Archaea Energy Kicks RNG Investments Into Warp Drive

Rarely does a company hit the ground running as quickly as Archaea Energy (Archaea) has done in the renewable natural gas (RNG) industry. After all, it was only September 2021 when Rice Acquisition Corporation closed its business combination with Aria Energy LLC and Archaea Energy LLC, taking the company public via special purpose acquisition company (SPAC) and listing it on the New York Stock Exchange.

Since then, Archaea has made headline after headline. On November 15, Archaea landed its first long-term contract with a US utility. On December 30, it achieved commercial operations at its Assai RNG Facility — the largest RNG production facility in the world. It was also around that time that UGI Utilities (UGI), a subsidiary of UGI Corporation, began accepting RNG from Archaea into its pipeline distribution system. On January 27, Archaea landed a 7.6 million MMBtu contract with FortisBC via a 20-year RNG agreement. In February, our sister publication, Gas Compression Magazine, featured an article titled “Assai Awakens” as the cover feature for its February issue. But Archaea didn’t stop there. On April 28, it announced an agreement to acquire NextGen Power Holdings LLC (NextGen Power) together with its subsidiaries (INGENCO) for US$215 million in cash. Then one week later, Archaea announced a US$1.1 billion joint venture (JV) with Republic Services (Republic) — US$800 million from Archaea and US$300 million from Republic — to develop 39 RNG projects across the country. The announcement marked the largest RNG portfolio build-out to date in the United States.

Archaea is wasting no time accelerating its investments and scaling its production capacity to capitalize on the growth of RNG and achieve consistent positive free cash flow (FCF) and profitability. ESG Review had the pleasure of sitting down with Megan Light, vice president of investor and community relations at Archaea Energy, to discuss the company’s project pipeline, its plans to make RNG profitable, the environmental benefits of its projects, the compression needs of RNG projects, and what Archaea has learned from project Assai that can be applied to future projects.

Archaea’s Bold Plans For 2022 And Beyond

Archaea achieved commercial operations at its Assai RNG facility in late December 2021, just under two years after obtaining gas rights for the project. Next, it performed an electric overhaul and various facility optimizations during the Q1 2022. “The facility has been operating above expected uptime and methane recovery since early March when that work was completed, utilizing full flows from the Keystone landfill,” said Light. “We received approval to add flows from the Alliance Landfill in early May. We are incorporating lessons learned from the Assai development and startup process to other projects in our development backlog to further streamline and optimize our processes.”

Archaea’s business deals have grown its backlog faster than it can develop projects. The company’s primary objective isn’t just to develop projects for the sake of checking a box, but to do so in a way that is a win for its partners, customers, and investors. “We are focused on executing on our development plan for 2022, which includes 20 development projects, including 10 optimization projects at existing RNG facilities and 10 new-build RNG projects [including four dairy digester facilities],” said Light. “We are also actively seeking opportunities to add to our backlog of high-quality development projects. We have added 53 projects year-to-date, including the INGENCO and Republic transactions, and today our backlog includes 88 projects for which gas rights agreements are in place or are expected to be in place after the INGENCO acquisition closes. We are in the process of optimizing our long-term development plan and scaling our development capabilities with the goal of building as many as 20 projects per year. We are utilizing our extensive gas processing and RNG expertise to build and optimize projects that are expected to have higher uptime and methane recovery than industry averages, and we expect our standardized approach to project development to result in lower capital costs and faster build times than industry averages.”

The US$215 million cash acquisition of NextGen Power gives Archaea 14 operating landfill gas-to-electric (LFGTE) plants at sites which had combined gas flows into the facilities of 7 million MMBtu in 2021, many of which have long-term agreements in place. Given the size of the acquisition, there are concerns that the deal could affect Archaea’s development backlog by delaying existing projects. However, Archaea said that the gas rights and long-term contracts associated with the INGENCO projects present attractive growth potential and help accelerate Archaea’s push toward profitability. “We expect to build RNG plants on 11 INGENCO sites over time and have included these incremental projects in our current backlog of 88 development projects,” said Light. “The 11 development projects are located on sites with strong growth potential. There are certain benefits and potential operating leverage to having RNG plants located on sites with existing electricity generation assets. We expect electric sites will generally have flexibility under the gas rights agreements on when the RNG projects can be developed, which enables us to better optimize our total project development backlog. Additionally, we have potential to generate power for our future RNG plants using the existing electricity generation assets and traditional natural gas from the pipeline grid, which can provide security of supply and potential cost savings compared to buying power off the grid.”

Achieving Economic And Environmental Benefits

Archaea’s purchase of US$215 million in cash for NextGen Power followed by its US$800 million investment in the JV with Republic represents more than US$1 billion in expenditures in a short period of time, begging the question on the impact these investments have on Archaea’s balance sheet and its cash flow. Unsurprisingly yet understandably, the company does not expect to be FCF positive in 2022. But through scale and by making large investments now, the company does feel that it will be better positioned to reach and sustain long-term growth and profitability. “Archaea now has incremental expected near-term capital investment needs due to the acquisition of INGENCO and the Lightning Renewables JV with Republic,” said Light. “With the capital investments expected over several years to develop our large, high-quality backlog, we expect capital expenditures to outpace cash flows generated in the near-term. However, with annual earnings power of approximately US$600 million of adjusted earnings before interest, taxes, depreciation, and amortization [EBITDA] expected once all projects in our backlog are completed and ramped up, we expect to become a FCF generation story over time.”

Similarly, the JV with Republic shakes up Archaea’s project timeline given that Archaea will develop, engineer, construct, and operate the RNG facilities, which will be located at Republic Services’ landfills in 19 states. Construction is slated to begin on projects in late 2022, with completion and commissioning of the projects planned through 2027. “We think of our RNG development backlog holistically,” said Light. “As mentioned, that backlog includes 88 projects for which gas rights agreements are in place or are expected to be in place after the INGENCO acquisition closes. We will develop and construct projects in the Lightning Renewables JV alongside other projects in our backlog. In total, we expect the backlog to take six to eight years to complete, depending on how quickly we can scale our capabilities. Our goal is to be able to develop 10, 15, or even 20 projects annually.”

In terms of an impact on Archaea’s cash position and its balance sheet, Light said that Archaea is “committed to securing funding via one or more capital markets or private financing transactions in the near term, and at the best possible terms for Archaea and our stakeholders. We are very pleased with the expected returns across our development portfolio, including the expected returns on Lightning Renewables JV projects, which we expect to have a build multiple of approximately 4.5 times as a ratio of development capital expenditures to expected adjusted EBITDA. Together, the Lightning Renewables JV and the INGENCO acquisition are expected to add approximately US$200 million to our long-term annual earnings power as represented by adjusted EBITDA.”

The JV between Republic and Archaea marks one of the largest partnerships the RNG industry has ever seen. When fully operational, the 39 projects are expected to generate more than 12.5 million MMBtu of RNG annually. “We are honored to partner with Republic on the Lightning Renewables JV,” said Light. “This partnership highlights Archaea’s ability to win greenfield development projects and make long-term, value-oriented capital investments with a meaningful expected sustainability impact for future generations. Archaea will develop, engineer, construct, and operate the 39 RNG development projects, which will be located at landfills owned or operated by Republic across 19 states. This JV alone almost doubled the number of projects in our backlog, and we expect there is potential for the JV to grow with additional development projects over time.”

RNG’s Impact On The Energy And Industrial Sectors

It’s no secret that US$100 per barrel oil and US$6.00 per MMBtu natural gas reduces the economic feasibility of oil and gas as a fuel source while bolstering the cost profile of nuclear and renewable energy. However, since RNG is chemically identical to fossil fuel-sourced natural gas and can be utilized as a drop-in substitute in any existing natural gas infrastructure, rising oil and natural gas prices are bolstering RNG project margins and making RNG investment more attractive even in a rising interest rate environment. “Today, any energy shortage is a global energy shortage, and recent geopolitical events highlight the need for diverse and secure sources of energy,” said Light. “RNG can help contribute to overall energy supply and do so in an environmentally beneficial way that promotes a more circular, sustainable economy. RNG facilities capture naturally occurring waste emissions and repurpose them into valuable, low-carbon fuel that displaces the use of non-renewable resources to produce the same amount of energy.”

The limited supply of RNG gives the fuel source an advantage over oil and gas especially as ESG investment increases in North America. In late April, WM, formerly known as Waste Management, announced a US$825 million investment in RNG between 2022 and 2026 to convert its fleet toward RNG fuel. It is commitments by major players like WM and Archaea, as well as Archaea’s partnerships with companies like Republic Services, that are accelerating RNG investment and leading to accelerated growth in the industry. “There is increasing focus on methane and other greenhouse gas emissions from landfills from regulators, investors, and other entities focused on decarbonization,” said Light. “This creates an additional incentive for environmental services companies to want to develop RNG facilities on their landfill sites, reducing greenhouse gas emissions and beneficially utilizing the methane within landfill gas to displace fossil fuels. We expect some of the major environmental services companies to develop projects, some to outsource projects to developers such as Archaea, and some to do a combination of the two. Structurally, the RNG market is supply constrained, as there is a finite amount of RNG that can be produced from landfills or other sources such as livestock farms, wastewater treatment facilities, and organic waste facilities. Meanwhile, an increasing number of entities are seeking RNG as a substitute for fossil natural gas in their existing structure, driven by regulatory or voluntary decarbonization mandates. This creates a strong demand that outpaces potential supply, and we expect the market for RNG to continue to grow.”

RNG Is A Net Positive For The Gas Compression Industry And The Energy Sector

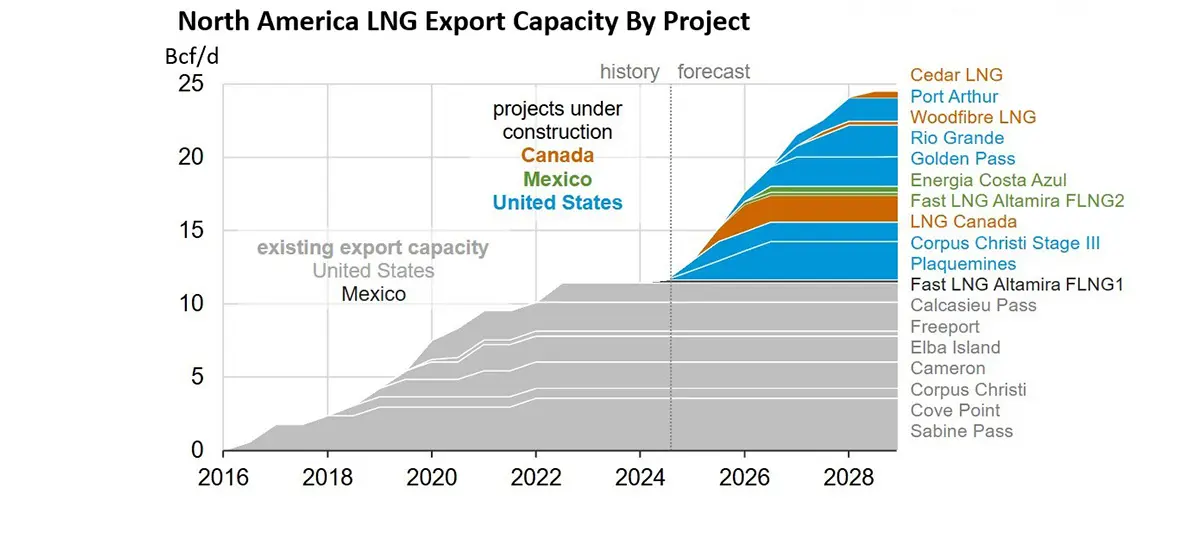

Oil and gas veterans used to fear liquefied natural gas (LNG) as an industry that would displace jobs and be a net negative for the US energy sector. As we have come to learn, LNG has, in fact, become the saving grace of the oil and gas industry and presents the single greatest growth driver because it gives the United States a global market for its natural gas surplus. Similarly, some industry veterans view RNG, and even the compressed natural gas (CNG) industry, as threats to existing infrastructure. However, there are myriad compression needs for RNG projects that benefit the gas compression industry. Therefore, the industry should not fear RNG, but rather, embrace it as an outlet for economic growth, job creation, and environmental benefits. “Compression is one of the major components of our RNG plants, as are nitrogen rejection units, thermal oxidizers, and membrane separation systems, among others,” said Light. “Increased RNG development and production growth increases demand for this major equipment, as well as demand for labor, providing for economic growth and job creation. Our RNG facilities also provide environmental benefits by reducing greenhouse gas emissions, including reducing certain air pollutants by up to 90% at operating sites, and by displacing fossil fuels in end uses including power or thermal generation and transportation fuel.”

Next Steps For Archaea And The RNG Industry

Industries across different sectors of the economy are ramping their long-term low-carbon budgets and reduction targets. Yet many are doing so through what is called greenwashing, which are investments made merely for positive press instead of the belief that ESG can foster economic benefits (see “Fahrenheit 2.7: The Gilded Age Of Greenwashing,” First Quarter 2022 ESG Review, p. 2). However, Archaea believes that its business model positions it to generate positive FCF and reduce cyclicality to improve an energy industry that is as focused as ever on consistent growth. “Our goal is for Archaea to be a stable, predictable, profitable business, and we seek to remove variability from our financial returns where possible,” said Light. “Our differentiated commercial strategy is focused on selling a targeted 70% of our expected RNG production volumes under long-term, fixed-price contracts with creditworthy counterparties. This enables us to lock in expected double-digit returns in a downside case, looking only at contracted volumes. We take a ‘highest and best use’ approach to remaining production volumes, which today are sold into the transportation market where they can generate renewable identification number [RIN] and/or low-carbon fuel standard [LCFS] credits. We prefer to reduce our exposure to these markets, which can be volatile and have regulatory risk, through our long-term contracting strategy. Additionally, we focus on landfill gas, which is a low-cost, stable, predictable, long-term feedstock, with landfill gas production expected for more than 20 to 30 years or longer on average at our project sites. Further, we are implementing the Archaea V1 plant design this year, which is a standardized, modularized design that is expected to significantly reduce capital costs and build timelines compared to industry averages.”

“The past 12 months have been transformation for Archaea since our business combination with Aria and Rice Acquisition Corp. was announced,” said Light. “We have signed landmark long-term RNG sales contracts with high-quality counterparties and we have more than doubled our backlog of development opportunities. We completed the largest RNG facility in the United States at a record pace, and we have begun executing on, and seeing the results from, our optimization program and developing our high-quality backlog of projects. We have secured our long-term runway for growth, with estimated long-term annual earnings power of approximately US$600 million once all projects in our backlog are completed and ramped up. We are committed to executing on our long-term development and growth strategy and becoming both a leading developer and long-term partner to landfill owners and other biogas hosts, as well as a premier supplier of RNG to blue-chip partners seeking reliable, non-intermittent, affordable decarbonization solutions.”