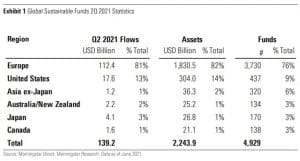

According to Morningstar’s data, inflows in Q2 2021 equaled US$139.2 billion, down 24% compared with the first four months of the year. The slowdown was driven by Europe, the largest market for sustainable funds, where inflows dropped by 25%. The United States saw an 18% decline, while Australasia and Japan offset the reduction slightly with a 114% increase in the former and level flows in the latter. On aggregate, the Q2 levels are at the lowest worldwide since Q2 2020. Europe accounted for more than 81% of sustainable flows this quarter while the United States accounted for 13%. Flows in the rest of the world clocked in at US$9.2 billion for Canada, Australia, New Zealand, Japan, and Asia combined.

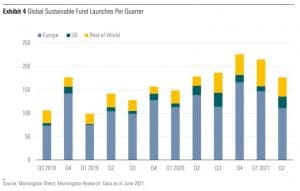

Despite not reaching the record US$184 billion inflows we saw in Q1 2021, the popularity of sustainable funds continues to increase. Assets grew by 12% to US$2.24 trillion at the end of June, helped by performance gains, and flows remain above 2020 levels. Asset managers continue to repurpose products into sustainable offerings and 177 new sustainable products have been launched globally, bringing the total number of funds formally considering ESG factors to 929.

The introduction of the Sustainable Finance Disclosure Regulation (SFDR) means managers are currently busy implementing better ESG transparency measures in their strategies. Over the past quarter, 286 funds have been repurposed and added to the sustainable universe for the region, bringing the total to 3730 at the end of June. Moreover, sustainable fund flows represented US$112.4 billion (or 42.7%) of the US$263 billion total fund flows.

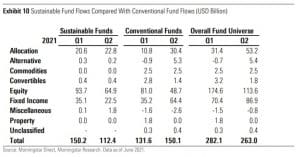

The biggest drop in inflows was seen in the fixed income category, which was down 36% over the period – in stark contrast to the 83% increase for conventional fixed income funds. However, in Europe, sustainable equity had less of a popularity drop than conventional equity. Inflows were down by 30.7% compared to 40%. And sustainable equity saw more investments overall than conventional equity too: US$64.9 billion versus US$48.7 billion. Sustainable allocation funds did increase with record inflows of US$22.8 billion, but this 10.3% jump is significantly smaller than the 181% leap for conventional allocation.

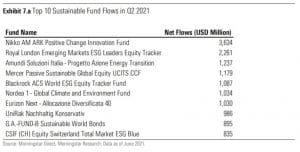

Among the best sellers, only a couple of environmental or climate theme funds managed to make the list, unlike past quarters. In the past three months, investors have preferred broad sustainability and impact-oriented strategy – among those, the newly launched Nikko AM ARK Positive Change Innovation, which attracted US$3.6 billion over the period.

Half of the top 10 funds were recent launches.

Hortense Bioy, director of sustainability research at Morningstar, notes that the high inflows into the Nikko fund helped propel Nikko AM into the top 10 asset managers in terms of flows over the quarter. “BlackRock continued to top the leaderboard, with US$11.3 billion in net new money, followed by Amundi and Nordea,” said Bjoy.

Overall, assets in European sustainable funds rose to a new record high of US$1.83 trillion at the end of June, representing a 11.5% increase since the end of March. This compares with a mere 4.6% increase in assets for the overall European fund universe.