Over the last 230 years, Flowserve has built a portfolio of fluid motion and control products. The company is one of the most integrated and specialized flow control product manufacturers and aftermarket services providers in the world, offering expertise in pumps, seals, valves, actuation and instrumentation products, energy recovery devices, decoking systems, and more. The company’s largest end market is oil and gas, followed by chemical, general industries, power, and then water. In terms of geographies only about 40% of Flowserve’s sales come from North America, with Europe and Asia Pacific each making up about 20% of sales and the Middle East, Africa, and Latin America combining for the final 20%. Flowserve had more than US$3.5 billion in 2021 sales and more than US$1 billion in 2021 gross profit.

Given its size, history, product and services differentiation, and international exposure, Flowserve is at a unique position when it comes to unlocking energy transition opportunities. For example, the company’s core business is grounded in legacy markets, but it has also pledged ambitious climate targets and is rapidly investing in liquefied natural gas (LNG), hydrogen, carbon capture, renewable fuels, and other low-carbon solutions. In 2020, Flowserve committed to reducing its carbon emissions by 40% from 2030 off of a 2015 baseline. As of 2020, it already achieved 57% of that target. It is also investing in new technologies to reduce emissions and drive performance for its customers.

LNG’s Role In The Energy Transition

Flowserve believes that emerging hydrogen technologies are at a crossroads and that working toward greenhouse gas-free hydrogen production and utilization will require both industry-wide efforts and new policy. The company believes that hydrogen and LNG have their pros and cons but will be integral contributors to the energy transition. “Unquestionably, LNG has a significant role to play in energy transition,” said Rakhi Oli, global strategy and partnerships development leader of LNG/Gas at Flowserve. “LNG is a known game to us; the entire LNG value chain from production all the way to distribution is figured out. It is the only at-scale fuel choice available today from the perspective of meeting the massive needs of growing economies to decarbonizing hard-to-abate industrial areas.”

Developed nations are increasingly transitioning away from coal and oil toward natural gas due to its attractive cost profile as well as its lower emissions. Natural gas emits up to 50% less carbon dioxide (CO2) than coal and is therefore a more climate friendly feedstock when it comes to hydrogen production and power generation. Natural gas is also a more reliable source of power than solar and wind. For these reasons, natural gas will likely play a complementary role to renewables in the decades to come.

Flowserve believes that natural gas and LNG are unique in that they are lower-emissions solutions that are available right now and can be used to drive economic progress in developing nations. “There are two areas to highlight on this topic: pragmatic fuel of choice to meet the transitional needs of growing economies [like the Asia-specific region] and the phased approach these growing economies will embrace,” said Oli. “While the growing economies take the phased approach toward deploying the emerging technologies, in the near term, LNG will be a significant bridge fuel. LNG to power projects is gaining a lot of momentum and traction because of the continuing shortage in power generation capacity across the globe.

A common criticism of LNG, particularly for developing nations in geographies that are conducive to wind or solar, is that renewables may be a better long-term investment since renewable development costs have come down and the carbon profile is less harmful. LNG projects take time and can be costly for countries that lack ample existing pipeline and storage infrastructure. However, LNG’s use cases are far more extensive than that of renewables, as LNG can make a sizeable impact in power generation, residential, commercial, industrial, and even the transportation sector.

The common use case of natural gas for transportation is through compressed natural gas (CNG). However, the maritime shipping industry is an often overlooked segment of the transportation sector that can benefit mightily from a transition toward LNG. “There is an increasing deliberation about using LNG to power projects; it is a relatively rapid way of adding significant capacity to the grid,” said Oli. “The biggest driver for the uplift of LNG economy also comes from its increased use within the transportation sector. This includes onshore and offshore marine transportation. With the International Maritime Organization’s (IMO) tightening of sulfur oxides (SOx) regulations introduced in January 2020, LNG as a marine fuel is a perfect decarbonization solution. One highlighted objective of the shipping industry is to transform their vessels from diesel-powered to LNG-powered to meet the IMO’s 2030 net-zero targets. The LNG industry has been widely open to the adoption of emerging technologies, be it digitization or energy optimization and efficiency projects. Being adaptive to new technologies also makes LNG an ace in the energy transition game. I am a big supporter of LNG, but let’s be pragmatic. As far as the cons are concerned, while LNG’s carbon footprint is smaller than diesel and petrol, it is not completely carbon-free. However, I think with aspirations in place for producing carbon-neutral LNG, and digitization and efficiency improvement projects supporting these aspirations, LNG’s carbon footprint will be drastically reduced in the coming years.”

Use Cases And Limitations Of Hydrogen

Conversations surrounding a net-zero hydrogen economy tend to revolve around green hydrogen. That is, hydrogen produced using clean energy. However, the vast majority of hydrogen currently produced (mainly for refining and ammonia) doesn’t come from renewable sources. Grey hydrogen is produced using steam reforming from natural gas, while blue hydrogen is produced using steam reforming from natural gas paired with carbon capture, utilization, and storage (CCUS). There’s even pink hydrogen, which is produced using nuclear energy. “As a world, we collectively emit approximately 51 billion tons [46.3 billion tonnes] of CO2 and CO2 equivalent emissions per year, and we need to address that,” said Willis Staszkow, director of Emerging Technologies and Energy Transition at Flowserve. “Addressing this problem by using one technology or one avenue is not the solution. We need to take a holistic approach to make progress toward 2030, and eventually 2050, net-zero goals. You can look at the set of goals to get to 2030 and then those to get to net zero in 2050; how you reach those goals will be different. While green hydrogen is a long-term solution, it is in early stages in terms of usage. Blue hydrogen, however, can help us make a more immediate impact. It allows us to build out the infrastructure of carbon capture because it can be implemented using grey hydrogen’s current production and capture processes.”

“The benefit of blue hydrogen is it gives us an opportunity to use the existing infrastructure,” said Oli. “Retrofitting hydrogen production with CCUS would allow the continued use of these assets while still achieving lower GHG emissions goals. It could cater as a transition shade until the green hydrogen technologies become at scale and cost competitive, especially within regions where sequestration sites are easily accessible and available. In the near term, I think we will have to be colorblind when it comes to hydrogen. There is a value proposition that each hydrogen color brings. Green hydrogen needs blue hydrogen to advance in demand, both financially and structurally. The energy tapestry will have green, blue, turquoise, and many other colors in the near term until we develop the green technologies at scale to meet the humungous energy demands. For a particular economy, the hydrogen production color that works best will depend upon the geographic deployment location and the geopolitical barriers and challenges that apply to that deployment location. Additionally, policy frameworks and governmental supports within that economy are also significant factors in the [hydrogen production] color selection process.”

Technologies And Solutions For Hydrogen And LNG Markets

Flowserve is exploring ways to propel the hydrogen economy forward, both through green hydrogen and blue hydrogen. “We are strategically looking into this segment,” said Oli. “We continue to adopt and develop new solutions and offerings, which will help us meet our product gaps and diversify even further. We are also engaging in the development of nontraditional strategic partnerships within the industry to move us forward with agility in the ever-evolving marketplace; our focus is on product and market extension.”

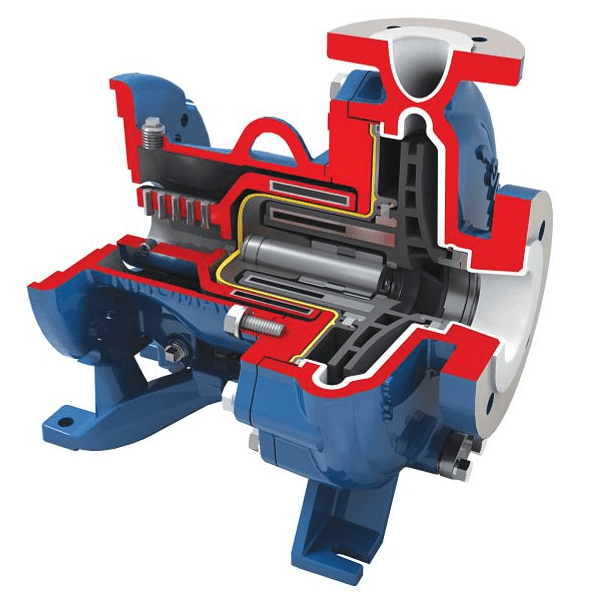

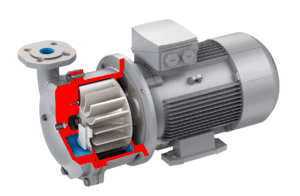

“We are getting involved with startup companies that are looking to scale up their technologies in green hydrogen,” said Staszkow. “Flowserve’s existing product lines — like our INNOMAG TB-MAG lined seal-less pumps and SIHI liquid ring vacuum pumps — are helping these companies in their initial startups and in how they are going to scale up in the future. We are also incorporating Flowserve’s RedRaven internet of things [IoT] condition monitoring and predictive analytics services platform into installations to give them valuable information as they work through these technologies.”

With a lack of existing hydrogen infrastructure and the need for capital-intensive investments, phase-in solutions like LNG could play an even bigger role supporting growing energy demand to buy time for the hydrogen economy to take form. “The limited existing hydrogen pipeline infrastructure is one challenge to look into,” said Oli. “The shipping route of transporting hydrogen would involve building one plant to liquefy the gas first and a second to convert it back to gas before consumption at the destination. So, beyond the technology risks, a project might also involve building pipelines, liquefaction plants, or even an onsite wind or solar energy farm to secure the green electricity for the green hydrogen projects. And with all these challenges, synergies between the hydrogen and LNG value chain to retrofit the existing pipeline infrastructure and reuse existing infrastructure would be another aspect to look into. There are gaps within the commercial execution of mega hydrogen projects, and that is where the government’s support and policy frameworks need to be built further. I spearheaded a forum titled Making Commercial Hydrogen Projects Bankable. One theme that was cohesively reiterated by most of the panelists was that there is a very minimal financial market for trading hydrogen or hydrogen derivatives. Producers cannot take any future contracts to guarantee the price of hydrogen that they produce. And that is where the entire debate on financing the hydrogen economy and capital projects begins.”

“Hydrogen implementation will happen in a phased approach because the production of cleaner hydrogen is costly and the infrastructure to distribute it does not exist,” said Viswadeb Ganguly, director of Application Development and Strategic Partnerships at Flowserve. “Both production and infrastructure are capital-intensive. So, who is going to run with this first? Those who are already consuming hydrogen, and those sectors are steel, cement, and refining. When hydrogen becomes acceptable in the larger practice, what we foresee is that heavy-duty transportation may become one option. But for that to happen, fuel-cell technology must become economically viable. Currently, the fuel cell is in the technological development phase. In the meantime, Flowserve is getting deeply involved in LNG and preparing ourselves for the future of hydrogen. It is a two-fold decarbonization strategy.

Changing Customer Demands

As companies evolve over time, changes can be seen through modernized corporate objectives, shifting product mixes, new technologies, and geographic exposure. One often overlooked paradigm for change is the customer profile of a company. While Flowserve’s core customer base hasn’t necessarily changed too much, the objectives of those customers have, acting as a driver for Flowserve to update its solutions to meet the needs of its customers. “The profile of our core customers and that of our energy transition customers looks similar, to some degree, depending on what a customer’s focus is: LNG, carbon capture, renewable fuels,” said Staszkow. “These are many of our customers. But what we are seeing is that with emerging technologies, new customers and companies are coming into the picture, too. These are startup companies that want to improve their technologies and scale up. They want more knowledge on flow control. That’s where Flowserve brings value. Customers in this energy transition space can rely on us to provide flow control solutions to help perfect their current technology and scale up.”

“Because the project implementation architecture is not fully developed, we can help customers in the energy transition space,” said Ganguly. “In a conventional mature market, we know who the technology provider is, the engineering contractor, the construction contractor, equipment supplier, and so on. In this emerging space, everything is being built. Things are still being defined, and there are a lot of gaps. Our focus is to add value through emerging technologies and our expertise.”

“The energy transition is also about how efficiently you’re using your energy right now, and how you can further improve that efficiency,” said Staszkow. “Flowserve evaluates the entire flow loop, looking at how a system is currently running and how it can be made more efficient. By making systems more efficient, we are saving customers energy and electricity, helping them decarbonize and have more uptime. We also evaluate our customers’ equipment, so it runs longer and more reliably.”

“Flow is at the heart of energy optimization,” said Oli. “Everything and anything in the facility is governed around flow. Once you can optimize the flow, you will see a change in efficiency. As a turnkey solution provider, our Energy Advantage Program is dedicated to showing that advantage to our customers from three perspectives: carbon, cost, and efficiency. We are working cohesively to introduce and implement our energy advantage initiatives in the brownfield LNG and oil and gas facilities, specifically the ones that have been running for five to six years now. Our ‘3D’ strategy of diversification, decarbonization, and digitization ties in with meeting and adopting emerging trends within LNG and energy transition. We are diversifying within the small- to mid-size modular LNG floating regasification segment by evolving our technology and making it fit for purpose.”

The Role Of Alternative Fuels In Decarbonizing Existing And New Industries

A conversation about the energy transition wouldn’t be complete without addressing the role of alternative fuels, specifically liquid fuels such as biodiesel, renewable diesel, and sustainable aviation fuel (SAF). “In the short term, the expected growth will come from renewable diesel and SAF because of mandates in Europe and North America,” said Ganguly. “Flowserve sees adjacency to this segment; for renewable diesel and SAF, a good portion of the investment is being made on modification of existing assets or brownfield facilities in refining. This means sometimes new facilities will be built, and other times existing facilities will be repurposed with new equipment. This is an area Flowserve understands very well. We are working to bring in more advanced products to fit the needs of this market segment. The second part of alternative fuels we can talk about involves converting CO2 to useful liquid fuels; this is nascent technology. Another option would be to use ethanol or other alcohols for conversion to jet fuels sometime in the future. This space is still evolving, and the technologies will need more time for large-scale adoption. The third alternative fuel is hydrogen; it will initially be used as a greening or decarbonization initiative in existing facilities in petrochemical and refining and possibly in steel manufacturing. The use of hydrogen as an at-scale transportation fuel is probably eight to 10 years away because of the lack of infrastructure and technological development needed to improve fuel cell efficiency.

The Early Stages Of The Energy Transition

The potential of renewable and alternative fuels is undeniable. However, the cost profile of these fuels remains unattractive, which makes legislation vital for adoption to grow. What’s more, geopolitical events have put an emphasis of energy security and availability. One may think that it’s hard to work toward sustainability when energy security is faltering. However, new energy opportunities can lower emissions and improve energy security by shaking up the landscape of energy producers and importers. “Renewable fuel adoption is largely incentivized by state policies,” said Ganguly. “In the United States, California is leading the adoption; it is expected other states will follow. SAF adoption is also largely driven by mandates in North America and Europe but are not a global phenomenon as we speak. The urgency in Europe is triggered by geopolitical events, and this is where the use of green hydrogen is the focus. This region is actively working to accelerate the acceptance of hydrogen compared to what would have been in a business-as-usual environment.”

LNG makes it possible to import from trustworthy countries, opening the door to energy security and leaving energy dependent countries less reliant on ground-only pipeline networks. Similarly, hydrogen tilts the energy balance toward a new cohort of producers, which gives energy importers more options. “When it comes to hydrogen adoption, we see more opportunities for blue hydrogen in North America and green hydrogen in Europe, the Asia-Pacific region, and the Middle East,” said Ganguly. “There is some interest in the adoption of pink hydrogen, but only in very selective markets. Because the energy source is a nuclear reactor, production cost is high, and the adoption policy framework is yet to be in place.”

Given the development of geopolitical tensions and energy instability, the energy transition is no longer merely a decarbonization opportunity. Rather, the energy transition offers the chance to reimagine the global energy supply chain by making energy access more reliable, less expensive, and less carbon intensive. Companies that can offer customers practical solutions in a variety of applications stand to benefit as hydrogen, LNG, and alternative fuels all play a growing role in the energy transition.