President Xi Jinping announced in September 2020 that China plans to reach peak carbon dioxide (CO2) emissions before 2030 and be carbon-neutral by 2060. As the world’s largest carbon producing country, accounting for one-third of the planet’s CO2 emissions, China’s pledge is an important step in efforts to limit global warming to 2.7°F (1.5°C).

One year after the President’s announcement, myriad projects have been announced to move China toward a carbon-neutral future. The challenge to lower China’s emissions has been met with nationwide support and significant investments across the entire renewable spectrum — with hydrogen development taking a priority.

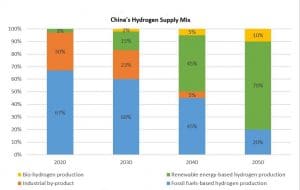

China produced more than 22 million tons (20 million tonnes) of hydrogen in 2020, of which 67% was from fossil fuels and 3% was from renewable resources, according to data from the China Hydrogen Alliance (CHA), a government-supported industry group.

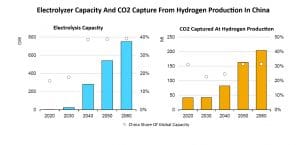

China’s goal to achieve peak emissions by 2030 and carbon neutrality by 2060 will accelerate the development of hydrogen as a fuel for power generation and vehicles. China’s hydrogen demand is expected to reach 66 million tons (60 million tonnes) by 2050, accounting for 10% of the country’s energy consumption, according to the CHA. The alliance forecasts that renewable energy will account for 70% of China’s total hydrogen production by 2050.

Projects Aplenty

Since unveiling its emissions pledge last fall, China has announced more than 50 hydrogen projects to support its low-carbon initiative.

China’s Sinopec Corp. has unveiled plans to spend US$4.6 billion on hydrogen development by 2025. The nation’s biggest oil refiner, Sinopec, wants to become China’s largest producer of hydrogen for transportation fuel, targeting an annual capacity of 220,000 tons (200,000 tonnes) of hydrogen refueling by 2025.

“Sinopec will expand forcefully into making hydrogen from renewable energy, and zero in on hydrogen for transportation fuel and using green hydrogen for refining,” said acting Sinopec Chair Ma Yongsheng. The company plans to produce more than 1.1 million tons (1 million tonnes) of green hydrogen between 2021 and 2025. The company currently produces about 3.3 million tons (3 million tonnes) per year of hydrogen from non-renewable energy sources.

Sinopec recently launched its first megawatt-level, electrolysis-based hydrogen production demonstration project in Zhongyuan oilfield, Henan province, China. The project will include installing a proton-exchange membrane (PEM) electrolyzer, which will produce hydrogen through water electrolysis. It will have a capacity of 2.5 MW with the ability to produce around 1.3 million tons (1.1 million tonnes) per day of ultra-pure hydrogen. The PEM electrolyzer will ensure a hydrogen purity level of about 99.9995%, the company said. The project is expected to be complete by September 2022.

The Energy Bureau of China’s Inner Mongolia Autonomous Region has approved a demonstration project to generate green hydrogen beginning in June 2023 from a network of wind- and solar-powered plants intended to transform one of China’s major coal-mining regions into a renewable-energy hub.

The cluster of projects, scheduled to break ground in Q4 2021, involves construction of five wind/solar hydrogen demonstration projects in Ordos City and two similar projects in Baotou City. Together, they will use 1.85 GW of solar and 369,500 MW of wind to produce 66,900 tons (60,691 tonnes) of green hydrogen a year.

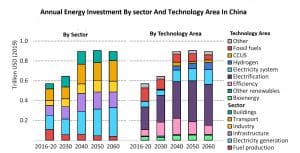

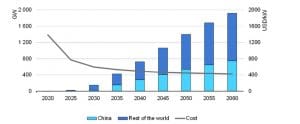

(Data Source: IEA)

The cluster of demonstration projects in Inner Mongolia is the Chinese government’s biggest yet. The region receives about 3100 hours of sunlight a year for solar generation and is located on the main channel of Siberian wind that could power dozens of gigawatts of wind turbines. Chinese officials are hoping to distribute renewable energy and hydrogen produced in Inner Mongolia to the rest of country.

In April, Ningxia Baofeng Energy Group Co. Ltd. began operation on a hydrogen production facility in the Ningxia Hui Autonomous Region of northwestern China that is powered by a 200-MW solar photovoltaic park. Capable of producing 160 million cubic meters of hydrogen per year, the company hopes the new development will cut coal use by up to 280,000 tons (254,000 tonnes) a year, thereby cutting 490,000 tons (445,000 tonnes) of CO2 emissions annually.

The CHA predicts that by 2025 the output value of the country’s hydrogen energy industry will reach US$152.6 billion, and by 2030 China’s demand for hydrogen will reach 35 million tons (31.7 million tonnes), accounting for at least 5% of China’s energy system.

Hydrogen Fuel Cell Vehicles

Hydrogen fuel cell vehicles play a significant role in China’s hydrogen strategy. CHA data shows that at of the end of 2020, China had an inventory of 7352 hydrogen fuel cell vehicles and 128 hydrogen refueling stations, the second largest hydrogen vehicle footprint in the world (the first being Japan). Those numbers are expected to grow rapidly as the Chinese government has prioritized the development of hydrogen refilling stations across the nation. To date, myriad regional hydrogen vehicle-centered development plans have been established across the country in such provinces as Guangdong, Jiangsu, Shandong, Hebei, Zhejiang, Henan, Sichuan, Shanghai, and Beijing.

The Guangdong provincial government has announced plans to build about 300 hydrogen refilling stations in the Pearl River Delta region. The Shandong provincial government plans to build eight hydrogen refilling stations and increase hydrogen capacity by 6000 kg/day in the province this year.

Sinopec will build 1000 hydrogen refueling stations, 5000 charging stations and power battery exchange stations, and 7000 distributed photovoltaic power stations throughout the nation between 2021 and by 2025.

China National Petroleum Corp, the largest oil and gas producer in China, commissioned its first hydrogen refilling station in Zhangjiagang, Hebei, in February 2021 and plans to build 50 hydrogen refilling stations over the next few years.

Incentivized by government subsidies, 35 projects related to fuel cells, fuel-cell vehicles, and hydrogen refueling stations worth a combined US$17 billion have been announced in China in the first half of 2021 alone.

While the interest in and investments for hydrogen fuel cell vehicles are readily available, these projects could be hampered by a lack of hydrogen supply.

Infrastructure Needs

A recent report from the International Energy Agency (IEA) shows that the widespread adoption of hydrogen and hydrogen-derived fuels as low-emissions energy carriers in China would require both modifications to existing infrastructure and the development of new infrastructure to distribute these fuels to end users. This includes hydrogen pipelines, hydrogen refueling stations (HRS), large-scale storage facilities, and terminals at ports.

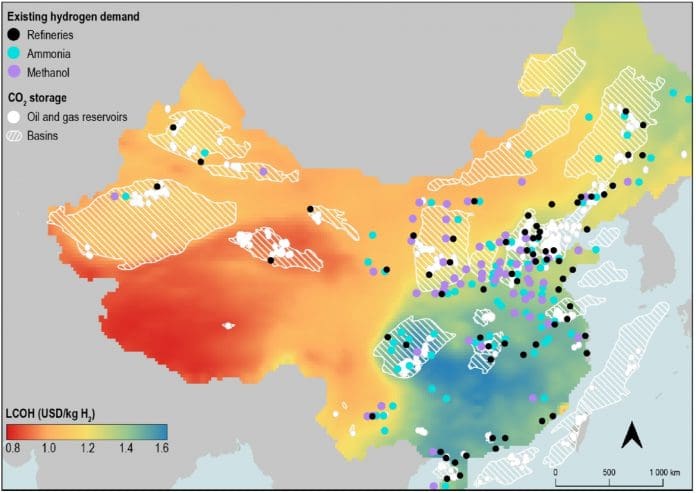

According to the IEA, there are only around 62 miles (100 km) of dedicated hydrogen pipelines in China today, all of them are privately owned in industrial clusters. The location of major industrial end users, the proximity to large renewable resources and adequate CO2 storage sites, and the pace and scope of growth of the distributed demand for hydrogen will determine the most suitable infrastructure in each region. This development will take time and will need to be carefully planned, but there are some short-term opportunities, like short-distance transport of liquid hydrogen using tanker trucks. Blending hydrogen into natural gas in existing networks can be a way to build up low-carbon supply while the hydrogen-specific infrastructure develops. Once it is ready, the low-carbon hydrogen supply infrastructure can deliver pure hydrogen to end users.

The IEA report states that repurposing existing high-pressure gas transmission pipelines to carry pure hydrogen, where technically feasible, is another possibility in China. This would help create a national hydrogen network to connect centers of demand. However, the natural gas network in China is relatively young and is still expanding to meet rising demand, so it will be several years before certain sections may become candidates for conversion.

The development of new dedicated hydrogen pipelines will also be required. Building them in industrial clusters, for example in the northwestern regions (Inner Mongolia, Shanxi, Shandong, and Shaanxi), where demand is concentrated and high rates of utilization of the pipeline capacity can be guaranteed, will be a good starting point. Around 50% of China’s hydrogen demand for ammonia and methanol production today is concentrated in those regions, according to the IEA. This could follow a similar model to that in the transport sector, where HRSs have been initially deployed in industrial hubs. The availability of large quantities of byproduct hydrogen from the chemicals sector and intensive use of the fuel in commercial fuel cell electric vehicles have ensured that HRSs are well utilized.

Ultimately, China’s growing hydrogen economy presents enormous opportunities for the gas compression industry. Investments in hydrogen research, development, and implementation is on the rise, as hydrogen holds great promise in China’s transition to a greener future.