In late September 2020, the 120 companies that had gathered at the World Economic Forum’s (WEF) annual meeting in Davos, Switzerland, published a near-100-page document detailing new reporting standards. Titled “Measuring Stakeholder Capitalism Toward Common Metrics And Consistent Reporting Of Sustainable Value Creation,” the report presents new ways to align mainstream reporting with environmental, social, and governance (ESG) reporting, effectively normalizing ESG in the business world. The core and expanded set of “stakeholder capitalism metrics” and disclosures are based on four pillars: people, planet, prosperity, and principles of governance.

The term “ESG” was first introduced in a 2004 report titled “Who Cares Wins.” The report takes the long-term view that if capital markets addressed ESG the same as revenue, profits, and dividends, then the market itself would become more sustainable and beneficial to society.

Money Talks

In just 15 years, ESG went from a new idea to a pivotal component in international standardization. Money followed. In 2012, US ESG-mandated funds totaled US$3.7 trillion, comprising just 11% of professionally managed assets. By 2018, it was 26%. Deloitte Insights estimates ESG-mandated assets are hitting their big growth spurt right now and could reach US$34.5 trillion, or 50% of US professionally managed assets, by 2025. But that’s just professionally managed money.

Regular people looking to manage their own money are investing in ESG exchange-traded funds (ETFs) or ESG index mutual funds. Although the funds vary in their specific criteria and investing strategy, the core approach is the same. Instead of selecting investments solely for the prospect of above-average returns, companies are chosen for their positive influence on the world, adherence to social responsibility, ethical governance, and a sustainable business model. Only after those criteria are met is traditional financial analysis applied.

The Breakout

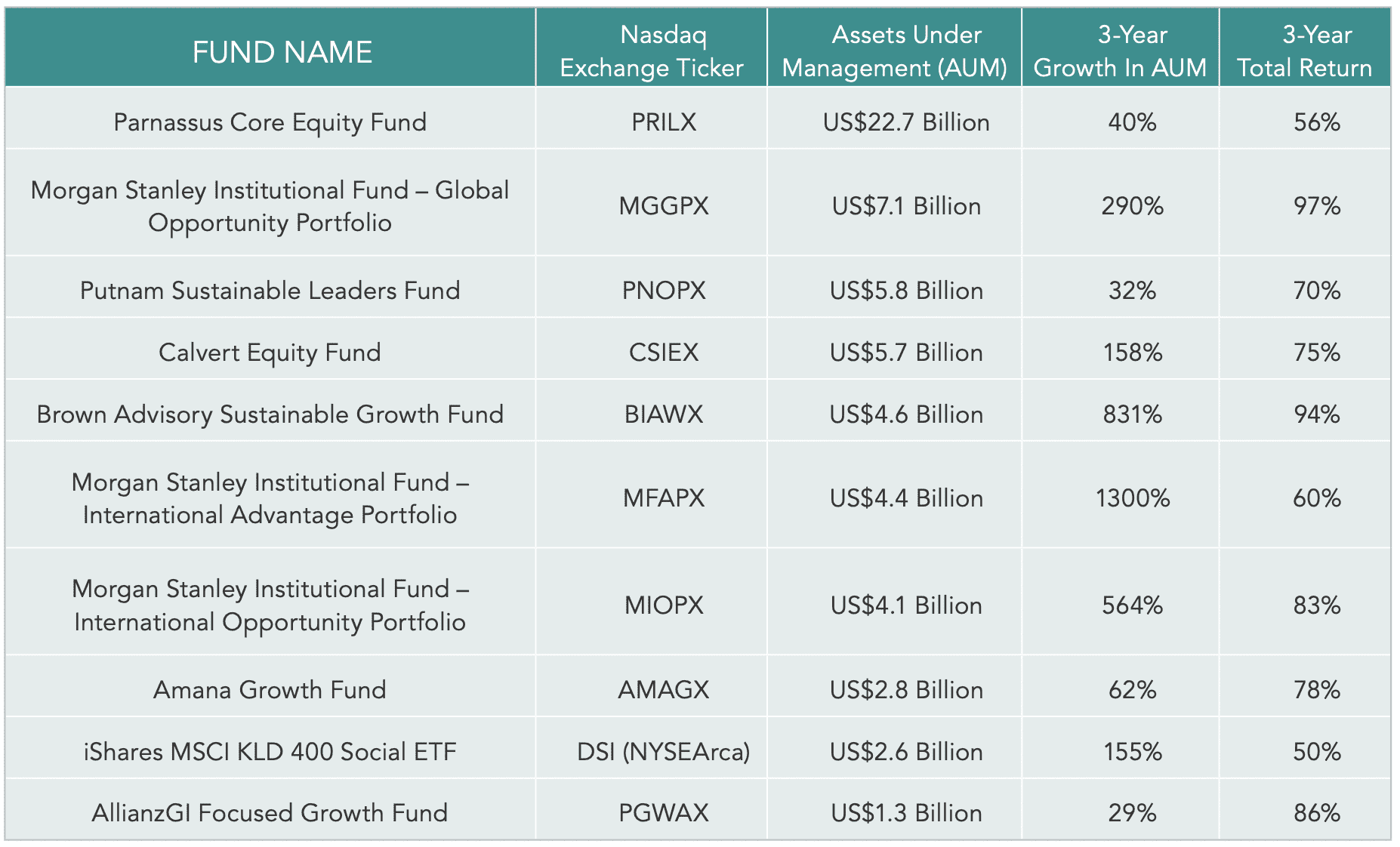

The core belief that ESG investing and reporting would benefit capital markets is coming to fruition. Over the past three years, several notable ESG funds have grown their assets under management (AUM) while also outperforming the general market. Consider that from 2018 to 2020, the S&P 500 returned roughly 45% compared to Bloomberg’s highest-rated ESG funds (see Figure 1).

State Street Global Advisors, owner of the SPDR brand of index funds, released a report in July 2020 titled “From Tipping Point To Turning Point.” In the report, the firm forecasted that the amount of money invested in these regularly available ESG index mutual funds and ETFs would increase from US$170 billion in 2020 to US$1.33 trillion in 2030, a near eight-fold increase. Last year tested the resilience of this theory. After notching record ESG inflows in the first quarter of 2020, institutional and retail investors continued to invest more money into ESG financial products throughout the pandemic. This is all the more impressive considering financial markets experienced net outflows as stocks were sold and the market tanked during the spring of 2020. The fact that ESG products attracted dollars when the broader market was losing them bodes well for the future of ESG investing.

Full Circle

At its core, ESG centers around time-intensive reporting. Although laborious, these detailed reports offer transparency and duty to a company’s communities, employees, customers, and shareholders. They also provide a level of accountability that has never existed, since companies are now judged against non-financial benchmarks. ESG reporting makes the motive not just about generating shareholder returns; although, that has so far been an added bonus. It forces companies large and small to think decades ahead, not just about the next quarter. It may seem unfamiliar at first, but ESG reporting and investing have proven that companies can reduce their negative effects on society and the environment without sacrificing financial performance.

Figure 1. (Data Source: Yahoo! Finance)