Cummins Lands 3 Hydrogen Engine Deals In 2 Weeks

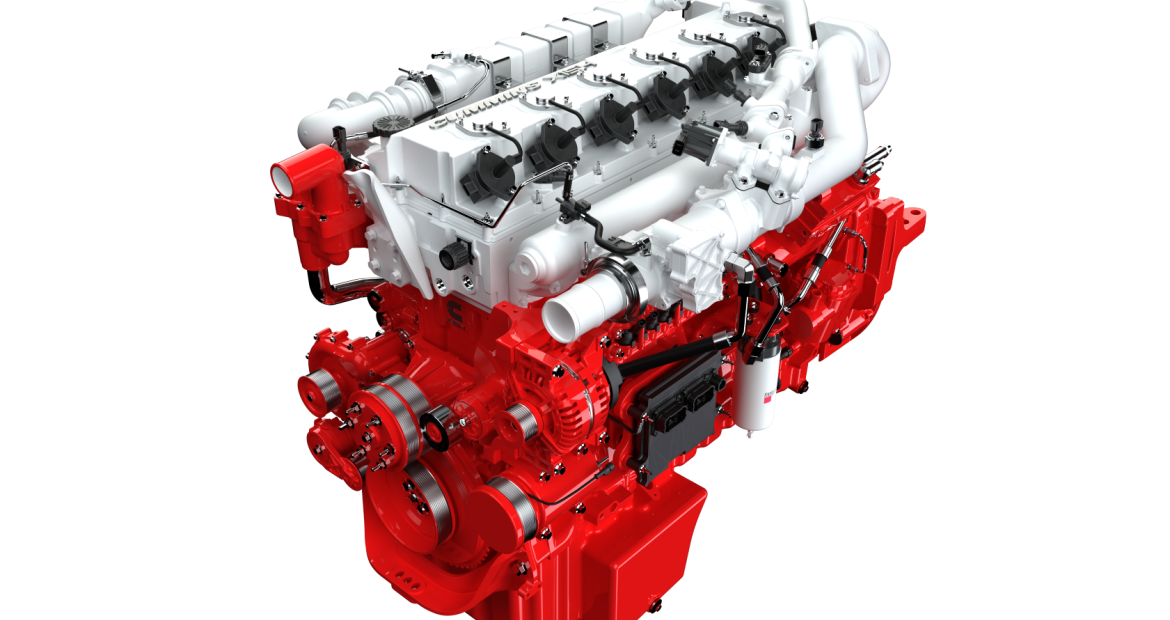

Since debuting its 15-liter (3.9-gallon) hydrogen engine line at ACT Expo in Long Beach, California, in May, Cummins Inc. (Cummins) has landed significant supply deals as its customers look for solutions to reduce emissions.

Hydrogen-Powered Tractors

In late August, Cummins and Buhler Industries Inc. (Buhler) a tractor manufacturer under the Versatile brand, signed a letter of intent. Versatile plans to integrate the Cummins 15-liter hydrogen engines into its equipment as it works to decarbonize the agriculture market. Versatile has been using Cummins engines in all its four-wheel drive tractors for 45 years. As Cummins’ new powertrain technology investments are centered around lowering emissions and improving performance, it was an easy call for a long-time customer like Versatile to transition toward hydrogen engines. “While diesel engines continue to be the flexible power of choice for the foreseeable future in agriculture, such a collaboration enables both companies to develop low- and zero-carbon solutions that are ideally suited to farming,” said Adam Reid, Versatile’s vice president of Sales and Marketing.

Cummins and Versatile said that hydrogen combustion engines are suitable to perform high load factor and high utilization tasks under a manageable cost profile. There’s no denying the impact of upfront costs associated with transitioning away from diesel toward hydrogen. However, hydrogen internal combustion engines end up saving operators expenses down the road. According to Cummins, its hydrogen combustion engines are easy to maintain while being dependable because of the overlap between parts and components across platforms. These similarities save money and time after the initial purchase and make it easier to scale and service a hydrogen combustion engine fleet.

“Cummins has recently announced its plan to leverage existing platforms and expertise in spark-ignited technology to build hydrogen engines. The high commonality among engine components between diesel and hydrogen leverages scale advantages for original equipment manufacturers [OEMs], while delivering the reliability that farmers need,” said Ann Schmelzer, general manager for Cummins’ Global Agriculture Business.

Hydrogen-Powered Trucks And Trailers

In late August, Transport Enterprise Leasing LLC (TEL) signed a letter of intent to purchase Cummins’ 15-liter hydrogen engines once they became available. TEL will use the hydrogen engines to lower the emissions of its heavy-duty truck fleet. “Our customers are at the heart of our company. Providing them with the best-value trucks equipped with lower-emissions power options will ensure we are prioritizing their continued success and also reducing our environmental footprint,” said Doug Carmichael, chief executive officer of TEL. “Cummins’ investment in multiple technologies minimizing emissions allows us to achieve both.”

Over the last 18 years, TEL has grown to average 6000 wholesale equipment transactions per year and has more than 8500 pieces of equipment currently leased around the United States. “We are pleased to see the leadership of customers like TEL, who are exploring solutions like our fuel-agnostic platform to help their own customers,” said Amy Boerger, vice president and general manager of North America for Cummins’ Engine Business. “The future will include many solutions to help customers decarbonize that meet their varied needs and duty cycles, and we believe hydrogen internal combustion engines will play an important role.”

TEL is yet another US-based company realizing the potential hydrogen can provide in simplifying fleet supply chains and lowering emissions. “We believe this technology is not only essential for the future of our planet but also for our customers to have access to options that work for them,” said Jim Nebergall, general manager of Cummins’ Hydrogen Engine Business. “Internal combustion engines that run on hydrogen will provide customers a financially feasible and familiar power option.”

Werner Orders 500 Hydrogen Engines From Cummins

In mid-September, Werner Enterprises (Werner), a transportation and logistics provider, signed a letter of intent for 500 Cummins 15-liter hydrogen internal combustion engines upon availability. Earlier this year, Werner said it planned to integrate Cummins’15-liter natural gas and Cummins’ X15H hydrogen engines into its fleet. Both engines are part of Cummins’ fuel-agnostic platform. “At Werner, we’re committed to a 55% reduction in greenhouse gas emissions by 2035 because we recognize the important role our sustainability efforts play,” said Werner’s Chair, President and CEO Derek Leathers. “Our customers are showing increased interest in more sustainable choices in the marketplace, and we see significant potential in using Cummins’ fuel-agnostic platform to continue the momentum toward reducing our carbon footprint.”

Dual-fuel engines that substitute natural gas for diesel reduce emissions and lower fuel costs. However, hydrogen-fueled solutions take it a step further because hydrogen fuels do not release any particulate matter, carbon monoxide, or volatile organic compounds. If hydrogen is sourced from electrolysis using electricity coming from solar panels or wind turbines, then there are no carbon dioxide (CO2) emissions related to the production or burning of the hydrogen fuel.

According to Cummins, converting medium- and heavy-duty trucks to clean hydrogen would eliminate about a quarter of all greenhouse gas emissions from the US transportation sector.

Cummins’ Fuel-Agnostic Program

In February, Cummins announced its fuel-agnostic platform, which includes a hydrogen option in both the 15-liter and 6.7-liter (1.8-gallon) displacements. A core driver behind Cummins’ deals with Versatile, TEL, and Werner was the advantage of parts commonality across applications, which makes it easier for customers to manage equipment servicing. Cummins’ fuel-agnostic engine platforms are similar across different engines, fuel types, and applications, meaning that similar parts and components are being used no matter the task performed. This commonality provides an advantage for integrated fleets, as well as Cummins’ service network’s ability to help customers no matter the application.

“With enough interest, we believe we can manufacture this technology at scale this decade, providing customers with an option with a low initial cost, extended vehicle range, powertrain installation commonality, and end-user familiarity,” said Nebergall.

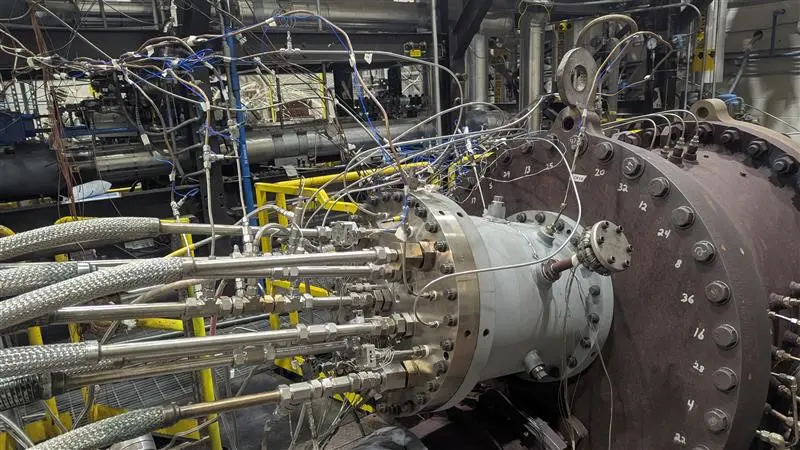

Most of the parts and components overlap occurs below the head gasket, but there are different components above the fuel gasket depending on the fuel type. Each engine operates using a different, single fuel. Cummins said that the new design approach is being applied across the company’s B, L and X-Series engine portfolios, which will be available for diesel, natural gas, and hydrogen.

Long-Term ESG Goals

Cummins’ fuel-agnostic engine platforms fit into its Destination Zero strategy, which involves reducing greenhouse gas emissions and lowering air quality impacts to reach net-zero emissions by 2050. By 2030, Cummins will reduce Scope 3 absolute lifetime greenhouse gas emissions from newly sold products by 25% and is partnering with customers to reduce Scope 3 greenhouse gas emissions from products in the field by 60.6 million tons (55 million tonnes). “Getting to zero is not a light-switch event,” said Srikanth Padmanabhan, president of Cummins’ Engine Business. “Carbon emissions we put into the atmosphere today will have a lasting impact. Having a variety of lower-carbon options is particularly important considering the variation in duty cycles and operating environments across the many markets we serve. There is no single solution or ‘magic bullet’ that will work for all application types or all end users.”

In addition to launching the fuel-agnostic engine platform, Cummins also manufacturers its own electrolyzers, giving the company an integrated offering for truly zero-carbon hydrogen applications. Through fuel cells and engine power, Cummins’ two-pronged approach gives it the ability to tap into different kinds of customers across industries. “Cummins is innovating at every level of the company to find new ways of working that use fewer of the world’s resources,” said Padmanabhan. “We know that our planet cannot wait for the perfect solution to happen. Instead, our approach must be a combined effort of using zero-emissions power where it’s available and using cleaner power where it is not. The planet cannot afford for us to hit pause in the meantime.”

Impact On The Gas Compression Industry

At first glance, the transition from diesel to hydrogen for heavy-duty transportation and agriculture applications may not appear to have direct impacts to the gas compression industry. However, the trickle-down effects are sizeable.

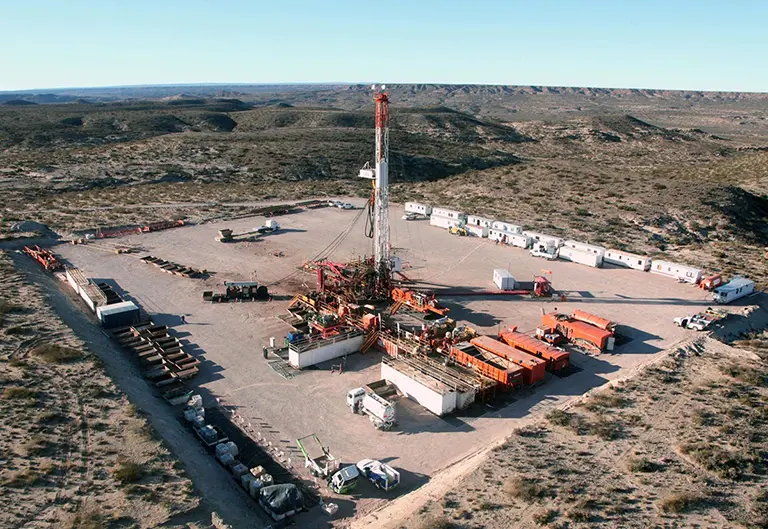

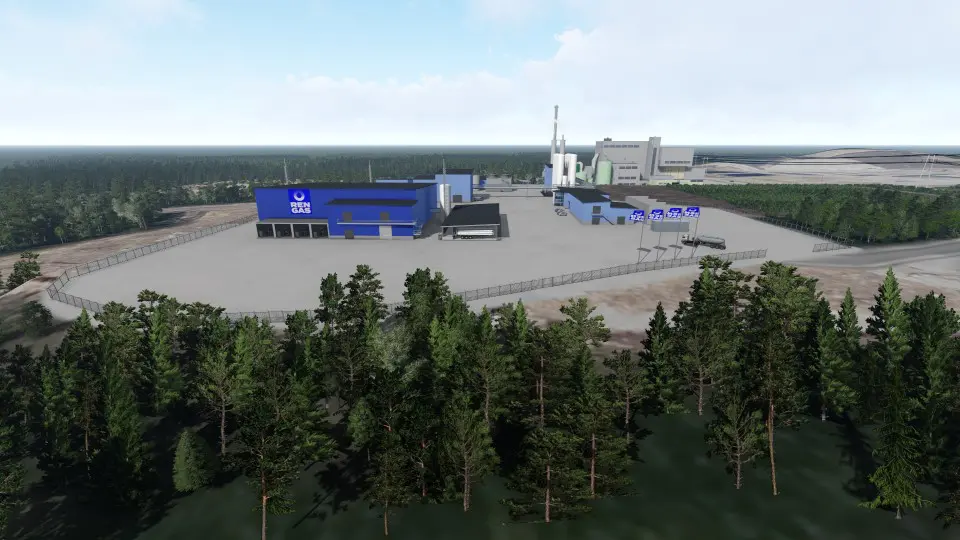

Increased integration of hydrogen across industries means higher demand for hydrogen production, whether that’s grey hydrogen produced from natural gas, blue hydrogen produced from natural gas paired with carbon capture and storage, or green hydrogen produced from electrolysis using electricity generated from solar and wind. Increased hydrogen output means new opportunities for compression. In general, heightened end-user interest in lowering emissions is a big win for the natural gas industry as customers look toward displacing diesel with natural gas and turning to compressed natural gas as a replacement for diesel and gasoline. It’s also worth remembering that hydrogen produced from renewable natural gas (RNG) achieves the same net-zero benefits as hydrogen produced from solar and wind. As investment floods into funding new RNG projects, the opportunities for onsite compression are sizeable (see “The Rise Of RNG,” Q3 2022 ESG Review, p. 26).

In sum, the shift away from diesel toward hydrogen and natural gas has cross-industry benefits for the gas compression industry. The trend toward decarbonization continues to unlock opportunities to drive profits and lower emissions for companies with a multi-decade growth horizon.