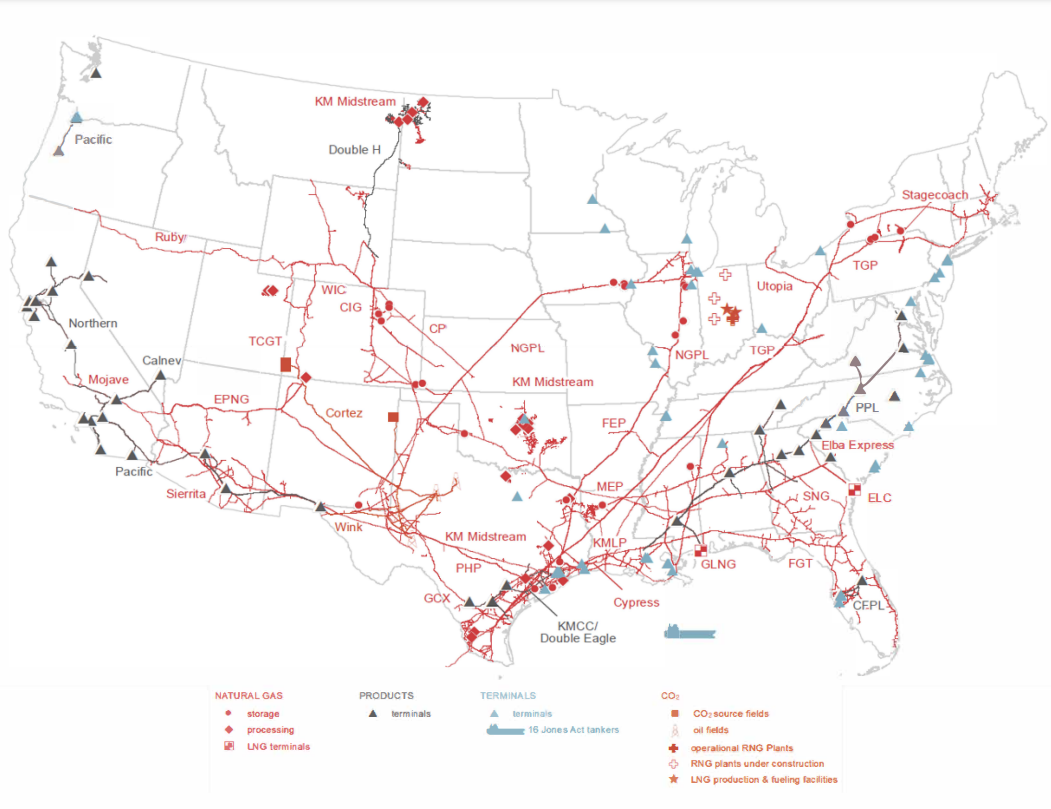

Kinder Morgan Gets US$565 Million For Partial Sale Of Elba LNG Equity Stake

Kinder Morgan sold half of its 51% equity interest in Elba Liquefaction Company LLC (ELC) to an undisclosed financial buyer for US$565 million, subject to customary purchase price adjustments to reflect an economic effective date of July 1, 2022. Upon closing, Kinder Morgan and the undisclosed financial buyer will each hold a 25.5% interest and Blackstone Credit will continue to hold a 49% interest in ELC. Despite being downgraded to a minority shareholder, Kinder Morgan will continue to operate the 2.5-MTPA facility and its 10 modular liquefaction units at Elba Island. The value of the equity interest implies an enterprise value of approximately US$2.3 billion for ELC. According to Kinder Morgan, this valuation is approximately 13 times the estimated 2022 earnings before interest, taxes, depreciation, and amortization (EBITDA) of ELC. Kinder Morgan said that the proceeds from the sale will help it reduce short-term debt and create additional capacity for attractive investments, including opportunistic share repurchases. “We are pleased to welcome a new partner into the ELC joint venture,” said Kinder Morgan’s Interstate Natural Gas President Kimberly Watson. “Recent geopolitical events have proven how critical liquefied natural gas (LNG) infrastructure is to meeting global energy demand. We believe this investment further shows the value of LNG and demonstrates the important role it will play for decades to come.”

ELC delivers LNG to Southern LNG Company LLC (SLNG) for export. Kinder Morgan owns 100% of SLNG, which owns and operates the Elba Island LNG Terminal, including the LNG storage tanks and the ship dock for import and export. The facility is supported by a 20-year contract with Shell LNG NA LLC, who is subscribed to 100% of the liquefaction capacity.

Blending Legacy Projects With Alternative Energy

The ELC sale adds to a growing list of notable investments and divestments Kinder Morgan has made in the last two years. In August, Kinder Morgan closed on the acquisition of North American Natural Resources Inc. (NANR) and its sister companies, North American Biofuels LLC and North American-Central LLC. The US$135 million acquisition in combined purchase price and related transaction costs includes seven landfill gas-to-power facilities in Michigan and Kentucky. Shortly following close, Kinder Morgan will make a final investment decision (FID) on the conversion of up to four of the seven gas-to-power facilities to renewable natural gas (RNG) facilities with a capital spend of approximately US$175 million. Pending FID, these facilities are expected to be in service by early 2024. Once complete, the facilities are expected to generate approximately 2 Bscf (56.6 × 106 m3) per year of RNG. This acquisition and the additional investments discussed should enhance the company’s vertically integrated platform that delivers differentiated solutions across the RNG value chain. The combined RNG operations will provide Kinder Morgan with annual RNG generation capacity of approximately 7.7 Bscf (218 × 106 m3) per year once all the RNG facilities are in service. The remaining three NANR assets, projected to produce 4.8 MW-hours in 2023, will further diversify Kinder Morgan’s renewable portfolio by adding electricity generation to its landfill gas-to-power operations.

Kinder Morgan expects the investment to be accretive to its shareholders as the four converted RNG facilities become operational over the next 18 months, with the purchase price and additional development capital expenditures representing less than six times expected 2024 EBITDA.

In June, Kinder Morgan took steps to increase the capacity of its Permian Highway Pipeline (PHP), announcing a binding open season for its PHP Expansion project. Targeting an in-service date of October 1, 2023, the project will involve compression expansions to increase natural gas deliveries from the Waha area to multiple mainline connections in Katy, Texas. Upon achieving a FID, the project will increase the pipeline’s capacity by nearly 650 MMscf/d (18.4 × 106 m3/d).

The PHP began service in 2020. The 430-mile (692-km) pipeline has a capacity of 2.1 Bscf/d (59.4 × 106 m3/d). Anticipating the ongoing rise of gas production out of the Permian Basin, Kinder Morgan initially unveiled plans to build the PHP in June 2018. The PHP was a direct response to the production of natural gas outpacing the region’s daily takeaway capacity.

In summer 2021, Kinder Morgan made two sizeable acquisitions. The first was the purchase of Stagecoach Gas Services (Stagecoach) for US$1.23 billion. The second acquisition was the purchase of RNG developer Kinetrex Energy (Kinetrex) for US$310 million. The Stagecoach acquisition gives Kinder Morgan four new natural gas storage facilities, 41 Bscf (1.2 × 109 m3) of Federal Energy Regulatory Commission (FERC)-certified working gas capacity, and 185 miles (298 km) of FERC-regulated natural gas transportation pipelines. Many of these pipelines are associated with Kinder Morgan’s Tennessee Gas Pipeline.

Kinder Morgan’s Kinetrex acquisition gives it quite a bit more than just RNG table steaks. The Indianapolis-based firm is a leading LNG supplier in the Midwest and produces and supplies RNG under long-term agreements. Long-term agreements are an integral part of Kinder Morgan’s business. In 2020, the company estimates that upward of 90% of its FCF was tied to take-or-pay and fee-based contracts. Kinetrex has a 50% interest in the largest RNG facility in Indiana as well as signed commercial agreements to begin construction of three additional landfill-based RNG facilities capable of producing a total of more than 4 Bscf (1.1 × 108 m3).

Kinder Morgan sees potential in alternative energy sources like RNG but continues to double down on its existing natural gas business. The company estimates that the US natural gas industry will grow by 23 Bscf (6.5 × 108 m3) by 2040. Between 2020 and 2030, it sees 80% of natural gas growth coming out of Texas and Louisiana, mainly due to exports to Mexico and LNG exports to buyers overseas.

Tying It All Together

Kinder Morgan’s Elba deal marks the first major sale following a string of acquisitions, expansion projects, and long-term investments. Although the company continues to discuss its optimism for the US natural gas industry, as well as the ability for the United States to be a leading natural gas exporter, its priorities lie with keeping a healthy balance sheet. Raising cash to keep debt levels low while supporting dividend increases and new investments makes sense, especially considering Kinder Morgan got a good deal on ELC. As mentioned, Kinder Morgan received 13 times estimated 2022 EBITDA for 25.5% of the Elba facility. For comparison, Kinder Morgan bought NANR for a purchase price and additional development capital expenditures of less than six times expected 2024 EBITDA. It bought Stagecoach for 10 times 2020 EBITDA. However, it forecasts that synergies with its existing business will bring the multiple down to the high single digits. And it bought Kinetrix for an estimated six times 2023 estimated EBITDA when factoring in the purchase price and capital investments for bringing three new RNG facilities online. Granted, the Elba deal arguably deserves a premium valuation relative to the other projects given its reliable cash flows and fully booked capacity. However, if Kinder Morgan is able to execute its RNG investments, the Elba sale could work out in its favor over the long term.