Whether discussing an individual, organization, or company, delivering on promises involves bridging the gap between expectations and reality. Often, the closer we are to our best selves, the happier we are. The best candidates for public office align policy with the consensus wishes of their constituents. A company must juggle the needs of its employees, customers, shareholders, and the communities it serves. The list goes on.

The stakes are higher when it comes to delivering on promises in the energy sector. After a rip-roaring 2021 where the energy sector went from the worst-performing sector of the economy to the best performing (as measured by equity returns), expectations were set for 2022 to sustain the boom. Yet, as geopolitical events escalated starting in late February 2022, there was a renewed emphasis on energy security, reliability, and cost.

The energy sector had a tall order in 2022. As a collective unit, it delivered on its promises to stakeholders without losing sight of the big picture. We’ll briefly discuss the ways in which the energy sector exceeded expectations in 2022, and then call out some of the year’s most notable mergers and market-moving developments.

The Energy Sector’s Greatest Challenge

Publicly traded companies are tasked with creating long-term value, which is no easy feat considering the wide array of options available. For example, a fast-growing young company primarily drives value through organic growth. Established companies in mature industries generally don’t grow as fast, but they can still deliver value with superior capital allocation, timely mergers and acquisitions (M&A), and a healthy capital structure that isn’t overly reliant on debt. They can also repurchase stock or consistently raise a dividend to provide a source of passive income, which takes the pressure off growing revenue and earnings at a market-beating pace.

After the oil and gas downturn of 2014 and 2015, Wall Street’s tolerance for over expansion and high leverage halted. The objective shifted from expansion to a preference for consistency and positive free cash flow (FCF), even at the expense of growth. Companies that demonstrated regimented growth and passed the stress test of the 2020 crash were rewarded.

If you tune into public earnings calls and M&A announcements, you’re going to hear a lot of discussion about FCF. And for good reason. FCF is the lifeblood of a healthy business. The formula is simple: subtract capital expenditures from operating cash flow. Simply put, it’s the money left over after expenses are paid and long-term investments are made. FCF can be used to do all sorts of things, like paying down debt, M&A, paying dividends, buying back stock, or reinvesting in the business. Generating consistent positive FCF no matter the market cycle ensures a company has the powder needed to execute on its promises to investors. It’s a concept that is talked about across sectors, particularly when the economic outlook deteriorates.

Just as we saw FCF discussed heavily in the energy sector over the past few years, so too are we seeing a heavy emphasis on FCF in the technology sector. The valuations of many high-growth companies have been compressed. Those with negative earnings and FCF have suffered a particularly severe sell-off because these companies must rely on debt issuance or equity dilution to make ends meet since the business can’t pay its bills. Put another way, negative FCF means that the cash going out of the company exceeds the cash coming in.

As important as FCF as to a business, the energy sector has added responsibility that few other sectors can match. If the lights don’t turn on, the water doesn’t run, there’s no fuel to start your car, and no gas to keep you warm, the modern economy doesn’t exist. Without original equipment manufacturers (OEMs), engineering, procurement, and construction (EPC) firms, producers, distributors, pipeline and infrastructure companies, and refiners, the integrated value chain breaks.

When Germany’s Emergency Plan for Gas went from level one to level two alert, it put the world’s fourth-largest economy on the brink of economic disaster. An economy built on manufacturing and industry cannot function without reliable raw material and energy inputs. Although the ripple effects of an energy-deprived Germany are unknown, the integrated nature of the modern economy means that Germany’s energy insecurity would severely impact Europe. Scale up that energy insecurity to the international level, and the energy sector becomes undeniably the single most essential part of the modern economy.

Aside from energy reliability and security, the energy sector must also contend with the harsh truth of climate change. A rising population that is increasingly industrialized cannot be sustained on fossil fuels alone without irreversible impacts on our planet. This is where the importance of ESG comes into play.

In sum, the energy sector had three primary expectations for 2022:

- Drive shareholder value by maintaining financial discipline and consistent positive FCF.

- Prioritize safety and reliability to foster energy security.

- Achieve the first two expectations while also lowering emissions and charting a path toward decarbonization.

The Logical Path Forward

Taking these expectations collectively illuminates the challenge: how does an oil and gas company make more money while also lowering emissions and sustaining positive FCF? Overinvesting would jeopardize positive FCF. Producing more oil and gas would put long-term ESG goals in jeopardy. Reducing operating expenses to try and squeeze higher margins could have an adverse effect on safety and reliability.

It is no accident that many oil and gas companies, large and small, integrated and pure-play, have come to the conclusion that the best way to balance expectations and position the company for long-term growth is to invest in emissions reductions efforts, low-carbon fuels, alternative energy, and renewable energy.

The past couple of years have presented a golden era for energy diversification. Margins are up because oil and gas prices are high and companies aren’t ramping production, which has led to a prolonged supply/demand imbalance. Demand could fall if there’s a global recession, but regardless of the short-term economic scenario there’s reason to believe oil and gas investment could remain muted for some time. In 2021 and 2022, we saw an overwhelming number of companies use outsized profits to pay down debt, grow dividends, repurchase stock, and make sizeable investments in energy transition efforts or go out and acquire companies that can drive profits while lowering emissions. For example, Chevron was able to generate more than US$5 billion in FCF for six consecutive quarters from Q2 2021 to Q3 2022. The company is on track to deliver its highest annual profit in history, all the while keeping production flat. In Q3 2022, Chevron produced more than 700,000 barrels of oil equivalent per day (boe/d) out of the Permian Basin and is on track to produce more than 1 million boe/d by 2025. Chevron sold other production assets and let contracts expire, so its average Q3 2022 global production was higher than Q3 2021.

ExxonMobil and Chevron have been keeping a lid on production and letting high margins work in their favor while reinvesting capital in long-term oil and gas projects, liquefied natural gas (LNG) projects, and the energy transition. Chevron is a good example of a sizeable company keeping production flat and using its gobs of FCF to improve its capital structure, improve its asset portfolio without increasing its emissions, and make acquisitions grounded in alternative energy. In June, Chevron finalized its acquisition of renewable fuels giant, Renewable Energy Group, in an all-cash transaction valued at US$3.15 billion.

Critics may question why many oil and gas companies aren’t boosting production when they have the means to do so. Taking a step back and looking at multi-decade environmental commitments paired with stakeholder incentives makes the choice to allocate capital toward decarbonization efforts a no brainer. Aside from environment-focused investments, companies can also unlock growth through M&A and business moves such as supply and distribution deals, partnerships, and other collaborations. Acquisitions simply pass ownership from one party to the next. In this vein, they offer an easy way to boost growth without harming the environment. And in many ways, synergies often lead to lower overall emissions. With that backdrop in mind, let’s reflect on some of the most notable business happenings of 2022.

Offshore Mega Merger

Maersk Drilling (Maersk) and Noble Corporation (Noble) completed a merger on October 3, 2022. At the time of the announcement in November 2021, the two companies were valued roughly the same, with Maersk fetching a market capitalization of US$1.73 billion versus Noble’s US$1.87 market capitalization. Given how close the two companies are in value, the deal will be a 50/50 split, with the new company being named “Noble Corporation.” Noble and its subsidiaries operate 12 drillships and semisubmersibles and eight jack-up rigs that are primarily contracted for ultra-deepwater projects in mature and emerging plays. Maersk owns 19 offshore rigs and specializes in harsh environments and deepwater projects. Given the two company’s similarities, merging seems to be a natural fit. The companies expect that the merger will result in US$125 million of annual cost savings starting roughly two years after the transaction is approved. In addition to financial strength, better earnings potential, higher FCF, and better expected shareholder returns as primary reasons for merging, Maersk and Noble seek to consolidate the offshore drilling industry and make their combined fleet more competitive in challenging markets.

Chisholm Sells Permian Assets To Earthstone For US$604 Million

Earthstone Energy (Earthstone) announced the US$604 million acquisition of privately held Chisholm Energy Holdings LLC (Chisholm). Chisholm was majority owned by Warburg Pincus LLC. Its assets are located in the northern Delaware Basin of the New Mexico portion of the Permian Basin. The acquisition increased Earthstone’s Permian Basin acreage by 35% to 138,000 net acres. The deal consists of US$340 million in cash, US$70 million of deferred cash due over the 12-month period following the deal’s closing, and 19.4 million shares of Earthstone Class A common stock valued at US$194 million as of the December 15, 2021, closing price. The effective date of the acquisition is November 1, 2021. The deal was closed on February 15, 2022.

Enerflex Agrees To Buy Exterran

A merger between Calgary-based Enerflex and Houston-based Exterran is a deal that’s been talked about in gas compression circles for quite some time. The speculation came to an end in late January when Enerflex announced it would acquire Exterran in an all-stock transaction that values the combined entity at an enterprise value of US$1.5 billion. The new company will remain headquartered in Calgary, Alberta, Canada, and be led by Enerflex’s C-suite and board, plus one board member from Exterran. The transaction was completed on October 13, 2022.

Enerflex is a single-source supplier of natural gas compression, gas processing, refrigeration, and electric power generation equipment. Enerflex covers the entire project lifecycle including engineering, design, manufacturing, construction, installation, commissioning, maintenance, and servicing. The company has a 250,000-sq.ft. (23,226-m2) facility in Calgary, a 260,000 sq.ft (24,155 m2) facility in Houston, and a 40,000 sq.ft. (3716 m2) facility in Eagle Farm, Australia. Enerflex packages Ariel, Dresser Rand, and General Electric compressors along with Caterpillar and INNIO Waukesha engines. It also has a relationship with Howden Thomassen Compressors B.V. in serving the low-speed reciprocating compressor market.

Exterran has a similar profile, but its specialty is cryogenic applications and oilfield water reuse and recycling. It also focuses on natural gas processing and treatment solutions. Throughout its nearly 65-year history, Exterran has treated 8 billion barrels of water, built more than 400 gas processing and treatment plants, installed more than 14,000 natural gas compression packages, has delivered more than 42,000 compression skids, and has 230 plants and compression stations under contract.

According to Enerflex, the newly combined entity is meant to further address natural gas markets and energy transition initiatives, including carbon capture, utilization, and storage (CCUS), renewable natural gas (RNG), hydrogen, and electrification.

Burckhardt Compression And KB Delta Unveil Strategic Partnership

Burckhardt Compression (Burckhardt) and KB Delta signed an agreement in which Burckhardt became a worldwide distributor for KB Delta. Headquartered in Torrance, California, KB Delta designs and manufactures interchangeable OEM and aftermarket products such as metallic compressor valve plates and rings ranging from 1 to 15 in. (25.4 to 381 mm), and high-performance thermoplastic compressor valve parts in PEEK (polyetheretherketone), carbon PEEK, mid temperature, and nylon, including X-Type materials. In addition to thermoplastic and metallic plates, KB Delta stocks essential compressor valve peripherals such as locknuts, center bolts/studs, guide pins, lift washers, springs, spring plates, guide rings, O-rings, gaskets, seats, guards, and complete valve assemblies. The two companies are no strangers to one another. KB Delta has been a longtime suppler of compressor parts to Burckhardt.

KB Delta has been in expansion mode since the 2020 launch of the company’s global initiative, a move that put partners in place on six continents and counting. A result of the new partnership, KB Delta immediately gains access to new global markets thanks to Burckhardt’s worldwide sales network. For Burckhardt, access to KB Delta’s extensive inventory of reciprocating compressor parts reduces the time required for overhaul and repair work. The agreement with KB Delta immediately strengthens Burckhardt’s local presence throughout North America thanks to KB Delta’s partner and service network throughout the United States and Canada. While the benefits listed cannot be understated, perhaps the biggest gain for each company is access to the other’s expertise. Burckhardt now has access to KB Delta’s component design and manufacturing expertise and KB Delta unlocks access to Burckhardt’s expertise in reciprocating compressor technologies and services.

MAN’s Half-A-Billion-Dollar Hydrogen Investment

Less than a year after acquiring majority ownership of H-TEC Systems (H-TEC), MAN Energy Solutions unveiled a multiyear plan to invest more than US$550 million in its subsidiary company. Specializing in hydrogen development and research, H-TEC produces electrolysis stacks and electrolyzers based on the polymer-electrolyte membrane (PEM) process for green hydrogen production. Headquartered in Germany, the company offers integrated container solutions in the MW range. MAN Energy Solutions acquired the majority of shares of Augsburg, Germany-based H-TEC in June 2021.

Warren Buffett’s Oil And Gas Investments

In less than three years, Warren Buffett-led Berkshire Hathaway (Berkshire) went from not owning any Occidental Petroleum (Oxy) equity to owning 20.9% of the company. Berkshire acquired the bulk of its Oxy position in the first half of 2022. As of press time, Oxy is Berkshire’s sixth-largest public equity holding. Berkshire also acquired a great deal of Chevron stock. As of press time, Berkshire owns 8.5% of Chevron, a position valued at US$30 billion. Chevron is Berkshire’s third-largest public equity holding behind Bank of America and Apple.

QatarEnergy Enters Five JVs For World’s Largest LNG Expansion Project

Since completing its 14th LNG train at RasGas 3 in 2010, Qatar’s LNG growth has been relatively muted. However, Qatar has plenty of untapped reserves left in its North Field cash cow. Known as the North Field Expansion (NFE), Qatar plans on increasing its LNG export capacity from its current 77 MTPA to a staggering 126 MTPA by constructing four trains by 2025 and then adding two more by 2027. In October 2020, Qatargas, which is 100% owned by Qatar Energy (QE), reaffirmed its intention to expand North Field production, receiving final proposals from engineering firms in September 2020. In 2021, QE began accepting bids from various EPC firms, as well as bids for financing. Over the course of June and July 2022, TotalEnergies, ExxonMobil, Shell, ConocoPhillips, and Eni each won a stake in the NFE. The project is estimated to cost US$29 billion.

WM Invests US$825 Million Toward 100% RNG-Fueled Natural Gas Fleet

WM, formerly known as Waste Management, is investing US$825 million between 2022 and 2025 to expand its RNG infrastructure with the goal of outfitting its entire natural gas fleet with RNG by 2026. Investments include RNG production plants, landfill gas-to-electricity plants, and other projects that WM estimates will power 1 million homes across North America. Between 2010 and year-end 2020, greenhouse gas (GHG) emissions were reduced by 43% for its collection and support fleet.

Tellurian Lands US$125 Million Haynesville Shale Acquisition

Tellurian Inc. (Tellurian) announced that Tellurian Production LLC (TPC), a wholly owned subsidiary of Tellurian, agreed to purchase US$125 million of natural gas production assets located in the Haynesville Shale from privately held EnSight IV Energy Partners LLC and EnSight Haynesville Partners LLC (collectively EnSight). EnSight’s assets include roughly 45 MMscf/d (1.27 × 106 m3/d) of natural gas; approximately 5000 net acres (2023 ha) in the core of the Haynesville Shale in DeSoto, Bossier, Caddo, and Webster Parishes, Louisiana; 44 producing wells and five wells in progress at transaction close; and proved reserves of approximately 108 Bscf (3.06 × 109 m3) of natural gas.

BlackRock Buys Vanguard Renewables

Vanguard Renewables, an organics-to-renewable energy company, announced that a fund managed by BlackRock Real Assets acquired the company from Vision Ridge Partners. BlackRock Real Assets will partner with Vanguard Renewables’ management team to build on the company’s track record and drive its next phase of growth, including its plans to commission more than 100 anaerobic digesters to produce RNG across the country by 2026.

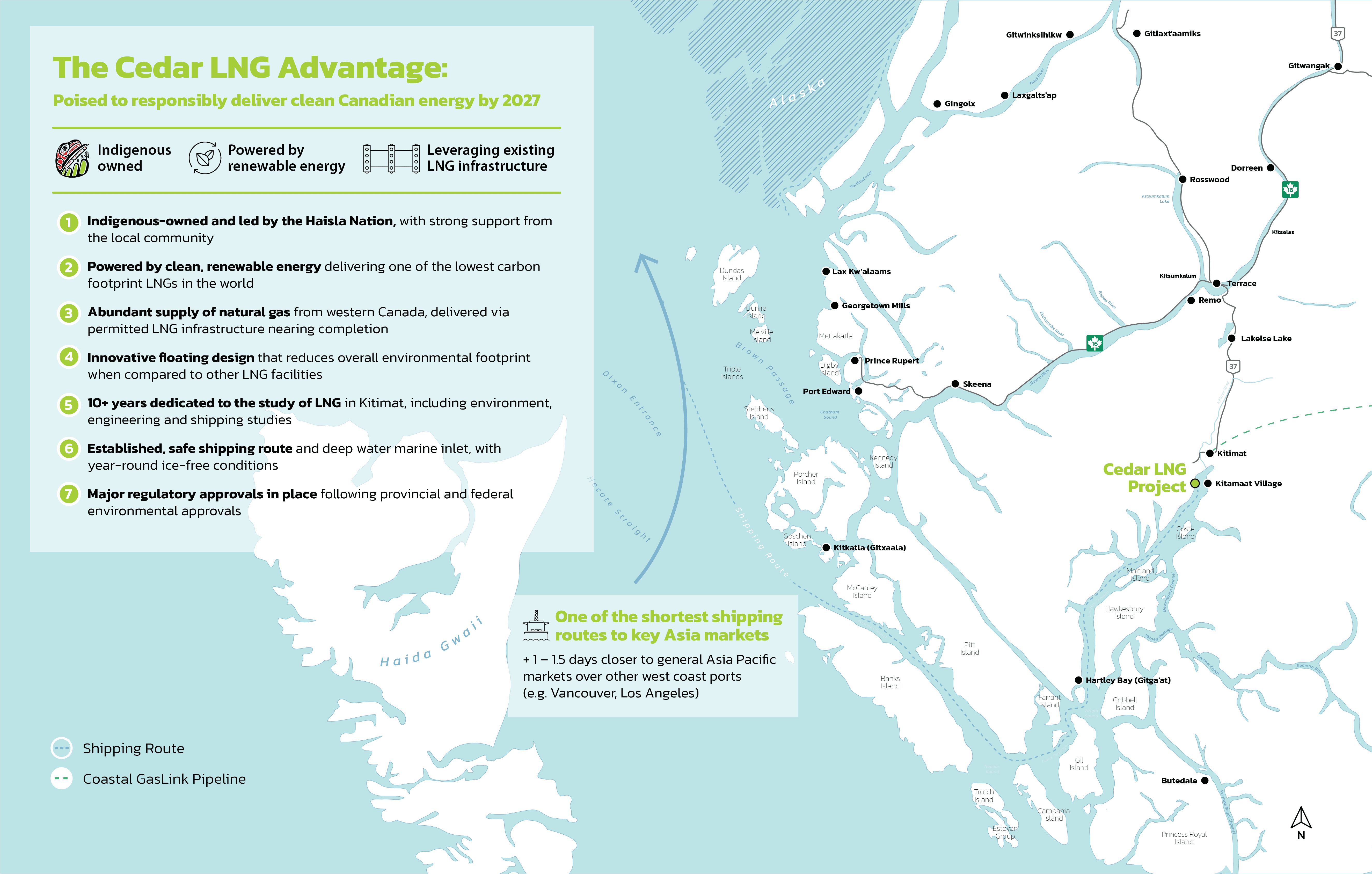

Enbridge Buys 30% Stake In Woodfibre LNG

On July 29, 2022, Enbridge Inc. (Enbridge) announced that it made a deal with Pacific Energy Corporation Limited (Pacific Energy) to buy a 30% stake in Woodfibre LNG, a liquefaction facility being developed near Squamish, British Columbia, Canada. The project is valued at roughly US$4 billion. Pacific Energy will retain a 70% stake in the facility. Enbridge claims that the facility will be one of the cleanest in North America because it is being powered by renewable hydroelectricity produced from the British Columbia grid. The renewable hydroelectricity will power electric motor drives. The decision fits into Enbridge’s long-term goal to be carbon neutral by 2050. Construction is expected to commence in 2023. The plan is for Woodfibre LNG and Pacific Canbriam to supply LNG produced in British Columbia, cool and condense it at the Woodfibre LNG facility, and then sell it to bp, which will export it for sale around the world. Squamish Nation is serving as a project partner and environmental regulator. Woodfibre LNG issued a Notice to Proceed to McDermott International in April. The project has a forecasted in-service date of 2027.

Kinder Morgan Diversifies Its Business

Kinder Morgan sold half of its 51% equity interest in Elba Liquefaction Company LLC (ELC) to an undisclosed financial buyer for US$565 million, subject to customary purchase price adjustments to reflect an economic effective date of July 1, 2022. Upon closing, Kinder Morgan and the undisclosed financial buyer will each hold a 25.5% interest and Blackstone Credit will continue to hold a 49% interest in ELC. Kinder Morgan will continue to operate the 2.5-MTPA facility and its 10 modular liquefaction units at Elba Island. The value of the equity interest implies an enterprise value of approximately US$2.3 billion for ELC. ELC delivers LNG to Southern LNG Company LLC (SLNG) for export. Kinder Morgan owns 100% of SLNG, which owns and operates the Elba Island LNG Terminal, including the LNG storage tanks and the ship dock for import and export. The facility is supported by a 20-year contract with Shell LNG NA LLC, who is subscribed to 100% of the liquefaction capacity.

The ELC sale adds to a growing list of notable investments and divestments Kinder Morgan has made in the last two years. In August, Kinder Morgan closed on the acquisition of North American Natural Resources Inc. (NANR) and its sister companies, North American Biofuels LLC, and North American-Central LLC. The US$135 million acquisition in combined purchase price and related transaction costs includes seven landfill gas-to-power facilities in Michigan and Kentucky. Shortly following close, Kinder Morgan will make a final investment decision (FID) on the conversion of up to four of the seven gas-to-power facilities to RNG facilities with a capital spend of approximately US$175 million. Pending FID, these facilities are expected to be in service by early 2024. Once complete, the facilities are expected to generate approximately 2 Bscf (56.6 × 106 m3) per year of RNG. The combined RNG operations will provide Kinder Morgan with annual RNG generation capacity of approximately 7.7 Bscf (218 × 106 m3) per year once all the RNG facilities are in service. The remaining three NANR assets, projected to produce 4.8 MW-hours in 2023, will further diversify Kinder Morgan’s renewable portfolio by adding electricity generation to its landfill gas-to-power operations.

In June, Kinder Morgan took steps to increase the capacity of its Permian Highway Pipeline (PHP), announcing a binding open season for its PHP Expansion project. Targeting an in-service date of October 1, 2023, the project will involve compression expansions to increase natural gas deliveries from the Waha area to multiple mainline connections in Katy, Texas. Upon achieving a FID, the project will increase the pipeline’s capacity by nearly 650 MMscf/d (18.4 × 106 m3/d). The PHP began service in 2020. The 430-mile (692-km) pipeline has a capacity of 2.1 Bscf/d (59.4 × 106 m3/d). Anticipating the ongoing rise of gas production out of the Permian Basin, Kinder Morgan initially unveiled plans to build the PHP in June 2018. The PHP was a direct response to the production of natural gas outpacing the region’s daily takeaway capacity.

Kinder Morgan’s ELC deal marks the first major sale following a string of acquisitions, expansion projects, and long-term investments. Although the company continues to discuss its optimism for the US natural gas industry, as well as the ability for the United States to be a leading natural gas exporter, its priorities lie with keeping a healthy balance sheet.

Sapphire Acquires Cleancor

On August 1, 2022, Sapphire Gas Solutions (Sapphire) acquired Cleancor Holdings LLC (Cleancor) which operated as CLEANCOR Energy Solutions LLC and CLEANCOR LNG LLC, with offices throughout the United States. Cleancor provides compressed natural gas (CNG), LNG, RNG, and hydrogen solutions for industrial, commercial, transportation, and pipeline infrastructure applications. Headquartered in Conroe, Texas, Sapphire is a turnkey infrastructure services and equipment provider focused on gas supply and energy transition solutions across the United States. It provides CNG, RNG, and LNG solutions to industrial, utility, manufacturing, and other end-use applications across the United States. The acquisition of Cleancor expands Sapphire’s footprint into the western United States, increases its equipment fleet capacity, and adds new service offering to its portfolio.

Cummins Lands Three Hydrogen Engine Deals In Two Weeks

Since debuting its 15-liter (3.9-gallon) hydrogen engine line in May, Cummins Inc. (Cummins) has landed significant supply deals as its customers look for solutions to reduce emissions. In late August, Cummins and Buhler Industries Inc. (Buhler), a tractor manufacturer under the Versatile brand, signed a letter of intent. Versatile plans to integrate the Cummins 15-liter hydrogen engines into its equipment as it works to decarbonize the agriculture market. In late August, Transport Enterprise Leasing LLC (TEL) signed a letter of intent to purchase Cummins’ 15-liter hydrogen engines once they became available. TEL will use the hydrogen engines to lower the emissions of its heavy-duty truck fleet. In mid-September, Werner Enterprises (Werner), a transportation and logistics provider, signed a letter of intent for 500 Cummins 15-liter hydrogen internal combustion engines upon availability. Earlier this year, Werner said it planned to integrate Cummins’15-liter natural gas and Cummins’ X15H hydrogen engines into its fleet. Both engines are part of Cummins’ fuel-agnostic platform. Dual-fuel engines that substitute natural gas for diesel reduce emissions and lower fuel costs. However, hydrogen-fueled solutions take it a step further. According to Cummins, converting medium- and heavy-duty trucks to clean hydrogen would eliminate about a quarter of all GHG emissions from the US transportation sector.

Increased hydrogen output means new opportunities for compression. In general, heightened end-user interest in lowering emissions is a big win for the natural gas industry as customers look toward displacing diesel with natural gas and turning to CNG as a replacement for diesel and gasoline. It’s also worth remembering that hydrogen produced from RNG achieves the same net-zero benefits as hydrogen produced from solar and wind. As investment floods into funding new RNG projects, the opportunities for onsite compression are sizeable. The shift away from diesel toward hydrogen and natural gas has cross-industry benefits for the gas compression industry.

BP Buys Archaea Energy For US$4.1 Billion

In October, Archaea Energy (Archaea) announced it had agreed to be bought by bp for a total enterprise value of approximately US$4.1 billion, including approximately US$800 million of net debt. On December 30, 2021, Archaea achieved pipeline-quality RNG production and commercial operations at its Project Assai (Assai). Assai is the highest-capacity operational RNG facility in the world. Archaea then followed up that achievement with a year of notable supply contracts, a few acquisitions of its own, and a US$1.1 billion joint venture with Republic Services. In the first nine months of 2022, Archaea added 53 projects to its development pipeline, bringing its total backlog to 88 projects.

The speed of Archaea’s project development paid off, as bp recognized the premium price existing projects paired with a packed pipeline provides. Archaea will benefit from bp’s platforms, capabilities, and capital resources for acceleration of its growth plans. Archaea’s business will be able to access bp’s trading capabilities and broad customer base, further helping many of bp’s customers achieve their decarbonization goals. Archaea will be integral to bp’s existing bioenergy business, which has established key positions in the segment and is one of bp’s key transition growth engines, which is anticipated to further Archaea’s growth into international markets.

NextEra Energy Resources Funds Alabama’s First RNG Project, Acquires US$1.1 Billion In Landfill Gas-To-Electric Facilities

NextEra Energy Resources (NEER), a subsidiary of NextEra Energy (NextEra), has partnered with Coffee County, Alabama, and Southeast Gas to build the first landfill RNG production facility in Alabama. All of the gas produced by the project will be sold to Southeast Gas under a long-term contract. On October 28, 2022, NEER announced agreements to acquire a large portfolio of operating landfill gas-to-electric facilities. Based on NextEra’s recent announcement and its managements’ commentary, the Coffee County RNG Project could serve as a way for NEER to build experience so it can better fund, develop, and operate future RNG projects. NextEra noted that the US$1.1 billion acquisition includes more than 30 existing projects that operate landfill gas, electricity, or RNG.