Energy Transition Investment Trends

By Drew Robb

With US$2 trillion invested in energy transition projects globally in 2024, one would think that everything was rosy on the net-zero and sustainability front. But when you look more deeply into the numbers, a mix of good and bad news emerges. Jon Moore, CEO (chief executive officer) of green investment analyst firm BloombergNEF, laid out the numbers during the Baker Hughes Annual Meeting 2025 in Florence, Italy. Some areas remain strong, some are weak, and a few have leveled off. Here are the key trends that have emerged:

Worldwide Investment Grows

Moore noted that Asia was the biggest investor in energy transition technologies, with China leading the way. European funding, on the other hand, fell in 2024. The Americas experienced 7% growth, but this was a slowing down compared to previous years, due primarily to policy uncertainty, according to Moore.

“Most global investment was in clean energy and green transportation followed by power grids,” said Moore. “Solar energy dominates renewable energy spending, while offshore wind was down 50% in 2024 compared to the previous year.”

Solar energy propelled renewables to record levels in 2024. Out of US$725 billion of funding for renewable energy in 2024 (up from US$675 billion in 2023 and US$382 billion in 2020), solar accounted for around US$500 billion. Mature markets like North America and Europe continued to increase their investment in solar photovoltaic but the real growth came from places like China and Brazil.

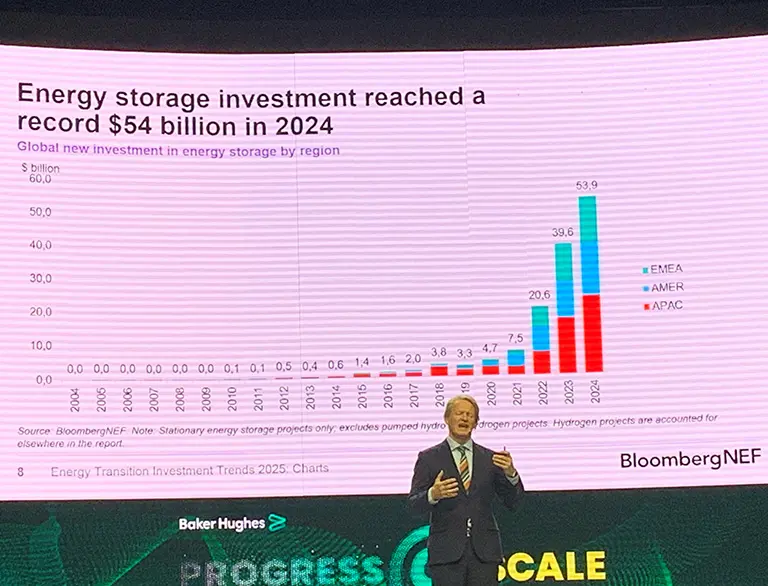

Energy Storage Soars

Energy storage was the big winner in 2024. It was up 36% compared to 2023 and reached US$54 billion worldwide. Battery pack costs dropped by about 20%, adding impetus to the trend.

Going back a decade, global investment in energy storage was as little as US$600 million. It rose to US$4.7 billion in 2020 and from that point is achieved almost exponential expansion — US$7.5 billion in 2021, US$20.6 billion in 2022, US$39.6 in 2023, and more than US$50 billion now, with no signs of slowing down. After several years of proof-of-concept and small-scale facilities, we are now seeing utilities step up with a series of mega-projects.

“Utility scale projects in energy storage made up 58% of total global investment,” said Moore.

EV (electric vehicle) sales and investments are also strong. EVs continued to post good numbers — 20% increase globally over 2023 despite rumors of Rivian’s financial troubles and anti-Musk sentiment potentially impacting Tesla. Electrified transport spending such as buses and trucks is growing, too, but forms a small portion of the overall pie. The market is being driven by passenger vehicles.

Grid investment was up 15% globally in 2024, achieving a record high of US$390 billion. The US, China, Europe, and Asia were particularly bullish on grid expansion and upgrade funding.

The Two-Speed Energy Transition

Moore made the point that a two-speed energy transition is emerging. “Mature sectors like power grids, energy storage, renewable energy, and electrified transport are expanding the most and account for 93% of total investment in the energy transition,” he said. “Emerging or less mature sectors are slowing in some areas and only make up 7% of total investment.”

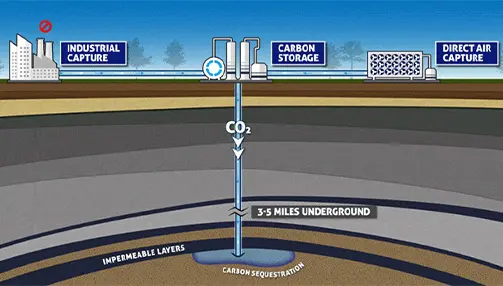

He’s talking about areas such as nuclear, CCS (carbon capture and storage), hydrogen, and clean shipping. After a peak of US$200 billion in 2023, investment in these areas fell to US$154 billion in 2024.

CCS, for example, fell dramatically after soaring from US$6 billion in 2022 to US$13.6 billion in 2023, CCS investment more than halved to US$6.1 billion in 2024. It was down in almost all areas of the world, especially EMEA (Europe, the Middle East and Africa). The US dropped from US$5.1 billion to US$3.9 billion. The one big plus for CCS is the energy sector where investment more than doubled from US$800 million to US$1.9 billion.

“Power sector CCS investment surged in 2024, but this didn’t offset the fall in other areas,” said Moore.

Other struggling areas include clean aviation, clean shipping, electric heat pumps, and nuclear. Despite all the hype over the past year about nuclear, global investment remains flat worldwide at around US$30 billion per year.

Is The Hydrogen Boom Over?

One of the biggest losers in 2024 turned out to be hydrogen. 2023 was a record year for hydrogen production at US$3.9 billion invested. It collapsed to US$800 million in 2024. A litany of project cancellations, and continual problems over hydrogen availability, affordability, and feasibility have dampened enthusiasm.

“Clean hydrogen investment in areas as hydrogen electrolyzers fell for the year although investment in hydrogen-ready pipelines grew a little,” said Moore.

Sustainable Energy Solutions Across Industries

Moore followed his summary of statistics by hosting a panel on what it will take to fund the energy transition and make it successful. Jennifer Obertino, senior vice president, global energy practice leader at infrastructure consultancy AECOM, said her company is involved in major investments in liquefied natural gas, the transmission grid, battery storage, and CCS.

“We need to develop a sustainable market that doesn’t depend upon subsidies,” she said.

Jeff Miers, global director of partnerships and alliances for energy and utilities at Amazon Web Services, laid out his company’s net-zero ambitions. As the largest purchaser of renewable power in the world, Amazon participates in 600 wind and solar projects globally. In addition, its large fleet of electric vehicles is becoming increasingly visible (it has 20,000 Rivian electric delivery vans operating and more coming). The company has also been testing hydrogen fuel cells and investing in CCS.

“We plan to deploy 5 GW of nuclear power by 2039,” said Miers. “We see a strong link between AI [artificial intelligence] and decarbonization as a way to speed the energy transition.”

Meanwhile, Jennifer Holmgren, chair and CEO of biotech company LanzaTech is engaged in recycling carbon emissions into plastics. The company takes industrial gases from steel mills or solid waste and uses bacteria to convert them to methanol and then to plastics. Six commercial facilities are already running. Funding is needed to scale projects up further.

“We use gas fermentation to make use of carbon rather than trying to capture it and store it underground,” said Holmgren.

Tayba Al Hashemi, CEO of Abu Dhabi energy producer ADNOC Offshore, claimed his company was the lowest carbon intensity producer in the world. It has already put US$23 billion into decarbonizing its operations and developing/adopting cleaner solutions. This includes US$3.8 billion to electrify its offshore operations to reduce emissions by 50%, which should be completed by 2026. AI, too, is getting plenty of funding.

“We spent half-a-billion dollars on AI in value creation in 2023 and we are just scratching the surface,” said Hashemi. “We currently have 40,000 people being trained in AI so they can be used to further enhance our operations.”

Editor’s Note: For more information on the products, systems, and technologies that are driving sustainability, visit esgreview.net. Updated with new content every Wednesday, esgreview.net is home to feature articles, news items, and more. In addition, ESG Review Magazine is published quarterly and delivered to readers in February, May, August, and November.