Integrated Ingenuity

The turmoil of the 2020 COVID-19 pandemic-induced oil downturn created a starkly contrasting trajectory for oil majors. In the United States, giants ExxonMobil (Exxon) and Chevron both reported catastrophic losses of US$22.4 billion and US$5.5 billion, respectively. Compared to their smaller European peers, both companies have made relatively minor investments in renewable energy, choosing instead to maximize operational efficiency and maintain their large dividends. Exxon paid a staggering US$14.87 billion in dividends last year. Chevron paid US$9.7 billion.

The European strategy couldn’t be more different. Royal Dutch Shell (Shell) and Norwegian giant, Equinor, each cut dividends by two-thirds in April 2020. Italian major, Eni, cut its dividend by 70% in July 2020. BP followed suit with a 50% dividend cut in August 2020. Total, sporting one of the healthier balance sheets of the European majors, was able to get through 2020 without cutting its dividend. The general theme of the European majors is to scale down and branch out by reducing oil and gas spending, cutting dividend payments, and selling oil and gas assets. Here’s a look at how Europe’s oil majors are embracing renewable energy and working together to achieve carbon neutrality.

Solar Energy

Total leads oil majors in solar investments. And impressively enough, most of it happened during the pandemic. Total’s solar investments had been relatively subdued since acquiring two-thirds of American solar photovoltaics (PV) cell and panel manufacturer, SunPower, in 2011. Everything changed when Total secured around 2 GW of solar capacity in February 2020. Then in September 2020, the French major acquired 3.3 GW of solar capacity in Spain, all of which is expected to be operational by 2025.

In early February 2021, the French energy giant acquired 2.2 GW of solar projects and 600 MW of Texas-based battery storage assets from SunChase Power and MAP RE/ES. The announcement came just weeks after Total entered into a 50/50 joint venture with 174 Power Global to develop 12 utility-scale solar and energy storage projects with a total projected capacity of 1.6 GW. Total now has nearly 4 GW of US renewable capacity projects in its pipeline. All projects are expected to come online between 2022 and 2024 as part of the company’s goal to have 35 GW of renewable generation capacity by 2035. According to Total, its gross power generation capacity was 12 GW (7 GW of renewables) as of the end of 2020. “I am very pleased that Total is further contributing to the development of solar power in the United States. We look forward to taking advantage of the many growth opportunities in the US market to address the challenges of the energy transition,” said Patrick Pouyanné, chair and CEO of Total.

Wind Energy

On August 4, 2020, BP announced a major shift in its global strategy. From “International Oil Company to Integrated Energy Company,” the strategy detailed specific ways in which BP was investing in renewables and reducing emissions to achieve its goal to become net-zero by 2050 — which it had originally announced in February 2020. Arguably the biggest takeaway from the release was the following statement: “By 2030, BP aims to have developed around 50 GW of net renewable generating capacity — a 20-fold increase from 2019 — and to have doubled its consumer interactions to 20 million a day. Over the same period, BP’s oil and gas production is expected to reduce by at least one million barrels of oil equivalent a day, or 40%, from 2019 levels.”

As of the time of this writing, BP has nine onshore wind farms across six states. Its US wind farms have a gross generating capacity of 1.7 GW, but all of its projects were onshore. That is, until September 2020 when BP announced it would pay Equinor US$1.1 billion for a 50% stake in its Empire Wind and Beacon Wind offshore assets. The transaction was finalized on January 25, 2021, two weeks after the New York Energy Research and Development Authority announced it had selected Equinor and BP to provide the state of New York with offshore wind power. Together, the two projects span over 200,000 acres off the US east coast and are projected to have a combined capacity of 4.4 GW. Equinor and BP will work together to develop the projects over the coming years.

BP and Equinor are both offshore oil and gas engineering specialists that plan on translating their core competencies to offshore wind. Equinor has been drilling in the North Sea for decades. But those assets are maturing and could become unprofitable by 2030, even with technological advancements. Luckily, the North Sea’s continental shelf is uniquely shallow, making it an ideal location to develop massive offshore wind projects. This is exactly what Equinor is doing. The company plans on becoming a global leader in offshore wind, growing its renewable capacity from 500 MW in 2019, to 4 GW to 6 GW by 2026, then to between 12 GW and 16 GW by 2035. By 2050, Equinor believes Europe will generate 450 GW of power from offshore wind, nearly half of which could come from the North Sea.

Norway’s neighbor, Denmark, also sees potential in offshore wind. This is no surprise considering Aarhus, Denmark-based wind turbine giant, Vestas, is the largest wind system manufacturer, seller, installer, and service provider in the world.

In early February 2021, Denmark greenlit a US$34 billion project to build a giant island in the North Sea, the largest construction project in Danish history. The island is expected to house a staggering 200 offshore wind turbines to supply 3 GW of energy (and potentially 10 GW in the future). The island follows in the footsteps of the Bornholm energy island, a concept to develop a 2 GW energy island in the Baltic Sea. The project was formed by an agreement between Germany, Belgium, and the Netherlands.

In December 2020, Denmark announced it was ending all new oil and gas developments in the North Sea as part of its goal to become carbon neutral by 2050. The decision followed the November 2020 European Union plan to increase offshore wind capacity to 60 GW by 2030 and at least 300 GW by 2050. To make it possible, the EU encourages cross-border project development between the public and private sector.

Electric Vehicles

In late January 2021, Shell signed an agreement to buy 100% of Berlin-based electric vehicle (EV) charging network company, Ubitricity. As of November 2020, Ubitricity is the United Kingdom’s largest public EV charging network, sporting over 2500 charge points. It has over 2700 charge points as of the time of this writing.

Ubitricity’s competitive advantage is its simplicity. The company’s EV chargers can be retrofitted to lampposts and street posts, making them easy to incorporate into existing city infrastructure. According to Ubitricity, the open standard charge points can be accessed with a Type 2 standard cable and a smartphone that can scan a QR code for activation and payment. The Type 2 charging cable is the standard plug-type used by virtually all new electric cars. “What excites so many people about Ubitricity is that our integration of EV charge points into existing on-street infrastructure makes EV charging easy and accessible for everyone who needs it, where they need it,” said Ubitricity CEO, Lex Hartman. “Particularly in larger cities where there is limited access to off-street parking, this is the solution many people have been waiting for to allow them to transition to EV ownership. Combining this piece of the puzzle with Shell’s existing range of EV charging solutions gives EV drivers access to a full range of charging options, making Shell and Ubitricity a perfect match.”

The acquisition announcement came just weeks after The Shell Petroleum Company of Nigeria Limited announced the US$453 million sale of its 30% stake in the Oil Mining Lease 17 in the Eastern Nigeria Delta. In October 2020, Shell’s CEO Ben van Beurden announced a detailed restructuring that will make Shell carbon-neutral by 2050. The plan involves drastically reducing the company’s upstream production as well as reducing its total number of refineries to just 10, down from 15 at the end of 2019 and 55 in 2005. The least effected of Shell’s business lines will be its integrated gas portfolio, which sports Shell’s industry-leading liquefied natural gas (LNG) assets. Shell plans on targeting low-carbon electricity, low-carbon biofuels, and hydrogen in favor of oil production, as well as continual investments in carbon capture and storage (CCS).

The Ubitricity acquisition fits nicely into Shell’s EV charging portfolio. Not including Ubitricity’s assets, Shell has 1000 charging points at around 430 of its retail sites worldwide, as well as access to over 185,000 third-party EV charging points. “Working with local authorities, we want to support the growing number of Shell customers who want to switch to an EV by making it as convenient as possible for them. On-street options such as the lamp post charging offered by Ubitricity will be key for those who live and work in cities or have limited access to off-street parking. Whether at home, at work, or on-the-go, we want to provide our customers with accessible and affordable EV charging options so they can charge up no matter where they are,” said Executive VP of Shell Mobility István Kapitány. The deal is expected to be finalized sometime later this year.

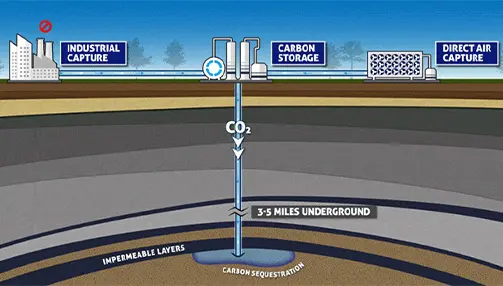

Carbon Capture And Storage

Shell, Equinor, and Total are investing heavily in CCS through their Northern Lights consortium, a plan to capture carbon dioxide (CO2) and store it along the Norwegian continental shelf. The Northern Lights project will coordinate with Norway’s Full-Scale (Longship) project, a collaborative effort between power generation and industrial infrastructure companies that will capture CO2 and deliver it to a terminal in Øygarden, Norway for intermediate storage. From Øygarden, the CO2 will be transported via newly designed ships to a permanent storage reservoir 8530 ft. (2600 m) below the seabed of the North Sea. In March 2020, a confirmation well was successfully drilled and completed, validating that the reservoir has the right geological characteristics and capacity to fulfil the needs of the project.

To fulfill the goals set by the Paris Agreement, many European companies feel the need to collaborate on large-scale integrated value chains like the Northern Lights project. Shell, Equinor, and Total initially came together in May 2020, signing a conditional agreement pending funding decisions by the Norwegian government. On December 15, 2020, the Norwegian government approved its decision to help fund the project. “CCS is important to achieve the goals of the Paris Agreement. Longship is the largest climate project ever in the Norwegian industry and will contribute substantially to the development of CCS as an efficient mitigation measure. Working together with the industry, the step-by-step approach has confirmed that the project is feasible. I want to thank the Northern Lights partners Equinor, Shell, and Total — and I am looking forward to our continued cooperation,” said Norway’s Minister of Petroleum and Energy Tina Bru.

“Northern Lights is a true pioneering project and the first of its kind offering a solution to cut emissions from industrial sources in Norway and Europe. We are ready to start realizing this project will be an important part of the climate solution. I want to thank the Norwegian government for the broad political support in making this a reality. I am certain that we together with our partners and suppliers will make this project a success,” said Equinor CEO Anders Opedal.

What makes Northern Lights and the Longship project unique is that it’s open to third parties. As the first ever open-source CO2 transport and storage infrastructure network, the project will operate across country borders to help industrial companies store their emissions safely and securely underground. With scale, the project will likely be much cheaper than businesses trying to reduce emissions on their own. The idea is to help Europe as a continent reduce its carbon footprint, with Shell, Equinor, and Total providing the means to do so. Phase one is expected to be completed by mid-2024 with a capacity of 1.5 million tonnes of CO2 per year with plans to increase the capacity up to 5 million tonnes per year based on an increasing customer base. “The Norwegian government’s initiative and support for what will be the world’s first open-source CO2, transport and storage project shows real vision and commitment,” said van Beurden. “Northern Lights is designed to provide a service to industrial emitters who can now take action on emissions that can’t be avoided. This is key to bringing real progress toward tackling climate change. Shell will play our part in making this a reality.”

“The development of the carbon capture and sequestration value chain is essential to decarbonize Europe’s industries,” said Pouyanné. “We [Total] are a long-standing partner of Norway, a pioneer country which has more than 20 years of experience in CCS, and today we thank its government for making possible the final investment decision to develop Northern Lights. CCS is key to achieving carbon neutrality in Europe and is fully part of our Climate Ambition to get to net zero emissions by 2050.”

True Transformation

In April 2020, Microsoft’s CEO, Satya Nadella, said that “We’ve seen two years’ worth of digital transformation in two months. From remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security — we are working alongside customers every day to help them adapt and stay open for business in a world of remote everything.” Similarly, the energy industry saw three to five years of energy transition in just one year. But unlike Microsoft, which reported record revenues and profits in 2020, the European majors chose this time, a pandemic and a moment of weakness, to initiate arguably the greatest changes in each of their rich histories.

With profits falling and debt levels rising, the European majors collectively decided that instead of hemorrhaging cash to pay their shareholders dividends, they would choose instead to reinvest toward a sustainable future. Total, BP, Equinor, and Shell may have different approaches and specialties when it comes to sustainability, but amazingly enough, they’ve already found plenty of reasons to work together. Hats off to the European majors for putting their chips on the table when it would be so easy to play their cards close to the chest. As long as they work together, the deck will almost surely be stacked in their favor.