Woodside’s Louisiana Longshot

The Global LNG Industry Faces Whirlwind Of Uncertainty

In July, Woodside Energy (Woodside) announced that it was acquiring all the outstanding shares of Tellurian for US$1 per share in an all-cash transaction. The deal valued Tellurian at US$900 million, or an enterprise value (including debt) of US$1.2 billion. The acquisition price represents a 75% premium to Tellurian’s closing price on July 19, 2024, and a 48% premium to Tellurian’s 30-day volume weighted average price. Notable factors affecting Tellurian’s valuation are the location of its liquefied natural gas (LNG) export terminal, Driftwood LNG, the project’s fully permitted status, advanced stage of pre-final investment decision (pre-FID) development, and its relationships with Bechtel, Baker Hughes, and Chart Industries.

On October 9, Woodside completed its acquisition of Tellurian. Including debt, the enterprise value of the deal is US$1.2 billion, which is dirt-cheap if Woodside is able to develop the project. Woodside seems confident that it can turn the facility into a cash cow in the coming years. By renaming the project Woodside Louisiana LNG, Woodside is marking an end to Driftwood LNG’s dark past and beginning anew.

Woodside expects to reach final investment decision readiness in the first quarter of 2025. In a press release, Woodside said that the Tellurian team and Bechtel have already completed a substantial amount of work to advance to the next stage of development. Woodside also said that it has received multiple requests from companies looking to join Woodside Louisiana LNG as strategic partners.

“This is a major growth opportunity that significantly expands our US LNG position, enabling us to better serve global customers and capture further marketing optimization opportunities across both the Atlantic and Pacific Basins,” said Woodside Chief Executive Officer Meg O’Neill. “Our acquisition provides a new strategic direction for this development. Woodside’s world class expertise in project execution, operations, and marketing means we are well-positioned to unlock the development and generate value. Woodside Louisiana LNG is a competitively advantaged opportunity. It is fully permitted, front-end engineering design is complete and site civil works are well advanced.”

Building Upon An Established LNG Portfolio

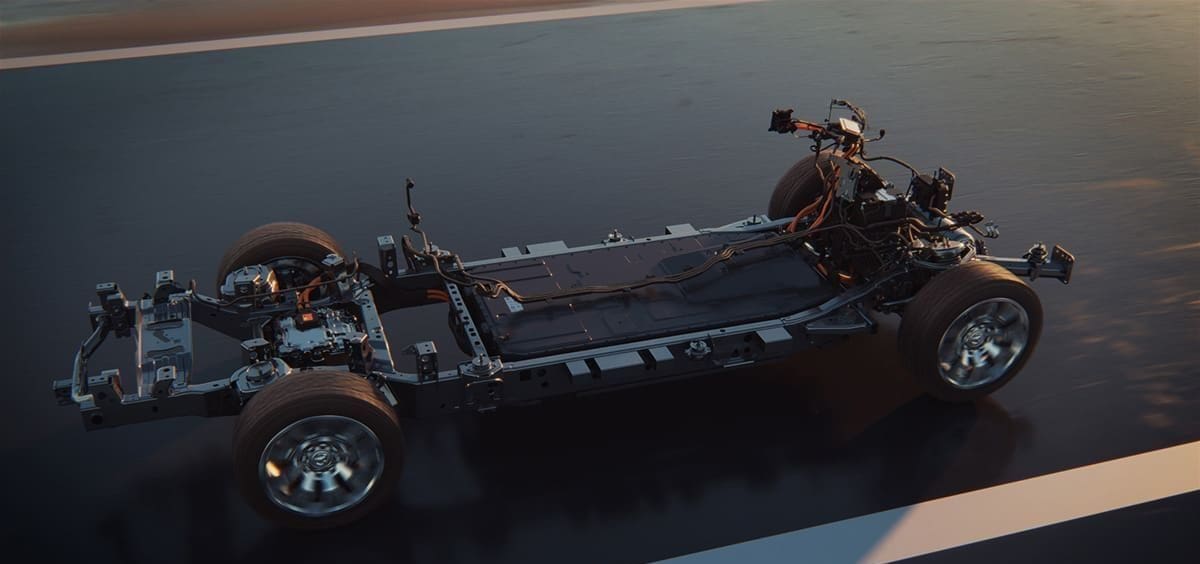

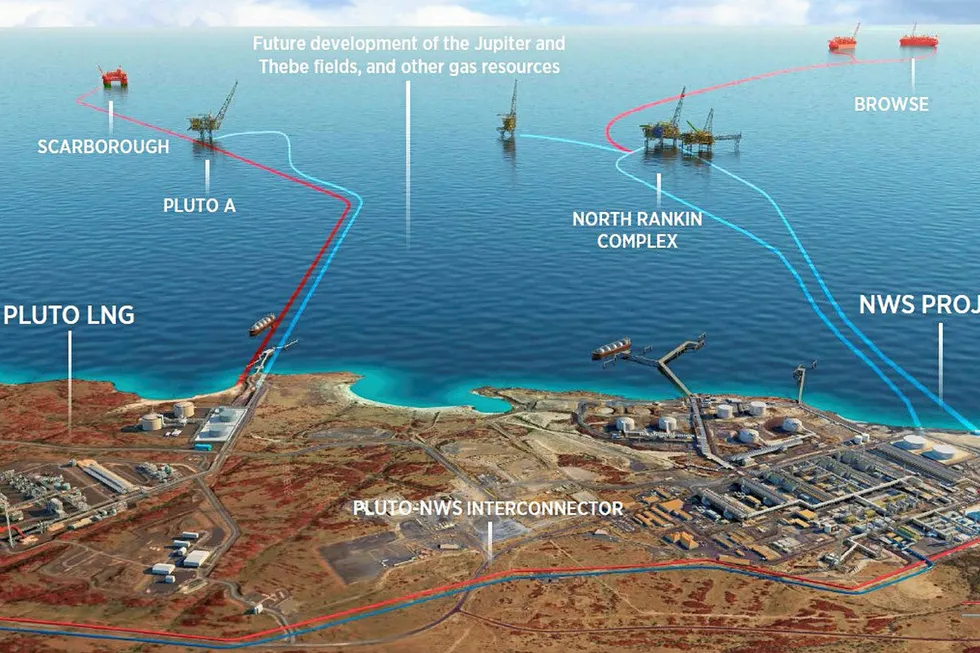

Woodside Louisiana LNG provides a significant amount of diversification to Woodside’s already sizable LNG project portfolio. The crown jewel of Woodside’s portfolio is Pluto LNG. Woodside developed Pluto LNG from 2005 to 2012. The facility processes gas from offshore fields in Western Australia. In June 2022, Woodside commenced construction of a second train at Pluto LNG, which will have a production capacity of around 5 MTPA. Woodside is also modifying Train 1 at Pluto LNG and expects up to 3 MTPA of gas from its Scarborough field will be processed through Pluto Train 1 facilities. All told, Pluto LNG should see its export capacity grow to 10 MTPA.

Woodside’s Scarborough Energy Project aims to produce natural gas offshore Australia and then transport it to the Pluto LNG facility. The challenge is that the Scarborough Energy Project is developing gas from the Carnarvon Basin and then transporting it via pipeline from 233 miles (375 km) off the coast of Western Australia. It’s a significantly further distance than existing Pluto 1 feedstocks, which come from the Pluto and Xena gas fields. From these fields, the gas is transported along 112 miles (180 km) of pipeline.

Pluto LNG is unique because Woodside is involved in the entire process, from production to transport, liquefaction, and shipment. Not all LNG projects are this integrated. In addition to Pluto LNG, Woodside owns a 13% non-operated interest in Chevron majority-owned Wheatstone LNG. Woodside also has several oil and gas projects throughout the world and aggressively invests in new energy technology to help the company reach its environmental, social, and governance goals.

Woodside aims to reduce Scope 1 and 2 greenhouse gas emissions by 15% by 2025, 30% by 2030, and reach net-zero by 2050 at the latest. The targets are based on Scope 1 and 2 emissions of 6.32 MT of carbon dioxide equivalent, which is what Woodside averaged from 2016 to 2020.

(Image Courtesy Of Woodside Energy)

A Dynamic Commodity

Cost-effective projects that are already permitted have become a hot commodity in the LNG industry. On January 24, 2024, the Biden administration announced a temporary pause for pending and future applications to export LNG. The pause applies to new projects and expansions to existing projects that aren’t already under construction. Since Woodside Louisiana LNG was already under construction, it was immune from a pause.

Still, folks may be wondering why Woodside doesn’t just invest in more Australian LNG expansions. The profitability and emissions profile of an LNG project depends on a slew of factors, such as regulations, permitting and development costs, access to natural gas feedstocks, labor costs, commodity prices, transportation costs, and proximity to buyers. Australia may be closer to many of the world’s more prolific LNG buyers in Asia, but it can’t produce LNG as cheaply as some US projects. Growing production out of the Permian Basin and Marcellus/Utica shale feed nicely into LNG export terminals along the Gulf of Mexico. US Pipeline and infrastructure companies and exploration and production companies work well to ensure that there isn’t a lack of takeaway capacity out of regions of production to areas of consumption or processing.

The bigger global threat to US and Australian producers is Qatar. In 2023, the US became the largest LNG exporting country in the world, but that could change as Qatar develops its North Field.

Construction on Qatar’s North Field East Expansion, the first of two expansion phases, began in October 2023. Since then, a slew of partners and investors have jumped on board, including TotalEnergies, Shell, ConocoPhillips, ExxonMobil, Eni, Sinopec, and China National Petroleum Corporation. The North Field East Expansion is expected to bring Qatar’s LNG export capacity from 77 MTPA to 126 MTPA by 2026, and then to 142 MTPA by 2030 with the development of the North Field South Expansion.

The expansion will make Qatar the undisputed leader in global LNG exports, with some forecasts calling for a whopping 27% increase in Qatar’s gross domestic product in 2026 compared to 2025.

Qatar’s abundance of low-cost reserves and state-owned energy industry allows the country to fast-track projects, which is very appealing to foreign investors. Qatar also has arguably less geopolitical risk than Australia and the US because its energy policy will stay pro oil and gas for the foreseeable future.

(Map Courtesy Of Woodside Energy)

Ubiquitous Uncertainty

On September 3, the US Department of Energy (DOE) authorized the export of 1.4 MTPA of LNG of New Fortress Energy’s Fast LNG 1 to non-Free Trade Agreement (FTA) countries for a term of five years. Prior to the news, Fast LNG 1 only had authorization to FTA countries. Fast LNG 1 is located offshore Altamira, Mexico, so it’s under different regulatory scrutiny than projects onshore the US. Still, the DOE’s authorization goes against the Biden administration’s LNG pause.

The incoming Trump administration will likely lift the LNG pause, bring lower regulation, and expedite energy and infrastructure project permitting. However, it won’t automatically mean growth for the LNG industry.

If the Trump administration moves forward with a 60% tariff on imports from China, that could result in retaliation from China through its own tariffs. Or China could simply avoid engaging in contracts for new US LNG production. China is the largest LNG importer in the world, with volumes increasing 12% in 2023. If trade wars escalate, China could simply buy up Qatar’s new production, leaving American and Australian exporters in a bind.

LNG provides energy security and reliability to energy dependent countries looking for lower emission alternatives to coal. But natural gas can also be weaponized to achieve geopolitical objectives, as we saw with Russia turning off Germany’s gas in 2022 or China potentially pausing its purchase of US LNG.

Woodside Louisiana LNG was a way for Woodside to diversify its LNG portfolio and avoid any prolonged permitting pause on US LNG projects, which might have occurred under the Harris administration. But under the Trump administration, pre-approved projects will likely lose some of their added value and all new projects could be under threat if tariffs get out of hand.