heightened skepticism toward LNG safety and policy. For now, the economic and environmental advantages of LNG compared to oil and coal continue to make it the fuel of choice for nations seeking a reliable fuel source that can work with existing infrastructure and complement renewable energy investments.