Jet fuel prices reached US$1.78 per gallon, the highest point since early January 2020, as air traffic continues to pick up. According to data by the Energy Information Administration (EIA), the US Gulf Coast kerosene-type jet fuel spot price is already up 28% in 2021.

Jet fuel prices have staged quite the comeback. Prices finished 2019 at around US$1.95 per gallon. As the holiday travel season came to a close, prices ticked down to about the US$1.60 per gallon mark by early February 2020 before plummeting to US$0.40 per gallon by late April 2020 as air traffic ground to a halt in response to the COVID-19 pandemic.

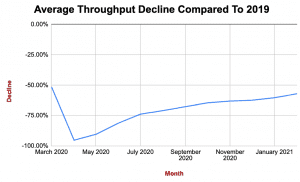

The Transportation Security Administration (TSA), which tracks daily traveler throughput, reported its best month since March 2020. TSA checked 57% fewer passengers in February 2021 than it did in February 2019, which sounds bad until you consider the numbers were much worse just a few months ago. TSA checked between 60% and 70% fewer passengers from September 2020 to January 2021. And in April and May 2020, TSA was checking, on average, 90% fewer passengers.

The estimates vary, but ongoing pandemic concerns and a permanent reduction in business travel means that air travel is unlikely to return to 2019 levels anytime soon. With the vaccine distribution well underway, 2021 travel numbers have a good chance of continuing their rebound. However, 57% fewer travelers is no small number. So why are jet fuel prices back to pre-pandemic levels? The answer has to do with supply and demand. Refiners reduced capacity during the pandemic because there was less demand for refined products (whether that be jet fuel and gasoline, or plastics used in industrial processes). Decreased capacity lowered supply, which doesn’t come back overnight. Oil prices, which are also at their highest levels in over a year, mean higher input costs for refiners. Refined product prices tend to increase as a result of higher refinery operation costs.

The US airline industry, which benefited from billions in loans and government aid, is still struggling mightily as people simply aren’t taking the vacations or business trips they used to. Travel demand will likely explode once Americans feel it’s safe to do so. Many folks have delayed vacations, business trips, weddings, reunions, trade shows, etc. And a general yearning to get out and enjoy normal experiences again is something virtually everyone is hoping for. For now, maybe higher jet fuel prices and low air traffic demand will help spark a continued discussion on alternative and sustainable jet fuel (see Blue Skies Ahead, ESG Review: First Quarter 2020, p. 4).