Much to the detriment of renewable energy, 2021 has been a banner year for oil and gas. Prices continue to rise, with West Texas Intermediate (WTI) crude oil closing in on US$85 per barrel at the time of this writing. Meanwhile, investment in new renewable energy projects is slowing as companies work through their existing backlogs.

TPI Composites, one of the largest independent manufacturers of wind blades and related precisions molding and assembly systems, reported its Q3 2021 earnings on Monday. Management’s commentary painted a cloudy image of the year that has been, and the years to come. “We are diligently navigating through a challenging macroeconomic backdrop that is adversely impacting the wind industry on a global scale,” said Bill Siwek, president and CEO of TPI Composites. “While we are pleased to achieve revenue growth in the quarter, near-term challenges have hindered the profitability in the business. We have witnessed volume declines from our OEM [original equipment manufacturer] customers as many of their customers are in a wait-and-see mode with the impending federal legislation pertaining to the Build Back Better Plan [BBB], the recently passed Infrastructure Investment and Jobs Act, and the tax credit incentives to be included in the BBB plan. We believe that final passage of this bill will help bring clarity to our future demand outlook. In addition, I’m extremely proud of the efforts of our team to mitigate the supply chain pressures which have led to rising input and freight costs as well as limited the availability of certain raw materials. We expect these challenges to persist through most of 2022.”

Companies like TPI Composites provide a good leading indicator for the overall health of the wind energy industry. TPI’s customers, such as Siemens Gamesa, Nordex, Vestas, and GE, are the very OEMs that fund and operate major projects. If these companies are slowing their orders, or if suppliers such as TPI are struggling to deliver on time, then that’s a sign the industry is challenged. TPI has an excellent reputation for on-time delivery and high utilization rates from its production lines. It uncharacteristically reported a 76% Q3 2021 utilization rate compared to 93% in Q3 2020. Put another way, the total wind blades produced during the three-month period were just 76% of what could have been produced, meaning TPI wasn’t booking the sales it thought it would.

The company also experienced production delays from some of its factories. The company produces blades mainly in the United States, Mexico, Turkey, and China. Its Mexico facility caused particular issues this quarter.

“We also experienced production delays at the manufacturing facility that we recently took over from Nordex in Matamoros, Mexico, during the third quarter and at one of our manufacturing facilities in Juarez, Mexico, where we are in the startup phase of producing an innovative new blade model for one of our customers,” said Siwek. “We expect these production delays will be resolved by the end of this year. Although these near-term headwinds present a challenge to TPI, we continue to work closely with and deliver to our customer base. In the quarter, we added new lines in China for Vestas and extended a couple of lines in Turkey with Nordex. We remain excited about the long-term prospects for our industry. As we have communicated in the past, we expect the overall wind market to be relatively flat in 2022.”

TPI’s weakening business signals lower appetite from its customers to order and deploy more wind blades. However, the challenges that TPI is facing have nothing to do with the long-term benefits of wind energy. “We believe that these near-term challenges will eventually abate, and, that we are well positioned as a trusted partner for our customers and with our global footprint to capitalize on the long-term growth opportunity in the wind industry,” said Siwek.

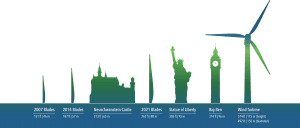

TPI estimates that global electricity demand will increase by 60% between 2019 and 2050. In 2050, the company forecasts that wind energy will make up one-third of total global power generation. The long-term forecast points to even lower levelized cost of energy (LCOE) due to longer blades, taller towards, high ratings, higher capacity, and lower operational and maintenance costs. For example, the LCOE for wind has decreased by more than 70% in the last 12 years alone. The 281-ft. (80-m) blades that TPI is producing today are nearly double the length of the blades the industry was using 15 years ago. By 2028, TPI said that blades should be 25% longer than they are today.

As with most cyclical businesses, it’s common for a booming industry to cool off for a few years. Some would argue that there was too much wind energy investment too quickly over the last few years. It’s fair to say that the industry got a little ahead of itself. Pairing that overextension with supply chain and labor challenges, it’s not all that surprising, and certainly not worrisome, to see OEMs tighten the tap on spending.