The US Energy Information Administration (EIA) has released its Annual Energy Outlook (AEO) 2022. The report presents an assessment by the EIA of the outlook for energy markets through 2050. The EIA collects, analyzes, and disseminates independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment.

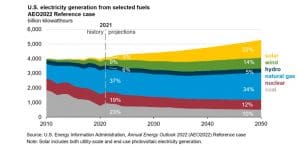

The AEO 2022 reveals that the share of renewables in the US electricity generation mix more than doubles from 2021 to 2050. Wind grows more than any other renewable generation type from 2021 through 2024, accounting for more than two‐thirds of those increases in electricity generation during that period. After the production tax credit (PTC) for wind phases out at the end of 2024, solar generation accounts for almost three‐quarters of the increase for renewable energy. In its reference case, the EIA models existing legislation for the investment tax credit (ITC): solar receives a 30% tax credit through 2024, which then reduces to 26% for projects coming online in 2024 and 2025 before phasing down to a non‐expiring credit of 10% starting in 2026.

Sustained low natural gas prices keep natural gas generation at the highest market share in the reference case. The share of natural gas in the generation mix remains relatively constant, at about one‐third from 2021 to 2050. Although the share remains the same, projected natural gas prices stay below US$4.00 per MMBtu for most of the projection period. The natural gas share remains consistent despite significant projected coal and nuclear generating unit retirements, which cause the shares from those sources to drop by half. Generation from renewable sources increases to offset the natural gas share, largely because regulatory programs and market factors incentivize these sources.

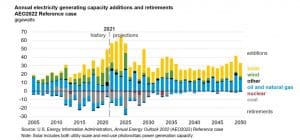

As more wind and solar capacity is added, both existing and new natural gas‐fired generation is displaced, and capacity factors for existing combined‐cycle units drop by nearly half from a peak of 60% in 2020. Because natural gas‐fired generating capacity grows faster than natural gas‐fired generation from 2020 to 2050, capacity factors for natural gas units decline steadily across all plant technology types. The average capacity factor of operating coal plants increases over the projection period as relatively old and inefficient coal plants retire and the more efficient and cost-competitive plants remain. Natural gas accounts for more than 40% of cumulative capacity additions from 2020 to 2050. About half of natural gas capacity additions through 2050 are low‐utilization combustion turbines, which are economically attractive when mostly used to provide infrequent peaking capacity.

Energy storage systems, such as standalone batteries or solar‐battery hybrid systems, will compete with natural gas‐fired turbines as sources of backup capacity for non-dispatchable renewable energy sources. Storage systems can act as an arbitrage tool to move solar and other generation from periods of high supply and low demand to periods of low supply and high demand, and they can provide capacity for grid reliability in times when non-dispatchable generation is not available.

Renewable electric generating technologies account for more than 57% of the approximately 1000 GW of cumulative capacity additions are projected from 2021 to 2050. This large share is a result of not only declining capital costs, but also continuing legislative incentives, such as state renewable portfolio standard (RPS) targets and the extension of federal and state tax credits. Although wind capacity is added steadily throughout the projection period, much less wind capacity is added than solar. Solar capacity accounts for 47% of electric generating capacity additions, and wind accounts for about 10%. Generating technologies fueled by natural gas make up most of the remaining share of new capacity additions (39%), some of which is used to generate electricity when intermittent wind and solar resources are not available.

The reference case assumes the production tax credit (PTC) for wind will be available through 2024, following a one‐year extension in 2020. Although capital costs for wind continue to decline throughout the projection period, most projected wind additions take advantage of available federal tax credits. Nearly half of cumulative wind capacity additions from 2021 to 2050 occur before the PTC expires for projects coming online after 2025. The steadier pace of solar additions reflects, in part, the continued availability of a 10% investment tax credit, which has no fixed expiration date after 2026, when the current 30% phases out.