Rivian Automotive (Rivian), a maker of electric trucks, SUVs, and delivery vans, went public on November 10, 2021, in one of the largest initial public offerings (IPO) in US history. The company, which is roughly 20% owned by Amazon and 12% owned by Ford, debuted on the Nasdaq stock exchange for around US$78 billion but climbed to a valuation of more than US$150 billion in just a week.

After settling down to a market capitalization (market cap) of US$114 billion at the time of this writing, Rivian is now the fourth most valuable car company in the world behind Tesla, Toyota, and Volkswagen (owner of Audi, Bentley, Bugatti, Lamborghini, and Porsche). In sixth place behind Daimler (owner of Mercedes-Benz) is Lucid Group (Lucid), a maker of luxury electric sedans.

Wall Street has spoken. Electric vehicle (EV) companies are fetching sky-high valuations not for their current production, but for what they could become over time. It’s a similar dynamic to what we’re seeing in the oil and gas industry. Energy companies that embrace ESG objectives by decarbonizing their existing businesses and investing in alternative energy see their share prices rewarded, whereas those that lag or simply comply with ESG efforts face consequences through generally underperforming stock prices.

What Makes Rivian Valuable

Rivian originally intended to deliver vehicles in 2021 but was delayed due to supply chain challenges and the global chip shortage (see “‘Super Crazy Supply Chain Shortages,’”

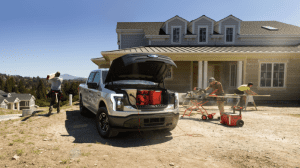

Fourth Quarter 2021 ESG Review, p. 2). It has no revenue and is years from profitability or positive free cash flow (FCF). So, what does Rivian have going for it that makes it more valuable that Mercedes-Benz? For starters, Rivian has friends in high places with financial backing from Amazon and Ford. It also raised about US$12 billion in cash from its IPO, which will provide the means to expedite its manufacturing and distribution. Rivian has also carved out a niche segment of the EV industry — outdoor activities. Its R1T truck is a mix between a Ford F-150 and a Jeep Wrangler. The R1T’s off-road capabilities, rugged design, impressive performance, and Environmental Protection Agency (EPA) estimated rated range of more than 310 miles (499 km) makes it a unique offering that few companies will be able to compete with anytime soon.

The company’s R1S model is an SUV that can do everything from day-to-day functions, to cross-country road trips, to sports and outdoor activities. Like the R1T, it also packs and EPA-estimated range of more than 310 miles. Both the R1T and R1S start at under US$70,000, which puts them in the same class as other luxury vehicles, enhanced trucks, and Jeeps.

Rivian’s all-electric delivery van is yet another model with a lot of potential. Rivian started making headlines in September 2019 when Amazon ordered 100,000 of its vans. Rivian intended to begin delivering vans to Amazon in late 2021 but is now expected to begin mass delivery sometime in 2022. After its IPO, the company announced that it would sell delivery vans to other companies, not just Amazon, in 2022 and begin delivering them in 2023. Given the ESG initiatives of package delivery companies like FedEx and United Parcel Service, as well as private fleets, Rivian’s delivery van might have the most value of any of its models.

Rivian is also developing the Rivian Adventure Network, which is a network of nationwide charging stations. Rivian’s outdoor and off-the-grid focus sounds cool in theory, but it can’t work under the current charging network. The company recognizes this barrier, and realizes it’s going to have to build a network itself for its sales pitch to land. The US$7.5 billion earmarked toward EV charging from the bipartisan infrastructure bill is intended for urban areas that need charging, not remote places for campers. Rivian’s decision to build its own chargers will take a chunk out of its capital, but it’s a necessary step to convince buyers that its vehicles are worth it.

In sum, Rivian has a lot of cash and a head start on the competition. It also has few threats given that it doesn’t really compete with the Ford F-150 Lightning or any of Tesla’s existing models, not even the yet-to-be-built Cybertruck. Whether that garners a valuation over US$100 billion is up for debate. But there’s no denying Rivian’s potential.

What Makes Lucid Valuable

Lucid’s management team consists of top talent from several of the largest tech companies in Silicon Valley, as well as a lot of ex-Tesla employees. Lucid’s CEO, Peter Rawlinson, was the chief engineer behind the Tesla Model S.

Lucid went public in July when it merged with a special purpose acquisition company (SPAC) called Churchill Capital IV. The company received US$4.4 billion in cash net of fees that will be used to scale production and further develop its technology.

| Model | Official EPA Estimated Range | Power |

| Lucid Air Dream Edition Range With 19” Wheels | 520 miles | 933 horsepower |

| Lucid Air Dream Edition Range With 21” Wheels | 481 miles | 933 horsepower |

| Lucid Air Dream Edition Performance With 19” Wheels | 471 miles | 1111 horsepower |

| Lucid Air Dream Edition Performance With 21” Wheels | 451 miles | 1111 horsepower |

| Lucid Air Grand Touring With 19” Wheels | 516 miles | 800 horsepower |

| Lucid Air Grand Touring With 21” Wheels | 469 miles | 800 horsepower |

Data Source: Lucid Group

Lucid is taking a page out of Tesla’s playbook by targeting the luxury sedan market. It’s starting with a high-priced, low production volume performance and range versions of its Air Dream Edition which costs US$169,000. From there, it will make the Air Grand Touring which has a price tag of US$139,000, followed by the Air Touring at US$95,000 and the Air Pure at US$77,400. The Lucid Air Dream Edition has a max range of 520 miles (837 km) and max performance of 1111 horsepower. As the first EV to break the 500-mile range barrier, Motor Trend named the Dream Edition its 2022 car of the year. Lucid began mass production in late September, deliveries in late October, and plans to produce and deliver more than 20,000 vehicles in 2022.

The company said that this is enough cash to grow and scale its operations for at least 2022. Lucid’s manufacturing plant in Casa Grande, Arizona, already has enough capacity to meet the company’s 2022 needs. By the end of 2022, Lucid hopes to be rolling all four Air trims off its production line, and also pave the way for production of its Lucid Gravity SUV in 2023.

Unlike Rivian, which is targeting a niche market, Lucid is going toe-to-toe with one of the most competitive cohorts in the automobile industry. Yet what makes it stand out from the pack is its technology, which Lucid believes is better than the competition. On paper, it’s a true statement. No EV can stand up to its power and range. But Lucid isn’t just getting these numbers by packing more battery cells into a clunky car. It developed its own battery pack, and motors, inverters, and the entire powertrain in house. The company is protective of its technology, so much so that it wants to control as many aspects from its operations as possible. This includes design, manufacturing, marketing, distribution, and more. “The proprietary EV technology that Lucid has developed will make it possible to travel more miles using less battery energy,” said Lucid CEO Peter Rawlinson. “For example, our Lucid Air Grand Touring has an official EPA rating of 516 miles of range with a 112-kWh battery pack, giving it an efficiency of 4.6 miles per kWh. Our technology will allow for increasingly lighter, more efficient, and less expensive EVs, and today represents a major step in our journey to expand the accessibility of more sustainable transportation. I’m delighted that production cars endowed with this level of efficiency are currently driving off our factory line.”

One of the few things Lucid isn’t controlling is its charging. It doesn’t see the need to spend billions building its own charging network when so many third-party platforms are coming on stream. ChargePoint, Blink, Volta, and Electrify America are just a few of the man companies that are looking to partner with EV makers.

Lucid has around 17,000 reservations across its Air product line. The average vehicles price per reservation is around US$100,000, which is a good sign that buyers aren’t just lining up for the lower-priced Pure trim, but rather, are distributed nicely across different price points. The key for Lucid will be attracting demand for the Dream Edition and Grand Touring to give it the sales needed to mass produce the lower-priced Touring and Pure.

Preferential Treatment

One big advantage that Rivian and Lucid have is free press. Since both companies are on the cutting edge of technology, design, and are making investors’ money, their cars could sell themselves without much advertising. EV tax credits, state and federal emissions policies, and a push for many consumers and companies to use zero-emissions vehicles are tailwinds that benefit both companies.

Rivian and Lucid’s introduction to public markets is epic, but the story isn’t complete without some discussion of Ford and General Motors (GM). Like their all-EV counterparts, both legacy automakers are also receiving preferential treatment for their decisions to seriously invest in EVs.

Ford stock has quadrupled from its 2020 low, is up more than double in 2021, and is outperforming Tesla stock. The simple reason is growth. Ford is spending US$11.4 billion on an EV mega campus in Tennessee and Kentucky. It expects 40% of its 2030 revenue will come from EVs. It has more than 150,000 reservations for the Ford F-150 Lightning, which is positioned to be the world’s most successful selling pickup for years to come. And it has received high praise for its Mustang Mach-E SUV.

GM has been in the EV game longer than Ford. It first began mass production of the all-electric Chevrolet Bolt in November 2016, growing global sales to nearly 30,000 by 2020. GM plans to completely transition from internal combustion engine (ICE) vehicles to EVs by 2035. It’s taking the high-volume approach to the EV market, rolling out 30 new sedan, truck, and SUV models by 2025. Like Ford, GM stock has undergone a bit of a renaissance and is up around 50% over the last year — making GM the seventh most valuable automaker in the world.

| Automaker | Market Capitalization |

| Tesla | US$1142 Billion |

| Toyota Motor | US$259 Billion |

| Volkswagen AG | US$136 Billion |

| Rivian Automotive | US$114 Billion |

| Daimler | US$109 Billion |

| Lucid Group | US$91 Billion |

| General Motors | US$90 Billion |

| Ford | US$77 Billion |

| BMW | US$70 Billion |

| Ferrari | US$67 Billion |

| Nio | US$62 Billion |

| Honda | US$50 Billion |

| Volvo | US$48 Billion |

| Hyundai | US$41 Billion |

| Kia | US$29 Billion |

| Nissan | US$22 Billion |

| Fiat Chrysler | US$16 Billion |

| Subaru | US$15 Billion |

| Rolls Royce | US$15 Billion |

| Peugeot | US$14 Billion |

| Mazda | US$6 Billion |

| Aston Martin | US$2.5 Billion |

Data Source: Yahoo! Finance

Growth At Any Price

With all the EV hype, it can be easy to lose sight of just how early the United States is in the transition from ICE vehicles to EVs. EVs account for less than 3% of new car sales in the United States. Yet American EV companies are now worth more than all the world’s car companies combined.

Similar to the disparity between oil and gas company market caps and solar, wind, and hydrogen energy company market caps, legacy automakers are being valued as if they will have negative long-term growth. It’s a tough pill to swallow, but the bright side it that automakers that invest in EVs will likely see their share prices rewarded in similar fashion to Ford and GM. The same phenomenon has occurred with utilities like NextEra Energy, Dominion Energy, and Duke Energy that are transitioning from coal, nuclear, and natural gas toward a mix of natural gas, wind, and solar.

10 Years Down The Road

EV euphoria seems crazy, and maybe it is. However, it’s not farfetched to think that today’s auto industry leaders will be tomorrow’s dying brands. Ten or 20 years down the road, there could very well be a different cast list leading the industry. Given the environmental consequences of transportation fuels like oil and diesel, the push toward EVs is something that policy and consumers are getting behind. Companies that delay investment could find themselves on an uphill battle that’s impossible to win. We’re already seeing a glimpse of that in stock markets.

Another less talked about reason for high EV stock valuations is the potential for other revenue streams. Tesla has an incredibly profitable renewable energy division and home charging business in addition to the cars it makes. EVs like the F-150 Lightning can act as generators that power a home for a few days. Rivian’s cars can provide a built-in power source for folks that want to go camping. There’s also the added layer of lower maintenance. EVs are notorious for saving fuel and maintenance costs, which reduces the total cost of ownership over the lifecycle of the car. The promise of lower costs allows the automakers to charge a higher price upfront, which helps their profit margins and drives shareholder returns.

A final factor worth considering is debt. Legacy automakers generally have a lot of debt whereas Tesla, Rivian, and Lucid are flush with cash. Given the demand for EV growth, these companies should have no problem diluting stock and raising more capital if needed, which keeps their balance sheets insulated from the debt markets.

Add it all up, and it’s clear to see why EV companies have so much potential.